Bhorjaj, Libby ('05) - K Mkt Pressure

Transcript of Bhorjaj, Libby ('05) - K Mkt Pressure

-

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

1/21

Capital Market Pressure, Disclosure Frequency-Induced Earnings/Cash Flow Conflict, and

Managerial MyopiaAuthor(s): Sanjeev Bhojraj and Robert LibbySource: The Accounting Review, Vol. 80, No. 1 (Jan., 2005), pp. 1-20Published by: American Accounting AssociationStable URL: http://www.jstor.org/stable/4093159.

Accessed: 05/08/2013 06:57

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at.http://www.jstor.org/page/info/about/policies/terms.jsp

.JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact [email protected].

.

American Accounting Associationis collaborating with JSTOR to digitize, preserve and extend access to The

Accounting Review.

http://www.jstor.org

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AMAll use subject to JSTOR Terms and Conditions

http://www.jstor.org/action/showPublisher?publisherCode=aaasochttp://www.jstor.org/stable/4093159?origin=JSTOR-pdfhttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/stable/4093159?origin=JSTOR-pdfhttp://www.jstor.org/action/showPublisher?publisherCode=aaasoc -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

2/21

THE ACCOUNTING REVIEWVol.80,No. 12005pp. 1-20

C a p i t a l M a r k e t Pressure DisclosureFrequency Inducedarnings Cashl o wC o n f l i c t a n d anagerial M y o p i a

Sanjeev BhojrajRobertLibbyCornell UniversityABSTRACT:We examinethe effects of increasedcapitalmarketpressureand disclo-sure frequency-inducedearnings/cash flow conflicton myopicbehavior. nourexper-iments, experiencedfinancialmanagerschoose between projectswhere a conflictex-ists between near-termearnings and total cash flow. Managersmore often chooseprojectsthat they believe willmaximizeshort-termearnings(andprice)as opposed tototalcash flows inresponse to increasedcapitalmarketpressureresulting roma pend-ing stock issuance, holdingconstant agency frictionsand other stock marketpres-sures. Whenfaced with increased capitalmarketpressure,changes in disclosurefre-quency cause managersto behave more or less myopicallydependingon the impactof the change on the patternof earningsandthe resultingearnings/cash flowconflict.Ourstudy providesinsightsintomanagers'beliefs about stock marketpressures,man-datoryreporting,and the availability f alternative ommunicationschannels,and con-tributes to literature n managerialmyopiaand earningsmanagement,as well as cur-rentdebates over disclosurefrequency.Keywords:managerialmyopia;capitalmarketpressures;financial eporting; isclosurefrequency.Data Availability:Contactauthors.

I. INTRODUCTIONe examinewhethermanagersehavemyopicallynresponseo increasedapitalmarketpressure,controllingfor agency frictionsbetween the managerand ex-isting stockholders.We also examine whether the prevalenceof myopia is af-fected by disclosurefrequency. n our setting,myopicbehaviorstrictlyrefers to giving upprojectswith greatercash flows to reportexternallyhighernear-term arnings.Priortheo-reticalwork(Stein 1989;Bar-GillandBebchuk2003) suggests thatthe degreeof myopicbehaviorwill be influencedby capitalmarket ncentivesthatdetermine he extent to whichmanagerscare aboutshort-termprice relative to long-termvalue, even in the absenceof

We thankRobertBloomfield,Joel Demski,TomDyckman,PaulHribar, imHunton,CharlesLee, MarkNelson,Nick Seybert,and seminarparticipants t CornellUniversity,he FARSDoctoralConsortium,he AAA DoctoralConsortium, ndMcMasterUniversity or theirfeedback.Editor'snote:Thispaperwas acceptedby S. JaneKennedy,Editor. Submitted October 2003Accepted June 2004

1

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

3/21

2 Bhojrajand Libby

agencyfrictions.1However,priorempiricalworkhas not directlydocumented ucheffects.In addition, n past and currentdebatesover mandatorydisclosurefrequency,manyhaveclaimed that increases in disclosurefrequencywill increasemyopic behavior,but priortheoreticalor empiricalwork has not tested this assertion.This issue is at the heartof thedebatein the EU, Japan,Hong Kong,and Singaporewherepolicy makersareconsideringmoving from a semiannualdisclosurerequiremento a quarterly equirement.2We examine these issues in an experimental ettingwherewe manipulate he degreeof marketpressure acedby the manager highandlow likelihoodof a stockissuance),thefrequencyof mandatory xternalreporting semiannualversusquarterly eporting),andthepatternof earningsgeneratedby alternativenvestmentprojects,controlling or sourcesofagencyfrictionsand other stock marketpressures.Since ourpurpose s to gain insightintowhatmanagers earn in the field aboutstock market ncentivesandfinancialreporting,89experiencedfinancialmanagersfrom 19 public companiesparticipaten our study.Ourapproach s most similarto Cloyd et al. (1996) who solicit managers'beliefs abouttheimportanceof tax andbook conformanceat publicversusprivate irms andKennedyet al.(1998) who studymanagers'and others'beliefs aboutthe meaningof alternativeiabilitydisclosures.3The managersare presentedwith two projects,one with highertotal cash flows butlower short-termearnings(henceforththe high-cash-flowproject)and one projectwithlowertotalcashflows buthighershort-termarnings henceforthhelow-cash-flowproject).The managerschoose the project o implementanddiscloseexternallybased on the marketpressureand disclosurefrequencyconditionsto which they are assignedand the beliefsthey bringto the experimentabout stock market ncentives,mandatory ccountingreports,and the availabilityof alternativecommunicationschannels.We furthermanipulate heearningspatternsexpectedfrom the two projectsbetweenourtwo experiments. n the firstexperiment,mandatoryquarterly eportsmakethe high-cash-flowproject ook morenega-tive than semiannualreportsat the time of the expected stock issuance. In the secondexperiment,mandatory emiannual eportsmake the high-cash-flowproject ook moreneg-ativethanquarterly eportsat thatpoint in time.Our studycontributes o literatureon managerialmyopia, earnings management,anddisclosurefrequency.Priorempiricalresearchhas focused on myopic behaviorresultingfrom agency frictions(e.g., Dechow and Sloan 1991) andearningsmanagement esultingfromcapitalmarketpressure e.g., Teohet al. 1998).Wecontributeo themyopia iterature,andcomplementexisting empiricalwork,by specifically dentifyinga causallinkbetweencapital marketpressureand myopic behavior.Consistentwith Stein (1989) and Bar-Gilland Bebchuk (2003), we documentthat, controllingfor agency frictions,managerswillmake more myopic project choices in responseto increasedstock marketpressure; nresponseto a pendingstock issuance, they more often choose projectsthat they believewill maximize short-term arnings(and price) as opposedto total earnings.4This is the

