City Transformation Forum, 3 februari 2016 - Data Driven Urbanisation

1 - Ziggomembers.chello.nl/r.vanwesel/docs/Pentascope.doc · Web viewThe word used by Pentascope...

Transcript of 1 - Ziggomembers.chello.nl/r.vanwesel/docs/Pentascope.doc · Web viewThe word used by Pentascope...

Rutger Ch. van Wesel

June 2004

HOGESCHOOL ROTTERDAMDepartment of Economy and Business

INTERNATIONALIZING PENTASCOPE

IN GERMANY THROUGH A STRATEGIC ALLIANCE

Cross-Border Consultancy in Germany

Internationalizing Pentascope in Germany through a Strategic

Alliance

AuthorRutger Ch. van WeselAlbert Verweijstraat 2a3061 SB RotterdamPhone +31 618 229 159Student no. 0743396Email [email protected]

OrganizationPentascopeUtrechtseweg 11-133811 NA AmersfoortPhone +31 182 543 643 Fax +31 182 543 644URL

http://www.pentascope.nl

Supervisor PentascopeMr. M. RiriassaHarderwijkweg 3-112803 PW GoudaPhone +31 182 543 643 Fax +31 182 543 644Email

[email protected] RotterdamDept. of Economy and BusinessKralingse Zoom 913063 ND RotterdamPhone +31 104 536 200URL http://www.hogeschool-rotterdam.nl

Institute SupervisorMr. G.J. van der StarKralingse Zoom 913063 ND RotterdamPhone +31 104 536 200Email [email protected]

Rotterdam, The Netherlands June 2004

© 2004 The author is fully responsible for the contents of this paper; the copyright of the paper rests with the author. No part of this paper may be reproduced, stored in a retrieval system, transmitted in any way, or by any means, without the prior written permission from the author or Pentascope

-2-

Cross-Border Consultancy in Germany

Preface

Dear Reader,

This report in front of you marks my final project in relation with my studies in International Marketing Management at the Hogeschool Rotterdam. International Business, especially export and import issues, is one of the fields that I interest myself in. My primary goal for this choosing this field of study is to prepare myself for working in an international business environment. In line with my activities of studying at Loyola College in Baltimore, Maryland and interning at the Maryland Department of Business and Economic Development; I decided to challenge myself with enhancing my college degree by attempting to exceed the regular college requirements and write an export policy plan according to the Federation of Dutch Exports (FENEDEX) regulations. A word of gratitude goes out the entire organization of Pentascope, which gave me the opportunity to do this.

I knew that writing an export policy plan, would prove to be a huge challenge. First, I have to thank my supervisor at Pentascope, Mr. Ririassa, for giving me insights in the company’s organizational processes and service delivery. He also initiated interviews with founding members of Pentascope, such as Mr. Dijt and Mr. Pieters, who gave me insights about the idea behind implementation services. Furthermore I would like to thank Mr. Kerckhoffs from Alpha & Omega in providing me with valuable information concerning franchising Pentascope’s services internationally.

In finding the best way for Pentascope to internationalize into the German market, I have to thank Mr. Hirte from Hirte consulting for providing me with information about the consulting environment and its possibilities. Also I have to thank Mr. R. de Jong from Integrify and Mr. B. van Coeverden, who gave me valuable information about internationalizing consulting services.

Furthermore, I would like to thank my supervisor at the Hogeschool Rotterdam, Mr. G.J. van der Star, for helping me structuring and directing my thoughts towards this research by asking questions and supplying critics about fundamental subjects.

I also would like to thank my family for giving a critical view and without whom I could not have completed this research.

Sincerely,

Rutger Ch. van Wesel‘s-Gravenzande, May 2004

-3-

Executive Summary

As an independently and privately owned, Dutch based consulting firm, Pentascope desires to expand its service delivery across Dutch borders. The internationalization of Pentascope’s services, in the field of advice and support for design and implementation of organizational changes with a highly customized approach that aims at the human aspect in that process, is an attempt to service its current clients and establish operations on foreign markets.

Germany, because of its macro-economic attractiveness and cultural compatibility, is identified to be subject to research for international expansion of Pentascope. The German consulting market is highly competitive and has similar outlooks as the Netherlands consulting market for the near future. Competitors such as McKinsey, Boston Consulting and KPMG benefit highly from their reputation where Pentascope does not. Pentascope’s advantage, favored highly by clients, lays in the fact that its competition stops at the design process where Pentascope also supports the actual implementation. This, however, is not exploitable on the German market because implementation is mostly done by relying on in-house capacity. When researched closer, Germany shows problems in its business attitude towards Pentascope’s services because of its lack of experience of German business culture and language.

The main challenges for Pentascope are overcoming barriers dealing with language and experience of German business culture, followed by convincing German companies to hire external consulting advice from Pentascope because of its expertise in the human driven approach for processes of organizational changes.

In determining the best mode of entry for Pentascope on the German market Pentascope was categorized as a location-bound customized project company. This means that a geographic local presence for Pentascope is required to be successful on the German market because that would be the only way to keep control over the servuction quality and manner in which it is offered. This excludes licensing or franchising and points to foreign direct investment as the method for internationalization. Forming an own Pentascope subsidiary, building or acquiring, is not considered to be financially possible. External market influences make companies not to expand their view to engage in new opportunities in a joint venture, but focus on their core business. It was found that the option of using a strategic alliance would be the best way to internationalize into Germany because it overcomes the existing barriers in the best way.

The ideal ally for Pentascope has to offer a complementary good or service. An ally for Pentascope, therefore, is a company that develops software solutions for organizational processes. The alliance could then offer the all-in-one solution of IT solution compared with implementation design and support. This would give Pentascope an argument in convincing clients to hire external consulting for implementation because of its expertise on the solution expertise. In engaging in strategic alliances, Pentascope has to be aware that alliance contracts have to foresee in as much detail as it possibly can.

The alliance will be built on the German companies’ name/reputation and its clients on one hand and Pentascope’s training and knowledge on the other hand. This research determines that Pentascope has to build two alliances, consisting of two consultants from each company, headed by an alliance committee consisting of the CEO and the director of operations from each company. The consultants will be trained in a, especially for the alliance designed, four week training program.

Pentascope has determined that international operations in Germany would have to bring in € 1.000.000,-- in the third year. Feasibility analyses show that this is too optimistic. Following the strategic alliance option, Pentascope’s estimated revenue for the first year will be -/- € 82.000,--. Total result estimates for the first year show a negative amount of € 187.000,--. For the second year the estimations indicate a revenue of € 99.500,-- and total negative result of € 17.500,--. German operations estimations show a revenue of € 163.050,-- the third year. The annual result from the alliance for Pentascope that year is € 26.650,--. These estimates are significantly below Pentascope’s financial goals.

Finally, this research concluded that Germany, although attractive and compatible at a macro economic level, has high barriers which are costly, take to much time and demand

-4-

to many personnel for Pentascope to invest. Furthermore, in Germany, Pentascope will not be able to reach its financial goals. Therefore the final decision is not to internationalize Pentascope into the highly competitive and demanding German market.

