W GE E EuropEan MarKEtscan - emc-commodity.com · 2020. 8. 4. · Diesel 10 ppm AAJUS00...

Transcript of W GE E EuropEan MarKEtscan - emc-commodity.com · 2020. 8. 4. · Diesel 10 ppm AAJUS00...

EuropEan products ($/mt)

code Mid change code Mid change

Mediterranean cargoes (PGA page 1114)

FoB Med (Italy) cIF Med (Genova/Lavera)

Naphtha* PAAAI00 346.00–346.50 346.250 +10.250 PAAAH00 353.50–354.00 353.750 +10.250Prem Unl 10 ppm AAWZA00 379.00–379.50 379.250 +14.250 AAWZB00 384.50–385.00 384.750 +14.250Jet AAIDL00 335.25–335.75 335.500 +4.750 AAZBN00 345.75–346.25 346.000 +4.75010 ppm ULSD AAWYY00 368.75–369.25 369.000 +4.250 AAWYZ00 375.75–376.25 376.000 +4.250Gasoil 0.1% AAVJI00 360.50–361.00 360.750 +5.000 AAVJJ00 369.25–369.75 369.500 +5.000Fuel oil 1.0% PUAAK00 273.00–273.50 273.250 +7.500 PUAAJ00 280.00–280.50 280.250 +7.500Fuel oil 3.5% PUAAZ00 250.50–251.00 250.750 +6.250 PUAAY00 257.25–257.75 257.500 +6.250

*Basis East Med.northwest Europe cargoes (PGA page 1110)

FoB nWE cIF nWE/Basis ara

Naphtha (Sep) PAAAJ00 365.25–365.75 365.500 +14.750Naphtha PAAAL00 360.25–360.75 360.500 +10.250Gasoline 10 ppm AAXFQ00 388.00–388.50 388.250 +15.000Jet PJAAV00 341.00–341.50 341.250 +5.000 PJAAU00 347.25–347.75 347.500 +4.750ULSD 10 ppm AAVBF00 366.50–367.00 366.750 +5.000 AAVBG00 373.75–374.25 374.000 +5.000Diesel 10 ppm NWE** AAWZD00 367.75–368.25 368.000 +5.000 AAWZC00 375.00–375.50 375.250 +5.000Diesel 10 ppm UK AAVBH00 375.75–376.25 376.000 +5.000Diesel 10ppm UK MOPL Diff AUKMA00 -0.734 +0.121Gasoil 0.1% AAYWR00 358.25–358.75 358.500 +6.000 AAYWS00 368.25–368.75 368.500 +5.750Fuel oil 1.0% PUAAM00 265.25–265.75 265.500 +7.500 PUAAL00 273.25–273.75 273.500 +7.500Fuel oil 3.5% PUABB00 234.75–235.25 235.000 +5.500 PUABA00 246.25–246.75 246.500 +5.500

**Basis Le Havre.

northwest Europe barges (PGA page 1112)

FoB rotterdam***

Naphtha PAAAM00 356.25–356.75 356.500 +10.250Eurobob AAQZV00 374.75–375.25 375.000 +18.000E10 Eurobob AGEFA00 377.000 +14.00098 RON gasoline 10 ppm AAKOD00 444.75–445.25 445.000 +18.000Premium gasoline 10 ppm PGABM00 378.50–379.00 378.750 +16.750Reformate AAXPM00 388.000 +18.000Jet PJABA00 351.75–352.25 352.000 +4.750Diesel 10 ppm AAJUS00 368.00–368.50 368.250 +4.000Gasoil 50 ppm AAUQC00 362.00–362.50 362.250 +4.000Gasoil 0.1% AAYWT00 352.50–353.00 352.750 +5.000DMA MGO 0.1% LGARD00 354.000 -5.000Fuel oil 1.0% PUAAP00 262.00–262.50 262.250 +7.500Fuel oil 3.5% PUABC00 249.25–249.75 249.500 +5.500Fuel oil 3.5% 500 CST PUAGN00 246.50–247.00 246.750 +5.500Rotterdam bunker 380 CST PUAYW00 267.50–268.50 268.000 +11.000

***See notes on delivery basis for this table.

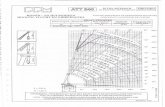

FUEL OIL HI�LO DIFF($/mt)

Source: S&P Global Platts

0

25

50

75

100

125

31-Jul 26-Jun 21-May 15-Apr 09-Mar 03-Feb

Volume 52 / Issue 149 / august 3, 2020

EuropEan MarKEtscan

www.platts.com

EuropEan FEEdstocKs and BLEndstocKs code Mid change

cIF northwest Europe cargo ($/mt) (PGF page 1760)

VGO 0.5-0.6% AAHMZ00 323.75–324.75 324.250 +6.500VGO 2% AAHND00 322.00–323.00 322.500 +6.500

FoB northwest Europe cargo ($/mt)

VGO 0.5-0.6% AAHMX00 312.00–313.00 312.500 +6.250VGO 2% AAHNB00 310.25–311.25 310.750 +6.250Straight Run 0.5-0.7% PKABA00 298.00–299.00 298.500 +4.000

FoB Black sea cargo ($/mt)

VGO 0.8% ABBAD00 315.500 +6.250VGO 2% ABBAC00 314.000 +6.500

cIF Mediterranean cargo ($/mt)

Straight Run 0.5-0.7% AAJNT00 299.750 +5.500VGO 0.8% ABBAB00 324.500 +6.250VGO 2% ABBAA00 322.750 +6.250

FoB rotterdam barge ($/mt)

MTBE* PHALA00 437.25–437.75 437.500 +14.000VGO 0.5-0.6% AAHNF00 305.50–306.50 306.000 +6.250VGO 2% AAHNI00 303.75–304.75 304.250 +6.250

*FOB Amsterdam-Rotterdam-Antwerp.

aFrIca products

code Mid change

West africa cargoes (PGA pages 1122, 2342 and 2412)

FoB nWE ($/mt)

Gasoline AAKUV00 368.250 +14.000

cIF West africa ($/mt)

Gasoline AGNWC00 388.500 +13.000

FoB sts West africa ($/mt)

Gasoil 0.3% AGNWD00 381.500 +4.500Jet AJWAA00 360.750 +9.250

cFr south africa ($/barrel)

Gasoline 95 unleaded AAQWW00 48.322 -1.151Jet kero AAQWT00 44.679 -1.579Gasoil 10 ppm AAQWU00 50.800 -1.266Gasoil 500 ppm AAQWV00 50.350 -1.266

(see page 12)

nEW HydroGEn assEssMEnts

EUROPEAN MARKETSCAN AUgUST 3, 2020

2© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

Euro-dEnominatEd assEssmEnts 16:30 LondonMed cargoes (€/mt) (PGA page 1120)

FoB Med cIF Med

(Italy) (Genova/Lavera)Naphtha* ABWHE00 294.907 ABWHD00 301.295Prem Unl 10ppm ABWGV00 323.013 ABWGU00 327.698Jet ABWGZ00 285.751 AAZBO00 294.69410ppm ULSD ABWHM00 314.283 ABWHH00 320.245Gasoil 0.1% ABWGQ00 307.257 ABWGO00 314.709Fuel oil 1.0% ABWGH00 232.731 ABWGF00 238.693Fuel oil 3.5% ABWGM00 213.568 ABWGK00 219.317

*Naphtha FOB Med is basis East Med.

northwest Europe cargoes (€/mt) (PGA page 1116)

FoB nWE cIF nWE/Basis araNaphtha AAQCE00 307.044Gasoline 10ppm ABWGS00 330.679Jet ABWHB00 290.648 AAQCF00 295.971ULSD 10 ppm ABWHO00 313.432 ABWHI00 319.607Diesel 10ppm NWE ABWHP00 312.367 ABWHK00 318.542Diesel 10 ppm UK ABWHJ00 320.245Diesel 10ppm UK MOPL Diff AUKMB00 -0.625Gasoil 0.1% ABWGR00 305.340 ABWGP00 313.857Fuel oil 1.0% AAQCG00 226.131 ABWGG00 232.944Fuel oil 3.5% ABWGN00 200.153 ABWGL00 209.948Straight run 0.5-0.7% ABWHG00 254.237

West africa cargoes (€/mt) (PGA page 1116)

FoB nWE cIF WaFGasoline AGNWA00 313.644 AANWC00 330.892

FoB sts West africa Gasoil 0.3% AGNWE00 324.930Jet AJWAB00 307.257

northwest Europe barges (€/mt) (PGA page 1118)

FoB rotterdamNaphtha ABWHF00 303.637Eurobob ABWGT00 319.394E10 Eurobob AGEFE00 321.09798 RON gasoline 10 ppm ABWGX00 379.014Premium gasoline 10 ppm AAQCH00 322.588Reformate AAXPN00 330.466Jet ABWHC00 299.804Diesel 10 ppm* AAQCI00 313.644Gasoil 50 ppm AAUQF00 308.534Gasoil 0.1%* AAYWY00 300.443DMA MGO 0.1%* LGARE00 301.508Fuel oil 1.0% ABWGI00 223.363Fuel oil 3.5% AAQCK00 212.503Fuel oil 3.5% 500 CST PUAGO00 210.161Rotterdam bunker 380 CST AAUHE00 228.260

*FOB Amsterdam-Rotterdam-Antwerp.

new York Harbor cargoes 16:30 London (€ cent/gal) (PGA pages 1350 & 1450)

FoB ny HarborUnleaded 87 AAPYV00 101.92Unleaded 89 AAPYW00 104.81Unleaded 93 AAPYX00 109.16

Euro/US$ forex rate: 1.1741. Platts Euro denominated European and US product assessments are based on market values and a Euro/US$ forex rate at 4:30 PM local London time.

ForEIGn ExcHanGE ratEs (PGA page 1151)

august 3, 2020 London 16:30Dollar/Swiss franc BCADC00 0.9208GB pound/Dollar BCADB00 1.3042Dollar/Yen BCACW00 106.1600Euro/Dollar BCADD00 1.1741Dollar/Ruble AAUJO00 73.3590

Euro cEnts pEr LitEr assEssmEnts 16:30 LondonMed cargoes (€ cents/liter) (PGA page 1370)

FoB Med cIF MedPrem Unl 10 ppm ABXGA00 24.378 ABXGB00 24.732Jet ABXGH00 23.346 ABXGI00 24.07610 ppm ULSD ABXGO00 26.567 ABXGP00 27.071Gasoil 0.1% ABXGY00 25.973 ABXGZ00 26.603

northwest Europe cargoes (€ cents/liter) (PGA page 1370)

FoB nWE cIF nWE/Basis araGasoline 10 ppm ABXGC00 24.957Jet ABXGJ00 23.746 ABXGK00 24.181ULSD 10 ppm ABXGQ00 26.405 ABXGR00 26.927Diesel 10 ppm NWE ABXGS00 26.495 ABXGT00 27.017Gasoil 0.1% ABXHA00 25.811 ABXHB00 26.531

northwest Europe barges (€ cents/liter) (PGA page 1370)

FoB rotterdamEurobob ABXGD00 24.105E10 Eurobob AGEFC00 24.23498 RON Gasoline 10 ppm ABXGE00 28.605Premium Gasoline 10 ppm ABXGF00 24.346Jet ABXGL00 24.494Diesel 10 ppm ABXGU00 26.513Gasoil 50 ppm ABXHC00 26.081Gasoil 0.1% ABXHD00 25.397

GB pEncE pEr LitEr assEssmEnts 16:30 London northwest Europe cargoes (p/liter) (PGA page 1370)

FoB nWE cIF nWE/Basis araGasoline 10 ppm ABXGG00 22.467Jet ABXGM00 21.377 ABXGN00 21.769ULSD 10 ppm ABXGV00 23.771 ABXGW00 24.241Diesel 10 ppm UK ABXGX00 24.370Diesel 10ppm UK MOPL Diff AUKMC00 -0.048Gasoil 0.1% ABXHE00 23.236 ABXHF00 23.884

IcE FuturEsplatts icE 16:30 London assessments* (PGA page 703)

Low sulfur Gasoil BrentAug AARIN00 369.50 Oct AAYES00 44.19Sep AARIO00 372.50 Nov AAYET00 44.56Oct AARIP00 377.50 Dec AAXZY00 44.93 Jan AAYAM00 45.27

*Platts ICE assessments reflect the closing value of the ICE contracts at precisely 16:30 London time.