While the termmanagerialmyopiamay conjureup imagesof managerial opportunism, .e., activities n theinterestsof the manager nd detrimentalo the interestsof the existingshareholders,his neednot be the caseandis not the case in ourstudy.Forexample, f a firm s planning o issue stock,thenmyopicbehavior ouldprotectexistingshareholdersromdilution hat couldresult f the high-cash-flow roject s chosen.2 See the Appendix for some examples.3 Libbyet al. (2002, 802) discuss the appropriatenessf use of experienced articipants henthepurposeof the

experiments to peer nto the minds of specificgroupsof experienced rofessionalso determinewhattheyhavelearnedaboutrelevant onceptsand events andhow that earningaffectsdecisions.4 In our study(as in Stein 1989), totalcash flow from a projectequalsthe totalearnings rom thatproject,bydesign.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

4/21

CapitalMarketPressureandManagerialMyopia 3firstdirectevidence of myopic behaviorthat is not drivenby additionalagency frictionsbetweenthe managerand existing stockholders.These findingsalso contribute o the lit-eratureon earningsmanagement,whichsuggeststhatmanagers endto manipulate arningsnumbers n orderto meet short-terminancialreportinggoals. The difference n ourstudy(as in all of the myopia literature)s that real cash flow sacrifices are differentiatedrompureaccountingmanipulations.We also contributeo the literatures n myopiaand disclosurefrequencyby providingthe firstempiricaldemonstration f the relationbetweenthe two factors. We findthattheeffect of change n disclosure requencydependson the impactof the changeon thepatternof earningsdisclosedandthelevel of capitalmarketpressure.Ourresultssuggestthatundernormalcircumstances i.e., in the absenceof particularlytrong capitalmarketpressures)a changefrom semiannual o quarterly eportings unlikelyto have largeeffects on man-agers' nvestment hoices.Inourexperiment,managersareunwillingto sacrifice7.5 percentof cash flows for the relateddisclosuregains. However,when faced with strong capitalmarketpressureresultingfrom a stock issuance,managersbehave moremyopicallyin thequarterlydisclosureregimewhenquarterly eports ncrease the conflictbetweennear-termearningsand total cash flows, and exhibit the oppositebehavior when quarterlyreportsreducethatconflict.The overalleffect of a changein disclosurefrequencyon myopiawilldependon the relativelikelihood of the two settings,which is an empiricalquestion.Be-cause of the natural moothingresultingfromlongerreportingperiods,we expectthat,onaverage,morefrequentdisclosurecouldcause greatermyopiain the presenceof significantaddedstockmarketpressure.This shouldbe of interest o policy makersbecause t providessystematicempiricalevidenceof the effect of disclosurefrequencyon myopia.Priorevi-dence in this regard s primarilyanecdotal.5

Thesefindingsalso indicatemanagersbelieve that, n the absence of mandatory eports,they areunable to crediblycommunicate nformationaboutthe choice of projectandlong-termcash flows to investorsthroughalternative hannels,or they areunwilling to do so.The use of experiencedfinancialmanagers s of vital importance o our projectsince itprovides nsightsinto the beliefs of people intimately nvolved with financialdecisionsandthe disclosureprocess.Thishighlightsthe importanceandseverityof the information om-municationproblem.The results should be of interestto regulatorssince they indicatepotentialsuboptimal esourceallocation.The remainderof the paperis organizedas follows: Section II discussesthe relevantliterature nddevelopsourhypotheses.In SectionIII,we outlinethe basic structure f ourexperiments.Sections IV and V presentmethodandresultsforeachof ourtwo experiments.We concludethe paper n SectionVI.

II. LITERATUREAND HYPOTHESESCapital Market Incentives and MyopiaFollowing Stein (1989), we definemanagerialmyopia as the desireto achieve a highcurrentstock price by inflatingcurrentearningsat the expense of longer-term ash flows(or earnings). Prior accounting research on the effects of capital marketpressure has focusedon its effects on earnings management. For example, Teoh et al. (1998) find that IPO firms5 In settingswheregreaterdisclosure requency esults n lowermyopia, irmscouldchooseto voluntarily iscloseinformationegardlessfmandatoryisclosurerequency,herebyncreasinghedisclosurerequency.owever,ourresultson myopiasuggestthatmanagers reeitherunableor unwilling o crediblycommunicatehis infor-mation hroughvoluntarydisclosure.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