-5-

TABLE OF CONTENTSEXECUTIVE SUMMARY.....................................................................................................41. INTRODUCTION.......................................................................................................8

1.1. CORE MISSION STATEMENT....................................................................................81.2. GROWTH STRATEGY.............................................................................................8

2. INTERNAL ANALYSIS...............................................................................................92.1. THE PENTASCOPE WEB.........................................................................................92.2. PENTASCOPE’S SERVICE DELIVERY..........................................................................102.3. PENTASCOPE’S PREPARATION PROCESS...................................................................112.4. PENTASCOPE’S CLIENT USE AND EXPERIENCE PROCESS................................................112.5. PRICING CURRENT PROJECTS.................................................................................122.6. PENTASCOPE’S FINANCIAL STATEMENT....................................................................13

3. EXTERNAL ANALYSIS.............................................................................................143.1. CONSULTANCY MARKET ANALYSIS..........................................................................14

3.1.1. Macro Environment....................................................................................................143.1.2. The Management Consultancy Branch....................................................................15

3.2. CUSTOMER ANALYSIS..........................................................................................153.3. PENTASCOPE’S MARKET SEGMENTATION..................................................................15

3.3.1. Telecom Services........................................................................................................163.3.2. Public Services............................................................................................................163.3.3. Financial Services.......................................................................................................163.3.4. Logistics Services.......................................................................................................163.3.5. Importance Business Line to Pentascope’s International Operations...............16

3.4. MARKET DEFINITION PENTASCOPE..........................................................................173.5. COMPETITOR ANALYSIS.......................................................................................17

4. MARKET ORIENTATION..........................................................................................194.1. PRELIMINARY SELECTION.....................................................................................194.2. COUNTRY ATTRACTIVENESS..................................................................................204.3. COUNTRY / COMPANY COMPATIBILITY......................................................................214.4. BUSINESS PORTFOLIO MATRIX WITH INDIVIDUAL COUNTRY SCORES.................................234.5. CONCLUSIONS...................................................................................................23

5. GERMANY.............................................................................................................245.1. MANAGEMENT CONSULTANCY IN GERMANY...............................................................255.2. OUTLOOKS FOR PENTASCOPE’S BUSINESS LINES........................................................27

5.2.1. Telecom Services........................................................................................................275.2.2. Public Services............................................................................................................275.2.3. Financial Services.......................................................................................................285.2.4. Logistics Services.......................................................................................................29

5.3. PENTASCOPE’S COMPETITOR ANALYSIS....................................................................295.4. CODE OF CONDUCT IN GERMAN BUSINESS ENVIRONMENT.............................................30

-6-

6. SWOT- ANALYSIS..................................................................................................316.1. PENTASCOPE’S COMPETENCES...............................................................................31

6.1.1. Pentascope’s Core Competences.............................................................................316.1.2. Pentascope’s Distinctive Competences..................................................................31

6.2. PENTASCOPE’S CONCERNS....................................................................................316.3. OPPORTUNITIES FOR PENTASCOPE..........................................................................326.4. EXTERNAL NEGATIVE INFLUENCES FOR PENTASCOPE....................................................326.5. CONFRONTATION MATRIX.....................................................................................336.6. PENTASCOPE’S MAIN POINTS OF ATTENTION (MPA)...................................................346.7. CONCLUSIONS...................................................................................................35

7. MARKET ENTRY STRATEGY.....................................................................................367.1. LICENSING OR FRANCHISING VERSUS FOREIGN DIRECT INVESTMENT.................................377.2. LEGAL / CONTRACTUAL ISSUES..............................................................................42

8. MARKETING PLAN.................................................................................................448.1. SEGMENTING THE GERMAN MARKET........................................................................448.2. TARGETING......................................................................................................458.3. POSITIONING PENTASCOPE...................................................................................468.4. STRUCTURING THE ALLIANCE.................................................................................468.5. PENTASCOPE’S PARTNER APPROACH.......................................................................47

9. STRATEGIC ALLIANCE FEASIBILITY.........................................................................499.1. ALLIANCE COST STRUCTURE..................................................................................499.2. ESTIMATES FOR THE ALLIANCE...............................................................................519.3. SCENARIOS......................................................................................................53

9.3.1. Worst case scenario...................................................................................................539.3.2. Best case scenario......................................................................................................53

10. CONCLUSIONS AND RECOMMENDATIONS................................................................5411. ACTION PLAN........................................................................................................56References............................................................................................................................................57ATTACHMENT Ia: The 2002 Consolidated Balance Sheet for Pentascope ATTACHMENT Ib: ......The 2002 Consolidated Statement of Annual Profits and Losses for PentascopeATTACHMENT II: Organization Profile of Location-Bound Customized Services CompaniesATTACHMENT III: Cost Factor Explanations

-7-

1. IntroductionPentascope is an independent Dutch consulting firm that offers its services in the domain of implementing changes in organizational structure and processes. Founded in 1990, it quickly grew to one of the largest firms in the Netherlands. One of the aspects for its rapid growth, is the difference in approach to these changes. Pentascope focuses on quality and the needs of clients recognizing the human aspect. Pentascope goes further than many competitors and does not stop at strategy formulation, but also performs the implementation and/or roll out of the formulated solutions. The final stage of every Pentascope project is a thorough feedback session and evaluation of the project.

1.1. Core Mission StatementPentascope’s core mission is formulated to explain the main reason for its existence and the basic idea behind its operations. The following statement reflects Pentascope’s overall mission and is formulated on Pentascope’s website.

“Guiding people through processes of change in organizations by helping them to make and accept those changes.”

1.2. Growth StrategyStrategically, Pentascope wants to keep and reinforce its current position in the Netherlands while penetrating internationally in regional developed markets. Internationally, besides penetrating regionally, it is Pentascope’s goal to assist its current clients in the international market. Pentascope has researched the general key factors for success of internationalization of consulting services. This research shows that client relationships and knowledge of the local market are the most important factors for successful internationalization.

Pentascope has set as goal to realize € 25.000.000,-- as result from all activities outside the home market of the Netherlands. This has to be realized in 3 to 5 years (2007). For the western European market, Pentascope has a goal of reaching € 2.000.000,-- revenue in three years growing to € 5.500.000,-- revenue in five years by entering two different markets.

This growth strategy resembles the market development strategy cell defined by Ansoff1. Ansoff describes in this strategy companies growing its operations by targeting new markets with its current products or services. Pentascope wants to know the possibilities of internationalization using a franchise model for its services.

1.3. Problem StatementThis report aimed to answer the following questions:

“Is franchising the way for Pentascope to reach its goals for internationalization? If so, what does this contain? If not, what other way would be the best way to internationalize Pentascope?”

If Pentascope wants to internationalize, it needs to know its current key factors for success and whether it is possible to use these on the international market. The key factors for success are found by analyzing the firm’s internal structure and external environment in a situational analysis. The analysis of the internal structure can be found in chapter two and the external environment is explained in chapter three. To find whether these key factors for success can used on the international market, Pentascope has to determine the best country to internationalize to. This is done in chapter five, in which countries are evaluated by cross referencing their macro economic attractiveness to their cultural compatibility with the Netherlands. An in-depth analysis of the determined country is carried out in chapter six. Chapter two to six provide insights in the strengths and weaknesses of Pentascope and the opportunities and threats of the determined market. These insights result in a SWOT analysis, which is carried out in chapter seven. The best strategy for entering the determined market and its resulting contractual/legal issues are described in chapter eight. On an operational level chapter nine concerns the marketing plan for the determined market. This report is concluded in chapter ten by researching the feasibility of the conclusions drawn from the market entry strategy and the marketing planning.

2. Internal AnalysisThis chapter is important in determining Pentascope’s key factors for success. In this internal analysis, the core business will be explained. What do Pentascope’s services encompass and what are the strengths and weaknesses of the business model? First, Pentascope’s internal organization structure is described. In this internal structure, the importance of its standard business units and its consultants are discussed. The Pentascope chain is divided in two parts; the preparation process and the client use process. A model illustration is given following the descriptions of these parts.

