Misbah Thesis

-

Upload

kashifkhan38 -

Category

Documents

-

view

222 -

download

0

Transcript of Misbah Thesis

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 1/62

Hierarchy of management

Management and risk control of financial institutions

A Thesis PresentedBy

A Thesis PresentedToThe Committee on Academic Degrees

In Partial Fulfillment of the RequirementsFor a Degree with HonorsOf M.Com

Business School,The University of Lahore(January, 2010)

1

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 2/62

DEDICATION

Dedicated to my beloved parents and those friends & teacherswho helped me with their precious ideas regarding this study

2

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 3/62

Acknowledgement

I am so grateful to Almighty Allah for helping me in the completion of this task. I am too thankful to my parents who brought me at thisstage and supported me in every walk of life and I would like to thankour respected teacher Sir Usman saeed for his role played in our

studies and I am sure that their work will prove itself as an asset inour practical life and it will have a lot of benefits for us in our futureconcerns.

3

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 4/62

Table of Contents Table of Contents ............................................................................................. 4

Chapter NO (1) ................................................................................................. 6

Introduction ................................................................................................ 6

Chapter NO ( 2) ................................................................................................ 8

Literature review ........................................................................................ 8

Chapter NO (3) ....................................................... 13

Management ............................................................................................ 13

Levels of Management by (Robert Anthony) .................................................. 15

Strategic management: ........................................................................... 15

Quality management: ..................................................................................... 17

Identifying a problem ................................................................................. 17

Goals .............................................................................................................. 20

Types of goals ......................................................................................... 20

Functions of management ............................................................................. 21

Planning and performance ............................................................................. 22

Types of plans .......................................................................................... 22

Types of departmentalization ......................................................................... 24Learning ......................................................................................................... 27

Measuring actual performance ...................................................................... 29

Comparing actual performance against standard ...................................29

Chapter NO (4) ....................................................... 31

Risk ......................................................................................................... 31

Types of risk ............................................................................................ 32

Mitigation of Operational risk ...................................................................... 34

Market risk .................................................................................................... 40

Examples of market risk: ......................................................................... 41

................................................................................ 41

Chapter No (5) ................................................................................................ 41

Financial institutions ................................................................................ 41

Basic functions ........................................................................................ 44

4

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 5/62

Hypothecation ............................................................................................... 47

Chapter No (6) .......................................................................... 47

Risk control of financial institutions .......................................... 47

Risk management plan ................................................................................... 49

Risk reduction ................................................................................................ 50

Chapter NO (7) ............................................................................................... 51

Stock markets .......................................................................................... 51

Introduction of the KASB securities limited : .................................................. 52

Principal Purpose for the Offer: ................................................................ 53

Future Prospects ............................................................................................ 53

Risk Factors .................................................................................................... 54

Chapter NO(8) ................................................................................................ 57

References ..................................................................................................... 58

5

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 6/62

Chapter NO (1)

Introduction

Risk control of financial institutions is a big term which behind a very big meaning in

its nature. It means to measure and manage the risk of financial institutions. The risk

management is a term describing by a wide variety of techniques typically starts

rather automatically in different business lines within a financial institutions. To

compare these techniques however one has to come up with on overall standard to

measure risk. Risk is a concept that is given different definitions. Risk is a

unacceptable lass which you have to bear. Risk concerns the expected value of one or

more future events technically the value of those results may be positive or negativity.

However general usage tends focus only on potential harm that may arise from a

future event which may occur either from incurring a cost or by failing to attain some

beneficial. Means risk is expected result of future results or the result of these events

may be positive or negative. You don’t know about certainty or uncertainty you only

estimate but you cannot estimate the exact true situations you know the word the

higher risk higher profit butt we can not know our gain or loss. However generalusage tends occur only on potential harms that may arise from a future event. Which

we have to bear by bearing a cost or sometimes we can not attain benefits that we

expected from the business. The risk management can be considered the

identifications and assessment of risks. Risk from comes from certainties in financial

markets , project frailer ,legal liabilities credit risk accidents natural causes and

disasters as well as deliberates attacks from on adversely. The strategies to manage

the risk include transferring the risk to another party avoiding the consequences of a

particular risk. Management is that cording works activities. So that they are complete

the work effectively and efficiently. The risk management is a protestations process is

followed where by the risk with the greatest loss and greatest possibilities of

occurrence a loss is handled first and risk which lower probability of occurrence of

loss are handled in descending order. The process can be very difficult and balancing

6

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 7/62

between risks and with a high probability of occurrence can offend be mishandled

means if risk is controlled in prior period the risk can be a higher risk. Intangible risk

management identifies a new type of a risk that has a100%probobilities of occurring

but is ignored by the organization due to a lake of identifications abilities. For

example when deficient knowledge is applied to situation a knowledge risk

materializes. Relationship risk occurs when ineffective collaboration occurs process

engagement risk may be an issue when ineffective operational procedures are applied

these risks directly reduces the productivity of knowledge workers decrease cost

effectiveness. Professionally services quality reputations bond value and earnings

qualities resources spent on risk management could have been spent on profitable

activities. The ideal risk management minimizing spending while reductions of the

negative effects of risk. Financial institutions provides services for its clients or

members probably the most important financial services provided by financial

institutions is activity as financial intermediaries most financial institutions are

usually regulated by gorvtment. There are three types of financial institutions.

Deposits these institutions include banks credit unions, trust companies and mortgage

loan, trust companies and mortgage loan companies. Insurance companies and

pensions funds, brokers, underwriters and investment funds.