5/21

4 Bhojrajand Libby

adoptmore income-increasingdepreciationpolicies andprovidesignificantly ess for un-collectibleaccountsreceivable see Healy andWahlen 1999] fora surveyof thesepapers).6Empiricalstudies of myopic behavior have focused mainly on R&D expenditures.Thisstreamof researchtends to view myopic behavioras reflecting managerialopportunism(wheremanagers akeactions that aredetrimental o the interestsof the shareholders). orexample,Dechow and Sloan (1991) and Baberet al. (1991) focus on identifying settingsin which managersare likely to care about near-termearnings (e.g., managersclose toretirement,irms ikely to incur a loss, etc.) andexamine if managersarelikely to cutR&Dexpendituresduring hisperiod.Bushee(1998) examinestherole that nstitutionalnvestorsplay in monitoringmanagersand mitigatingagency frictionsand myopic behavior(mea-suredas reduction n R&D expenditure). n a departurerom the primarystreamof workthatfocuses on R&D,Graham t al. (2004), using surveydata,findthat financialexecutivesare willing to give up economic value to meet a short-run arnings target. Along similarlines, Roychowdhury 2003) finds thatfirmsreporting mallpositive annualearningshaveabnormally ow cash from operationsand abnormallyhigh productioncosts, providingevidence of manipulation hroughreal activities. However,none of the priorstudies testwhethermyopic behaviorcan occur aftercontrollingfor agency frictions(i.e., when themanager s actingin the interestsof the existingshareholders), s is also suggestedby thetheoreticaliterature.n this study,we complementexisting empiricalworkby establishinga causal linkbetweena changein capitalmarketpressureandmyopicbehavior, ontrollingfor agency frictions, and examining the effect of a change in disclosurefrequencyonmyopic behavior.7Stein(1989) showsthat, n theface of a rational tockmarket,managerswouldsacrificetotal cash flows to boost near-termncome in an effort to influence the market'scurrentassessmentof the firm'svalue. Along similarlines, Bar-Gill and Bebchuk(2003) modelthe misreportingof corporateperformancewhen a firm is likely to issue stock and theabilityto misreport equires acrificingcash.Thesemodels suggest that the extentof man-agerial myopia dependson the extent to which managerscare about near-termearningsrelative to longer-termobjectives.Further, his focus on near-term arningsand resultingmyopic behaviorcan occur even when the managersareactingin the interestsof existingshareholders.8In the case of a pendingstock issuance,myopic behaviorcan protectthe interestsofexistingshareholdersn two ways. First,undervaluation ould occur because the choice ofthe high-cash-flowprojectwouldlead to lower short-term arningsand lowerexpectationsaboutthe future.This, in turn,would resultin the existing shareholders' alue being ad-versely affected in the eventof a stock offering.However, or myopicbehavior o increasein this setting,the managermustperceivean inability o crediblycommunicate nformationaboutthe future cash flows of the high-cash-flowprojectthroughalternativedisclosures.Second, managerscould behave myopicallyeven if they could crediblycommunicate n-formationaboutfuturecashflows at the time of stockissuance.Thisoccursif themanagers6 Otherstudiessuggest thatmanagersuse accountingmethodsand accruals n orderto meet other short-termgoals relatedto analysts'earningsexpectations,bonus targets,priormanagementorecasts,etc. (e.g., Healy1985;Jones 1991;Kasznik1999;LibbyandKinney2000; Bartovet al. 2002).7 Otherrelated work includesJacobsonand Aaker (1993) who examine the effect of degree of informationasymmetrybetween the managerand the marketon managerialmyopiaand Lys and Vincent(1995), whodocumentAT&T'swillingness o burn ash to obtainshort-termarningsbenefits.8 The termmyopia s mostoften usedto reflectagency rictions, .e., actionsby themanagerhatharm heexistingshareholders.noursetting, hetermreflectsactionsby managershatbenefit xistingshareholders utadverselyaffectincomingshareholders.ntroducing dditional gencyfrictions n this settingcouldproducemyopicbe-havior hatwouldbe to the detriment f existingshareholders.TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

6/21

CapitalMarketPressureandManagerialMyopia 5choosenotto disclose information bout hehigh-cash-flow lternative ecausetheybelievethatthe valuation hatresultsfromchoosingand notdisclosingadditionalnformation boutthe low-cash-flowproject s greater han the valuation romchoosingand disclosing addi-tionalinformation bout he high-cash-flowproject Bar-GillandBebchuk2003). Managersin thissettingmightchoosethe low-cash-flowprojectandnot discloseinformation n futurecash flows, therebybenefitingexistingshareholders t the expenseof the incomingshare-holders.9 n keepingwith the theoreticalresultsof Stein (1989) andBar-GillandBebchuk(2003) we expect that:

HI: In the presenceof a conflict between near-term arningsand total cash flow, in-creasingstockmarketpressurewill increasemanagerialmyopia.Disclosure Frequency and MyopiaThe issue of the relative costs and benefitsof increasingthe frequencyof mandateddisclosureshas been of continuing nterest o managers, nvestors,andpolicy makersalike.This topic elicited a greatdeal of interest when the U.S. was consideringchangingthemandateddisclosure nterval o a quarterlybasis in 1969 (see Wheat CommissionReport,SEC 1969). More recently,this issue has surfacedin the EU, Japan, Hong Kong, andSingaporewherepolicy makers are consideringchanginginterimdisclosurerequirementsfrom semiannual o quarterly.Recent discussionsin the U.S. have centeredon increasingthe disclosurefrequencybeyondthe currentquarterlybasis. Both the SEC (2000) andtheFASB (2000) haverecognizedthe need for morefrequentreporting.The primaryargument hatproponentsmake for increaseddisclosurefrequencyrestson enhancingtimeliness and transparency. ncreasingdisclosurefrequencymakes the in-formationmoretimely, thereby ncreasing ts value to investors.Morefrequentdisclosureis seen as especiallyimportantn environments hatchange rapidly.A key argument gainstincreasingdisclosurefrequency s that it will promotemanagerial hort-termism r myo-pia.'0Opponents uggestthat morefrequent eportingwill forcemanagers o increase heiremphasison even shorter-run erformanceat the expense of longer-runperformance.Forexample,in the U.K.,AccountancyMagazine(Evans2003) suggeststhat one of the lead-ing arguments gainstquarterly eportings that t places pressureon companies o performon a moreregularbasis andproduceshort-termesults,whichis encouraging hort-termismin the market.Disclosurefrequency s not a widely studiedpartof the disclosureliterature.A fewpapers ncludingBaginskiet al. (2002) andBhojraj 2003) studyfactors hatinfluencehowfrequently irmsissue voluntaryearningsforecasts.Butleret al. (2003) studythe effect ofdisclosurefrequencyon the speedthat informations impoundedn prices.They findevi-dencesuggesting hat ncreasing he frequencyof mandated eportings unlikelyto increasethe timeliness of informationdisclosed.Using a sampleof 215 financialmanagers,Huntonet al. (2003), findthat the managersbelieve thatincreasingmandateddisclosurefrequencywould increase the decisionusefulnessof financialstatementsandthe qualityof earnings.9 In ourexperiment,he managermust issue stock.In this case, paintingan optimisticearningspicture, herebyincreasing tock price, alwayshurtsthe new shareholders ecausetheyreceivea smallerportionof the firm,regardless f how thefundsgenerated y the stock issuancearesubsequently sed.1o Threeadditional rgumentsmadeagainst ncreaseddisclosure requency re:(1) by increasinghefrequency fdisclosure,while one is gainingon the timelinessdimension, he reliabilityof the informationdisclosure sadverselyaffected.Reliability s furtherdecreasedby the fact that thesedisclosuresare not audited; 2) to theextentthatthere s a demand rom the investors or morefrequentdisclosure, irmscanvoluntarilydo so; and(3) greater isclosure requency lacesgreaterinancial urden n reportingompaniesdue to increasedeportingcosts.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