2.1. The Pentascope WebFig.2.1 Organizational Sketch Pentascope

1 Dr. K.J. Alsem; Strategische Marketing Planning; 2nd print, 2000

-8-

Since 1997 Pentascope has a network structure. These networks are focused on increasing the level of service and results to clients by using Pentascope’s unique perspective on implementation. The implementation network forms the basis of Pentascope’s activities. Clients in the Netherlands home market turned to Pentascope and expressed their need for assistance in an international perspective. In order to assist clients also internationally, the Pentascope Group added the SBU Pentascope International in 2001. In 2002 Pentascope International took over a group of consultants formerly employed by KPN Royal Dutch Telecom giving Pentascope expertise, experience and network relationships in the telecom sector.

-9-

The Pentascope

Group

Pentascope Implementation Network

Locations:Den Haag; Amsterdam; Amersfoort;

Eindhoven and Groningen

Sectors:Telecom; Healthcare; Public;

Financial Institutions; Trade, Industry and Logistics; Co operations, Real Estate and Construction

Network Partners & Strategic Alliances

Next Dimension

Pentascope International

Seven Business LinesHuman DevelopmentControlICTProject managementQuality & ExcellencePentascope AcademyProcess Support

Six separate companiesMalgilChange CompanyNOVIHome RunRun 2 MoveSupport Plus

Two CompaniesAbility AllianceTriam Management

Four Business lines:Telecom ServicesPublic ServicesFinancial ServicesLogistics Services

Standard Business Units have their own budget and goals. If consultants are needed in another SBU because of their knowledge they are commonly “rented out” to the other SBU at a certain price. Judging from interviews with Mr. L. Pieters, CEO Pentascope implementation network, this complicates and frustrates optimal knowledge flow. To prevent this, project reports are made explicit and stored on a common internal server, from which it can be accessed by everybody within Pentascope for any use. According to Mr. Th. Dijt, CEO Pentascope Group, there is a lack of international knowledge and experience throughout the Pentascope organization.

2.2. Pentascope’s Service DeliveryAll organizations are exposed to changes and have to adapt their internal processes due to evolving markets and changing external environments. These changes occur in phases. A new direction, strategy, IT solution or organizational structure has to be developed and implemented. Most consulting organizations focus on the design part of the change process and pay less attention to the fact that a change should gain acceptance by the organization and that people have to learn and work in the changed situation. Pentascope recognizes that implementation requires attention to both the design part and to the human aspects involved in implementations. Implementing change starts at the beginning; meaning that change starts with the determination, whether the plans of the proposed changes are SMART (Specific, Measurable, Acceptable, Realistic and Time constraint). This will result in researching the possible consequences that the change in organization structure or process brings for both the process and the people dealing with that process. Pentascope supports, guides and suggests organizations in those change processes in order to find an implementation strategy suitable for both management and personnel. The word used by Pentascope is: “Human-driven result-focused”

Fig.2.2 Human-driven Result-focused chart

Pentascope offers an integrated scope on implementation services with expertise in the areas of Program Management, Systems Technology, Human Resource Management, Process Management and Quality Management.

For Pentascope’s business processes and their output are the interface with clients. Modeling and analyzing these business processes enable organizations to develop further and improve its effectiveness and quality of work. 2 Managing the key processes efficiently is crucial to the success of the company. Pentascope uses methodologies following international standards to ensure its service quality level. These standards include Balanced Business Score Card, Business Process Redesign (BPR), EFQM and TQM, Implementation tools, Standard for Interactive Strategy (SIS), Telecom Operations Map (TOM) Telecom Project Management (TPM) and Telecommunications Management Network model (TMN).

2 ISO 9000; Diensten Marketing Management and Waardering door klanten

-10-

Situation before implementing change

Situation after implementing changeMAKE

IMPLEMENT

LEARN

MADE

IMPLEMENTED

LEARNED

2.3. Pentascope’s Preparation ProcessConsultancy depends on people. People interact with other people to deliver the service. Therefore when Pentascope starts a project the first process is making sure that they have the right people, with the right skills and knowledge necessary for the project. Another aspect is money. Before starting complex and large projects that take time, Pentascope has to have enough money to start the process. All these factors come together in Pentascope’s human resource. Realizing that getting the right people is an important part of Pentascope’s process and a major organizational strength, human resource is highly valued in the process.

Consultants are trained and given time to gain experience for projects. This takes effort of everybody in the company, therefore demanding knowledge, skills, people and money to train the consultants. After this consultants are ready to start selling Pentascope’s concept of consultancy using their own existing business network and created new leads. In consultancy business relies heavily on personal relationships3, therefore marketing will mainly be personal and targeted directly to the client in personal contacts. Establishing and maintaining structural, direct relationships between consultants and clients are centered in this process. The goal is to sell Pentascope’s services by maintaining excellent relationships. This process evolves into a sales effort on the new consultant’s side. When in fact, a sales agreement has been reached, the consultant can start to prepare for this project by, again, getting the right people with the right knowledge and skill to bring the project to an end. Training people is important but they are mainly stimulated in developing themselves within existing projects.

2.4. Pentascope’s Client Use and Experience ProcessThe client starts to be involved in the process at the marketing and sales phase. Together with delivering the service (Operations) this phase in the service process can be indicated as the core service delivery. Because the service leans for the most part on human interaction, it demands a continuous feedback stream from both the client and Pentascope consultants in that process; enhancing the service delivery experience for the client and at the same time “training” the consultant in experience. Handling the feedback and dealing with it during the service delivery is therefore an important aspect to deliver a good service and generating new business. This can also be beneficial to other consultants not dealing with this particular project because they can learn from others. As indicated before there might be an opportunity for Pentascope to intensify the knowledge transfer within the company. There is a feedback stream leading to the after sales service involving an evaluation of the core service delivery. In consultancy, relationship networks and management are important factors in generating new business.4 Because of its success on the Netherlands home market it can be concluded that this is a competence of Pentascope’s orientation.

Porter’s value chain5 analysis was build to highlight the important factors in the organization. However, the original format is not suitable for a service company with intangible and complex products that are hard to standardize. Because it is important to take a look at the core and supporting processes in the organization, a service mapping of Pentascope is made by using a flowcharting tool. This tool makes it possible for managers to influence the different dimensions of the service quality in order to reach the desired level of service delivery.

3 Gummesson,1987/1999; Webster, 19924 van Coeverden, 20035 Kotler, Marketing Management, 2000

-11-

Fig.2.3 Blueprint/service mapping Pentascope

2.5. Pricing Current ProjectsPricing is established using the following criteria: Customer segments; the higher quality and added value for the client, the higher the price.

Because of market woes, the client has a strong foot in the negotiating process. Competitors; pricing levels in the market. The table below shows Pentascope’s pricing compared

to competitors (average price level of competition) In the Management Team top 100 research, in which Pentascope came in second, is determined that Pentascope offers the best price/quality relation.6 Reason for this is that Pentascope implements with various feedback streams, reassuring clients with the feeling that they have an influence in the process.

Pentascope’s pricing is based on the rates that the market of these consultancy services can bear. Long-term contracts will be offered at discount prices. Price ranges in Euro per consultant level can be found in the following table. The full costs will be annually adjusted with the alary index quotes.

Table 2.1 Hourly rates of Pentascope consultants compared to competitionLevel Hourly Rates

PSI% of

competitionConsultant 120 - 140 65Senior Consultant

140 - 160 50

Managing Partner

170 - 200 45

Pentascope offers both turnkey projects at a fixed price and contracts with prices based on hours worked. In case of a turnkey project, the exact deliverables and the pre-conditions that have to be met by the customer are described in the first two weeks of the project. The costs of travel & lodging of consultants and their daily allowances are paid by the customer, without mark-up.