7

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 8/62

Chapter NO ( 2)

Literature review

Morton (1990) explored that overall objective of regulating of financial sectors should be

to ensure that the system factions effectively in helping to transfer and allocate resources

across time and space under conditions of uncertainty .however actual regulation attempts

to accomplish several objects beyond facilitating the efficient allocation of resources in

fact at least four relations for financial regulation may be defined safeguarding the

financial system against the systematic risk protecting consumers for enhancing the

efficiency of financial system and achieving a wide range of social objectives .He also

explores the systematic risk may be defined as the risk of sudden unaccepted event that

damage the financial system. Such shocks means such type of losses originate inside or

outside the organization and may include the sudden failure of a major participation in

the financial system a technological breakdown or payments or a political shock. such

events can disrupt the normal functioning of financial markets and institutions by

disturbing mutual trust that lubricates most financial tranactions.He also explored that

competition policy not only by the concern to protect consumers from monopolistic

pricing but the basic aim of these markets forces to enhance the efficiency of the

allocation within the financial sector and the financial rest of the economy. He also

explored the consumers of the financial services practically unsophisticated consumers

have to face to difficulty to evaluate the quality of financial information and services

provided to them means unsophisticated faced problems about the evaluation financial

information such as prices of different products purchase and sale of securities and

services provided to them. many financial institutions must often be made in the current period in exchange for benefit that are promised means such as debentures and securities

are soled in the stock market and different companies sell their securities through

different banks and financial institutions. The question is that when these sold in current

period but their benefit is for future period so consumers faced difficulties about their

financial information and services provided to them.

8

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 9/62

Herring and Litan (1995) explored that reserve requirement means why companies

maintains reserve requirements and capital requirements and liquidity requirements

means (cash securities debentures and bonds etc) designed to insure that firms face loss

during their business periods .The reserve requirement an d capital requirement will be

able to honor its liabilities to its customers means they will be also in a position to

complete the liabilities of their customers and safe guard the systemic risk. He also

explored Government also make policies for socials development of country. Most of the

countries subsidize financing for export sometimes through special guarantee such as in

Pakistan through credit guarantee scheme because exports are made through private

traders so these private traders feel hesitation to start exports business because they feel

risk to before the start of export business because they consider the point in their mind if

their export their products in foreign countries the traders of foreign countries cannot

make payments of their products so to remove this risk the Government of Pakistan has

take an action and started the export guarantee scheme. In this scheme the Government

give guarantee to traders to start the business the Government is responsible for their

every risk if the foreign traders cannot make payment so through this scheme the traders

are honored and exported are encouraged besides this many other steps have been taken

by the Government to increase the exports such export bonus scheme, trading corporation

of Pakistan played very important role for increasing the exports of Pakistan.finaly many

members of the organizations for economic corporations and development have imposed

repotting requirements on banks and some other financial in an effort to combat money

laundering associated with the drugs trade and organized crime. Means there is a lake of

consensus amongst even the developed countries about with criminal. Money laundering

is the conversations of profits derived from illegal activities into financial assets with

consequently appear to have leg mate assign. Many countries of organization for

economic corporation and development have imposed repotting requirements on banks.

Such as in Pakistan only money laundering measures have been taken by the

Government. Specific emphasis on the policy knows your customer. Antimony

laundering unit established at stat bank. The Government of Pakistan has passed

antimony laundering act. Replacement of money changes by exchange companies.

9

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 10/62

Blakt al (1975) explored that a sudden unanticipated withdrawn of deposits that funds

longer term illiquid loans can give raise to instability means illiquid loans can give rise to

instabilities in the economy. Means if loans are made to traders they buy stock and keep

it black when these are storage of stocks in the markets. They make monopoly and sell

things at high prices the consumers had pay high costs so inexpedient allocations of

recourses results from instability and effects economics growth and instability in banking

system can understand confidence in the financial system and disrupt role in facilitating

the efficient allocation of recourses.Latin etol(1987) explored that insured deposits be

invested only in start team treasury bills or closed substitute banks would also issue non

guaranteed financial instruments such commercial paper such as cheque. bill of exchange

letter of credit securities treasury bills to funs conventional bank loans. Just as finance

companies and learning companies and how do they explored that if banks were to hold

not only short term treasury bills but also other assets they are regulatory traded on well

organized markets and can be marked to market daily. This could be implemented in two

ways the secure depository approach in which institutions would be required to form

separately incorporated entities taking insured deposits approach in which institutions

would be required to form separately incorporated entities taking insured deposits and

holding only permissible marketable asset. Bestonetal(1989) explored that capital

requirement for secure depositing would be set to reduced the insolvency between daily

markets to markets points. This is also protect the deposit insuring agency from

loss.Kawomoto (20001) explored that the enterprise risk management is overall risk of

the organization are managed in aggregate result then independently. Risk is also viewed

as a potential profit opportunity rather than as some thing simply to be minimized or

eliminates means the higher risk the higher the profit. He also explored that the level of

decision making under enterprise risk management is also shifted from the insurance risk

manager. who would generally seek to control risk to that chief executive officer a board

of directors who whold be willing to embrace profitable risk opportunities means they

take a risk of those besides this the control management mostly take a risk of those

business which have profitable risk opportunities. he also explore that the risk first risk

management text presentably titled risk management and the business was published in

1963 after six years of development by Robert in this text the objective management is to

10

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 11/62

maximize the productive effectively of the enterprise. The basic purpose of this text was

that risks should be managed in a comprehensive manner and not simply insured.

Financial risk s begins to be dressed much later and by a separate business segment of

most organizations this field also developed own terminology and techniques for

addressing risk. Independently of those that used in traditional risk management Smith

and Witt (1985) explored that most of the companies face financial risk as a result of

failure to manage their hazard risks effectively. He explored that in it has been estimated

in 1970 that financial risk because an important source of uncertainty for firms and hence

this time tools for handling financial risk were developed these new tools allowed

financial risks to be managed in such a ways that pure risks had been managed for

decades. D, Arey (1999) explored that fixed income assets and investment which has

been made in foreign currency and operating results are moistly affected by inflation and

foreign exchange rates represents probabilities in a business they represented speculative

risk. Means when big traders save stocks for future selling their stock in such time when

there is shortage of that product they saved in a stock. But by occurrence of deflation and

people had no money to buy the set prices and substitute also available suddenly their

estimation is wrong they have to face a risk. This risk is called speculative risk. Smithson,

(1998) explored that the basic tools of financial risk management are forward contracts.