7/21

6 BhojrajandLibby

Finally,Bruns(1966) does not finda significantrelationbetweenthe frequencywithwhichmanagersreceive accounting nformation(as opposed to the frequencyof disclosuretoothers)and the decisionstheymake.Thoughwidelydiscussed n thepress,prior heoreticaland empiricalworkhas not examined the effect of externaldisclosurefrequencyon man-agerialmyopia.The discussionleadingup to HI suggeststhatmanagerialmyopiais influencedby theextent of capitalmarketpressureand the extent of conflictbetween total cash flows andnear-term arnings. Capitalmarketpressurecan result from severalfactors includingthelikelihood of stock issuance,probabilityof takeover,pressure o meet analysts'forecasts,etc. Thus, managersare constantly subjectedto these pressuresand these pressuresvaryfrom periodto period.Given these capital marketpressures, he effect of disclosurefre-quencyon myopiashoulddependon its effect on the conflictbetweentotal cash flows andreportednear-term arnings.Whenincreasingdisclosure requencycausesa decrease n theconflict betweentotalcash flows andreportednear-termarnings,we should see a decreasein managerialmyopia. Similarly,managerialmyopia shouldincreasewhen increasingdis-closurefrequencycauses an increasein the conflictbetweentotal cash flows andreportednear-term arnings.Considera situationwherethe firmissues stockin the fourthquarter.n a semiannualdisclosureenvironment,he firmwill issue only interim nformation elatedto the firsttwoquarterspriorto the stock issuance. However, n a quarterlydisclosureenvironment,hefirmwill issue interim nformation elated to the threequarterspriorto the issuance. In asemiannualdisclosureenvironment,myopicmanagerswouldchoose theprojectthatyieldshigherearnings n the firsttwo quarters;n thequarterly isclosureenvironment,heywouldchoose the projectthatyields higherearnings n the first threequarters.Thus,dependingon whetherthere is greaterconflict betweennear-term arningsandtotal cash flows afterthreeor two quarters,ncreasingdisclosurefrequencycould lead to more or less myopicbehavior.Thissuggeststhat, n thepresenceof additional tockmarketpressure,an increasein disclosurefrequencycould either increaseor decreasemyopic behavior.This leads toour secondhypothesis:

H2: Increasingdisclosurefrequencywill increaseor reducemanagerialmyopiacausedby an increase in stock marketpressure,dependingon whether t causes greateror lesser conflict betweennear-term arningsand total cash flows.III. EXPERIMENTAL OVERVIEWOurexperimentsaredesignedto test whethermanagers'propensity o choose projectsthatwill maximizeshort-termarningsas opposedto totalcashflows (managerialmyopia)is affectedby the degreeof stock marketpressureand externalreporting requency.Thisrequiresthat we constructalternativeprojectsthat create a conflict between short-termexternalreportinggoals and total cash flows, while controllingother factors that mightaffectmanagers'preferencebetweenprojects.Each of ourexperimentspresentsexperienced inancialmanagersof public companiesfollowedby analystswith an investmentcase wherethey areadvisingthe CEOof a publiccompany ollowedby analysts. 1 he case involvesselectingfrom two alternativemarketingcampaigns.Each is expectedto be effectivefor fourquarters nd to produce he same sales

We chose to put the financial managers in the position of advisors to the CEO rather than the CEO themselvesto minimize decisions driven by self-interest. By acting as advisors they are further distanced from potentialagency frictions between the CEO and the stockholders.TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

8/21

CapitalMarketPressureandManagerialMyopia 7and gross profitin each quarter.For both alternatives, he companyhas also arranged omakeequalquarterly ayments o the vendor(one-quarterf the totalamounteachquarter),whichequalizesthetimingof the cash inflows and outflowsacrossthe alternatives.Holdingconstant the patternof cash flows across the two projectchoices is importantbecause itequalizes the cash flow risk between the alternativesand ensures a match between thedirectionof differences n total cashflows anddifferences n the presentvalueof totalcashflows.'2The two alternativesdifferin two ways. First,they areexpectedto have differenttotal costs, so they will generatedifferent otal cash flows and earnings.Second,becauseof differences in the timing of expense recognitionrelatedto the campaigns, they areexpectedto producedifferentearningspatternsover the interimperiods.In all conditions,themanagersarepresentedwithinternal nformationncluding heexpectedquarterlygrossprofit,selling and generalexpenses,and income from operations or the two alternatives.AlternativeOne is alwaysthe myopic choice.In each experiment,wo factors arevariedbetweensubjects: 1) stockmarketpressureand (2) frequencyof reporting.To vary stockmarketpressure,we manipulatewhether hecompanyanticipates ssuing additionalsharesthrougha secondarystock offering duringthe fourthquarterof the year.13 As statedearlier,capitalmarketpressurecan result fromseveralfactorsincludingthe likelihood of stockissuance,probabilityof takeover,pressureto meet analysts'forecasts, etc., which suggeststhatmanagersare constantlysubjected othese pressures.We vary the level of stock marketpressureby addingthe stock issuancebecause of its focus in the theoretical iteratureas a source of pressurethat is likely toresult in myopic behavior that is in the interestsof existing shareholders Bar-GillandBebchuk2003), as well as its discretenature.Otheroperationalizationsuch as pressure omeetanalysts' orecastshavecomplexmultiperiod ffectsthatare notwell understoode.g.,beatingthis period'sforecastmay make it harder o beatthe nextperiod'sforecast)andarealso naturallyrelatedto other incentives which may cause managers o take actions thatarenot in the interestsof shareholderse.g., relatedto bonuses,etc.).14The no-stock issuanceconditionservesa vital role as a controlgroup,becausemyopicbehaviordrivenby factorsotherthanthe stock issuance (otherstock marketpressuresoragency frictions)should manifestin this condition,allowing us to isolate the incrementaleffect of the stock issuance(the additionalcapitalmarketpressure)on managerialmyopia.In other words, if the myopia we observe is primarilycaused by agency frictions suchas thoserelatedto internalperformance valuationor otherstock marketpressuresbesidesthoserelatedto stock issuance,we should observethe samedegreeof myopicbehavior nboth the no stock issuance and stock issuance conditions.For example, if all participantsassume thatthey arebeing evaluatedbased on externalreportingandthereforemaketheir

12 AlternativeTwoalways has higher otal cash flows andhighernet presentvalue. Though he cash-flowrisk ofthe two projects s exactlythe same, the alternatives re designedsuch that even if the subjects ocusedonearningsandmistookthemfor cash flows, it would take a very high discount actor or the perceivedNPV ofAlternativeOneto exceedthat of AlternativeTwo(55 percentdiscountrate n ExperimentOneand73 percentdiscountrate n ExperimentTwo).13 Note that the managerdoes not determinewhether herewill be a stockissuance.S/he only chooses betweenthe investment lternatives.14 A stockissuance s a relatively ow frequency ause of stockmarketpressure.However, heory suggeststhatthe resultsshouldgeneralize o anymanipulationhatsuccessfullyvariesstock marketpressure.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

9/21

8 Bhojrajand Libbydecisionsto increasemanagerwealth(agency considerations),hen theirincentives shouldmanifest n the no stock issuancesetting,which acts as ourcontrolgroup.15Tovary frequencyof reporting,we manipulatewhether hecompany s listedon a stockexchangethatrequiresquarterly r semiannualnterimreports.Eachparticipatingmanagerthen selects between the two alternatives, asedon the quarterlynternal nformation boutexpectedresults(held constant)and the pro formaquarterlyor semiannualstatementsofearnings expected to result from each of the two alternatives.Participantsare assignedrandomly o treatments.