IcE gasoil settlements (PGA page 702)

Low sulfur Gasoil Low sulfur GasoilAug * ICLO001 370.00 Nov ICLO004 381.50Sep ICLO002 373.00 Dec ICLO005 384.00Oct ICLO003 378.00 Jan ICLO006 387.50

*On day of ICE LS Gasoil midday expiry, M1 shows settlement value

IcE Ls gasoil GWaVE (previous day’s values) (PGA page 702)

Aug PXAAJ00 365.00 Sep PXAAK00 367.50

nyMEx FuturEs (16:30 London time)nyMEx WtI (PGA page 703)

$/barrel $/barrelSep AASCR00 41.10 Oct AASCS00 41.37

nyMEx ny uLsd (PGA page 703)

¢/gal ¢/galSep AASCT00 124.73 Oct AASCU00 126.17

nyMEx rBoB (unleaded gasoline) (PGA page 703)

¢/gal ¢/galSep AASCV00 121.41 Oct AASCW00 113.94

JEt IndEx (PGA page 115)

august 3, 2020 Index $/mtEurope & CIS PJECI00 119.59 PJECI09 349.75MidEast & Africa PJMEA00 125.21 PJMEA09 330.81Global PJGLO00 124.04 PJGLO09 358.18

BIodIEsEL prIcE assEssMEnts Low-High Midpoint change

northwest Europe differential to IcE gasoil ($/mt) (PBF page 1313)

FAME 0 (RED) FOB ARA AAXNT00 483.50-488.50 486.00 +26.75

PME (RED) FOB ARA AAXNY00 443.50-448.50 446.00 +26.75

RME (RED) FOB ARA AAXNU00 725.50-730.50 728.00 +22.75

SME (RED) FOB ARA AAXNX00 564.25-569.25 566.75 +25.50

UCOME (RED) FOB ARA AUMEA00 900.00 +26.00

EUROPEAN MARKETSCAN AUgUST 3, 2020

3© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

MarKEt coMMEntary

platts European Gasoline daily Market analysis�� European refineries cap run rates amid weak demand

outlook�� Buying demand in August remains weak for Med gaso-

line market

Poor refining margins continued to prevent some refiners from ramping up production at facilities in Europe, as the recovery in demand faltered amid a rise in coronavirus cases in some European countries.

“I don’t see any support for the Mediterranean gasoline market, margins are still awful,” a trader said, adding that the only export demand supporting the Med region could be to Northwest Europe, for the right grades.

Spanish company Cepsa said July 30 it would see its refineries in Spain operate with 85% run rates during July, while gradually increasing this toward the end of the year if demand rose. The company’s refineries were running at 82% during June.

Another Spanish company, Repsol, said its refineries would have a utilization rate of 77% for 2020, slightly higher than the 78% seen during the first half of the year.

In the shipping market, the lackluster buying sentiment for excess Northwest European gasoline had eroded

support for freight rates out of the region. The S&P Global Platts UK Continent-West Africa clean tanker route was assessed at Worldscale 120 July 31, with a vessel heard put on subjects from the Amsterdam-Rotterdam-Antwerp hub to WAF for as low as w60 July 30. A flattening contango structure in both the NWE and Med gasoline market does not favor floating storage interest for shippers.

In the European gasoline paper market, the September Eurobob crack was assessed at $1.15/b. The August/September spread was assessed at a $3.75/mt contango, while the September/October spread was in a $11.50/mt backwardation.

Meanwhile, the August Med/North gasoline differential – the spread between the August FOB Mediterranean 10ppm

EuropEan financiaL dErivativEs: auGust 3, 2020 ($/mt) (PPE page 1600)

code august* change code september change code october change

London Moc

Propane CIF NWE Large Cargo Financial ABWFX00 318.000 +15.000 AAHIK00 323.000 +23.000 AAHIM00 328.500 +18.500Naphtha CIF NWE Cargo Financial ABWFV00 364.500 -9.000 PAAAJ00 365.500 +14.750 AAECO00 365.250 +13.750Gasoline Prem Unleaded 10 ppm FOB ARA Barge Financial ABWFT00 383.750 -18.750 AAEBW00 387.500 +17.500 AAEBY00 376.000 +2.000Gasoline Eurobob 10 ppm FOB ARA Barge Financial ABWFB00 377.250 -15.750 ABWFC00 381.000 +18.000 ABWFD00 369.500 +2.500Gasoline Eurobob Non-oxy E10 Barge Financial AGEAB00 383.250 -15.750 AGEAM01 387.000 +19.000 AGEAM02 375.500 +3.500Jet FOB Rdam Barge Financial AAXUH00 346.250 -6.750 AAXUM01 351.250 +9.000 AAXUM02 359.000 +12.750Jet CIF NWE Cargo Financial ABWCI00 347.250 -2.500 ABWCJ00 354.000 +10.750 ABWCK00 361.750 +12.750ULSD 10 ppmS FOB ARA Barge Financial ABWEA00 369.500 +0.250 ABWEB00 373.000 +7.750 ABWEC00 377.500 +9.750ULSD 10 ppmS CIF NWE Cargo Financial ABWDM00 375.000 -0.500 ABWDN00 378.750 +8.250 ABWDO00 383.250 +9.750ULSD 10 ppmS CIF Med Cargo Financial ABWCY00 375.750 -1.250 ABWCZ00 379.500 +8.250 ABWDA00 384.500 +10.250LS Gasoil Frontline Financial ABWAO00 371.500 +0.500 AAPQS00 376.000 +9.250 AAPQT00 380.000 +9.250Gasoil .1%S (1000 ppm) FOB ARA Barge Financial ABWBT00 356.750 +1.000 ABWBU00 360.750 +8.750 ABWBV00 367.000 +11.500Gasoil 0.1%S CIF NWE Cargo Financial ABWBF00 368.000 +2.750 ABWBG00 372.500 +9.750 ABWBH00 376.500 +9.500Gasoil .1%S (1000 ppm) CIF Med Cargo Financial ABWAS00 368.750 +0.500 ABWAT00 372.500 +8.500 ABWAU00 377.000 +9.750FO 3.5%S FOB Rdam Barge Financial ABWAE00 248.250 +6.000 AAEHB00 243.750 +2.750 AAEHC00 240.250 +3.500FO 3.5%S FOB Med Cargo Financial ABWAG00 245.000 +6.500 AAEHK00 238.000 -0.250 AAEHL00 231.500 +0.500FO 3.5%S FOB Rdam Barge vs FO 3.5%S FOB Med Cargo Financial ABWAM00 3.250 -0.500 AAEHK01 5.750 +3.000 AAEHL01 8.750 +3.000FO 1%S FOB Rdam Barge Financial ABWAA00 261.250 +4.250 AALTA00 261.500 +7.500 AALTC00 266.000 +11.500FO 1%S FOB NWE Cargo Financial ABWAC00 266.250 +6.250 AAEGR00 269.000 +10.000 AAEGS00 274.250 +12.250FO 1%S FOB NWE vs FO 3.5%S Barge (HiLo Diff) Financial ABWAI00 18.000 +0.250 AAEGR01 25.250 +7.250 AAEGS01 34.000 +8.750

*Balance-month swaps are assessed from the 1st to the 15th of the month.

singapore at London Moc

FO 380 CST 3.5%S FOB Spore Cargo at London MOC Financial FPLSM01 255.500 +4.000 FPLSM02 255.750 +5.500FO 380 3.5% FOB Spore Cargo vs FO 3.5% FOB Rdam Barge (E-W) FQLSM01 11.750 +1.250 FQLSM02 15.500 +2.000at London MOC FinancialFO 180 CST 3.5%S FOB Spore Cargo at London MOC Financial FOLSM01 262.750 +4.250 FOLSM02 263.250 +5.750FO 180 3.5% FOB Spore Cargo vs FO 3.5% FOB Rdam Barge (E-W) F1BDM01 19.000 +1.500 F1BDM02 23.000 +2.250at London MOC Financial

EUROPEAN MARKETSCAN AUgUST 3, 2020

4© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

MarInE FuEL (PGA page 30)

$/mt change0.5% FOB Singapore cargo AMFSA00 322.010 -7.0400.5% FOB Fujairah cargo AMFFA00 312.750 -7.0300.5% FOB Rotterdam barge PUMFD00 296.250 +4.2500.5% FOB US Gulf Coast barge AUGMB00 305.250 +4.7500.5% Dlvd US Atlantic Coast barge AUAMB00 316.000 +4.7500.5% FOB Mediterranean cargo MFFMM00 298.250 +3.5000.5% CIF Mediterranean cargo MFCMM00 304.500 +3.500

$/barrel0.5% FOB US Gulf Coast barge AUGMA00 48.070 +0.7500.5% Dlvd US Atlantic Coast barge AUAMA00 49.760 +0.740

vs Fo 380 Mops strip ($/mt)0.5% FOB Singapore cargo AMOPA00 72.390 -2.930

MarInE FuEL 0.5% dErIVatIVEs, auG 3 Balance* change Month 1 change Month 2 change aug sep oct $/mt $/mt $/mt0.5% FOB Singapore cargo FOFS000 321.750 +9.250 FOFS001 321.750 -7.050 FOFS002 322.750 -6.0000.5% FOB Fujairah cargo FOFF000 311.750 +9.250 FOFF001 311.750 -7.050 FOFF002 312.750 -6.0000.5% FOB Rotterdam barge AMRAB00 300.500 +2.750 AMRAM01 305.500 +9.000 AMRAM02 311.250 +9.2500.5% vs. 3.5% FOB Rotterdam barge AMRBB00 52.250 -3.250 AMRBM01 61.750 +6.250 AMRBM02 71.000 +5.750 $/barrel $/barrel $/barrel0.5% FOB US Gulf Coast barge AUSAB00 47.600 +0.650 AUSAM01 47.400 +0.550 AUSAM02 47.550 +0.9000.5% vs US Gulf Coast HSFO barge AUSBB00 9.550 +0.500 AUSBM01 9.550 +0.100 AUSBM02 9.900 +0.400

*Balance month swaps are assessed from 1st through the 15th of the month; Asia swaps are assessed through the 14th of February

code Mid

FoB Med cargo (Italy) (PGA page 1115)

Naphtha* PAAAI03 365.859–366.359 366.109Prem Unl 10ppm AAWZA03 388.793–389.293 389.043Jet AAIDM00 335.685–336.185 335.93510ppm ULSD AAWYY03 370.196–370.696 370.446Gasoil 0.1% AAVJI03 359.674–360.174 359.924Fuel oil 1.0% PUAAK03 262.826–263.326 263.076Fuel oil 3.5% PUAAZ03 234.804–235.304 235.054