These contracts all termed derivatives since their values derived from some other

instruments value farward contract are entered into today in which the exchange will take

place at some future. The terms of the contract price the date and the specific

characteristics of the underlying asset all are determined when the contract is made no

money changes hands when the contracts is initiated. At the specified date each party is

obligated to consummate the transaction since each forward contract is individually

negotiated between the two parties there is considerable flexibilities regulatory the terms

of the contract. He explored that the future contract were developed to address the credit

risk and liquidity concern of forward contract. Similar to forwards and futures are

interred in to today for on exchange that will take place out some future date. The terms

of contract are determined when the contract is entered in to and no money changes

hands when the contract is initiated. However there are server significant differences

between forward and future contracts. Molnar (2000) explored that when disaster strikes

11

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 12/62

the company will suffer a loss to its property means when any unlucky incident takes

places in a company the company will suffer a loss to its property but the higher volume

of telephone traffic that typicality follows a major disaster will help offset this loss. he

also explored that enterprise risk management involves so money different aspects of an

organizations operations and integrates of wide variety of different types of risks no

person is likely to have the expertise necessary to handled this entire real in most of cases

team approach is used with the keep of a team drawing on the skills and expertise of a

number of different areas. Including traditional risk management financial risk

management and management information system, auditing, planning and line operations

the use of team approach through, does not allow traditional risk managers to remain in

focuses only on hazard risk means traditional managers does not focus only hazards risk.

He also explored that for team effectiveness each area will have to be understand the

risks and the approach of the other cases besides this the other areas besides this the team

leader will needs to have a basic understanding of the steps involved in the entire process

and all the methods involved in to contract the risk factors mostly understand by the team

leader because all success depends upon the team leader.Ackerman (2001) explored the

steps of enterprise risk management these are the steps which has been explained by

Ackerman identify the questions identify the risk. Risk measurement Formulate

strategies to limit risk. Implement strategies. Monitor results and repeat. Means fist of all

the question should be identified what type of risk occurs such as hazard risk traditional

risk financial risk and what are the measures have been taken when risk occurs and offer

this prepare strategies means prepare strategies means prepare long term planning to

limit the risk, or to control the risk and when these strategies are prepared implemented

them and monitor the results and respected them means every step to control the risk has

been respected to know that what method which gives useful result deposits it. ARI

(2001) explored the steps which have been taken by the risk control manager to control

the risk Identifies risk on our enterprise basis measure it formulates strategies and tactics

to limit. Execute those strategies and tactics means he explored that to control the risk the

control risk manager have to identify the risk on enterprise basis means identifies the risk

according to the nature of the business and measure it means which type of volume the

risk occurs in business and formulates strategies means strategies are prepped according

12

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 13/62

to the volume and nature of the risk and apply these strategies and then the results. Smith

and wilfored (1995) explored on entire chapter to motivating financial risk management

as a value enhancing strategy, He also describe the approaches accepting the notion that

the volatility of performance has some negative impact on value of the firm leads

managers to consumer risk mitigations strategies there are three generic types. Risk can

be eliminated or avoided by simple business practices. Risk can be transferred to other

participants and risk can be transferred to other participants and risk can be activity

managed at the firm level. Means risk can be eliminated or avoided by simple business

practices means in every small type business practices means in every small type of risks

big risk can be eliminated easily risk can be transferred to other participants means if a

team is prepared to control the risk the team leader should inform the every team member

he explain the risk can be the activity manage day a firm level.

Chapter NO (3)

Management

Getting things done by the people selecting, training and motivating the people. The

business manager is also resource manager. How uses all the recourses to producemaximum output without wasting them.

Business resources

Business resources are as follows

• Financial resources

•

Human rescores

• Material recourses

• Information resources

• Technology resources

13

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 14/62

Another definition of management is that coordinating work activities so that they arecompleted efficiency and effectively with other people. Management means to completethe organization work effectively and efficiency.

Efficiency:

Efficiency means getting maximum output from minimum inputs or resources.

Resources: means money, equipment, asset etc.

Effectiveness:It means doing the work and perform activity in the right way it will help the organizationto achieve its goals.

Goals;

They are objectives of the organizations that should be most specific and smart.

Another definition

In all business and organization activity the management is the act of getting peopletogether to achieve the desired goal and objectives.

Michmccrimmon (2007) explored that management is the organizational function thatlike investment. Get thingseffciently and effectively to gain the best return on allresources which we can use. It means management is a faction where we invested capitaland get profit to use the all recourses effectively and efficiently. He also explored thatmanagement is an organizational factions, like sales, marketing or finance. It does to

manage the people. We can manage our self with the help on management and done our work that is assign to us very well. Its means that we do our job in a well organized andwell manner.

He also explored that management is like investment where manager have resources toinvest their time and human resources. The goal of management is to get the best returnon such recourses by getting things done efficiency and effectively.

14

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 15/62

.

Levels of Management by (Robert Anthony)

• Top management/ strategic management

• Middle management/ technical management

• Operational management/ functional management

Strategic management:

Strategic management purely concern with developed of strategic as well as instructionsfor the functionality.

The strategic management can control the whole organizations and make plan and

strategy for organizations its functions is to make strategy and plan for present and future period the strategic management play a vital roll for the success of the business and tomanages the organization and also make the goals to achieve the objective of theorganization.

Middle management:Middle management is concerned with work allocation according to strategy means

they needs to play tasks by understanding the qualification experience of operationalmanager so that they can disturb the work according. Its means middle management candivide the person according to their skills, knowledge and experience and divide to their region for planning the task or for doing work on these methods and goals that is a given by the strategic management.

Operational management:Operational management is operating with work. Its means the management that is workson tactics that is given by the middle management and play the tasks or work.

15

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 16/62

Strategy:

It is the general statement of long term objective and goals and methods by which thoseobjectives can be achieved.