6 Kernstof-B, Gb. Rustenburg, T. de Gouw, A.W. de Geus, J.C.A. Smal, R.H. Buurman, derde druk, 2003, p.434

-12-

Client

Human Resource

CLIE

NT

USE

Training

Operations

After Sales Service

Customer Relationship

CoreService Delivery

Experience

Experience

Experience

Feedback Core Processes

Supporting Processes

PSI ConsultantExperience

Experience

Evaluation

MoneyPeople

SkillKnowledge

Marketing and SalesExperience

PREP

ARAT

ION

2.6. Pentascope’s Financial StatementThe financial flow is viewed from Pentascope’s foundation in order to judge Pentascope’s financial governance. Pentascope experienced a rapid growth from its founding in 1990, mainly helped by the extreme growth situation in the Dutch economy. Every year was concluded with a larger profit than the year before. Even when the market changed to a demand market, started because more companies moved into the implementation services, Pentascope’s growth was extremely high. The world wide economic recession had its consequences for Pentascope as well and in 2002 Pentascope reported a loss for the first time in its history. The table below illustrates Pentascope’s annual situation from its founding until 2002.

Table 2.2 Economic Developments Pentascope 1991 – 2002 € 1 Mln. 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002Revenue €

0,6 0,95 1,5 2,1 2,9 5,8 9 13,5 20 24 27 25,4

Growth % 58 58 40 40 100 55 50 48 20 13 -7

Combined with a successful growth of its employees Pentascope’s capacity became to large for the market demand. Pentascope had to downsize its employees, which have to turn Pentascope’s figures in a positive way. Judging from the figures of 2003 (early estimates state a revenue of 25,6 Mln.) Pentascope seems to be on the right path, this measure was successful in stopping the growth of losses. Even though Pentascope experiences rough times, it keeps up investing in knowledge, expertise and quality.

Pentascope is still a privately owned company which allows it to work independently and is subject to stock market fluctuation. It also means that Pentascope does not possess deep financial pockets to buy its way into the international markets and can not work large scale international projects.

-13-

3. External AnalysisThe external analysis is made to determine the opportunities and threats on the Netherlands home market influencing Pentascope’s current operations. In this chapter first, the characteristics of the consultancy market are described by analyzing the macro environment and the branch outlook. Secondly the clients of Pentascope are analyzed. Then the market segmentation is made after that. These analyses result in the market definition. Finally the current competitors are analyzed.

3.1. Consultancy Market AnalysisConsultancy, specialized people helping other organizations and people by applying their expertise and experience, has always existed. Because of the extraordinary economic growth in the second part of the 1990’s, organizations increasingly needed outside help if they wanted to sustain their production capacity and adapt organizationally. Under the current economic woes companies still depend on outside expertise because they have never acquired the expertise themselves. However, organizations are less likely to get outside help because there is less money available as in the 1990’s. Another trend that can be seen is the reorganization in terms of downsizing, lay-offs and mergers. These are a result of the economic restraints and now form the corner stones of the consultancy market.7

3.1.1. Macro Environment Consultancy is a business to business service; there are few macro environment factors that really have a direct influence on the consultancy branch. Relevant factors are the economic environment and its consequences for the business, the European integration and what that means, and technological developments that are used in business.

Economic IssueAt the moment the economic environment in the Netherlands indicates a recession. This has an immediate effect on Pentascope’s business. The consulting branch explains an economic recession as less of a threat than it really is. Consultancy businesses speak of a demand change from services dealing with expansion, human resource and other forms of growth resulting from good economic environment towards a demand for services dealing with lay-offs, downsizing and mergers because of economic recession. However, it is clear that companies are less likely to purchase outside assistance in times where the budgets are tight.

Political/Legal IssueOngoing European integration means on one hand more competition from international companies entering the market. This might be seen as a threat, but can also be seen as an opportunity to engage in co operations in order for Pentascope to get foot in the international market with a company that offers complementary services to Pentascope. Also EU integration may force companies to implement IT audit systems for better internal control and clarification to third parties. An example is that industry and business need to build mandatory risk management systems described in the Control and Transparency Act (KonTraG) and the Basle II proposals.

Contracts in developing countries are mainly appointed through large international organizations such as the World Trade Organization, the International Monetary Fund and the World Bank. For those opportunities it is important to have contacts and lobbyists working Pentascope’s cause within those organizations.

Technological IssueTechnological developments can have a positive effect on business for Pentascope as they have to be implemented within organizations; IT and otherwise. However, in the current economic environment companies are reluctant to purchase new technological systems.

7 Economische Voorlichtings Dienst (www.evd.nl)

-14-

3.1.2. The Management Consultancy BranchFirst a few main points are stated that are important for this research: According to CBS Pentascope’s services fall under CBS# 74141 (Organisatie-adviesbureaus) Number of organizations in the Netherlands according to CBS8: 20.005 Number of people working in this sector in the Netherlands: 38.800

The primary demand indicates Pentascope’s market size. According to the Rabobank9 the current share of the management consultancy is 2% of the entire consultancy market.

Developments in the management consultancy marketConcentration and internationalization of the management consultancy market is a fact. The number of international clients and projects is growing which pushes the companies to make choices in developing international strategies. Most companies will focus their services in a broader perspective while trying to establish international operations. In the beginning of 2003 the outlooks for the consultants were still tough. The job market is still decreasing and lay-offs are inevitable. However, analysts indicate that in 2005 the market will grow as much as 11%, promising better times.10

3.2. Customer AnalysisThere are two main segmentation strategies in the consultancy market that are commonly used. The first strategy, stated by FEACO (The European Federation for Management Consultancy Associations; www.feaco.org), divides the market in five segments: Information Technology (IT) Consulting/IT-Implementation, Corporate Strategy Services, Operations-Management, Human Resources (HR)-Management en Outsourcing Services.

The second strategy covers the division of the market by content and niche. This way the market can be divided into strategic consultancy, functional consultancy and IT-consultancy. Strategic means concentrating on giving strategic advice (Takeovers, strategic solutions on a high level) e.g. Boston Consulting Group and McKinsey. Functional consultancy concentrates on advice, guidance, professionalizing and practical implementation e.g. Pentascope. The last group, IT consultancy, concentrates mainly on implementing soft- and hardware systems. 11

Pentascope’s services can be defined as advice, guidance, professionalizing and practical implementation. Therefore , the best way for Pentascope to divide the market is the latter segmentation strategy in which it can be defined as a functional consulting company. Within the functional consultancy is Pentascope known for its alternative view on implementation as described in the first chapter.

3.3. Pentascope’s Market SegmentationPentascope identifies four main segments; telecom services, public institutions, financial services and logistics services. When defined based on these grounds, companies will be categorized based on their revenue size. This results in two main streams: Large (multinationals and other large companies), middle-large, and small (every company that doesn’t fit in the large). Pentascope offers all its services throughout every identified segment. There are very few small companies that Pentascope offers its services to. A reason is that these companies do not have the resources or the management structure complexity to be interested in Pentascope’s services. This is also consistent with the 80/20 rule which states that 80% of your result is generated by the top 20% of the clients. In this case these companies are segmented as large companies (AAB, Aegon Insurance, Akzo Nobel, Delta Lloyd, DSM, Fortis Bank, Frans Maas, Organon, National Railway Company, Oce, Royal TPG and Royal Dutch Shell). Below follows an indication for the business segments identified by Pentascope. Together with their clients, Pentascope developed interesting new models to have employees change themselves towards a result driven and customer oriented service organization.

3.3.1. Telecom Services The telecom services business line is the most important line to Pentascope’s International operations as 86% of the international revenue is generated by this segment. Pentascope has divided this business line into five main areas: Strategy Development; Processes, systems and organization development; Product & Service Management; Customer Relationship Management and their core implementation services. The telecom market, in which Pentascope is active, is divided into three main segments. These are the mobile operators; fixed operators; and data/IP operators and service providers.

3.3.2. Public ServicesPentascope operates in three main areas: local government, federal government and in the social & health care sector. The change towards a more client driven, process oriented organization is recognizable in all sectors. By implementing cockpit-tools like the Balanced Scorecard, Service Level Agreements and benchmarking figures Pentascope can assist organizations in making results more measurable and more objective.

