Deel 7 quantificatie van de winst

-

Upload

piet-de-pauw -

Category

Business

-

view

456 -

download

0

description

Transcript of Deel 7 quantificatie van de winst

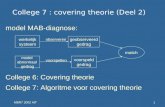

Overzicht1. Representatieve Democratie ideaal versus werkelijkheid

2. Waarom representatieve democratie ALTIJD afglijdtnaar particratie

3. Benchmarking the Best in Class

4. Verklaring van de performantieverschillen

5. Grondoorzaak de vergeten basiswaarden

6. Aanbevolen ordening van de samenleving

7. Quantificatie van de winst

8. Een nieuwe en andere rol voor politici

Quantification of the savings

Public Sector EfficiencyAn International

Comparison

ECB working paper number 242, July 2003 "Public Sector Efficiency_An International Comparison“ by Afonso, Schuknecht and Tanzihttp://www.pedz.uni-mannheim.de/daten/edz-ki/ezb/03/w-paper/ecbwp242.pdf

Benchmarking Belgium versus Switzerland

The ECB working paper number 242, July 2003 "Public Sector Efficiency_An International Comparison“ by Afonso, Schuknecht and Tanzi, on Public sectors Performance Indictors (Table II, in attachment) shows an overall governmental efficiency for all tasks executed by the Belgian government a rating of 0.83, while for Switzerland 1.33. (*)

This means that when Belgium takes over for its government the AVERAGE Swiss model, the cost of the Belgian government would be reduced, for the same service, to 0.83/1.33 = 62%. Since the Belgian government takes about 50% of the GNP, this study suggests a potential savings of (100% - 62%) X 50% = 19% of the GNP compared to the average Swiss model.

(*) ECB working paper number 242, July 2003 "Public Sector Efficiency_An International Comparison“ by Afonso, Schuknecht and Tanzi http://www.pedz.uni-mannheim.de/daten/edz-ki/ezb/03/w-paper/ecbwp242.pdf

Bijkomende efficiecientieverhogingdoor automatische Financiele

Referenda ?

Lars P. Feld, John G. Matsusaka, "Budget referendums and government spending: evidence from Swiss cantons“ Journal of Public Economics 87 (2003) 2703– 2724

Lars Feld and Gebhard Kirchgasser, "Local fiscal Referenda: The dampening effect on taxes and spending",EconomicPolicy, 2001

20% Bijkomende Efficientieverhoging door automatische financiele referenda met lage drempel

Besparing op Uitgaven Overheid door verplichte automatische

Financiele Referenda in vergelijking tot het geval dat deze niet

verplichtend dienen te worden georganizeerd

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

0 5 10 15 20

Drempel Financieel Referendum (M CHF)

Besp

ari

ng

(%

)

Alleen kantons met

verplichte referenda

Lars P. Feld, John G. Matsusaka, "Budget referendums and government spending: evidence from Swiss cantons“ Journal of Public Economics 87 (2003) 2703– 2724

Bijkomende efficientieverhoging door Automatische finciele referenda

There are large differences in Switzerland from canton to canton.

When financial referendums are made obligatory, Lars P. Feld, John G. Matsusaka (**) found in their economic correlation studies an efficiency improvement of 14% (very large financial treshold) to 20% (small financial treshold) compared to the case where financial referenda are not obligatory. I.e. additional efficiency improvements occur compared to the Swiss canton.

(**)Lars P. Feld, John G. Matsusaka, "Budget referendums and government spending: evidence from Swiss cantons“ Journal of Public Economics 87 (2003) 2703– 2724 http://www.iandrinstitute.org/New%20IRI%20Website%20Info/I&R%20Research%20and%20History/I&R%20Studies/Feld%20and%20Matsusaka%20-%20Fiscal%20Evidence%20from%20Swiss%20Cantons%20IRI.pdf

Or http://www.umar.gov.si/fileadmin/user_upload/konference/06/03_feld.pdf

Bijkomende efficientieverhoging door Automatische finciele referenda

Introducing automatic financial referenda with low thresholds in Belgium in addition to the system of Gemeindefreiheit results is savings of governmetalcosts of 0.083/1.33 x (1-20%) = 50%.

Since the Belgian government takes about 50% of the GNP, the combination of the ECB study of Afonso, Schuknecht and Tanzi, and the study of Feld and Matsusaka study suggests a potential savings of (100% - 50%) X 50% = 25% % of the GNP.

Libertarian View on Savings PossibleDavid R Barker

David R Barker in an interview with Stefan Moulyneux estimates the saving which can be obained in a libertarian society to be between 20% to 30% of the GNP per capita.

He asks: Is this worth the trouble to change society?

http://www.youtube.com/watch?v=YasmmiR0PrM&feature=youtube_gdata

Additional growth of the GNP

2.9588772.3965581.55796715

2.7524442.2609041.5125914

2.5604132.1329281.46853413

2.381782.0121961.42576112

2.2156091.8982991.38423411

2.0610321.7908481.34391610

1.9172391.6894791.3047739

1.7834781.5938481.266778

1.6590491.503631.2298747

1.5433021.4185191.1940526

1.4356291.3382261.1592745

1.3354691.2624771.1254

1.2422971.1910161.0923

1.1556251.12361.06092

1.0751.061.031

additional growth of GNP per capita

7.5%6.0%3.0%invested part (1/3 of savings)

25%20%10%

Savings in GNP per capita