IV. EXPERIMENT ONEMaterials and ProceduresAs noted above, participantsare presentedwith two alternatives hat differ in totalexpense to be recognizedand patternof expense recognition n a mannerthat createsaconflictbetweenshorter-runinancialreportingobjectivesand total cash flows. In this firstexperiment,he values areselected suchthat,during he fourthquarterwhenany secondaryshareofferingwould be made,high-cash-flowAlternativeTwo looks inferiorto low-cash-flow AlternativeOne when quarterlyreportsare issued, but not when viewed throughsemiannualreports.This is accomplished n ExperimentOne by choosing amountssuchthatAlternativeTwo would resultin 7.5 percent highertotal earningsand cash flows forthe year, but lower, more irregularearningsto date and for the immediatepriorquarterwhenobservedduring he fourthquarter.16he internal nformation n the expectedresultsfrom the two alternatives s depictedbelow:Alternative One Quarter 1 Quarter 2 Quarter 3 Quarter 4 TotalGross profit 3,200 3,200 3,200 3,200 12,800Sellingandgeneral xpenses 2,200 2,200 2,200 2,200 8,800Incomeromoperations 1,000 1,000 1,000 1,000 4,000Alternative Two Quarter 1 Quarter2 Quarter3 Quarter4 TotalGross profit 3,200 3,200 3,200 3,200 12,800Selling andgeneralexpenses 3,300 950 3,300 950 8,500Income fromoperations (100) 2,250 (100) 2,250 4,300All subjectsin the four experimental onditionssee the same expected quarterly nternalinformation.Subjectsalso see the externalreportsexpectedto resultfrom each investmentalter-native.The externalreportsexpectedin the quarterlyandsemiannual eporting onditionsarepresented n Figure 1, Panels A and B. The shading ndicatesthe periodthatwill notbe visible to the stock marketat the time of the stock issuance.The unshadedportionsofFigure 1 illustrate hatthe superiorityof AlternativeTwo is visible to the stock marketat15 This still leavesopenthe possibility hat additionalpersonalbenefitsmay accrue o the manageras a resultofa moresuccessfulstockissuance.Forexample, he manager's ompensationmaybe tiedto the success of thestock issuance. We acknowledge his possibility.However, hese personalbenefitsare likely to motivate hemanagers o act in a manner onsistentwiththe current hareholders'nterests.16 We purposelycreate a numberof differencesbetweenthe two alternatives fterthreequarterso increase hechancesthatwe can generate he effect of interest.It is not our purpose o determine he exact reasonwhyAlternativeTwomightor mightnotbe preferredlackof smoothness,ower income to date,lowermostrecentperiodearnings, he existence of losses, etc.), butto test the effects of stockmarket ncentivesand disclosurefrequencyon thatpreference.t is importanto reemphasizehat cash flowsare smooth or bothalternatives.TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

10/21

CapitalMarketPressureand ManagerialMyopia 9the time of the stock issuance (the fourth quarter) in the semiannual setting, but not in thequarterly setting.Page One of the experimental materials requests participants' cooperation. Page Twoexplains the setting, describes the elements of the projects that are held constant, presentsthe quarterly internal information, and indicates whether the company publishes externalinterim quarterlyor semiannual reports and whether a secondary share issuance in the fourthquarteris anticipated (the levels of the two independent variables). Page Three presents thetwo pro forma income statements indicating the expected amounts to be reported to share-holders for each alternative and asks participants to select an alternative and indicate theirstrength of preference on a seven-point scale. Page Four asks participantsnot to refer backto prior pages and includes debriefing questions. These include questions on: (1) the ra-tionale behind their selection, (2) which project they believe will result in the highest

FIGURE 1ExperimentOne: Pro Forma External Reports Expectedto Result from Each Investment AlternativePanel A: QuarterlyReporting ConditionPresentedbelow aretwo sets of proformafinancial statements ndicating he expectedamounts obe reported o shareholdersf the companychooses each of the two alternatives. lease examineand comparethemcarefully.Thenmakeyour choice consideringthese statementsand thefactspresentedon theprior page.

AlternativeOne 1Statementof Earnings(in $000)Quarter Quarter Quarter QuarterNet sales $6,000 $6,000 $6,000 $6,000Less: Cost of goods sold 2,800 2,800 2,800 2,800Grossprofit 3,200 3,200 3,200 3,200Sellingandgeneralexpenses 2,200 2,200 2,200 2,200Income romoperations 1,000 1,000 1,000 1,000

AlternativeTwoStatementof Earnings(in $000)

Quarter Quarter Quarter QuarterNet sales $6,000 $6,000 $6,000 $6,000Less:Costof goodssold 2,800 2,800 2,800 2,800Grossprofit 3,200 3,200 3,200 3,200Sellingandgeneralexpenses 3,300 950 3,300 950Incomefromoperations (100) 2,250 (100) 2,250

The fourthquarters shadedhere,butnot in the instrument,o illustrate he periodthat wouldnotbe disclosed at the time of the stockissuance.

(continued on next page)17 Useableresponsesdid not resultfromthis question,andit is not discussed urthern the paper.