Strategic planning:Strategic planning is the process of formulation and evaluations and selections of appropriate most suitable adoptable strategy out of all possible options or substitute for making long-term plan to achieve the target and goals. its means strategic planning is the process of build and judge the options that is related and suited and that is uses and helpfull for making long-term plan and for making goal that is used to achieve the target of the organization

Levels of strategies:

There are three levels of strategies

• Corporate level

• Business level

• Operational level

Corporate level:

Corporate level is concerned with entire or whole the business strategy which coversentire the business as a whole. Corporate level strategy comprises all the basic factions or module of a business in detail (it is concerned with head office) its means the strategythat is cover the whole business or the strategy that is made in main office by top levelmanagement is called the corporate strategy.

Business level

The strategy for a specific area or region or a product is called business level strategy. Itmeans the strategy that is different in all regions or area is called the business level.

Operational strategy:Operational level is concerned with the factions or the departments.

16

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 17/62

Quality management:

it is a philosophy of management driven by continual improvement and responding tocustomer needs and expectations. Its mean the customers needs and improve the qualityof goods. Quality management is improve and expand the quality of products of organizations product and services internally and externally .It is the objective of anorganizations to control the cost and to provide the best quality products at lower cost. Itis competitive advantage of organizations. In organizations effectiveness and efficiencyare due to the decision and the actions of the managers. It means the decisions of the toplevel management is depend upon the performance of the business a good managersanticipate change, explit opportunities, correct the poor performance and leads theorganization towards the goals of the organization.

Decision

A decision is a choice from two or more alternatives. It means to select one or morereliable goals from two or more than two alternatives. The top level management makedecision about their organization goals, They make decision that new market developedand what product or services to be offered. Although decision making is typicallydescribes as choosing among alternatives.

It is a set of eight steps that include identify the problem, selecting an alternative, and

evaluating the decisions, effectiveness.

Identification of a problem

Identification of decision criteria

Allocation of weights to criteria

Development of alternatives

Analysis of alternatives

Selection of an alternatives

Implementation of the alternatives

Evaluating decision effectiveness

Identifying a problem

Decision making process starts with the existence of problem or more specifically itsmean before decision making we identify the problem of the organization.

17

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 18/62

Identifying the decision criteria

When a manager has defined a problem the decision criteria is important to resolving the problem that must be defined or identified. The manager must determine what’s relevant

For making decision

Allocating weights to the criteria

The criteria that we define in decision making criteria are not equally importance. Thedecision makers must weight the items in order to give them the correct priority in thedecision.

Developing Alternatives

It requires the decision maker to list of alternatives that could resolve the problem.

Analyzing alternative:

When the alternatives have been defined or identified a decision maker must criticallyanalyze each of alternatives.

Selecting an alternative:

In this step the decision maker choose the best alternative from among those considered.

:Implementation the alternativeIt is concerned with putting the decision into action. This involves conveying the decisionto those affected by it and getting their commitment.

Evaluating decision effectiveness:

The last step in the decision making process involves evaluating the outcome of thedecision to see if the problem had been resolved.

Decision making conditions:

18

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 19/62

There are three conditions managers may face as they make decisions certainty, risk anduncertainty.

Certainty:

A situation in which a manager of the organization can make accurate decision becauseall outcomes are known.

Risk:A situation in which the decision maker is able to estimate the certain outcomes or

results.

Uncertainty

A situation in which a decision maker has neither certainty nor reason probabilityestimates available.

Decision making styles

The four making styles are

Directive style

A decision making style in which the decision maker characterized by low level of tolerance for ambiguity and a rational way of thinking. This is used for make fastdecisions and focus on the short run. The minimum information and alternatives.

Analytic style

A decision making style characterized by a high to level tolerance for ambiguity and

more information before making decision.

Conceptual style

19

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 20/62

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 21/62

Functions of management

Batsman Snell (2007) explored that the position that managers provide in planning,organizing, leading and controlling. It is necessary for a business the manager mustorganize these functions to reach ands achieve the organization goals.

Planning

Planning is a logical thinking though goals and making decision as to what needs toaccomplished in older to reach the organization objectives. The managers use it for forecast or future planning and decide to take an action. He also explored that the planning is the first step of management and it is essential to facilitate and control thevariable decision making process.Planning is involve define the organizations goals, establishing an overall strategy of theorganization for achieving the organizations goals and developing a comprehensive set of plans to integrated the organizational work.

Formal planning means the goals of the organization must be specific and defined the period to covering the goals. These goals are written and shared with organizational

members and specific action programs exist for the achievement of these goals.

Purpose of planning

Planning provides direction, reduces uncertainty, minimize waste and set the standardsused in controlling. Its means planning the goal s of the organization must be specific anddefined the period to covering the goals these goals are written and shared withorganizational members and specific action programs exist for the achievement of thesegoals. Planning provides direction, reduces uncertainty, minimizes waste and set thestandards used in controlling. It means planning is a process to get maximum out with

minimum resources means cash stock etc. planning provides direction to managers andno mangers alike when employees know where the organization or work unit is going andwhat they must contribute to reach goals, can coordinate their activities, cooperate witheach others. Do what it takes to accomplish those goals without planning, departmentsand individuals might work at cross purposes, preventing the organization from movingefficiently towards its goals. It means what manager takes place to accomplish thosegoals and what activity they perform.

21

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 22/62

Planning and performance

o Planning is an association with higher profits, higher return on assets and other

positive financial return.

o The quality of planning process and its approaches implementation of the plans

contributes more too high performance.

o Its means the main objectives of planning is to earn high profit and contribute

higher performance of the organization.

Types of plans

Following are the types of plans

• Strategic plan

• Operational plan

• Long term plan

• Short term plan

• Specific plan

• Directional plan

Strategic plan

22

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 23/62

Plans that apply to the entire organization or whole organization it established theorganizations overall goals and seek the position of the organization it term of environment of the organization is called the strategic plan.

Operational plans

Plans that specify or describes the detail that how we can achieve overall goals. It is themethods to achieve the goals or objectives of the organization operational plan mean howwe implement the plan in to the organization is called operational plan.

Long term plan

Plans with a time frame beyond three or five years. Long term plan means the plan for more than one year is called long term plan.

Short term plan

Plan that is made for one year or less than one year is called short term plan.