8 Centraal Bureau voor de Statistiek www.cbs.nl (Dutch central bureau for statistics and analysis)9 Rabobank (www.rabobank.nl)10 http://www.intermediair.nl/branche/consultancy/branche/omschrijving.htm# 2/25/200411 Idem

-15-

IT Consultancy

Strategic Consultancy

Functional Consultancy

Program Management Systems TechnologyHR-ManagementProcess ManagementQuality Management

1 2 3 4

Telecom ServicesPublic ServicesFinancial ServicesLogistics Services

IIIIIIIVV

I II III IV V

CLIENT NEEDS

PSI’s MARKETSEGMENTS

PSI’sSERVICE AREAS

The basic excellence lies in the area of process management: significant improvement of productivity, connected to an increased ability to change. In contrast to the profit sector, which experiences tough times at the moment, the non-profit sector, like healthcare and other public services are offering better results for consultancy.

3.3.3. Financial ServicesIn the financial services business line Pentascope’s main activities are interim management, change management, coaching on management level (mission - vision), project management, re-design of processes, training programs and their core implementation services. Financial services companies include insurance, banking, mortgage suppliers and other money supplying institutions.

3.3.4. Logistics ServicesThe logistics services are the second largest account area for Pentascope’s international revenue. Pentascope defines logistics as any organization that transports and distributes people or goods. Within the Logistics Sector, the European railway companies and postal companies must privatize to cope with the challenging demands of the European Community are interesting for Pentascope.

3.3.5. Importance Business Line to Pentascope’s International Operations.Fig.3.1 Percentage of Revenue per Client Segment of Pentascope’s Operations

86%

2%

2% 10%

Telecom Services

Public Services

Financial Services

Logistics Services

From this illustration it becomes clear that the telecom services business line is the core of Pentascope’s international business. This can be explained by the fact that a large number of former Royal KPN consultants were hired with extensive knowledge and relationship networks in this sector and the three year management contract in Nigeria for privatizing the telecom company. This contract was received with the assistance of the World Trade Organization.

3.4. Market Definition PentascopeThe external situational analysis results in a market definition for Pentascope. Pentascope business can be illustrated as in the model described by Abell (1980)12. From this model it can be concluded that Pentascope satisfies the clients in the needs for (mainly) functional but also (partially) strategic consultancy services in the areas of program management, systems technology, human resource management, process management and quality management to the four main market segments of telecom, public institutions, financial services and the logistics segment.

Fig.3.1 Market Definition according Abell

3.5. Competitor AnalysisPentascope’s main competitors on the management consulting market are:

Quint Wellington Redwood Hey Group 12 Dr. K.J. Alsem; Strategische Marketing Planning; 2nd print, 2000; Chapter 2, p39-40

-16-

BMC McKinsey & Company GITP Management Consulting Deloitte Consulting Twynstra Gudde Berenschot Groep K+V organisatie

adviesbureau PNO Consultants

A.T. Kearney KPMG Consulting Cap Gemini Ernst & Young IBM Business Consulting Services LogicaCMG Boer & Croon Accenture The Boston Consulting Group

The magazine ”Management Team” (June 2003) performed a research among clients of these companies and by giving ratings to know-how, price, service and result, generated a top list of best companies for 2003. In this list Pentascope came in at a 2nd place beating big competitors such as McKinsey & Company and The Boston Consulting Group. Clients judged Pentascope to have the best quality/price relation. The primary reason for this is that Pentascope implements with various feedback streams, reassuring clients with the feeling that they have a say in the process. This is valued very highly in the Netherlands according to the article in Management Team.

The competition on the management consultancy market is fierce and mainly influenced by the following factors: The relationship that the consulting firm has with their clients resulting from past experiences. Secondly, companies search for big (and supposedly secure) companies with good reputations. The fact that Pentascope is not known all over every industry sector is a major weakness.

The only real substitution for consulting services can be made if an organization performs the service itself. On the other hand, it can be concluded that since every consulting firm uses a different way of offering the consulting service they can all be substitutions to Pentascope’s services. With that difference, that most companies concentrate on the change process design, where Pentascope adds the implementation of that design to its services.

It is clear that Pentascope offers a different view, with focus on the human aspect. This means that Pentascope operates in a market niche. However, this niche is developing to be more and more common and separate market segment as more and more companies recognize the long-term benefits of this unique approach on implementation new organizational processes and systems.

To establish a consulting firm is easy. Just register and there are no other requirements necessary. However, for newcomers it is not easy to enter the market and get projects because it relies mainly on existing relationships. Newcomers have to focus on new companies that haven’t worked with consultants before. This is difficult because companies rather work with “established” management consulting firms. Another possibility is to target a niche and supply specific consultancy to that niche.

Pentascope markets itself as a unique company within the market. Judging from the 2003 client satisfaction research, this view is not shared by Pentascope’s clients. For them Pentascope is just one of the many and decisions are made with regard to price, name, reputation etc. Pentascope emphasizes its uniqueness, but in fact it is still possible to identify its services within known parameters.

-17-

4. Market OrientationIn this chapter a determination will be made which country offers the best option to start internationalizing Pentascope. First six countries are selected for macro economic analysis. Pentascope’s services highly depend on cultural influences. These countries are, therefore also judged on their cultural compatibility with the Netherlands. Those analyses are combined in a business portfolio matrix. From this matrix an advice can be given to Pentascope on what country offers the best possibility to start its internationalization in.

4.1. Preliminary SelectionReferring to Pentascope’s international strategies; follow current clients and establish a permanent representation on the international market; Pentascope has to determine the best country to start internationalization in. For Pentascope the international market has a three folded outlook. The world can be divided into developed economies, emerging economies and less developed countries (LDC’s). Judging upfront it seems that developed economies have better outlooks for Pentascope if they want to follow its current clients, to grow with getting new business relations and after that establish a permanent representation on that market. There are also possibilities in the public sector of emerging economies. These markets heavily depend on governmental direction, which means that they offer government contracts, which are mostly guided and initiated by world institutions such as the World Bank, IMF or the WTO. LDC’s don’t show opportunities for Pentascope because companies in these economies don’t have money for purchase of consulting services. The opportunities in developed economies are less time and cost intensive for Pentascope. Moreover, companies in these economies have more money and are more likely to purchase outside consulting services. Current large clients are mainly represented in countries with developed economies. For these three reasons, this research focuses on developed economy countries in determining countries for internationalizing Pentascope. Developed economies are the North Americas, European Union, Australia, New Zealand and Japan.

For Pentascope it is important to internationalize to countries that have the opportunity to help Pentascope internationalize further. The North Americas, Australia and New Zealand don’t offer large possibilities in expanding internationally at a quick rate, because these countries are relatively isolated in the world. Japan is not interesting for Pentascope because of its unique management style that they use. Japan’s culture is so different that Pentascope would have to change its services to adapt. In case of the European Union Pentascope can internationalize quickly, because these markets are smaller and the services that Pentascope offers do not have to be changed much to be suitable for these markets. This reduces internationalization barriers. Also, less economic barriers within the EU help lowering difficulties for internationalization. Another factor is that the entry to the EU, geographically seen, is easiest to accomplish from the Netherlands home market. Therefore this research is targeted at the European Union.

Pentascope has made a selection of six countries within the EU that will be subject to this research. These countries are the United Kingdom, Sweden, Denmark, Germany, Belgium and France. These countries will be researched using several criteria to find the primary and secondary target countries. Examination takes place at macro level and meso level. A filter model, introduced by Harell and Kiefer,13 is used to determine which country offers the best option for Pentascope, by viewing the country’s attractiveness compared to its compatibility with Pentascope.