FoB Black sea (PGF page 1761)

VGO 0.8% ABBAD03 306.272VGO 2% max ABBAC03 301.391

cIF Med cargo (Genova/Lavera) (PGA page 1115)

Naphtha PAAAH03 373.685–374.185 373.935Prem Unl 10ppm AAWZB03 394.565–395.065 394.815Jet AAZBN03 346.620–347.120 346.87010ppm ULSD AAWYZ03 377.424–377.924 377.674Gasoil 0.1% AAVJJ03 368.663–369.163 368.913Fuel oil 1.0% PUAAJ03 270.674–271.174 270.924Fuel oil 3.5% PUAAY03 242.533–243.033 242.783VGO 0.8% ABBAB03 316.250VGO 2% max ABBAA03 311.391

FoB nWE cargo (PGA page 1111)

Jet PJAAV03 341.761–342.261 342.011ULSD 10 ppm AAVBF03 367.098–367.598 367.348Diesel 10ppm NWE AAWZD03 368.348–368.848 368.598Gasoil 0.1% AAYWR03 355.957–356.457 356.207Fuel oil 1.0% PUAAM03 255.728–256.228 255.978Fuel oil 3.5% PUABB03 223.457–223.957 223.707Straight run 0.5-0.7% PKABA03 301.011–302.011 301.511VGO 0.5-0.6% AAHMY00 304.859–305.859 305.359VGO 2% max AAHNC00 299.989–300.989 300.489

cIF West africa cargo (PGA page 1111)

Gasoline AGNWC03 398.011

caLEndar MontH aVEraGEs For JuLy 2020 code Mid

FoB nWE West africa cargo (PGA page 1111)

Gasoline AAKUV03 379.761

cIF nWE cargo (basis ara) (PGA page 111)

Naphtha physical PAAAL03 380.598–381.098 380.848Gasoline 10ppm AAXFQ03 405.489–405.989 405.739Jet PJAAU03 348.120–348.620 348.370ULSD 10 ppm AAVBG03 374.511–375.011 374.761Diesel 10ppm NWE AAWZC03 375.761–376.261 376.011Diesel 10 ppm UK AAVBH03 376.598–377.098 376.848Diesel 10ppm UK MOPL Diff AUKMA03 2.002Gasoil 0.1% AAYWS03 366.065–366.565 366.315Fuel oil 1.0% PUAAL03 263.837–264.337 264.087Fuel oil 3.5% PUABA03 235.065–235.565 235.315VGO 0.5-0.6% AAHNA00 316.641–317.641 317.141VGO 2% max AAHNE00 311.761–312.761 312.261

FoB rotterdam barges (PGA page 1113)

Naphtha PAAAM03 376.598–377.098 376.848Eurobob AAQZV03 384.174–384.674 384.42498 RON gasoline 10 ppm AAKOE00 454.174–454.674 454.424Premium gasoline 10 ppm PGABM03 391.500–392.000 391.750MTBE** PHBFZ03 447.902–448.402 448.152Jet PJABA03 352.478–352.978 352.728Diesel 10 ppm** AAJUW00 368.467–368.967 368.717Gasoil 50 ppm AAUQC03 363.087–363.587 363.337Gasoil 0.1%** AAYWT03 355.011–355.511 355.261DMA MGO 0.1%* LGARD03 354.913Fuel oil 1.0% PUAAP03 252.511–253.011 252.761Fuel oil 3.5% PUABC03 238.391–238.891 238.641Fuel oil 3.5% 500 CST PUAGN03 235.315–235.815 235.565Rotterdam bunker 380 CST PUAYW03 250.413–251.413 250.913VGO 0.5-0.6% AAHNG00 306.815–307.815 307.315VGO 2% max AAHNJ00 301.935–302.935 302.435Reformate AAXPM03 398.293

*Naphtha FOB is basis east Med. **FOB Amsterdam/Rotterdam/Antwerp.

EUROPEAN MARKETSCAN AUgUST 3, 2020

5© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

cargo swap and the equivalent FOB Amsterdam-Rotterdam Eurobob barge – was assessed at $1/mt, with September at minus $2/mt.

Platts NWE Gasoline FOB Barge Daily Rationales & ExclusionsGasoline prem unleaded 10ppms FoB ar Barge <pGaBM00>

assessment rationale: FOB AR 10 ppm premium unleaded gasoline barges were assessed at a $3.75/mt premium to physical Eurobob gasoline barges, down from $5/mt, off the back an outstanding competitive offer over mid-window dates. A 13 cents/mt contango structure, derived from the $377.25/mt August and $381/mt September swaps assessments, was applied to the front and back of the curve.

Gasoline Eurobob FoB ar Barge <aaQZV00> assessment

rationale: Eurobob gasoline barges were assessed at a $6/mt discount to the August swap, the differential unchanged on the day, using information heard from the market and in the absence of competitive indications in the Platts Market on Close assessment process.

Exclusions: No data was excluded from the Aug. 3 market on close assessment process.

Platts NWE Med Gasoline Unl Cargo Daily Rationales & Exclusions

Gasoline 10ppms cIF nWE cargo <aaxFQ00> assessment

rationale: The CIF NWE gasoline cargo market was assessed at a $13.25/mt premium over Eurobob gasoline barges, off the back of an outstanding competitive offer for $387.67/mt over Aug. 13-17 dates. A 13 cents/mt contango structure, derived from the $393.50/mt August and $397.25/mt September swaps assessments, was applied to the curve.

Gasoline prem unleaded 10ppms FoB Med cargo

<aaWZa00> assessment rationale: The FOB Mediterranean gasoline cargo market was assessed at a $1/mt premium to the August Med swap, based on the relationship between the physical and swaps markets in the absence of

dEaLs suMMary

premium gasoline 10 ppm barges

trades (PGA page 1304)

�■ 10PPM: NWE Brg Smr 10ppm: MW: STR* sold to BP 1kt: kt $379.00/mt 15:25:07�■ 10PPM: NWE Brg Smr 10ppm: MW: STR* sold to BP 1kt: kt $379.00/mt 15:27:39�■ 10PPM: NWE Brg Smr 10ppm: MW: LITASCO* sold to BP 1kt: kt $379.00/mt 15:27:44�■ 10PPM: NWE Brg Smr 10ppm: MW: STR* sold to BP 1kt: kt $379.00/mt 15:29:03�■ 10PPM: NWE Brg Smr 10ppm: MW: STR sold to BP* 1kt: kt $379.00/mt 15:29:13�■ 10PPM: NWE Brg Smr 10ppm: MW: STR* sold to BP 1kt: kt $379.00/mt 15:29:33�■ 10PPM: NWE Brg Smr 10ppm: MW: LITASCO sold to BP* 1kt: kt $379.00/mt 15:29:41�■ 10PPM: NWE Brg Smr 10ppm: MW: STR sold to GUNVORSA* 1kt: kt $379.00/mt 15:29:43

* Denotes market maker. All times GMT

Bids (PGA page 1302)

�■ No bids reported

Withdrawals

�■ 10PPM: NWE Brg Smr 10ppm: MW: BP no longer bids 1kt: $379.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: GUNVORSA no longer bids 1kt: $379.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: TOTSA Withdraws bid 1kt: $378.00/mt

** Denotes OCO order.

offers (PGA page 1303)

�■ 10PPM: NWE Brg Smr 10ppm: FE: LITASCO offers 1kt: $379.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: STR offers 1kt: $379.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: HARTREEUK offers 1kt: $382.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: MCTSA offers 1kt: $387.00/mt

Withdrawals

�■ 10PPM: NWE Brg Smr 10ppm: MW: LITASCO no longer offers 1kt: $379.00/mt�■ 10PPM: NWE Brg Smr 10ppm: MW: LITASCO-MSILEW Withdraws offer 1kt: $379.00/mt

** Denotes OCO order.

EBoB Barges

trades (PGA page 1304)

�■ No trades reported* Denotes market maker. All times GMT

Bids (PGA page 1302)

�■ No bids reported

Withdrawals

�■ No bids reported** Denotes OCO order.

offers (PGA page 1303)

�■ No offers reported

Withdrawals

�■ No offers reported** Denotes OCO order.

Gasoil 50ppm barges

trades (PGA page 1417)

�■ No trades reported* Denotes market maker. All times GMT

Bids (PGA page 1415)

�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: FE: PSXCS bids 1-3kt: $-8.5/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: FE: MABADEUT bids 1-3kt: $-10/mt

Withdrawals

�■ No bids reported** Denotes OCO order.

offers (PGA page 1416)

�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: FE: BELGOM offers 1-3kt: $-7/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: FE: GLENCOREUK offers 1-3kt: $-5/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: MW: BELGOM offers 1-3kt: $-6/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: MW: GLENCOREUK offers 1-3kt: $-5/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: BE: BELGOM offers 1-3kt: $-6/mt�■ PLATTS GASOIL 50PPM BARGE 1-3KT ICE LSGO M1: ARA: BE: GLENCOREUK offers 1-3kt: $-5/mt

Withdrawals

�■ No offers reported** Denotes OCO order.

EUROPEAN MARKETSCAN AUgUST 3, 2020

6© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

competitive indications seen in the Platts Market on Close assessment process.

Gasoline prem unleaded 10ppms cIF Med cargo <aaWZB00>

assessment rationale: The CIF Mediterranean gasoline cargo assessment was derived as a freight net-forward from the FOB Mediterranean gasoline cargo assessment, using the following: FOB Med gasoline cargo assessment plus the cost of transporting a 30,000 mt clean cargo from a basket of Mediterranean ports to a basket of Mediterranean destinations.

Exclusions: No data was excluded from the Aug. 3 assessment process.

platts European Gasoline, cargo, Bids, offers, trades

Bids: Platts Prem Unl FOB Med Crg FOB bss Thessaloniki 10-25, BP bids Aug 15-Aug 19 100% Flat Price Flat Price $379.00 for 25000-25000 “Optol: 0-5kt: pricing basis FOB Med, B/L plus 3 quotes plus $0/mt.Spec: EN228 EU qualified min 95/85 ron/mon, 10ppm S max,60 kPa RVP max, REACH compliant, 0.755 escalate/de-escalate”Offers:Platts Prem Unl FOB Med Crg FOB bss Thessaloniki 10-25, LITASCO offers Aug 17-Aug 21 100% Prem Unl 10ppm FOB Med Crg BalMnth Next Day $2.00 for 27000-27000 “Optol: 0-6 kt at Platts FOB Med Mean Prem Unl 10 ppm plus $0/mt, (B/L plus 3 quotes), where BL = 0, of EN228 EU qualifying min 95/85 Ron/Mon, 10ppmS max, 60 kPa RVP max, reach compliant, 0.755 escalate/de-escalate, loading 17-21 August 2020 FOB basis on safe port/berth Thessaloniki.Platts Gasoline CIF NWE Crg CIF bss Thames 10-25, LITASCO offers Aug 13-Aug 17 100% Flat Price Flat Price $387.00 for 9000-9000 “0-2kt sellers option at mean Platts Gasoline Cargo CIF NWE pricing 3 quotes after COD (COD= 0) at $0/mt pricing, for EN228 10ppm unleaded gasoline CIF Basis Thames UK, 13-17 August 2020 on full cargo with ec/wc/ara options on Exxon / Total / Shell approved vsl. Product must be EU-qualified; it must meet EN228 Specification with max

Gasoil 0.1% Barges

trades (PGA page 1426)

�■ No trades reported* Denotes market maker. All times GMT

Bids (PGA page 1424)