Specific planThe plan that is clearly defined every plan should be clearly defined it should beunderstandable and in easy to lean it is called the specific plan.

Organizing

The Bestman, snell (2007) is explored that the organizing is achieved throughmanagement staffing and setting the training for employees. For acquiring the resourcesand organizing the work is called the organizing.

Organizational structure

The formal arrangement of job with an organization is called organizational structure.

Organizational design

When manager change the structure of the organization they are engaged theorganizational design. The organizational design is the process that is involves indecisions about six key elements. Work specializations. Departmentalization, chain of command, span of control, centralization and decentralization and formulation.

23

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 24/62

Work specialization

The degree to which tasks in an organizations are divided into separate job also known asdivision of labor. It means divided the work in to separate duties.

Departmentalization

The basis by which jobs are done in grouped together. It means the divided of job in togroup of people not individual person. For example in collages and universities thegroped are made for making project. It means corrective activity of two or more peoplenot individual person.

Types of departmentalization

• Functional departmentalization

• Product departmentalization

• Customer departmentalization

Functional departmentalization

The function that is performed by the grouped of people or group of employee is calledthe Functional departmentalization.

Product departmentalization

Grouped perform them jobs by product line. It means each major product area is placedunder the authority a manager who’s responsible for everything having to do with that product line.

Customer departmentalization

Grouped jobs are done on the basis of common customer. Its mean make the product and provides the services according to the customer needs and customer behavior. Some people can not perform work individually in very well. So the management can makegroup of these people to enhance the work or tasks.

Chain of command

24

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 25/62

It is a authority that extends from upper level of organization to lower level and clarifieswho report to whom. it is responsible.

o Authority

The right inherent in a position to tell the people are employee what to do and to expect them todo it.

o Responsibility

The obligations or expectation to perform the duties that is assigned them by themanagement is called responsibility.

Unity of command

The management principal or rules that each person or employee should be report to therework only one manager.

Span of control

Span of control the number of employee that a manager can be managed with efficiencyand effectively.

CentralizationThe degree to which decision making is concerned at a single point in the organization,

Decentralization

The degree in which the lower level employee provides input and actually decisionmaking.

Formulation

The degree to which jobs with in the organization are standardized and to whichemployee behave is guided with rules and procedures of the organization.

Leading:

25

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 26/62

Allen G.(1998) explored that if managers can motivate to their works to fulfill the goal of the company and out-perform their competitors. They also have day to day control withwork and leads their using open communication and able to them to give the directionindividually as well as with in teams department and divisions. The management aims to

inspire the subordinates or employees to solve the problem.

Alien Gemmy (1998) explored that the quality of leadership is that‘A leader can be a manger but a manager is not necessary a leader. He also explored that‘A leadership is a power of the people to take actions towards the goals of the company.

The Bestman,snell (2007) Explored that leadership involves the interpersonalcharacteristics and skills of a managers position that includes communications and closecontract with team members it means leadership is a quality to inspire or motivate the people.

Personality

The unique combination of psychological characteristics that effect how a person reactand interact with other. It means the personality of leader is inspirable. His personalityinspire to other.

AttitudeEvaluative statement either favorable or unfavorable concerning objects people or events.A leader show favorable attitude toward its employee or team. The behavior of leader

show the cencerty towards its teams and goals.

Behavior

The action of the people towards a leader. The action or perception of the people towardits leader must be positive, favorable and trustable.

Perception

The process of organizing and interpreting sensory impression in order to give meaningto the environment. Its means a leader can motivate and inspire the people so the

26

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 27/62

perception of the people toward a leader should be sincere and also give an impression onthem.

Learning

Any relatively permanent change in behavior that occurs as a result of experience. Itsmeans the permanent change in the behavior of people or team on the basis of results or experience or knowledge.

Types of leaningThere are two types of learning

• Operant conditioning

• Social leaning

Operant conditioning

A type of learning in which desired behavior leads to a reward or prevents a punishment.In this theory we learn the behavior of the people we lean what people want and getsomething that they want and avoid from those who they not want in I this study we judge are see the desired of the people about things and their behavior.

Social leaning

It is a theory of leaning that says people can lean though observation and experience theleader. Its means people can lean and judge the leader on the basis of observations so the

personality of a leader must be inspire the people though his knowledge and experience.

Controlling

Allen G (1998) explored that control are placed on employees by requiring thecompletion of daily work and responsibilities and guidelines, by possibility takingdispensary action when it is necessarily. Managers and supervisor given a work for evolution and for the assessment of performance and take collective action on it. Ha also

explored that evaluation step is takes place on regularly or daily basis.

what is control?

The process of monitoring the activities of people or employees to ensure that they arecompleted the work or tasks as planed and correcting any significant deviations.

27

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 28/62

Types of control

There are three types of plan that is described as follow

• Market control

• Bureaucratic control

• Clan control

Market control

An approach to control the emphasized the use of internal markets mechanisms toeatables the standard used in the control system. Its means to control the marketmechanisms is set some standard and make some polices and procedures that is used tocontrol the market system.

Bureaucratic control

An approach to control the organizational authority and relies on admistrative rules andregulations, procedures and polices.

Clan control

Clan control an approach that is used to control the employee behavior towards theorganization culture such as its rules, tradition, polices procedures etc.

Control process

Three steps is including in process measuring actual performance, comparing actual performance against a standard and taking managerial action to correct deviations or

inadequate standards.

a) Measuring actual performance b) Comparing actual performance against standardc) Taking managerial action

28

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 29/62

Measuring actual performance

To detriment how we manage or measure the actual performance the information that is

collect about it its means for measure the performance the sources will used observation,report and written report.