13 Harrell & Keifer, 1993 Multinational Market Portfolio in Global Strategy Development, International Marketing Review #10

-18-

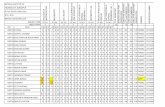

4.2. Country AttractivenessIn order to judge a country’s attractiveness quickly and thoroughly the countries are judged on their macro and meso economic environment factors listed below. Which country is most attractive for Pentascope for that particular factor will is shown in the table below. First place gets 4 points, 2nd place receives 3 points, 3rd place 2 points and countries in 4th place receive 1 point. Countries that finish in 5th or 6th place receive no points. However, the factors are weighted because some are considered more important to others. The weight is between 1-4; 4 being most important and 1 being less important. For the results see the table below.

Table 4.1 Macro Economic Criteria for Selected Country Criteria United

KingdomSweden Denmark Germany France Belgium Ratings

Attractiveness

Weight

Size 244.100 km2 449.964 km2 43.092 km2 356,970 km2 544,000 km2 30.528 km2 1. FRA2. SW

E3. GE

R4. UK

1

Citizens (2002 est.)

58.8 mln 8,9 mln 5,4 mln 82,2 mln 61,4 mln 10,2 mln 1. GER

2. FRA3. UK4. BEL

1

Use of English in Business

All-over Extensive knowledge and use

Extensive knowledge and use

Less than 20%

None Just in Flanders / Brussels; some

1. UK2. SW

E3. DE

N4. GE

R

2

GDP

GDP per Capita

Growth GDP 2003

€ 1.523 bln

€ 37962,92

1,8%

€ 260 bln

€ 28221

1,5%

€ 160,4 bln

€ 29785

2.1%

€ 1.958 bln

€ 23826

3,1%

€ 1.520,8 bln

€ 24837,30

1,2%

€ 253 bln

€ 29586

1,0%

1. UK2. GE

R3. DE

N4. SW

E

4

Inflation 2004 (Expected)

Inflation 2005 (Expected)

2,4%

2,5%

2,4%

2,2%

2,3%

1,9%

1.1%

1,8%

1,9%

1,8%

2,2%

1,8%

1. FRA2. GE

R3. UK4. SWE

2

Unemployment rate

5,1% 4,2% 5,1% 9,3% 9,1% 11% 1. SWE

2. DEN2. UK4. FRA

1

Currency(16/03/2004)

Pound£ 1 = € 1,46

Swedish KroneSKK 1 = € 0,105

Danish KroneDKK 1 = € 0,13

Euro Euro Euro 1. GER1. BEL1. FRA4. UK

1

Total Imports € 321,5 bln € 67 bln € 51,6 bln € 521,2 bln € 380,2 bln €202,4 bln 1. GER2. FRA3. UK4. BEL

2

Total Exports € 271,3 bln € 83,6 bln € 59,4 bln € 574,9 bln € 411,6 bln €186,7 bln 1. GER2. FRA3. UK4. BEL

1

Service industry % of total

74% 74% 79% 63.8% 71% 73% 1. DEN2. UK2. SWE4. BEL

4

Sources EIU, EVD/CBS, Office for National Statistics

EIU, EVD/CBS

EIU, EVD/CBS, Statistics Denmark

EIU, EVD/CBS, Statistisches Bundesamt

EVD/CBS, EIU, Insee

EIU, EVD/CBS, NIS

By means of a “weighted factor score model”, all factors are used to judge these countries. All scores are added up and these are represented in the following table, which shows the United Kingdom,

-19-

before Germany as being the most attractive for Pentascope to start internationalization according to the macro and meso economic factors.

-20-

Table 4.2 Country attractiveness rankingCountry s1 s2 s3 s4 s5 s6 s7 s8 s9 s10 Total from 76 Percentage RankingBelgium 0 1 0 0 0 0 4 2 1 4 12 15,79% 6France 4 3 0 0 8 1 4 6 3 0 29 38,16% 5Denmark 0 0 4 8 0 3 0 0 0 16 31 40,79% 3Sweden 3 0 6 4 2 4 0 0 0 12 31 40,79% 3Germany 2 4 2 12 6 0 4 8 4 0 42 55,26% 2United Kingdom 1 2 8 16 4 2 1 4 2 12 52 68,42% 1

4.3. Country / Company CompatibilityTo judge the compatibility of these countries to Pentascope, the difference between the Netherlands and their scores on Geert Hofstede’s14 index for cultural dimensions, are used as criteria. This will offer a quick judgment whether the particular country shows large differences with the Netherlands on a cultural level indicating the cultural barrier in internationalization. Pentascope’s service delivery heavily depends on the business culture and therefore it is important to view to what extend it has to change its servuction to the country. The rating is received by counting the difference with the Netherlands. Six factors are considered in this rating. The Power Distance Index; Individualism of society; Masculinity of society and the Uncertainty Avoidance Index. Below is shown what the weight (importance) is of these factors from 4 to 1. Four being most important and 1 being the least important. Moreover the country’s compatibility is viewed in how many of the top 12 clients have a presence in that particular country. This comes forth from Pentascope’s international strategy to be able to assist its current clients internationally. Finally, the investment size needed for start-up is judged for these countries.

Table 4.3.1 Compatibility Factors and their weightWeight

PDI Power Distance Index 3IDV Individualism 3MAS Masculinity 1UAI Uncertainty Avoidance Index 1

How many of Top 12 clients have presence in country 4Money needed for start-up 3

Power Distance Index (PDI) focuses on the acceptance of the degree of equality, or inequality, between people in the country's society.

Table 4.3.2 Power Distance Index for selected countries and their scoreCountry PDI Difference with the Netherlands score Score x weightGermany 35 3 4 12United Kingdom 35 3 4 12Sweden 31 7 2 6Denmark 18 20 1 3Belgium 65 27 - -France 68 30 - -Netherlands 38 0

Individualism (IDV) focuses on whether a society values individual achievement versus collective achievement.

Table 4.3.3 Individualism for selected countries and their scoreCountry IDV Difference with the Netherlands score Score x weightBelgium 75 5 4 12Denmark 74 6 3 9France 71 9 2 6Sweden 71 9 2 6United Kingdom 89 9 2 6Germany 67 13 - -Netherlands 80 0

Masculinity (MAS) focuses on the degree of male values in a society.

Table 4.3.4 Masculinity for selected countries and their score Country MAS Difference with the Netherlands score Score x weightDenmark 16 2 4 4Sweden 5 9 3 3France 43 29 2 2Belgium 54 40 1 1Germany 66 42United Kingdom 66 42

14 Werken met Cultuurverschillen; Geert Hofstede; 2000

-21-

Netherlands 14 0

Uncertainty Avoidance Index (UAI) focuses on the level of tolerance for uncertainty and ambiguity within the society - i.e. unstructured situations.

Table 4.3.5 Uncertainty Avoidance Index for selected countries and their scoreCountry UAI Difference with the Netherlands score Score x weightGermany 65 12 4 4United Kingdom 35 18 3 3Sweden 29 24 2 2Denmark 23 30 1 1France 86 33Belgium 94 41Netherlands 53 0

Reviewing its international strategy, following current clients and assisting current clients internationally, it is important to view how many companies have a presence in the country that is targeted. This is therefore also the most important country/company factor and its weight is set to 4.

Table 4.3.6 Number “big” clients that have presence in selected country Country # companies Score Score x weightDenmark 7Sweden 7France 9 1 4Belgium 10 4 16Germany 10 4 16United Kingdom 10 4 16

The above mentioned factors are important to see how Pentascope fits the country’s cultural profile and the country’s ability to follow the main internationalization strategy. Earlier it became clear that Pentascope does not possess deep financial pockets for internationalization. Below there is a ranking of the countries that indicate the difference in money needed to enter the country. Its importance for Pentascope is three. This ranking is received by viewing the invested time, tax regulations, people needed for startup. The country with the lowest investment needed for startup will lead the ranking.