�■ PLATTS GASOIL 0.1 BARGE 1-3KT ICE LSGO M1: ARA: BE: LITASCO bids 1-3kt: $-18/mt

Withdrawals

�■ No bids reported** Denotes OCO order.

offers (PGA page 1425)

�■ PLATTS GASOIL 0.1 BARGE 1-3KT ICE LSGO M1: ARA: FE: GLENCOREUK offers 1-3kt: $-14.5/mt�■ PLATTS GASOIL 0.1 BARGE 1-3KT ICE LSGO M1: ARA: BE: GLENCOREUK offers 1-3kt: $-14.5/mt�■ PLATTS GASOIL 0.1 BARGE 1-3KT ICE LSGO M1: ARA: BE: BP offers 1-3kt: $-14.5/mt

Withdrawals

�■ No offers reported** Denotes OCO order.

diesel barges

trades (PGA page 1476)

�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI* sold to MABADEUT 2.9kt: kt $-1.75/mt 15:28:27�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TOTSA* sold to BP 3kt: kt $-1.75/mt 15:28:37�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: STR* sold to BP 3kt: kt $-1.75/mt 15:28:46�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: STR* sold to VITOL 3kt: kt $-1.75/mt 15:28:56�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: STR* sold to MABADEUT 2.3kt: kt $-1.75/mt 15:29:03�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI sold to MABADEUT* 3kt: kt $-2/mt 15:29:13�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI sold to GLENCOREUK* 3kt: kt $-2/mt 15:29:25�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI sold to BP* 2kt: kt $-2/mt 15:29:30�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: STR sold to MABADEUT* 3kt: kt $-2/mt 15:29:32�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI sold to BP* 2kt: kt $-2/mt 15:29:46

* Denotes market maker. All times GMT

Bids (PGA page 1474)

�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: MABADEUT bids 1-3kt: $-1.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: BP bids 1-3kt: $-1.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: GLENCOREUK bids 1-3kt: $-2/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: MABADEUT bids 1-3kt: $-1/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: BP bids 1-3kt: $-1/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: GLENCOREUK bids 1-3kt: $-2/mt

Withdrawals

�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: GLENCOREUK no longer bids 1-3kt: $-2/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: MABADEUT no longer bids 1-3kt: $-2/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: BP no longer bids 1-3kt: $-2/mt

** Denotes OCO order.

offers (PGA page 1475)

�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: GUNVORSA offers 1-3kt: $-1/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: GUNVORSA offers 1-3kt: $-0.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: FG Smr: MW: TOTSA offers 1-3kt: $-0.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: TOTSA offers 1-3kt: $-0.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: STR offers 1-3kt: $-0.5/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: MW: TRAFI offers 1-3kt: $-0.25/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: TRAFI offers 1-3kt: $-0.25/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: TOTSA offers 1-3kt: $0.50/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: BE: STR offers 1-3kt: $0/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: FG Smr: BE: TOTSA offers 1-3kt: $0/mt

Withdrawals

�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TRAFI no longer offers 1-3kt: $-1.75/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: TOTSA no

dEaLs summarY (continuEd)

EUROPEAN MARKETSCAN AUgUST 3, 2020

7© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

10ppm Sulphur, max 60kpa, max 35% Aromatics, max 0.9% wt total oxygen, E70 and metallic additives as per Platt’s guidelines”Trades: NoneThis assessment commentary applies to the following market data codes: Gasoline 10ppm CIF NWE Cargo <AAXFQ00> Prem Unl 10ppm FOB Italy <AAWZA00> Prem Unl 10ppm CIF Genoa/Lavera <AAWZB00>

platts European naphtha daily Market analysis�� Naphtha sees uptick on crude rise�� Demand remains challenged

The European naphtha market saw some support at the beginning of the week Aug. 3 in terms of outright prices, but as demand was not strengthening fundamentals remained a challenge.

Naphtha CIF NWE was assessed at $360.50/mt, up $10.25/mt on July 31, largely tracking more positive sentiment in the crude oil complex.

However, demand in the European market appeared to be weakening as excess volumes built up in Northwest Europe, sources said. Blenders were still finding naphtha blendstock grades unattractive despite the recent weakness of prices because gasoline demand was also falling off amid uncertainty regarding new coronavirus spikes. The gasoline Eurobob FOB ARA September swap was assessed at a premium of $15.50/mt over the equivalent naphtha contract.

“Demand in August doesn’t look great,” a naphtha trader said.

The main pressure point for demand recovery in the near term at least could be buying interest from petrochemicals producers, particularly as the premium to propane was narrowing. However, an increase in naphtha utilization rates would be something a slow of a process, sources said. The naphtha CIF NWE August contract closed at a $42.50/mt premium to its propane equivalent, down $8.25/mt.

longer offers 1-3kt: $-1.75/mt�■ PLATTS ULSD BARGE 1-3KT ICE LSGO M1: ARA Smr: FE: STR no longer offers 1-3kt: $-1.75/mt

** Denotes OCO order.

HsFo barges

trades (PGA page 1505)

�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: TOTSA sold to LITASCO* 2kt: kt $248.75/mt 15:29:49�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to LITASCO* 2kt: kt $249.25/mt 15:28:59�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to VITOL* 2kt: kt $249.50/mt 15:29:03�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to LITASCO* 2kt: kt $249.25/mt 15:29:08�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to LITASCO* 2kt: kt $249.25/mt 15:29:28�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to VITOL* 2kt: kt $249.25/mt 15:29:31�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: TOTSA sold to VITOL* 2kt: kt $249.25/mt 15:29:38�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to LITASCO* 2kt: kt $249.00/mt 15:29:44�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR sold to VITOL* 2kt: kt $249.25/mt 15:29:56

* Denotes market maker. All times GMT

Bids (PGA page 1503)

�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: LITASCO bids 2kt: $248.50/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: MAERSK bids 2kt: $248.25/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: VITOL bids 2kt: $248.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: BPBV bids 2kt: $242.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO bids 2kt: $248.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: VITOL bids 2kt: $248.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO bids 2kt: $247.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: BPBV bids 2kt: $242.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: LITASCO bids 2kt: $248.50/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: LITASCO bids 2kt:

$248.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: VITOL bids 2kt: $248.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: MAERSK bids 2kt: $247.75/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: LITASCO bids 2kt: $247.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: VITOL bids 2kt: $247.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: BPBV bids 2kt: $243.00/mt

Withdrawals

�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: MERCURIASA Withdraws bid 2kt: $248.50/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: STR Withdraws bid 2kt: $242.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO no longer bids 2kt: $249.25/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: MERCURIASA Withdraws bid 2kt: $249.25/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: VITOL no longer bids 2kt: $249.25/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO no longer bids 2kt: $249.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: MAERSK Withdraws bid 2kt: $247.75/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR Withdraws bid 2kt: $242.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: STR Withdraws bid 2kt: $242.00/mt

** Denotes OCO order.

offers (PGA page 1504)

�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: TOTSA offers 2kt: $250.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: STR offers 2kt: $251.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: TOTSA offers 2kt: $250.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: STR offers 2kt: $250.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: GUNVORSA offers 2kt: $253.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: STR offers 2kt: $249.50/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: TOTSA offers 2kt: $250.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: GUNVORSA offers 2kt:

dEaLs summarY (continuEd)

EUROPEAN MARKETSCAN AUgUST 3, 2020

8© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

In Asian markets, the September East-West spread – the premium of the CFR Japan naphtha cargo swap over the CIF NWE equivalent – was assessed at $17.75/mt, up $3.50/mt from the previous assessment, with October $2.50/mt higher at $17/mt. The slight uptick was mainly due to a weaker European complex.

In other paper market activity, the front-month September CIF NWE naphtha swap was assessed at $365.50/mt, up $14/mt on the day, while the market structure remained in contango, with the differential between naphtha CIF NWE August and the equivalent September contract seen at $1/mt, down 25 cents/mt. The naphtha crack spread against the ICE Brent crude oil October contract closed at minus $3.25/mt, up 60 cents/mt.

platts nW Europe naphtha cIF cargo daily rationale & Exclusions

naphtha cif nWE cargo <paaaL00> assessment rationale:

The CIF NWE naphtha cargo assessment was derived using the following input: Aug. 18 was assessed at $360.34/mt, factoring in an outstanding offer for a 28,000 mt cargo, for Aug. 16-20 delivery in the Platts Market on Close assessment process. A 3 cents/day contango structure,

Editorial: Naphtha: +44-20-7176-6122 | Gasoline: +44-20-7176-6205 | Jet: +44-20-7176-6672 | Diesel: +44-20-7176-1294 | Gasoil: +44-20-7176-7813 | HS Fuel Oil: +44-20-7176-6230 | LS Fuel Oil: +44-20-7176-6512 | North Sea crude: +44-20-7176-6059 | Urals and Med crudes: +44-20-7176-6112 | WAF crudes: +44-20-7176-6230

contact platts support: [email protected]; Americas: +1-800-752-8878; Europe & Middle East: +44-20-7176-6111; Asia Pacific: +65-6530-6430

trade data: Platts has defined standards for entities it considers to be related and verifies through a variety of inputs whether counterparties in reported trades meet these criteria.

© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

The names “S&P Global Platts” and “Platts” and the S&P Global Platts logo are trademarks of

S&P Global Inc. Permission for any commercial use of the S&P Global Platts logo must be granted in writing by S&P Global Inc.

You may view or otherwise use the information, prices, indices, assessments and other related information, graphs, tables and images (“Data”) in this publication only for your personal use or, if you or your company has a license for the Data from S&P Global Platts and you are an authorized user, for your company’s internal business use only. You may not publish, reproduce, extract, distribute, retransmit, resell, create any derivative work from and/or otherwise provide access to the Data or any portion thereof to any person (either within or outside your company, including as part of or via any internal electronic system or intranet), firm or entity, including any subsidiary, parent, or other entity that is affiliated with your company, without S&P Global Platts’ prior written consent or as otherwise authorized under license from S&P Global Platts. Any use or distribution of the Data beyond the express uses authorized in this paragraph above is subject to the payment of additional fees to S&P Global Platts.

S&P Global Platts, its affiliates and all of their third-party licensors disclaim any and all warranties, express or implied, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use as to the Data, or the results obtained by its use or as to the performance thereof. Data in this publication includes independent and verifiable data collected from actual market participants. Any user of the Data should not rely on any information and/or assessment contained therein in making any investment, trading, risk management or other decision. S&P Global Platts, its affiliates and their third-party licensors do not guarantee the adequacy, accuracy, timeliness and/or completeness of the Data or any

component thereof or any communications (whether written, oral, electronic or in other format), and shall not be subject to any damages or liability, including but not limited to any indirect, special, incidental, punitive or consequential damages (including but not limited to, loss of profits, trading losses and loss of goodwill).

ICE index data and NYMEX futures data used herein are provided under S&P Global Platts’ commercial licensing agreements with ICE and with NYMEX. You acknowledge that the ICE index data and NYMEX futures data herein are confidential and are proprietary trade secrets and data of ICE and NYMEX or its licensors/suppliers, and you shall use best efforts to prevent the unauthorized publication, disclosure or copying of the ICE index data and/or NYMEX futures data.

Permission is granted for those registered with the Copyright Clearance Center (CCC) to copy material herein for internal reference or personal use only, provided that appropriate payment is made to the CCC, 222 Rosewood Drive, Danvers, MA 01923, phone +1-978-750-8400. Reproduction in any other form, or for any other purpose, is forbidden without the express prior permission of S&P Global Inc. For article reprints contact: The YGS Group, phone +1-717-505-9701 x105 (800-501-9571 from the U.S.).