Comparing actual performance against standard

The acceptable parameters of variance between actual performance and standard

Taking managerial action

The final step in control process is managerial action. Managers can choose among tree possible courses of action.

i. They can do nothingii. They can correct the actual performance.

iii. They can revise the standards

i. They do nothing

Doing nothing is fairly self explanatory.

ii. Correct actual

Correct actual means to correct the problems .it means the source of performancevariation is unsatisfactory work the manager must correct the unsatisfactory work.

iii. Revise the standard

It’s the standard that needs attention on their goal. See standard to raise the sales. So they

set the goal controlling to their standard and then work

29

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 30/62

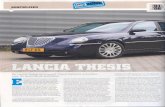

Hierarchy of management

30

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 31/62

Chapter NO (4)

Risk

31

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 32/62

Risk is as the effect of uncertainty on objectives whether positive or negative. Risk management considered risk is come from certainly in financial markets project familiar,legal accidents natural causes and disasters as well as deliberate attacks from onadversary.

Risk concerns the expected value of one or more than one results or one or more than onefuture events.

Risk is an unexpected loss which you have to bear.

Types of risk

a) Operational risk

b) Enterprise risk

c) Financial risk

d) Credit risk

e) Market risk

Operational risk

The loss that is occurring to failed the internal or external system of the organization.The risk that is occurs due to the internal and external events of the organization.

Its means this risk is occurring due to inefficiently or ineffectively used the resources.Such as if the organization system failed the loss is occurring. If the employee can notwork properly then loss is also occur.

Other definitionsThe risk or loss resulting form inadequate or failed internal process people and system or

from external events. Its also include the strategic risk. Loss that is arising due to week strategy and week planning

U.S department described the risk

32

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 33/62

• Accept risk when benefits out weight the cost

• Accept to unnecessary risk

• Anticipate and manage risk by planning

• Make risk decisions at the right level

Accept risk when benefits out weight the cost

Its means to accept the risk at that limit which meets our cost if we take a very high risk.We may be getting higher benefit but we suffer a loss we have lost our every thing.

Accept to unnecessary risk

Accept no unnecessary risk means the risk which results from loss or the doubt in our mind that it will give us a lower benefit. We can not accept it.

Managed the risk The risk can be managed with decision making, assessment the risk with the help of management planning to use the all rescores with effectively and efficiently.

Make the decision at right levelThe management should make plan to control the risk with right way to assess the risk and then make some standard rules and polices to control the risk. The manager mustassess the example risk when he make plan and then managed it in a right way witheffectively and efficiently and the manager should accomplished the mission or objectiveeffectively and safely

Examples of operational risk Computer failure;

• Mistakes in record-keeping;• Poor compliance of members/employers with earnings declaration and contribution payment;• Inaccurate allocation of expenses between branches;• Inadequate staffing to maintain operations satisfactorily, for example because of

Recruitment problems or uncompetitive salaries;• Strikes and other staff unrest;

• Weak management;• Fire, earthquake, hurricane or flood compromising the head office;• Fraudulent transactions;• Hostile hacking into the main computer database;• Failure to implement an element of the legislation;• Failure to warn insured persons of an impending change in coverage or benefitaccrual;• Unexpected fiscal liabilities;

33

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 34/62

• Litigation challenging disability award decisions;• Failure of risk controls on delegated authorities;• Poor risk management est.

Mitigation of Operational risk

It is a continuous process which includes risk assessment risk, decision making andimplementation of risk controls which result in acceptance, mitigation or avoidance of risk. Operational risk management can therefore be considered or described theidentification, assessment and prioritization of the risk. It is the act of minimize, monitor and control the probability of uncertainty in financial markets, project failures, legalabilities, credit risk accidents, natural causes and disaster as well as risk managementstandards have been developed including the management. It means to set standard andmake procedures and polices to control the risk.

The Navy (U.S) that critics the risk management in four steps model.

There are three condition of assessment

i. Task leadingii. Additive condition

iii. Human factors

i. Task loading

It refers to the negative effect of increase the work or task and what effect on the performance of the worker. For example if an organization can increase the workinghours so what effect on employee performance.

ii. Additive conditionIt aware the situation of a communicative effect of variable. its means we can aware theeffect of change then what effect on our assessment.

iii. Human factorsIts is refer that limitation of the ability of the human body and environment. Such as if wecan increase the working hours so the employee’s performance might be week because

they feel tied situation. The environment of work and the nature of the job also dependupon the perform of the employee.

Balance your resources

Balance the resources this means to evaluate all information, labor, equipment martialrecourses,

Communication with right people

34

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 35/62

Use the right style communication style gets the specific results from a specific situation.Its means our communication style is always right the other person can impress with you.For listing your communication and he also easily understand your talk or your speech.Always use easy wording

Take action and monitor the change

We can evaluate and rewired the mission to see that is completed well. To make plan for future performance improvement.

Credit risk

Credit risk is a commitment to repay debt or bank loan default occurs when borrow cannot future the financial obligation. Such as they can not pay interest on loans. In the eventof default, if lender or banks suffer a loss. They will not receive all the payments promised to them.

Measurement of credit risk

For the measurement of credit risk the credit risk premium. It is the difference betweeninterest rate that a firm pays when it borrows and the interest rate on a default freesecurity.

Who is affected by credit risk ?

Credit risk affects any party making or receiving a loan payment a debt payment someexample bound issuers, bound investors and commercial bank.

Bound issuer

Bound issuer are effected by the credit risk because there cost is depend upon on thedefault borrower who issuer the debt may face risk in future.

Bound investor

Bound investor also suffers the credit risk. They reduced the uncertainty to increase their credit premium.

Commercial banks

35

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 36/62

Bank also expected to risk that borrower will may default on their loan the credit risk ishighly suffered by the banks because they mostly issue loans to the industries where thechance of insolvent is higher.

Credit swap

Credit swap is used to reduce the credit risk. It is mostly used by the banks who creditrisk is higher because they granted learning to the industries or firm where the chance of insolvent is higher.

Credit derivatives

The largest risk of using credit derivative is operational risk. Operational risk is that whentrader use speculation instead of hedging.

Counter partySecond of credit risk is the counter party risk. It means the risk in which transaction iddefault. Transactions mean the thing dealing with two is more persons.

Koyologue and Hicknan (1998) explored credit risk is a techniques from three séanceFinance, economics and actual sciences into a single framework.