Table 4.3.7 Investment needed for startup in selected countries and their score Country Investment for start-up (smallest in 1st place) score Score x weightUnited Kingdom 4 12Denmark 3 9Germany 2 6Sweden 1 3BelgiumFrance

By means of a “weighted factor score model”, all factors are used to judge these countries. All scores are added up and these are represented in the following table, which shows the United Kingdom, before Germany as being the most attractive for Pentascope to start internationalization according to the macro and meso economic factors.

Table 4.3.8 Rankings of Compatibility for selected countriesCountry Country / company compatibility (points of 60) Percentage RankingUnited Kingdom 49 81,67% 1Germany 38 63,33% 2Belgium 29 48,33% 3Denmark 26 43,33% 4Sweden 20 33,33% 5France 12 20% 6

The results from the country attractiveness analyses and the country/Pentascope compatibility analyses are shown below. A business portfolio matrix, as shown in figure 5.1, is a way to identify the country which offers the best option for Pentascope to start internationalization in. This is done in two ways. First the country’s individual scores are used to find the best country and second the ranking among the six countries researched are used to fill in the business portfolio matrix. The size of the circle indicates the potential market size for Pentascope.

4.4. Business Portfolio Matrix with Individual Country ScoresTable 4.4 Scores for compatibility and attractiveness of selected countries

Country Country / company compatibility Ranking Country attractiveness RankingUnited Kingdom 49 1 52 1Sweden 38 5 31 3Denmark 29 4 31 3

-22-

Germany 26 2 42 2Belgium 20 3 12 6France 12 6 29 5

Fig 4.2 Business Portfolio matrix (Harrell and Kiefer; International Marketing Review #10) According to Country Individual Scores According to Country Rankings

4.5. ConclusionsHarrell and Keifer (1993) draw the conclusion from this that there are primary (High/High), secondary (High/Medium & Medium/High) and tertiary (Low/High, Medium/Medium & High/Medium) opportunity countries. In this case the United Kingdom seems to be the primary opportunity country for Pentascope to start internationalization before Germany which forms a secondary opportunity. Judging from the above, the UK and Germany do not have many differences and look quite similar to the Netherlands. Pentascope’s servuction, the production and service provision do not have to be changed much to work in Germany and the UK. The Scandinavian countries, Sweden and Denmark, can form a tertiary opportunity. Pentascope has to change its methods to work on the compatibility with these countries if it wants to internationalize into these countries. Even though the United Kingdom shows better opportunity, Pentascope decided that Germany would have to be researched as the country to start its internationalization in.5. GermanyThis chapter clarifies how the German management consulting market looks and what Pentascope will face when entering this market.

Germany has 82,2 million people. That is 230 per square kilometer. Germany, therefore, has one of the highest population densities in Europe only outweighed by Belgium, the UK and the Netherlands. Germans are highly concentrated to specific areas. Most important is the “Ruhr” area which inhabits 11 million people and has virtually no borders between cities. Other important concentrations exist along the river “Rhein”, the “Main”-area (Frankfurt, Wiesbaden, Mainz) and the “Neckar” area (Mannheim, Ludwigshafen). High people/business concentrations consist also around the large cities of Berlin, Bremen, Dresden, Hamburg, Leipzig, München and Nürnberg. The result is that Germany is a highly regionally oriented country. Targeting it for Pentascope would mean researching each region thoroughly. 49,6% of Germany’s population works and its unemployment rate is 9,3% of which a third lives in the former West-Germany (BRD). The economic recession continues to raise the unemployment figures.

Fig. 5.1 People/Business concentration in Germany

-23-

0

0

60

76Country attractiveness

Cou

ntry

/ co

mpa

ny c

ompa

tibili

ty

UK

GER

FR

B SD

High Medium Low

Lo

w

Med

ium

H

igh

6

6

0

0 Country attractiveness

Cou

ntry

/ co

mpa

ny c

ompa

tibili

ty

GER

UK

S

D

FR

B

High Medium Low L

ow

M

ediu

m

H

igh

Areas:1. Ruhr area2. Main area3. Neckar area4. Berlin5. Bremen6. Dresden7. Hamburg8. Leipzig9. München10. Nürnberg

The concentration of people also reflects the concentration of businesses. Of the top 12 clients that Pentascope has in the Netherlands 10 have a presence in Germany. From those eight have a presence in the three largest areas. With reference to assisting current clients abroad, the main focus should be to the Ruhr area, Rhein area and Main area.

-24-

9

1

2

3

4

57

68

10

9

5.1. Management Consultancy in GermanyGerman companies try to cut costs and make more use of the expertise of management consultancy companies. This trend was started by the telecommunications industry that lowered its expenditures for consultancy services significantly. After this branch, others followed quickly. However, this demand is mostly limited to the design part for management consulting. The demand for organizational consulting, functional and strategic combined,– i.e. for projects aiming at cost savings and rationalization – increased by 35.7% between 2001 and 2002. The total revenues of the German management consulting sector amounted to 12.3 billion Euros in 2002 and are thus 4.5 per cent lower than in the preceding year (2001: 12.9 billion Euro). In the year 2001 the sector had still grown by 5.7%. Companies had to postpone their projects or to retract innovative projects entirely.15

The trend within the management consultancy more and more resembles 'integrated solutions', which demands high competence and expertise from consultancy firms. This is positive for Pentascope, because it moves ahead of this trend and it offers an opportunity if Pentascope is able to partner up with a local IT developer. Small and middle-sized companies are expected to fail in pursuing this trend what will push them to start co operations according to BDU research. While classic management consulting (organizational/functional and strategic consulting services) saw an increase in revenues of a total of 10.3%, the development in the consulting areas of IT consulting/IT Services (- 20.1%) and management consulting (- 15.0%) decreased. Development of management consulting, however, proved inconsistent. Clients' demand for organization consulting services increased markedly, while the number of strategic consulting projects decreased by 13.6%. BDU16 explained the unusual development for the consulting industry above all by the clients' reluctance with regard to awarding innovative projects. The development of individual consulting areas – up with organizational consulting, down with IT consulting, strategic consulting and executive staff consulting – underlines, according to BDU, that important investments into Germany's future are no longer made and that development has come to a standstill. Therefore the BDU estimates a slight growth in market turnover in the consulting industry for the year 2003.

In Germany management consultancy can be segmented in the: IT, Strategic consultancy and Functional consultancy. All of these segments experienced growth in its revenue figures in 2001.

Table 5.1 Revenue Management and Marketing consultancy Germany 1997/2001 (Billion Euro)Sector 1997 2001IT 3,2 5,0Strategic consultancy 2,5 3,8Functional consultancy 2,7 4,1

Source: Euromonitor, September 2002

The economic crisis affected the top forty (- 4.2%) as well as the medium- (- 4.7%) and the small-sized consulting firms (-4.8%) of a total of 14,400 firms. The market share of the top forty consultants remained almost unchanged at approximately 50%. The demand for consulting projects has clearly increased in the producing sector which now has a share of 30.9% of the total demand (2001: 25%). This corresponds to an increase by approximately 18%. The IT and media industry saw a dramatic decrease in demand of 20.1 per cent where a negative business development led to a squeeze of the consulting budgets. The trend for those companies is to form co operations with functional and strategic consulting businesses according to BDU.

15 Economic Information Service (economische voorlichtingsdienst www.evd.nl)16 Bundesverband Deutscher Unternehmensberater (www.bdu.de)

-25-

Fig 5.2 Development of German Consulting Market from 1992 until 2002 including 2003 est.