For all other queries or requests pursuant to this notice, please contact S&P Global Inc. via email at [email protected].

EuropEan MarKEtscan

$253.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: MERCURIASA offers 2kt: $254.00/mt

Withdrawals

�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: BPBV Withdraws offer 2kt: $250.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: LITASCO Withdraws offer 2kt: $254.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: FE: LITASCO Withdraws offer 2kt: $255.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: BPBV Withdraws offer 2kt: $251.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO Withdraws offer 2kt: $254.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: MW: LITASCO Withdraws offer 2kt: $255.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: LITASCO Withdraws offer 2kt: $254.00/mt�■ PLATTS FUEL OIL 3.5% RDAM BARGES: BE: LITASCO Withdraws offer 2kt: $255.00/mt

** Denotes OCO order.

LsFo barges

trades (PGA page 1505)

�■ No trades reported* Denotes market maker. All times GMT

Bids (PGA page 1503)

�■ No bids reported

Withdrawals

�■ No bids reported** Denotes OCO order.

offers (PGA page 1504)

�■ No offers reported

Withdrawals

�■ No offers reported** Denotes OCO order.

HsFo rMK 500 barges

trades (PGA page 1505)

�■ No trades reported* Denotes market maker. All times GMT

Bids (PGA page 1503)

�■ No bids reported

Withdrawals

�■ No bids reported** Denotes OCO order.

offers (PGA page 1504)

�■ No offers reported

Withdrawals

�■ No offers reported** Denotes OCO order.

dEaLs summarY (continuEd)

EUROPEAN MARKETSCAN AUgUST 3, 2020

9© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

russIan doMEstIc rEFInEd products assEssMEnts (rb/mt) Fca privolzhsky Federal district, Basis ufa Fca central Federal district, Basis Moscowdiesel (PGA page 1430)

Diesel AAUDO00 44,150 0 AAUDT00 46,400 -50

Gasoline (PGA page 1330)

Gasoline Premium Unleaded AAUDL00 51,950 -1500 AAUDQ00 53,500 -1300Gasoline Regular Unleaded AAUDM00 49,750 -450 AAUDR00 51,150 -850

Fuel oil (PGA page 1530)

Low sulfur fuel oil 1% AAUDP00 9,850 +600 AAUDU00 12,900 +300Fuel oil 3.5% M-100 AAUNU00 9,050 +600 AAUNV00 12,100 +300

russIan doMEstIc rEFInEd products nEtBacKsrefinery port code rb/mt change code $/mt change underlying marker

Middle distillates (PGA page 1440)

Gasoil and diesel 10 ppmMoscow St Peter AAWRP00 37,884.417 +465.922 AAWRO00 515.953 +5.909 ULSD CIF NWE CrgMoscow Ventspils AAWRR00 37,122.328 +464.570 AAWRQ00 505.574 +5.900 ULSD CIF NWE CrgYaroslavl St Peter AAXKP00 38,378.577 +465.922 AAXKO00 522.683 +5.903 ULSD CIF NWE CrgNORSI Novorossiysk AAXKA00 35,596.299 +399.130 AAWRU00 484.791 +5.026 ULSD FOB Med CrgSyzran Novorossiysk AAXKI00 36,381.567 +399.130 AAXKH00 495.485 +5.016 ULSD FOB Med CrgSyzran Ventspils AAWJQ00 36,746.632 +464.570 AAWJP00 500.457 +5.904 ULSD CIF NWE CrgKomsomolsk Nakhodka AAWRJ00 35,548.820 -1195.324 AAWRI00 484.144 -16.708 GO 0.05% SporeCrgKhabarovsk Nakhodka AAWRD00 36,202.316 -1195.324 AAWRC00 493.044 -16.716 GO 0.05% SporeCrgUfa Ventspils AAWJT00 36,458.692 +464.570 AAWJR00 496.536 +5.908 ULSD CIF NWE CrgUfa Primorsk AAXYF00 37,289.805 +466.395 AAXYJ00 507.855 +5.923 ULSD CIF NWE CrgOmsk Ventspils AAWJO00 34,849.084 +464.570 AAWJN00 474.614 +5.926 ULSD CIF NWE CrgOmsk Novorossiysk AAWKQ00 33,607.059 +399.130 AAWKP00 457.699 +5.049 GO 0.1% Med CrgYaroslavl Primorsk AAWJZ00 39,163.737 +466.395 AAWJY00 533.376 +5.901 ULSD CIF NWE CrgNORSI Primorsk AAWJX00 39,009.069 +466.395 AAWJW00 531.270 +5.903 ULSD CIF NWE CrgKirishi Primorsk AAWJV00 40,591.797 +466.395 AAWJU00 552.825 +5.884 ULSD CIF NWE CrgVolgograd Novorossiysk ABXKR00 37,871.007 +399.130 ABXKQ00 515.770 +4.999 ULSD FOB Med CrgDiesel damping value RNDCD00 -4,760.486

Jet fuelMoscow Ventspils AAWKB00 25,715.767 +441.788 AAWKA00 350.227 +5.723 Jet fuel ARA Brg

Gasoline (PGA page 1340)

Moscow Vysotsk AAWRT00 42,815.791 +1610.772 AAWRS00 583.114 +21.457 Eurobob ARA BrgYaroslavl Vysotsk AAXKT00 43,259.407 +1610.772 AAXKS00 589.156 +21.452 Eurobob ARA BrgNORSI Novorossiysk AAXKE00 41,287.951 +1280.337 AAXKD00 562.306 +16.970 Prem Unl Med CrgNORSI Vysotsk AAWIN00 42,493.327 +1610.772 AAWIO00 578.722 +21.460 Eurobob ARA BrgSyzran Novorossiysk AAXKL00 42,073.219 +1280.337 AAXKK00 573.001 +16.962 Prem Unl Med CrgKomsomolsk Nakhodka AAWRL00 40,889.789 -805.481 AAWRK00 556.884 -11.456 Unl 92 Spore CrgKhabarovsk Nakhodka AAWRF00 41,543.285 -805.481 AAWRE00 565.784 -11.463 Unl 92 Spore CrgKirishi Vysotsk AAWIW00 44,580.283 +1610.772 AAWIP00 607.145 +21.436 Eurobob ARA BrgUfa Vysotsk AAWJE00 40,981.663 +1610.772 AAWJD00 558.135 +21.479 Eurobob ARA BrgOmsk Vysotsk AAWJC00 40,143.187 +1610.772 AAWIX00 546.716 +21.489 Eurobob ARA BrgGasoline damping value RNGCD00 -5,271.393

Fuel oil (PGA page 1540)

Moscow St Peter AAWRN00 12,907.936 +497.645 AAWRM00 175.795 +6.633 FO 3.5% ARA BrgYaroslavl St Peter AAXKN00 13,402.096 +497.645 AAXKM00 182.525 +6.627 FO 3.5% ARA BrgNORSI Novorossiysk AAXKC00 11,665.699 +563.801 AAXKB00 158.877 +7.549 FO 3.5% Med CrgSyzran Novorossiysk AAXKG00 12,450.967 +563.801 AAXKF00 169.571 +7.539 FO 3.5% Med CrgKomsomolsk Nakhodka AAWRH00 12,639.471 -517.484 AAWRG00 172.139 -7.201 380 CST Spore CrgKhabarovsk Nakhodka AAWRB00 13,292.967 -517.484 AAWRA00 181.039 -7.208 380 CST Spore CrgKirishi Vysotsk AAWJG00 14,846.130 +541.997 AAWJF00 202.191 +7.214 FO 3.5% ARA BrgUfa Vysotsk AAWJK00 11,247.510 +541.997 AAWJJ00 153.181 +7.256 FO 3.5% ARA BrgOmsk Vysotsk AAWJI00 10,409.034 +541.997 AAWJH00 141.762 +7.266 FO 3.5% ARA Brg

Spot prices assessed by Platts in key markets are used as underlying markers for netback calculations.

derived from the $364.50/mt August and $365.50/mt September swaps assessments, was applied to the physical curve.

No market data was excluded from the Aug. 3 assessment process.

Platts NW Europe Naphtha CIF Cargo Bids, Offers, TradesNAPHTHA CARGO CIF NWE MOC deals: TRADES: No trades reported. NAPHTHA CARGO CIF NWE MOC: OUTSTANDING INTEREST:BIDS: None.OFFERS: 1) GLENCOREUK Offer, Platts Naphtha NWE Crg 12.5 KT +/- 10%, pricing $379/mt, laycan Aug 20 - Aug 24, TQC ; 2) BP Offer, Platts Naphtha NWE Crg 12.5 KT +/- 10%, pricing $368/mt, laycan Aug 13 - Aug 17, TQC indic 1; 3) BP Offer, Platts Naphtha NWE Crg 12.5 KT +/- 10%, pricing $368/mt, laycan Aug 16 - Aug 20, TQC indic 2; 4) GUNVORSA Offer, Platts Naphtha NWE Crg 12.5 KT +/- 10%, pricing $370/mt, laycan Aug 23 - Aug 27, TQC Indication 1; 5) BP Offer, Platts Naphtha NWE Crg min qty 28 KT, pricing $360/mt, laycan Aug 16 - Aug 20, TQC indic 3 optol flat;This assessment commentary applies to the following market data codes: Naphtha CIF NWE Cargo <PAAAL00>

platts Mediterranean naphtha FoB cargo daily rationale

naphtha foB med cargo <paaai00> assessment rationale:

The FOB Mediterranean naphtha cargo assessment was derived as a freight netback from the CIF NWE naphtha cargo assessment, using the following assessments: CIF NWE naphtha cargo assessment minus the cost of transporting a 27,500 mt naphtha cargo from Alexandria in the Mediterranean to Rotterdam.

EUROPEAN MARKETSCAN AUgUST 3, 2020

10© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

platts European Jet daily Market analysis�� Global scheduled flying capacity 4.3% higher on week

on Europe ramp-up�� Repsol produces bio-jet fuel for the first time for

Spanish market

The European jet fuel complex started the week on a broadly stable note with sentiment still weighed down by a resurgence of coronavirus cases in Europe, while a modest uptick in demand coupled with still reduced run at European refineries offered some support.

Global flying capacity increased 4.3% on the week to 60 million seats for the week starting August 3, but this was still 49.6% less than a year earlier, aviation information provider OAG said Aug. 3.

“There are undoubtedly some markets where capacity is returning to previous year levels and others where further growth remains out of reach pending lockdowns being eased. But with demand continuing to lag, the outlook remains worrying from so many angles for both the industry and wider travel sector,” OAG said.

According to OAG, Western Europe benefited from the strongest weekly growth with a 14.6% increase and the addition of 1.524 million seats, bringing to total capacity for the current week to around 12 million seats. However, worries around potential new lockdowns and quarantine measures due to an increase in coronavirus cases in the continent threatened further growth next week.

Moreover, the number of long-haul flights operating in the first week of August remained well below normal levels seen at the peak of the summer season. Looking at large aircraft typically used for long-haul travel and thus the most fuel-thirsty, the B777 is only operating at some 29% of its January levels but scheduled operations have increased by nearly 18% this week. Meanwhile, the A380 is scheduled to operate some 64 flights this week, compared with the mid-January schedule of 2,205 flights, according to OAG data.