There are three basic components.

• Treatment for joint default behavior

• Conditional default

• Distribution for independent

Default risk means when we enter into a contract with other party and at the expiry datethe other party can refuse to pay the money is called the default risk.

He also explored that the default component of portfolio credit risk and concentrate aloss distribute and change in value of distribution.

Metorn (1974) explored that firm defaults when the value of asset of a companies comesto down to its liabilities. The credit risk default means once a company become theinsolvent when they are continuously suffering loss and come to that stage when its assetvalue fall down to its liabilities then the directors sells the asset of the company and toovercome its liabilities.

36

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 37/62

J.P .Margans is explored that the problem to the distribution of return of most financialassets the distribution of daily return of any risk factor would in resulting typically showthe significant amount of positive. This leads to further trail and occurring much morefrequently then would be predicted by norms distribution which would leads to an under

estimation of var.

Examples of credit risk

When the customer of the bank can not pay the money it is called credit risk defaulter when lending is on boom the bank take exec vie risk. When lending on the boom theasset side of the bank balance sheet is likely to cause the bank risky project.Reinhart(1999) is argue that recently the banking sector face the problem that the assetside of bank balance sheet is increase than liability side due to increasing in non performing or non receiving loans it is the worldwide problem that is faced by banks. For example in the period of Niwaz Shareef Government the cousins of Niwaz Shareef can

take loan millions rupees from Habib bank limited and can not pay back so Habib bank can face millions of rupees credit loss.

Mitigation of credit risk For mitigation of credit risk the banks maintain the reserve criteria. Different bank demand some securities for lending of money as a reserve such as pledge moorage andhypothecations five methods are also used by banks

(1) Modifications of deposit insurance pricing structure to remove miss-pricing;(2) Modifications of the insurance contract;(3) Changes in insolvency resolution mechanics;

(4) Elimination of uncertainties about the quality of the federal deposit guarantee; and(5) Changes in responsibilities related to the lender-of-last-resort function

Financial risk

The risk that a company will not have adequate cash flow to meet financial obligations.

The risk that a firm will be unable to meet its financial obligations. This risk is primarilya function of the relative amount of debt that the firm uses to finance its assets. A higher proportion of debt increases the likelihood that at some point the firm will be unable tomake the required interest and principal payments.

Financial risk is the additional risk a shareholder bears when a company uses debt in

37

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 38/62

addition to equity financing. Companies that issue more debt instruments would havehigher financial risk than companies financed mostly or entirely by equity.

Financial risk management is a process that entails companies setting up guidelines todefine their policy on accepting financial risk. Individuals that work in financial risk management do not make investment decisions for a company. Instead, those individuals

create the guidelines that the risk-takers must follow when analyzing investments they areconsidering for the company.

Examples of financial risk:Central banks, reserve banks and commercial banks faces the financial risk becausecommercial bank gives the loans to borrowers and charge interest on loans so they facethe financial risk if their customer can not pay back the loans and they become insolvent.for example if the state bank can make policy to collect money on lower rates of interestand then depositor can not deposits the money then bank can not lend the money.Commercial banks also face the financial crises so some time they can not meet their obligation accordingly. For example, the customer may become insolvent and unable to pay the contract fees; the service provider may cease to carry on business; or either partymay have insufficient funds to support an indemnity.

Financial risk mitigation:

Value-at-Risk (VaR) is a widely used measure of financial risk, whichprovides a way of quantifying and managing the risk of a portfolio as akey component of the management of market risk for many financialinstitutions. It is used as an internal risk management tool, and hasalso been chosen by the Basel Committee on Banking Supervision as

the international standard for external regulatory purpose. Recentyears, non-bank energy traders and end-users have begun to use VaR.Now the majority of major oil companies and traders are using the VaRmethod for risk measument.There are many approaches to measuringVaR. Any valuation model for computing VaR simply represent of apossible reality or a possible outcome, based on certain probability andconfidence percentage parameters. VaR measures the worst expectedloss over a given time horizon with a certain confidence – or probability– level. VaR allows management to see the probable risk theircompany is taking, or, in the case of companies hedging

There are two methods to mitigates the financial risk o Hedging using correlation of stock/ CAPM

o Using derivative

The most commonly and frequently used methods is CAPM its means portfolio or correlation between two financial assets. Financial assets mean stock, debt etc. andderivatives means equity stock or share capital etc.

38

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 39/62

It is a practice that is created by the financial instrument (bill of exchange, letter of creditetc) it is required to manage can be quantitative and qualitative. It is focus on hedge usingfinancial instutrument. Financial risk prescribed trust a firm should take on a projectwhen it want to increase share holders when we applied financial risk management itimplies that the manager of the firm should not hedge the risks that an investor can hedge

them self at some cost it mean when we give the loan to any person. We can demand tohedge his property for security. The firm manager perform the very of the share holder using financial risk management techniques.

Enterprise risk :According to the Casualty Actuarial Society (CAS), enterprise risk managementIs defined as:

"The process by which organizations in all industries assess, control, exploit, finance andmonitor risks from all sources for the purpose of increasing the organization's short and

long term value to its stakeholders."

A risk defined as a possible events or circumstances that can have a negative effect onthe enterprise its impact can be on the very existence the recourses (Haman and capital)and product or customers of the entries as well as external impact on security such as onsecurity market or the environment in the financial institution, enterprise normallythrough the combination of interest rate risk credit risk. Market risk and Operational risk.

Examples of enterprise risk:Remember that your investment actually own p pace of your business it is depend upon

how they invest you give up central region so you have to aware when you agree to takean investor debt financing institution and banks only expect there loan rapidly. The bank also gives many facilities to its customer. Such as on line transfer of money overdraftfacility.