0,0

2,0

4,0

6,0

8,0

10,0

12,0

14,0

Size in Billion Euro

1992 1995 1998 2001Source: Bundesverband Deutscher Unternehmensberater (www.bdu.nl)

Expecting a huge increase in revenue of the consulting industry in the year 2003 has proven to be false, as revenue estimates only show a slight increase. The reason for this is the backdrop of the insecure economic and political developments. It is, however, recognizable that the postponement of projects that has been occurring in 2002 will lead to a considerable investment bottleneck in the clients' companies. Reforms in the areas of labor, taxes and health, the resulting economic dynamics will also lead to a need for more consulting. The improvement of IT and data security counted among the most urgent tasks of the companies. Moreover, due to the Basle II17 provisions the companies are increasingly obliged to introduce comprehensive adjustments in their organization as well as in their strategic orientation in conjunction with the necessary rating procedures. Industry and business would also need to catch up, in order to build up the mandatory risk management systems provided for by the Control and Transparency Act (KonTraG). 18

In 2002 the management consulting firms could not avoid restructuring either. This trend will continue into the end of 2004. The extension or focusing of the service portfolio as well as the optimization of customer relations will become a central task for consulting firms. At present the German Association of Management Consulting Firms (BDU e. V.), organizes about 16,000 business and management consultants working for more than 550 management, IT and executive staff consulting firms. In 2002 the member organizations had a total turnover of about 3.2 billion Euro (3.3 billion Euro in 2001) and first indications for 2003 show a slight growth but not yet back to the level of 2001.

17 Basle II provisions are political measures proposed to counter large-scale fraud in companies as seen recently in the Royal Dutch Ahold and Enron. 18 Bundesministerium für Wirtschaft und Arbeit (http://www.bmwi.de)

-26-

5.2. Outlooks for Pentascope’s Business LinesFor Pentascope it is important to also view the outlooks of its business segments in order to get a total view of the opportunities that the German market offers. After viewing this Pentascope may find itself targeting only one of two segments while entering the German market instead of a four business segment broad targeting or a market broad view.

5.2.1. Telecom Services The telecommunications industry is one of the most promising sectors in the German service industry. Germany has a large expertise and new developments are quickly integrated. The following illustrates how the telecommunications services market developed over the past three years.

Fig 5.3 German Telecom Sector development 2001 – 2003

Source: Verband der Anbieter von Telekommunikations- und Mehrwertdiensten (VATM), www.vatm.de

This sector depends heavily on Deutche Telekom AG that is in the process of being privatized by the government under European guidelines. Deutsche Telekom became a private company in 2000 however it is still struggling with the switch. The market should open in the future for service providers from other European Union countries.19

5.2.2. Public ServicesDemand from the public service also increased by 6% (market share as to the demand side in 2002 of 8.9%, 2001: 8.0%). The main trend here is “full-privatization” under European guidelines. Public services in Germany exist on three levels. First there is the Federal Government in Berlin. Then there is the level of individual federation countries. Finally governmental institutions and privatizations exist on city level. The economic tasks for the government on central, state and city level focus on sectors that supply the community needs. Privatization of telecommunication, railways and energy suppliers are in the completion phase. The new developments are the privatization of other public services such as airports (Frankfurt and Hamburg) and the federal printing company “Bundesdruckerei AG”20

The highest concentration businesses can be found in the Rhein, Ruhr and Neckar areas. Most of the Bundesministeriums (federal departments) are seated in Berlin.

19 Verband der Anbieter von Telekommunikations- und Mehrwertdiensten (VATM), www.vatm.de20 Economic Information Service (Economische Voorlichtingsdienst www.evd.nl)

-27-

2001 2002 2003

€ 25,0 Bln43,3%

€ 32,8 Bln56,7%

€ 25,5 Bln43,1%

€ 33,6 Bln56,9%

€ 26,8 Bln43,3%

€ 35,1 Bln56,7%

€ 57,8 Bln€ 59,1 Bln

€ 61,9Bln

+ 2,2%+ 4,7%

+ 2%

+ 2%

+ 5%

+ 5%

Deutsche Telekom

Other

Fixed-line services € 9,3 Bln 34,7%

Mobile services € 17,5 Bln 65,3%

5.2.3. Financial ServicesThe financial services industry consists mainly of banks and insurance companies. A mentionable development is the trend towards the “Allfinanzkonzept” which encompasses the expansion of financial institutions with other services than their core business.

Banks and insurance companies have reduced their consulting budgets only marginally (by 0.9%), but they have changed the purpose. The demand of banks and insurance companies shifted from IT innovation projects to Pentascope's service offerings of cost-cutting measures and process optimization. Banks also developed insurance activities where insurance companies started to offer banking services

The German Banking sector can be segmented in the Central bank, private trade banks, public saving banks and cooperative banks. The middle and small segment include mortgage, investing and ship mortgage banking. 21

The trend in this sector is a large number of mergers, take-overs and closings due to decreasing profits in this sector in the last couple of years. The focus has shifted towards international investing banks in order to survive in an integrating European Union and a globalizing market. Other trends indicate that banking through the internet is growing rapidly as well as banking services through the telephone.

The top five banking institutions are the Deutsche Bank AG, Bayerische Hypo- und Vereinsbank AG, Dresdner Bank AG, Commerzbank AG, Westdeutsche Landesbank Girozentrale. They had a total possession of 3.500 Bln Euro worth in 2002.22 Most of the companies that had a regional approach start focusing on centralization for Germany. This market is mainly concentrated around Frankfurt, which also houses the European Monetary institutions.

Insurance services had to deal with the weak economic situation and the aftermath of destabilization in the world following the terror threats. The annual figures of the Gesamtverband der Deutschen Versicherungswirtschaft (the union for German insurance >> www.gdv.de) shows a growth of 4,0 percent among its members in 2002 which came from 2,7% in 2001.23

Further growth is believed to show throughout the sector in the coming years, especially in life insurances, pensions24, private health and car insurance. Also in this sector internationalization has been a driving force behind mergers, take-overs and closings. The sector is open for international companies; however, customers stay loyal to German companies. These companies are headquartered mainly around München and the Rhein area (Source GDV)

21 The German Financial Department (www.bundesfinanzministerium.de)22 Die Bank february 2004(www.die-bank.de) & the Bundesverband deutscher Banken, www.bdb.de23 Gesamtverband der Deutschen Versicherungswirtschaft (GDV), www.gdv.de24 Verband Deutscher Rentenversicherungsträger (pensionfundings), www.vdr.de

-28-

5.2.4. Logistics ServicesLogistics are concentrated around two main areas: Bremen and Hamburg because of the harbors on one hand and Frankfurt because of its large international airport, which lays in the economic heart of Germany the Ruhr area. Road, railway, sea and air transport, the four most important segments, reported decreasing results in 2003.25 26 The sector has also dealt with large-scale privatization under EU regulations. The resulting figures state that sea shipments to Bremen and air traffic to Frankfurt became more and more important. The Bremen harbor reported a record annual turnover in 2002 in the sea shipments. Frankfurt reported a product traffic increase of 5,2%. Surprisingly Stuttgart reported an increase of over 30%. This shows that air traffic became increasingly important and that the Ruhr area is the most important area for logistical services.

5.3. Pentascope’s Competitor Analysis2003 estimates indicate that the management consultancy market is growing for the first time since 2001. Pentascope's German competition shows large similarities with the situation on the Netherlands home market. As in the Netherlands competition on the management consultancy market in Germany is also fierce. Furthermore, it is mainly influenced by firstly the relationships that exist with companies resulting from past experiences. Secondly, companies search for big (and supposedly secure) companies with good reputations. This results in choosing big international companies such as McKinsey, Boston Consulting or KPMG. Finally, in acquiring new customers, another disadvantage for Pentascope is that they have no name recognition in Germany what so ever.