In industry news, Spain’s Repsol produced 7,000 mt of aviation fuel with a bio-component at its complex at Puertollano, it said Aug. 3. The bio-component of the fuel

(continued on page 10)

asIa products code Mid change code Mid change

singapore (PGA page 2002)

FoB singpore ($/barrel)Naphtha PAAAP00 40.25–40.29 40.270 -1.400Gasoline 92 unleaded PGAEY00 42.38–42.42 42.400 -1.110Gasoline 95 unleaded PGAEZ00 43.69–43.73 43.710 -0.840Gasoline 97 unleaded PGAMS00 44.69–44.73 44.710 -0.790Kerosene PJABF00 42.61–42.65 42.630 -1.430Gasoil 0.05% sulfur AAFEX00 47.38–47.42 47.400 -1.860Gasoil 0.25% sulfur AACUE00 46.90–46.94 46.920 -1.670Gasoil POABC00 48.66–48.70 48.680 -1.110Fuel oil 180 CST 2% ($/mt) PUAXS00 259.62–259.66 259.640 -3.150HSFO 180 CST ($/mt) PUADV00 253.91–253.95 253.930 -3.080HSFO 380 CST ($/mt) PPXDK00 248.85–248.89 248.870 -6.040

Gasoline components (PBF page 2010)

FoB singapore ($/mt)MTBE PHALF00 387.00–389.00 388.000 -18.000

singapore swaps (PPA page 2654)

september ($/barrel) october ($/barrel)Naphtha Japan ($/mt) AAXFE00 374.75–375.25 375.000 -6.750 AAXFF00 375.00–375.50 375.250 -6.250Naphtha PAAAQ00 39.98–40.02 40.000 -1.300 PAAAR00 40.03–40.07 40.050 -1.200Gasoline 92 unleaded AAXEL00 42.88–42.92 42.900 -0.870 AAXEM00 43.13–43.17 43.150 -0.960Reforming Spread AAXEO00 2.88/2.92 2.900 +0.430 AAXEP00 3.08/3.12 3.100 +0.240Kerosene PJABS00 43.30–43.34 43.320 -1.030 PJABT00 44.03–44.07 44.050 -0.730Gasoil POAFC00 48.50–48.54 48.520 -1.130 POAFG00 48.72–48.76 48.740 -0.850HSFO 180 CST ($/mt) PUAXZ00 253.68–253.72 253.700 -4.300 PUAYF00 253.28–253.32 253.300 -4.350

Middle East (PGA page 2004)

FoB arab Gulf ($/barrel)Naphtha ($/mt) PAAAA00 355.68–357.43 356.555 -13.250Naphtha LR2 ($/mt) AAIDA00 357.16–358.91 358.035 -13.250Kerosene PJAAA00 41.21–41.25 41.230 -1.430Gasoil 10 ppm AAIDT00 47.18–47.22 47.20 -1.110Gasoil 0.005% sulfur AASGJ00 47.03–47.07 47.050 -1.110Gasoil 0.05% sulfur AAFEZ00 46.73–46.77 46.750 -1.110Gasoil 0.25% sulfur AACUA00 46.38–46.42 46.400 -1.110Gasoil POAAT00 47.18–47.22 47.200 -1.110HSFO 180 CST ($/mt) PUABE00 243.35–243.39 243.370 -3.080

Japan (PGA page 2006)

c+F Japan ($/mt) premium/discountNaphtha PAAAD00 373.00–374.75 373.875 -13.250Naphtha MOPJ Strip AAXFH00 375.00–375.50 375.250 -6.000 AAXFI00 -1.63/-1.13 -1.380 -7.260Naphtha 2nd 1/2 Sep PAAAE00 375.25–375.75 375.500 -13.750Naphtha 1st 1/2 Oct PAAAF00 374.25–374.75 374.500 -13.250Naphtha 2nd 1/2 Oct PAAAG00 373.00–373.50 373.250 -13.250Gasoline unleaded ($/barrel) PGACW00 43.95–43.99 43.970 -1.160Kerosene ($/barrel) PJAAN00 43.98–44.02 44.000 -1.400

EUROPEAN MARKETSCAN AUgUST 3, 2020

11© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

us products: JuLY 31, 2020 code Mid change code Mid change code Mid change

new york harbor (PGA page 152)

cIF cargoes (¢/gal) rVp

Unleaded 87 0.3% AAMHG00 115.31–115.41 115.360 -2.630 AAMHGRV 9.0Unleaded-89 0.3% AAMIW00 118.71–118.81 118.760 -2.630 AAMIWRV 9.0Unleaded-93 0.3% AAMIZ00 123.81–123.91 123.860 -2.630 AAMIZRV 9.0

$/barrel 1% strip nyH cargo vs 1% strip

No. 6 0.3% HP PUAAE00 54.55–54.57 54.560 +2.940 AAUGA00 12.63/12.65 12.640 +2.780No. 6 0.3% LP PUAAB00 54.55–54.57 54.560 +2.940 AAUGB00 12.63/12.65 12.640 +2.780No. 6 0.7% PUAAH00 50.05–50.07 50.060 +2.940 AAUGC00 8.13/8.15 8.140 +2.780No. 6 1.0%** PUAAO00 45.05–45.07 45.060 +2.940 AAUGG00 41.91–41.93 41.920 +0.160 AAUGD00 3.13/3.15 3.140 +2.780No. 6 2.2% PUAAU00 40.79–40.81 40.800 +1.260 AAUGE00 -1.13/-1.11 -1.120 +1.100No. 6 3.0% PUAAX00 37.95–37.97 37.960 +0.140 AAUGF00 -3.97/-3.95 -3.960 -0.020

residual swaps ($/barrel)

No. 6 1.0% paper Bal M AARZS00 NA–NA NA NANANo. 6 1.0% paper 1st month PUAXD00 41.85–41.95 41.900 +0.150No. 6 1.0% paper 2nd month PUAXF00 42.30–42.40 42.350 +0.150No. 6 1.0% paper next quarter PUAXG00 43.00–43.10 43.050 +0.150

Boston cargoes (PGA pages 152)

$/barrel

No. 6 2.2% ($/barrel) PUAWN00 41.64–41.66 41.650 +1.260

NY/Boston numbers include duty. **This assessment reflects 150 max al+si

FoB Gulf coast (PGA page 156 & 338)

¢/gal rVp

Unleaded 87 PGACT00 108.31–108.41 108.360 -1.970 PGACTRV 9.0Unleaded 89 PGAAY00 110.61–110.71 110.660 -2.270 PGAAYRV 9.0Unleaded 93 PGAJB00 114.06–114.16 114.110 -2.720 PGAJBRV 9.0MTBE PHAKX00 111.16–111.26 111.210 -2.830Jet 54 PJABM00 109.60–109.70 109.650 +0.770Jet 55 PJABN00 110.10–110.20 110.150 +0.770ULS Kero AAVTK00 114.60–114.70 114.650 +0.770No. 2 POAEE00 106.60–106.70 106.650 +0.370Alkylate* AAFIE00 8.20/8.30 8.250 0.000

*Premium to US Gulf Coast pipeline gasoline; DAP

cargo (¢/gal) cargo ($/mt)

FOB Naphtha AAXJP00 92.110 -2.720 AAXJU00 322.400 -9.520Export ULSD AAXRV00 113.000 +0.250 AAXRW00 353.570 +0.770

$/barrel usGc HsFo strip vs 1% strip

Slurry Oil PPAPW00 47.79–47.81 47.800 +0.350 AAUGS00 10.35/10.37 10.360 +0.220No. 6 1.0% 6 API PUAAI00 42.67–42.69 42.680 +0.350 AAUGT00 5.23/5.25 5.240 +0.220USGC HSFO PUAFZ00 37.29–37.31 37.300 +0.350 AAUGW00 37.43–37.45 37.440 +0.130 AAUGU00 -0.15/-0.13 -0.140 +0.220RMG 380 PUBDM00 37.29–37.31 37.300 +0.350 AAUGV00 -0.15/-0.13 -0.140 +0.220

residual swaps ($/barrel)

USGC HSFO swap M1(Aug) PUAXJ00 37.35–37.45 37.400 +0.150USGC HSFO swap M2(Sep) PUAXL00 37.10–37.20 37.150 +0.200USGC HSFO swap Q1( Q4 20) PUAXN00 36.80–36.90 36.850 +0.130

EUROPEAN MARKETSCAN AUgUST 3, 2020

12© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

was produced using biomass, with the bio-component less than 5% to meet quality requirements. Repsol said production of bio-jet would be rolled out to its other facilities and it would also look to produce biofuels from waste.

This first batch will avoid the release of 440 mt of CO2 emissions -- the equivalent of 40 flights between Madrid and Barcelona.

In the paper market, the contango in the first-month/second-month jet CIF NWE cargo outright swaps was at $6.71/mt Aug. 3, wider than the $5.66/mt contango July 31.

In the physical market, CIF NWE jet fuel cargoes were assessed at a $22/mt discount to front-month ICE low-sulfur gasoil futures Aug. 3, up from a $22.25/mt discount the previous trading day. FOB FARAG jet fuel barges were assessed at a $17.50/mt discount, up from a $17.75/mt discount.

In Asia, the FOB Singapore jet fuel/kerosene started off the month on a relatively weaker note as demand for aviation fuel appeared weak amid the resurgence of the coronavirus pandemic.

Meanwhile, Singapore’s commercial stockpiles of jet fuel and gasoil eased from a six-week high as the city-state retained its net exporter status in the week ended July 29, reflecting still-healthy gasoil exports against a backdrop of lower inflows owing to tight regional supply. On the jet fuel front, outflows stood at 10,517 mt in the week ended July 29, with the bulk of exports bound for Vietnam and Fiji at 6,191 mt and 3,528 mt respectively, Enterprise Singapore data showed. Jet fuel inflows into Singapore stood at 3,016 mt in the week ended July 29, most of which came from Malaysia.

Platts NWE Jet Barge Daily Rationale & ExclusionsJet foB faraG <pJaBa00> assessment rationale: The FOB barge market assessment was based on the previous relationship between the FOB barge and CIF NWE cargo markets, in the absence of competitive indications in the Platts Market on Close assessment process.

Exclusions: No market data was excluded from the Aug. 3 assessment process.

platts nWE Jet Barge Bids, offers, trades

Bids: 1) BP Bid, 2-3 kt, FARAG, FE1 (6/8 - 10/8), ICE LSGO M1 $-27.00;Offers: NoneTrades: NoneThis assessment commentary applies to the following market data codes: Jet FOB Rdam Barge <PJABA00>

Platts NWE Jet Cargo Daily Rationales & Exclusions:Jet cif nWE cargo <pJaau00> assessment rationale: The CIF NWE cargo market assessment was based on the relationship between the physical and swaps markets, which was adjusted 25 cents/mt higher, in the absence of competitive indications in the Platts Market on Close assessment process.

Jet foB med cargo <aaidL00> assessment rationale: The FOB Mediterranean jet cargo assessment was derived as a

freight netback to the CIF Northwest Europe jet cargo assessment, using the following calculation: CIF NWE jet cargo assessment minus the cost of transporting a 27,500 mt clean cargo from Augusta, Italy, to Rotterdam, Netherlands.

Exclusions: No market data was excluded from the Aug. 3 assessment process.