The Accounting Review, January 2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

11/21

-

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

12/21

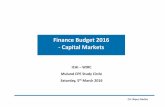

CapitalMarketPressureandManagerialMyopia 1116 percentCMAs. On average,30 percentof their wealth is tied up in companystock.Anonymityfor the individualsand firms is guaranteed.The experimental essions, whichtakeplace duringa trainingprogram, ast about20 minutes.ResultsAll participants nsweredthe two manipulation heck questionscorrectly.Participantpreferences or the two projectsare measuredby coding theirchoices as - for Alter-nativeOneand + forAlternativeTwo andcombining hemwiththeseven-point trength-of-preference cale to producea 14-point-intervalcale ranging rom -13 to + 13 in inter-vals of two.19 Participantsmean preferencescores, standarddeviationsand choices bytreatment ombinationare presented n Table 1, Panel A (and the means are graphed nFigure3, PanelA). The overallanalysisof variance s presentedn Table1, PanelB, whilethe simplemaineffects tests arepresented n Panel C. The two main effects as well as theinteractionarehighly significant.Hypothesis1 suggests that, in the presenceof a conflict betweennear-term eportedearningsand total cash flow, managerialmyopia will be greaterwhen a firm anticipatesissuing stock in the nearfuture.In ExperimentOne, thereis a conflict betweennear-termreported arningsand total cash flow in the quarterlyeporting etting.Thus,thehypothesiscan be testedby comparing he managers'weightedpreferencesbetweenthose facingtheneed to issue stock in the fourthquarterand those withoutthat additionalcapitalmarketincentive in the quarterly etting.The difference n weightedpreferences s highly signifi-cant(F = 160.9,p = .000).20Whenthere s no pendingstockissuance,10 of 11participantsselect AlternativeTwo,which has lower year-to-date arnings,buthighertotal cash flows.However,consistent with Stein, when the pendingstock issuanceis addedin the fourthquarter,11 of 11 participantselect AlternativeOne (themyopicchoice),which has higheryear-to-date arnings,butlower total cashflows.This difference s highlysignificant Fishertest, p < .005).Hypothesis2 suggeststhat ncreasingdisclosure requencywill increaseor reduceman-agerialmyopia causedby an increasein stock marketpressure,dependingon whetheritcauses greateror lesser conflict between near-term arningsand total cash flows. In Ex-perimentOne,there s greaterconflictbetweennear-termarningsand totalcashflowsafterthreequarters.Consequently,we should see the stock issuancecause a greater ncrease inmyopic behaviorin the quarterlysetting than the semiannualsetting. As predicted,thedifference n weighted preferencescausedby the additionof the stock issuanceis signifi-cantlylarger n the quarterly ettingthanin the semiannual etting(F = 81.8, p = .000).21In the semiannual ettingwhere there is no conflict between near-term arningsand totalcash flows, all 11 participantsn the no stock issuanceconditionandin the stockissuanceconditionchooseAlternativeTwo.In the quarterlyettingwhere there s a conflict betweennear-term arningsandtotal cash flows, as indicatedabove, 10 of 11 participants hooseAlternativeTwoin the no stock issuancecondition,whereas n the stockissuancecondition11 of 11 participantshoose AlternativeOne, the myopic alternative.This finding stronglysupports the hypothesis. However, to demonstrate that this phenomenon can occur in eithera quarterly or a semiannual setting and is not a consequence of more frequent reporting19 A scale of -7 to +7 would not be appropriateecausethatwouldcause an intervalof two pointsbetween -1to +1. To ensureuniformity f the scale intervalswe chose intervalsof two.20 All p-valuesare two-tailed.21 An analysisof varianceusingthe choices as the dichotomousdependent ariableproduces he sameresults.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

13/21

12 Bhojrajand Libby

TABLE 1Results of ExperimentOneThe datacome from an experimentwhere44 experienced inancialmanagers elect betweentwoalternativenvestmentprojectsandindicatetheirstrengthof preference.A negativepreference coreindicatesa preferenceor the highershort-run arnings, owertotal cash flows alternativethemyopicchoice). A positive preference core indicatesa preferenceor the lower short-runarnings,highertotalcash flows alternative.The InterimReporting reatmentmanipulateswhethersemiannual r quarterly eportsare issued to investors.The StockIssuance reatmentmanipulateswhethera stock issuance s anticipatedn the fourthquarter.Panel A: Mean Managers'Preferencesacross Conditions(StandardDeviations in parentheses)[# Choosingthe Myopic Alternative/Sample Size in Brackets]

Interim ReportingStock Issuance Semiannual QuarterlyNo StockIssuance 11.9 (1.6) 9.7 (7.8)[0/11] [1/11]StockIssuance 12.1 (1.9) -12.5 (0.9)[0/11] [11/11]Panel B: Two-WayANOVA(Effect of Interim Reportingand Stock Issuance)Source df Mean Squares F-statistic p-valueInterimReporting 1 1964 116.8 .000StockIssuance 1 1331 79.1 .000InterimReportingx StockIssuance 1 1375 81.8 .000Error 40 16.8Panel C: Simple Main Effects TestsSimple Main Effects df F-statistic p-valueStockIssuanceat Quarterly 1 160.9 .000StockIssuanceat Semiannual 1 0.0 .918InterimReportingat No StockIssuance 1 1.6 .219InterimReportingat StockIssuance 1 197.0 .000

per se, this hypothesis must also be tested in a setting where there is greaterconflict betweennear-termearnings and total cash flows after two quartersthan after three. Experiment Twoprovides such a test.V. EXPERIMENT TWOMaterials and Procedures

As in Experiment One, participants are presented with two alternatives that differ intotal expense to be recognized and pattern of expense recognition in a manner that createsa conflict between shorter-runfinancial reporting objectives and total cash flows. However,in Experiment Two the earnings pattern in Alternative Two is altered so that there is greaterconflict between near-termearnings and total cash flows after two quartersthan three. Thisis accomplished by keeping the smooth pattern for Alternative One and creating a patternwhere earnings rise for the first three quarters and then fall in the fourth quarterfor Alter-native Two. The internal information presented to all participants on the two alternativesare depicted below:TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

14/21

Capital Market Pressure and Managerial Myopia 13

Alternative One Quarter 1 Quarter 2 Quarter3 Quarter4 TotalGrowsprofit 3,200 3,200 3,200 3,200 12,800Sellingandgeneralexpenses 2,200 2,200 2,200 2,200 8,800Income fromoperations 1,000 1,000 1,000 1,000 4,000Alternative Two Quarter 1 Quarter 2 Quarter3 Quarter 4 TotalGrossprofit 3,200 3,200 3,200 3,200 12,800Sellingandgeneralexpenses 2,750 2,600 1,000 2,150 8,500Income fromoperations 450 600 2,200 1,050 4,300Again, all subjects in the four experimental conditions see the same expected quarterlyinternal information. The external reports expected in the quarterly and semiannual re-porting conditions are presented in Figure 2, Panels A and B. The shading indicates the