Platts NWE Daily Jet Cargo Bids, Offers, TradesBids:1) LITASCO Bid [15:28:56], CIF Basis Antwerp, Main: 27 kt, Thu 13 Aug - Fri 28 Aug, Indication 7:Main Volume 27kt : pricing balance month as per indicationOptol 0-6kt: pricing 5 after COD, diff as per mainSpec: Jet A1 DEFSTAN 91-091, meeting JFSCL latest issueCP: Full NWE CP OptionsVessel: Litasco/BP/Shell, 100% of main at Jet CIF NWE Crg -$3.00, Next Day;2) BP Bid [15:21:16], CIF Basis Rotterdam, Main: 27 kt, Fri 14 Aug - Fri 21 Aug, Indication 2Laycan - seller to declare a 5 day window at the time of the

Please note that the assessments which appear in the FOB Rotterdam barge section have varying delivery bases as noted below:

code delivery basisNaphtha PAAAM00 FOB Amsterdam-Rotterdam-AntwerpEurobob AAQZV00 FOB Amsterdam-RotterdamE10 Eurobob AGEFA00 FOB Amsterdam-Rotterdam98 RON gasoline 10 ppm AAKOD00 FOB Amsterdam-RotterdamPremium gasoline 10 ppm PGABM00 FOB Amsterdam-RotterdamReformate AAXPM00 FOB Amsterdam-RotterdamJet PJABA00 FOB Flushing-Amsterdam-Rotterdam-Antwerp-GhentDiesel 10 ppm AAJUS00 FOB Amsterdam-Rotterdam-AntwerpGasoil 50 ppm AAUQC00 FOB Amsterdam-Rotterdam-AntwerpGasoil 0.1% AAYWT00 FOB Amsterdam-Rotterdam-AntwerpDMA MGO 0.1% LGARD00 FOB Amsterdam-Rotterdam-AntwerpFuel oil 1.0% PUAAP00 FOB RotterdamFuel oil 3.5% PUABC00 FOB RotterdamFuel oil 3.5% 500 CST PUAGN00 FOB RotterdamRotterdam bunker 380 CST PUAYW00 Rotterdam Delivered bunkers

dELIVEry BasIs

EUROPEAN MARKETSCAN AUgUST 3, 2020

13© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

trade (if applicable)Main volume- 27kt pricing CCM related on balance of current month dates starting from next dayVol Tol 0-6kt - pricing CCM related 3 quotes after COD (COD=day zero), premium as per main volumeSpec: Jet A1 DEFSTAN 91-091, meeting JFSCL latest issue (current at bill of lading) with possible exception of electrical conductivity (Stadis to beprovided on board in drums), ISPS compliantCP: Full NWE charter party options at charter party rate, terms and conditionsVessel clearances: BP/Totsa/KPC, 100% of main at Jet CIF NWE Crg -$4.00, Next Day;3) TOTSA Bid [15:26:14], CIF Basis Le Havre CIM Terminal, Main: 27 kt, Fri 14 Aug - Thu 27 Aug, Indication number : 1Laycan : market taker to narrow to 5-day laycan at time of trade, if applicableMain volume pricing : 27kt pxg full sepOptol : 0-6kt (pricing basis 3 quotes after COD with COD=0) at CCM + main volume diff - 1 usd/mtSpec : Jet A1 Defstan 91-091 latest issue, JFSCLI latest issue (current bill of lading) with possible exception of electrical conductivity (stadis to be provided on drums)CP : full NWE C/P Options at CP rate, terms and conditionsVessel : TOTAL / SHELL / BP approved, ISPS compliant, 100% of main at Jet CIF NWE Crg -$8.00, SepOffers:1) STR Offer [15:28:58], CIF Basis Le Havre CIM Terminal, Main: 27 kt, Fri 21 Aug - Fri 28 Aug, Indication 5 oco 6Laycan- buyer to narrow at time of booking (if applicable)Main volume- 27kt pricing EFP-relatedVol Tol - 0-6kt pricing EFP related as per last indicationSpec- Jet A1 DEFSTAN 91-091, meeting JFSCL latest issue (current at bill of lading) with possible exception of electrical conductivity (Stadis to be provided on board in drums), ISPS compliant CPTerminal- Le Havre CIMCP Options- NWE CP Options @ CP cost, terms and conditionsVessel- Breeze, 100% of main at EFP ICE LS GO -$17.00, Aug;

2) STR Offer [15:28:58], CIF Basis Le Havre CIM Terminal, Main: 27 kt, Fri 21 Aug - Fri 28 Aug, Indication 6 OCO 5Laycan- buyer to narrow at time of booking (if applicable)Main volume- 27kt pricing CCM related pricing 15-31 Aug 2020Vol Tol 0-6kt - pricing CCM related as per main plus 2 USD/mt, 3 quotes after COD (COD=day zero)Spec- Jet A1 DEFSTAN 91-091, meeting JFSCL latest issue (current at bill of lading) with possible exception of electrical conductivity (Stadis to be provided on board in drums), ISPS compliant CPTerminal- Le Havre CIMCP Options- NWE CP Options @ CP cost, terms and conditionsVessel- Breeze, 100% of main at Jet CIF NWE Crg $1.50, See TQCTrades:None.This assessment commentary applies to the following market data codes: Jet CIF NWE cargo <PJAAU00> Jet FOB Italy cargo <AAIDL00>

platts European Gasoil daily Market analysis�� ICE LSGO futures net speculative length slips back

from 6-month high�� NWE distillate MOC physical cargo volumes hit 2020

low in July�� Nigeria’s Duke Oil buys 60,000 mt of 0.3% from

SaharaSpeculative net long positions in ICE low sulfur gasoil futures fell 7,091 contracts to 59,189 in the week to July 28, according to ICE data, down from the six-month high reached the previous week.

Fears of a second wave of coronavirus and a resurgence in cases in several regions in Europe weighed on distillates markets over the reporting week.

Managed money long positions decreased by 2,203 contracts to 86,565 contracts, while short positions increased by 4,888 contracts to 27,376.

This sharp increase in short positions was the largest since the week ended April 28 when short positions increased by 5,680 to 47,317.

Open interest in the futures fell by 1,307 contracts over the reporting week to 875,874.

In the Platts Market on Close assessment process in July, 405,000 mt of distillates products traded across the jet fuel, gasoil and diesel cargo markets in Northwest Europe, down 318,000 mt from June and the lowest volume traded in the process since December.

Published bids and offers were relatively steady, down by 117 on the month to 500, but higher than May which had 499 indications across the jet fuel, gasoil and diesel cargo MOC processes.

Nigeria’s Duke Oil bought 60,000 mt of 0.3% gasoil from Sahara to be delivered August 2-6 in Nigeria, sources at the parent company NNPC said Aug. 3. The vessel carrying the cargo was the MT Norstar Intrepid, a source at NNPC said. The tender was issued last week and Sahara Energy were not immediately available to comment.

Rhine water levels fell to nearly 100 cm at key choke-point Kaub over the weekend, but were set to increase drastically this week which would relieve the need to part load barges.

According to the German Waterways Authority (WSV), water levels at Kaub in Germany were set to rise to 210 cm by Aug. 7.

Without part loading, barge freight costs would remain low and prevent a decrease in demand, sources said.

In the broader oil market, crude oil futures were trading lower on Aug. 3 on a slower-than-expected recovery in demand, while at the same time OPEC+ production was increasing and the new global surge in coronavirus cases was casting further doubt on the outlook for oil-product consumption.

“Speculators appear to be getting more nervous about the demand recovery, with the path much more gradual than market expectations coming into the second half of the year,” ING’s head of commodities strategy Wenyu Yao wrote in a daily note. “This stall in demand comes at a time when the market is already starting to see supply coming

EUROPEAN MARKETSCAN AUgUST 3, 2020

14© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

back,” she said, adding that a recent survey showed that OPEC output increased by 970,000 b/d month on month in July to average 23.32 million b/d, with the extra voluntary cuts from Saudi Arabia, the UAE and Kuwait ending.

Platts NWE Gasoil 0.1% Barge Daily Rationale & Exclusions

Gasoil .1%s (1000ppm) FoB ara Barge <aayWt00>

assessment rationale: FOB ARA 0.1% gasoil barges were assessed on the previous relationship between physical and swaps markets, as the outstanding bids and offers in the Platts Market on Close assessment process did not prove value differently.

Exclusions: None

platts nWE Gasoil 50ppm Barge daily rationale & Exclusions

Gasoil .005%s (50ppm) FoB ara Barge <aauQc00>

assessment rationale: FOB ARA 50 ppm gasoil barges were assessed on the relationship to 10ppm FOB ARA barges and July 31’s spread between the two products, as the outstanding bids and offers in the Platts Market on Close assessment process did not prove value differently.

Exclusions: None

Platts NWE Gasoil 0.1%S Cargo Daily Rationale & ExclusionsGasoil 0.1%s FoB nWE cargo <aayWr00> assessment

rationale: The FOB Northwest Europe 0.1% gasoil cargo assessment was derived as a freight netback from the CIF NWE 0.1% gasoil cargo assessment, using the following assessments: CIF NWE 0.1% gasoil cargo assessment minus the cost of transporting a 22,000 mt clean cargo from a basket of ports in the Baltic and Northwest Europe to Le Havre, France.

Gasoil 0.1%s cIF nWE cargo <aayWs00> assessment

rationale: CIF Northwest Europe 0.1% gasoil cargoes were

assessed on the previous relationship between physical and swaps markets, in the absence of any indications. This level was not tested in the Platts Market on Close assessment process.

Exclusions: None

Platts NWE Gasoil 0.1%S Cargo Bids, Offers, TradesBids:None.Offers:None.Trades:None.This assessment commentary applies to the following market data codes: Gasoil 0.1% FOB NWE cargo <AAYWR00> Gasoil 0.1% CIF NWE cargo <AAYWS00>

Platts Mediterranean Gasoil 0.1%S Cargo Daily Rationales & ExclusionsGasoil 0.1%s FoB Med cargo <aaVJI00> assessment

rationale: The FOB Mediterranean 0.1% gasoil cargo assessment was derived as a freight netback from the CIF Med 0.1% gasoil cargo assessment, using the following assessments: CIF Med 0.1% gasoil cargo assessment minus the cost of transporting a 30,000 mt clean cargo from a basket of ports in the Med and Black Sea to Genoa, Italy, and Lavera, France.

Gasoil .1%s (1000ppm) cIF Med cargo <aaVJJ00>

assessment rationale: CIF Mediterranean 0.1% gasoil cargoes were assessed on the following input expressed as a differential to the front-month ICE low sulfur gasoil futures contract: Aug. 15 was assessed at minus 0.72 cents/mt below a competitive outstanding offer observed in the Platts Market on Close assessment process and a contango of around 13 cents/mt as suggested by the paper market was applied to the rest of the curve.

Exclusions: None

platts Mediterranean Gasoil 0.1%s cargo Bids, offers, trades

Bids:None.Offers:1) VITOL Offer [14:44:57], CIF Basis Genoa, Main: 27 kt, Thu 13 Aug - Mon 17 Aug, Number: 1Main volume pricing: as per indicationOptol: 0-6kt pricing 3 quotes after COD,price as per last differential indicationSpec: spanish summer spec B&CCP: euromed neobig (excl yugo/former yugo/albania/syria but includingcroatia/slovania)+Tunisia+Egypt Med+Algeria+Libya, other cp optionsavailable/obtainable at costVessel: Cape Bradley (9264271), 100% of main at Gsl0.1CIFMedCrg $0.00, +5 quotesTrades:None.This assessment commentary applies to the following market data codes: Gasoil 0.1% FOB Italy <AAVJI00> Gasoil 0.1% CIF Genoa/Lavera <AAVJJ00>

platts European diesel daily Market analysis�� European diesel demand in Q3 to jump 610,000 b/d on

the quarter: Platts Analytics�� USGC-Europe arb volumes at 720,000 mt for Aug, up

from 440,000 mt in July

The European 10ppm diesel market continued to eye second-wave fears spreading across the region, as the threat of new lockdowns could hamper prompt diesel demand, just as it had begun to recover.

European demand in Q3 2020 is expected to climb up 610,000 b/d on the quarter, but this remains 350,000 b/d lower on the year, data from S&P Global Platts Analytics showed July 31.

Meanwhile on the supply side, refining sources eyed increased runs, with diesel the likely focus of optimization

EUROPEAN MARKETSCAN AUgUST 3, 2020

15© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

as the 10ppm crack continued to perform well. Platts Analytics sees the primary increase in runs in China, and even though other regions continue to suffer from high stocks and weak margins Europe is also seeing an increase.

The increase in refinery activity is on top of a steady Primorsk loading program for August at around 933,000 mt. Regarding Black Sea supply, a copy of the initial loading program for the Russian Black Sea port of Novorossiisk showed that the first two 30,000 mt cargoes set to load from the Sheskharis oil terminal are chartered to Litasco on the North Swan and Rinella M tankers. The loading program was 372,000 mt, and with refineries ramping up sources expect a similar volume for August.

Arbitrage volumes are set to increase for August from the US Gulf Coast into Europe, as economics become more favorable. Imports of ULSD into Europe from the USGC are predicted at 720,000 mt for August, according to data intelligence company Kpler, compared with 440,000 mt in July. If 720, 000 mt of exports do materialize, this would surpass levels seen in March, the highest for 2020.

As the trading season for summer specification diesel draws to an end, inventories of summer specification diesel in tank are ample and blending opportunities with jet fuel could occur, to produce winter-specification diesel. Already traders can see cargoes with lower density and better cold properties. A trader on August 3 said some players were looking to retain summer spec ULSD until next year if they had ullage available.

platts nWE uLsd Barge daily rationale & Exclusions

uLsd 10ppms FoB ara Barge <aaJus00> assessment

rationale: The FOB ARA 10 ppm ULSD barge assessment was based on the following input, expressed as differentials to the front-month ICE LSGO futures contract: Value on Aug. 8 was assessed at minus $1.75/mt on five repeated traded offers; value August 12 was assessed at minus $1.25/mt above a consequently competitive bid. Structure was applied between the two and drawn across the remainder of the curve.

Exclusions: No market data was excluded.

Platts NWE ULSD Cargo Daily Rationales & ExclusionsuLsd 10ppms cIF nWE Basis uK cargo <aaVBH00>

assessment rationale: The CIF UK diesel cargo assessment was derived as a freight net forward from the CIF Northwest Europe (ARA) diesel cargo assessment, using the following assessments: CIF NWE (ARA) diesel cargo assessment plus the cost of transporting a 30,000 mt clean cargo from a basket of ports in the Baltic to a basket of UK ports.

uLsd 10ppms cIF nWE Basis Le Havre cargo <aaWZc00>

assessment rationale: The CIF Northwest Europe (Le Havre) diesel cargo assessment was derived as a freight net forward from the CIF NWE (ARA) diesel cargo assessment, using the following assessments: CIF NWE (ARA) diesel cargo assessment plus the cost of transporting a 30,000 mt clean cargo from a basket of ports in the Baltic to Le Havre, France.

uLsd 10ppms cIF nWE cargo <aaVBG00> assessment

rationale: The CIF NWE diesel cargo assessment was based on the following input, expressed as differentials to the front-month ICE LSGO futures contract: Value was derived based on July 31’s swaps differential as the outstanding indications did not test value.

Exclusions: No market data was excluded.

platts nWE uLsd cargo Bids, offers, trades

Bids:1) GLENCOREUK Bid [15:28:46], CIF Basis Hamburg, Main: 27 kt, Mon 24 Aug - Fri 28 Aug, Indication 1Main volume: As Per EFPOptol: 0-6kt EFP as per main indicationSpec: ULSD 10ppm French Summer, clear & brightCP: Hamburg-Bdx, North Spain + ECUKVessel: BP/Shell/Total, 100% of main at EFP ICE LS GO -$0.50, Sep;

2) GLENCOREUK Bid [15:25:39], CIF Basis Hamburg, Main: 27 kt, Sat 15 Aug - Wed 19 Aug, Indication 2Main volume: As Per EFPOptol: 0-6kt EFP as per main indicationSpec: ULSD 10ppm French Summer, clear & brightCP: Hamburg-Bdx, North Spain + ECUKVessel: BP/Shell/Total, 100% of main at EFP ICE LS GO -$2.50, SepOffers:1) GUNVORSA Offer [15:24:41], CIF Basis Le Havre, Main: 27 kt, Thu 13 Aug - Fri 28 Aug, Indication 2Buyer to narrow 5 day windowMain volume Pricing: 5 quotations after CODOptol: 0-6kt 5 quotations after COD, at last offeredSpec: French summer specs, C&BCP: hamburg-bdx + north spain + ecukVessel: Lukoil/BP/p66 acceptableGT&C’s: BP 2015 v1.1, 100% of main at ULSDCIFHavreCrg -$1.00, +5 quotesTrades:None.This assessment commentary applies to the following market data codes: Diesel 10ppm CIF UK NWE cargo <AAVBH00> Diesel 10 ppm NWE CIF NWE cargo <AAWZC00> ULSD 10 ppm CIF NWE cargo <AAVBG00>

Platts Mediterranean ULSD Cargo Daily Rationale & ExclusionsuLsd 10ppms cIF Med cargo <aaWyZ00> assessment

rationale: The CIF Med diesel cargo assessment was based on the following input, expressed as differentials to the front-month ICE LSGO futures contract: Value on Aug. 22 was assessed below an outstanding competitive offer at $6.62/mt and a 13 cents/day contango was applied to the remainder of the curve.

Exclusions: No market data was excluded

EUROPEAN MARKETSCAN AUgUST 3, 2020

16© 2020 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

Platts Mediterranean ULSD 10ppm FOB Cargo Daily Rationale

uLsd 10ppms FoB Med cargo <aaWyy00> assessment

rationale:

The FOB Mediterranean 10ppm ULSD cargo assessment was derived as a freight netback from the CIF Med 10ppm ULSD cargo assessment, using the following assessments: CIF Med 10ppm ULSD diesel cargo assessment minus the cost of transporting a 30,000 mt clean cargo from a basket of ports in the Med to Genoa, Italy, and Lavera, France.

Platts Oil Diesel Mediterranean Bids, Offers, TradesBids:1) HARTREEUK Bid [15:28:49], CIF Basis Koper, Main: 27 kt, Thu 20 Aug - Mon 24 Aug, Indication 2 oco 1Seller to nominate a 5 days delvery window at time of booking (if applicable)Main volume 27kt pricing: COD + 5Optol 0-6 kt in s.o: diff as per main pricing COD+5 quotations (COD = 0))Spec: French Summer, C&BCP: Euromed neobig+Slovenia+Croatia excludingy/fyugo/toc+Turkish med+Morocco+others obtainable/avail at costVessel: Totsa/BP/Shell, 100% of main at ULSD CIFMed Crg -$2.00, See TQC;2) HARTREEUK Bid [15:28:49], CIF Basis Koper, Main: 27 kt, Thu 20 Aug - Mon 24 Aug, Indication 1 oco 2Seller to nominate a 5 days delvery window at time of booking (if applicable)Main volume: EFPOptol: 0-6 kt EFP premium as per mainSpec: French Summer, C&BCP: Euromed neobig+Slovenia+Croatia excludingy/fyugo/toc+Turkish med+Morocco+others obtainable/avail at costVessel: Totsa/BP/Shell, 100% of main at EFP ICE LS GO $1.00, Sep;3) GUNVORSA Bid [15:27:18], CIF Basis Barcelona, Main: 27 kt, Sat 15 Aug - Thu 20 Aug, Indication: 4Main pricing: 27 kt pricing 15-20 August inclusiveOptol: 0-6 kt price as per main price diff 5 quotes after COD

( COD = Zero )Spec: French Summer, C+B. Flash min 60 deg CCP: EUROMED NEOBIG + EXCL. Y/FYUGO/TOC BUT INCL. SLOVENIA + CROATIA + TURKISH MED + SOM + MOROCCO + OTHERS OBTAINABLE AT CP COST.Vessel: BP/SHELL/ENI , 100% of main at ULSD CIFMed Crg -$3.00, See TQC;4) VITOL Bid [15:28:52], CIF Basis Koper, Main: 25 kt, Sun 23 Aug - Fri 28 Aug, Indication 1Optol 0-5 kt in s.o as per main EFPSpec: ULSD French Summer inc C+BCP: Euromed neobig exc Y/FY/TO but including Slovenia + Croatia + Turkish Med + SOM + Morocco + otherse obtainableVessel: Shell/Total/Saras, 100% of main at EFP ICE LS GO $3.50, SepOffers:1) CEPSASAU Offer [15:25:19], CIF Basis Lavera, Main: 27 kt, Sun 16 Aug - Thu 20 Aug, Optol 0-6kt in s.o: as per main EFPSpec: ULSD 10ppm french summer including C+BCP: Euromed neobig exc Y/FY/TOC but including Slovenia + Croatia + Turkish Med + Tunisia + SOM + Morocco + others obtainableVessel: Saras/Total/BP””GTCS BP 2015”, 100% of main at EFP ICE LS GO $8.00, Aug;2) RTSA Offer [15:28:57], CIF Basis Lavera, Main: 27 kt, Sat 15 Aug - Mon 24 Aug, Main 27kt Pricing 20 August - 31 August, inclusiveOptol 0-6kt: as per main volume pricing basis 5 quotes after COD with COD=0Spec: French Summer, C+BCP”Euromed neobig”+”Slovenia”+”Croatia excludingy/fyugo/toc+Turkish medGTCs: TOTSA latestVessel: BP/Total/Repsol, 100% of main at ULSD CIFMed Crg -$0.50, See TQCTrades:None.This assessment commentary applies to the following market data codes: 10 ppm ULSD CIF Genoa/Lavera cargo <AAWYZ00>

platts European Fuel oil daily Market analysis�� Demand for very low sulfur fuel oil in Europe remains

muted�� Bunker sales of VLSFO in Rotterdam down more than

6% on quarter

The European fuel oil market continued to see opposing fundamentals for VLSFO and HSFO, while July volumes of fuel oil traded in the Platts Market on Close assessment process in London rose 27% month on month

Some 138,000 mt of 0.5%S marine fuel traded during July’s MOC, up from 96,000 mt in June and 118,000 mt in May.

Despite the increase in trades, market sources continued to note a lack of demand in the market.

“There is no demand, and unsold cargoes,” one source said Aug. 3 referring to VLSFO in the Mediterranean. They said this was down to the summer lull and participants likely already had their required inventory.

Meanwhile, some 222,000 mt of 3.5%S RMG 380 CST fuel oil traded during the MOC last month, up from 188,000 mt in June but still well below May volumes of 352,000 mt.

HSFO continued to find support on tighter availability, as demand for the product from the US Gulf Coast as coker feed and Saudi Arabia for utilities added pressure to the more limited supply locally.

In other news, bunker sales volumes at Europe’s key Rotterdam bunkering hub dropped 6.4% on the quarter in the April-June period, and were also down 1.3% from a year earlier, data from the port authority showed.

Bunker volumes totaled 2,218,924 cu m in Q2, down from 2,371,441 cu m in January-March, the lowest quarter for volumes since Q3 in 2019.