FIGURE 2ExperimentTwo: Pro Forma External Reports Expectedto Result from Each InvestmentAlternativePanel A: QuarterlyReporting ConditionPresentedbelow are two sets of pro formafinancial statements ndicating he expectedamounts obe reportedo shareholdersf the companychooses each of the two alternatives. lease examineand comparethemcarefully.Then makeyour choice consideringthese statementsand thefactspresentedon the priorpage.AlternativeOne Statementof Earnings(in $000)Quarter Quarter Quarter QuarterNet sales $6,000 $6,000 $6,000 $6,000Less: Costof goodssold 2,800 2,800 2,800 2,800Grossprofit 3,200 3,200 3,200 3,200Sellingandgeneralexpenses 2,200 2,200 2,200 2,200Income romoperations 1,000 1,000 1,000 1,000

Alternativewo Statement of Earnings(in $000)Quarter Quarter Quarter QuarterNet sales $6,000 $6,000 $6,000 $6,000Less:Costofgoods old 2,800 2,800 2,800 2,800Gross rofit 3,200 3,200 3,200 3,200Sellingandgeneralexpenses 2,750 2,600 1,000 2,150Income romoperations 450 600 2,200 1,050__ [,m

The fourthquarters shadedhere,butnot in the instrument,o illustrate he periodthat wouldnotbe disclosed at the time of the stock issuance.(continued on next page)

The Accounting Review, January 2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

15/21

14 Bhojrajand LibbyFIGURE 2 (continued)

Panel B: SemiannualReporting ConditionPresentedbelow are two sets of pro formafinancial statements ndicating he expectedamounts obe reportedo shareholdersf the companychooseseach of the two alternatives. lease examineand comparethemcarefully.Then makeyour choice consideringthese statementsand thefactspresentedon thepriorpage.

Alternativene I I IStatementof Earnings(in $000)11stHalf 2nd HalfNet sales $12,000 $12,000Less: Costof goodssold 5,600 5,600Grossprofit 6,400 6,400

Sellingandgeneralexpenses 4,400 4,400Income romoperations 2,000 2,000

AlternativewoStatementof Earnings(in $000)

1 t Half 2ndHalfNet sales $12,000 $12,000Less: Costof goodssold 5,600 5,600Grossprofit 6,400 6,400Sellingandgeneralexpenses 5,350 3,150Incomefromoperations 1,050 3,250The secondhalf is shadedhere,but not in the instrument,o illustrate he periodthat wouldnotbedisclosed at the time of the stock issuance.

periodthat will not be visible to the stock marketat the time of the stock issuance.Theunshadedportionsof Figure2 illustrate hat the superiority f AlternativeTwo is visible tothe stock market at the time of the stock issuance (the fourthquarter) n the quarterlysetting,but not in the semiannual etting.All otheraspectsof the experimentare the sameas in ExperimentOne.ParticipantsOurparticipantsn ExperimentTwo are45 experienced inancialmanagers meanbusi-ness experience = 23.5 years; mean accounting/financial experience = 21.5 years) from17 publiclytradedcompaniesfollowed by financialanalysts (medianassets = $931 mil-lion).22The companies nclude a bank,a hotelchain,threeretailers, hreerestauranthains,two pharmaceutical ompanies,two information echnology companies,one mining andprocessing company,and four manufacturers. ob titles rangefrom CEO or CFO (seven)to AssistantController two). Forty-ninepercentof the participants reCPAs,fourpercent22 Fourof the companiesoverlap hose in ExperimentOne.TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

16/21

-

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

17/21

16 Bhojraj and Libby

FIGUREResultsof ExperimentOneandExperimentTwoPanelA: Resultsof ExperimentOne15

10C:

-- --- Semi-Annual0.- ,-

- - -Quarterly-5

-10

-15 No StockIssuance Stock IssuancePanelB: Resultsof ExperimentTwo15

10Cloco 5

S----- Semi-Annual0_ 0-0 i - .-Quarterlya -5

-10

-15 No StockIssuance Stock Issuance

setting.The difference n weightedpreferencess highly significant F = 233.4, p = .000).When there is no pending stock issuance, 11 of 11 participants elect AlternativeTwo,which has lower year to date earnings,but highertotal cash flows. However,consistentwith Stein (1989), in responseto the addition of a pendingstock issuancein the fourthquarter,11 of 12 participantselect AlternativeOne (themyopicchoice), which has higherThe Accounting Review, January 2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

18/21

CapitalMarketPressureand ManagerialMyopia 17

year-to-datearnings,but lowertotal cash flows. Thisdifference s highly significant Fishertest, p < .005).Since there is greaterconflict between near-term arningsand total cash flows aftertwo quartershanthreein ExperimentTwo,H2 predictsthat the stock issuancewill causea greater ncreasein myopic behavior n the semiannual ettingthanthe quarterly etting.As predicted, he differencein weighted preferencescausedby the additionof the stockissuance is significantly argerin the semiannualsetting than in the quarterly etting (F= 107.2, p = .000).23 n the quarterly ettingwhere thereis no conflict betweennear-termearningsandtotal cash flows, all 11 participantsn the no stock issuanceconditionandinthe stock issuancecondition choose AlternativeTwo. As noted above, in the semiannualsetting where there is a conflict between near-term arningsand total cash flows, all 11participantshoose AlternativeTwoin the no stock issuancecondition,whereas n thestockissuancecondition 11 of 12 participants hoose AlternativeOne, the myopic alternative.This findingstronglysupports he hypothesis.24

VI. CONCLUSIONIn this study,we examinewhethermanagersexhibitmoremyopicbehaviorn responseto increasedcapitalmarketpressure,controlling or agencyfrictions.We also examinetheeffect of changein disclosurefrequencyon myopic behavior.Using two experiments,wemanipulate he degree of marketpressurefaced by the manager, requencyof reporting,andwhether he increase n reporting requency ncreasesor decreasesthe conflict betweennear-term arningsand totalcashflows, while controlling he internal nformation vailableto themanagerandagencyfrictions.Ourexperienced inancialmanagers' esponsessuggestthatincreasesin stock marketpressurecan increasemanagerialmyopia, even when man-agers are actingin the interestsof existingshareholders.This behaviorcouldoccurdue toperceived nabilityor unwillingness o crediblycommunicatenformation boutfuturecashflows (of thehigh-cash-flowproject).Ourresultsalso suggestthat, n thepresenceof strongspecificcapitalmarketpressure,ncreasing requencyof reportingrom semiannualo quar-terlycan either ncreaseor decreasemyopic behavior.Theeffect dependson whethermorefrequentdisclosurecauses greateror lesser conflict betweennear-term arningsand totalcash flows of the projectchoices. Because of the naturalsmoothingresultingfromlongerreportingperiods,we expect that,on average,more frequentdisclosurewill cause greatermyopiain the presenceof significantstock marketpressure.25Hadwe manipulated gencyfrictions n oursetting,this couldproducesimilarmyopicbehavior,whichwould be to thedetrimentof existing shareholders,ather han the new shareholders, s is the case in ourstudy.This study also suggests that not only do managersuse accountingchoices and esti-mates to meet short-term isclosuregoals, as evidencedby studiesof earningsmanagement,butthey arealso willing to sacrificecash flows in orderto do so. This speaksto the valueof providingmanagerswith some accountingdiscretion.One potential mplicationof our23 An analysisof varianceusing the choices as the dichotomous ependent ariableproduces he same results.24 Since subjectsarenot assignedrandomlybetweenthe two experiments, three-wayANOVA, ncluding xper-iment as well as capitalmarket ncentives and reporting requencyas factors,is not formallycorrect.Forcompleteness,as expected,the three-way nteractionn such an analysisis highly significant F = 181.8, p

= .000).25 ASnotedabove,we do not speakto other actors hatmustbe consideredn the debateon disclosure requencysuch as cost of disclosure,reliabilityof the information isclosed,excessivemanagerial ime commitmentothe disclosureprocess,etc.

TheAccountingReview,January2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

19/21

-

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

20/21

Capital Market Pressure and Managerial Myopia 19

Baginski, S. P., J. M. Hassell, and M. D. Kimbrough.2002. The effect of legal environmentonvoluntarydisclosure:Evidence frommanagement arnings orecasts ssued in U.S. andCana-dian markets. The Accounting Review 77 (1): 25-50.Bar-Gill,0., andL. A. Bebchuk.2003. Misreportingorporate erformance.Workingpaper,HarvardLaw School.Bartov,E., D. Givoly,and C. Hayn.2002. The rewards o meetingor beatingearningsexpectations.Journal of Accounting & Economics 33 (2): 173-204.Bhojraj, S. 2003. Managerialcharacteristicsand disclosure decisions. Working paper, CornellUniversity.Bruns,W. J. 1966. The accountingperiod conceptandits effect on managementdecisions.Journalof Accounting Research 4 (3): 1-14.Bushee,B. J. 1998.Theinfluenceof institutionalnvestorson myopicR&D investmentbehavior.TheAccounting Review 73 (3): 305-333.Butler,M., A. G. Kraft,andI. S. Weiss.2003. The effect of reportingrequencyon the timelinessofearnings:The cases of voluntaryandmandatorynterimreports.Workingpaper,UniversityofRochester,LondonBusinessSchool,and ColumbiaUniversity.Cloyd,C. B., J. Pratt,and T. Stock. 1996.Theuse of financialaccounting hoiceto supportaggressivetax positions:Public andprivate irms.Journalof AccountingResearch34 (1): 23-43.Dechow,P. M., and R. G. Sloan. 1991. Executive ncentivesandthe horizonproblem:An empiricalinvestigation. Journal of Accounting & Economics 14 (1): 51-89.Evans,C. 2003. Reporting-Quarterlycomplications.Accountancy April).Financial Accounting Standards Board (FASB). 2000. Electronic Distribution of Business ReportingInformation. teeringCommitteeReportSeries.BusinessReportingResearchProject.Stamford,CT:FASB.Graham,J. R., C. R. Harvey,and S. Rajagopal.2004. The EconomicImplicationsof CorporateFinancialReporting.Workingpaper,DukeUniversityandUniversityof Washington.Healy,P. M. 1985. The effect of bonus schemes on accountingdecisions.Journalof Accounting&Economics7 (1-3): 85-107., and J. M. Wahlen.1999.A review of the earningsmanagementiterature ndits implicationsfor standardetting.AccountingHorizons13 (4): 365-383.Hunton,J., A. Wright,and S. Wright.2003. Assessingthe impactof morefrequent xternal inancialstatement eportingandindependent uditorassuranceof qualityof earningsand stockmarketeffects. Workingpaper,Bentley College, Boston University,and Universityof MassachusettsBoston.Jacobson,R., and D. Aaker. 1993. Myopic managementbehaviorwith efficient, but imperfect,financial-markets-Acomparisonof informationasymmetriesn the United-StatesandJapan.Journal of Accounting & Economics 16 (4): 383-405.Jones, J. J. 1991. Earningsmanagementduring mportrelief investigations.Journalof AccountingResearch29 (2): 193-228.Kasznik,R. 1999.On theassociationbetweenvoluntarydisclosureandearningsmanagement.ournalof Accounting Research 37 (1): 57-81.Kennedy,J., T. Mitchell,and S. E. Sefcik. 1998. Disclosureof contingentenvironmentaliabilities:Some unintended consequences? Journal of Accounting Research 36 (2): 257-277.Libby,R., andW. R. Kinney.2000. Does mandatedaudit communication educeopportunisticor-rectionsto manageearnings o forecasts?TheAccountingReview 75 (4): 383-404.~-, R. Bloomfield,and M. W. Nelson. 2002. Experimental esearch n financialaccounting.Accounting, Organizations & Society 27 (8): 775-810.Lys,T.,andL. Vincent.1995. An analysisof valuedestructionn AT&T'sacquisition f NCR. Journalof Financial Economics 39 (2-3): 353-378.Roychowdhury, . 2003. Management f earnings hroughmanipulation f real activitiesthataffectcash fromoperations.Workingpaper,Massachusettsnstituteof Technology.Securities and Exchange Commission (SEC). 1969. Disclosure to Investors: A Reappraisal of FederalAdministrative Policies under the '33 and '34 Acts: The WheatReport. Washington, D.C.: SEC.

The Accounting Review, January 2005

This content downloaded from 163.119.134.202 on Mon, 5 Aug 2013 06:57:22 AM

All use subject to JSTOR Terms and Conditions

http://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsphttp://www.jstor.org/page/info/about/policies/terms.jsp -

8/13/2019 Bhorjaj, Libby ('05) - K Mkt Pressure

21/21