Mitigations enterprise risk :

Its means hoe risk will be managed and plan how we make plan and include task,responsibility, activity and budget. Enterprise risk management is simply a practice of

systematically selecting cost effectiveness approaches to minimize the cost andmaximized the quality of tour product. It is also competitive advantage of the firm toreduce the cost and improve the qualities of product the firm should focus on customer needs and devolved the product according to customer need and demand. It is necessaryto make effective plan and implement on the organization and evaluate the plans.Communication is also necessary to reduce the risk of the business communicator involved how to reach the intended audience response to the communication etc the maingoal of the communicating is to improve collective and individual decision making. To

39

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 40/62

manage the risk we can implemented the control and set the standard and procedures. Therisk management of enterprise is used for threat to realization to the organization.

Market risk

Market risk is defined as the possibility of losses owing to unfavorable marketmovements. Such losses occur when an adverse price movement causes the market tomarket revaluation of a position to decline. It can be due to a large number of risk factors,including fluctuations in interest rates, exchange rates, equity prices andCommodity prices, as well as changes in volatility of these rates and prices that affectThe values of options or other derivatives, as well as changes in correlations betweenThose risk factors.

Market risk and Asset and Liability (ALM)-risk are narrowly related. Both types of

Risk is defined as ‘the risk of adverse movements in market factors (such as asset prices,foreign exchange rates, interest rates) and their volatilities and correlations’.The term market risk is typically used by banks and refers to trading, usually a short termActivity, and focuses on changes in market/fair value. The term ALM risk is used by both banks and insurance firms and relates to the consequences of changes in market factorsfor all asset and liability items of the balance sheet. In banks ALM risks typically refersto interest rate risks in banking books with a focus mostly on accrual earnings where longterm assets are funded by short term liabilities. Insurance companies face the opposite problem. Typically the liabilities are longer than the assets and the asset portfolio mayinclude some equity investments. Furthermore, both banks and insurance companies haveincreased ALM risks due to embedded options in their assets and liabilities. Its means the

risk that is occurs due to inflation or deflation in the economy when the prices of goodsincrease and interest rate increase and the value of money decreased. The most suffer themarket risk the speculators that speculate that the prices are increase in future and theygain profit but unfortunately the prices of goods comes to down due to the deflation so hesuffer or bear the loss this type of loss is called the market risk when we can do thetransaction with foreign country the exchange rate is use it is also effect on the market prices the changing in the exchange rate also cause the market risk.

Click and plumm (2005) explored that for the traction with foreign country. The problemis that to convert the local currency in to foreign currency from the most perception of theinvestors the common currency that is used for foreign trade is U.S $ some of the

movements in stock price indse3x may be reflect their foreign exchange he describes thatthe listed company the local currency is preferable in comparison with foreign currency.The researcher control the exchange rate variations to remove the hesitation of theinvestors and the listed company which involves in foreign trade and use the exchangerate on daily basis.

40

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 41/62

Examples of market risk:

Market risk means changing in prices of shares foreign exchange, according to financingof my analysis. I have come to know that efficiency in stock market is not strong enough.This is all because of indicators but strong rules. The main reason of economy down

towards politically instability uncertainty investors avoid to invest the money in financial project. In Pakistan all indicators method interaction we need extra rules and regulations

Mitigations of market risk:

It is mitigation that is used to control the market risk. Such mitigation that takescontingent claims whose financial settlement is depend upon uncertain variables. Themethods that are used to reduce the market risk with risk sharing agreement. For examplefor selling of share through public offering risk the third party is involve such as bank toreduces the risk we can hedge the price risk by purchasing a financial contract that pays

different between some settlement price and market price. If the price of the shares goesdown the payoff from this contract and loses are occur due to decline of share so wecontract the option. So fluctuation prices with long term contract due to fluctuating of prices. Development of market instruments, markets and institutions for risk trading andrisk sharing. Such development should be viewed as “Market Engineering” which buildson the “physics” of markets explored by social sciences (including economics) butfocuses on the harnessing of market forces and human behavior to achieve a desiredoutcome.

Create mechanisms for transforming involuntary private risks to voluntary risk so asto empower individual choice. Without individual choice market based risk mitigation is

not possible.

Remove regulatory and institutional impediments to the exercise of individual risk Preferences.

Develop decision analytic methodologies that integrate expert risk assessment withmarket based pricing of risk (e.g. decision theory, real option theory, financialengineering methods)

Develop pricing and portfolio analysis methods for valuation and optimization of risk mitigation options.

Chapter No (5)

Financial institutions

41

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 42/62

Sklos pieme (2001) explored that financial institutions provides services for its clients or members probably the most important financial service provided by financial institutionsis activity as financial intermediaries most financial institutions are usually regulated bygovernment tree types of financial institutions

• Deposits: these institutions include banks credit union, trust companies andmortgage loan companies.

• Insurance companies and pension fund

• Brokers, underwriters and investment funds

Financial institutions provide service as intermediaries of the capital and debt markets.They are responsible for transferring funds from investors to companies, in need of thosefunds. The presence of financial institutions facilitates the flow of money through theeconomy. To do so, savings are pooled to mitigate the risk brought to provide funds for loans. Such is the primary means for depository institutions to develop revenue. Should

the yield curve become inverse, firms in this arena will offer additional fee-generatingservices including securities underwriter ting, and prime brokerage.

Financial institutions exist to improve the efficiency of the financial markets. If savers andinvestors, buyers and sellers, could locate each other efficiently, purchase any and all assetscostless, and make their decisions with freely available perfect information, then financialinstitutions would have little scope for replacing or mediating direct transactions. However, this isnot the real world. In actual economies, market participants seek the services of financialinstitutions because of the latter's ability to provide market knowledge, transaction efficiency, andcontract enforcement. Such firms operate in two ways. They may actively discover, underwrite,and service investments made using their own resources, or merely act as agent for market participants who contract with them to obtain some of these same services. In the latter case,

investors assemble their portfolios from securities brought to them by these same firms. In lightof the two ways in which institutions may operate in the financial sector, several issuesimmediately arise.First, when and under what circumstances should these firms use their own resources to providefinancial services, rather than offering them through a simple agency transaction?

Second, to the extent that such services are offered through the use of the institution’s ownresources, how should it be managing its portfolio so as to achieve the highest value added for its

stakeholders.ting, and prime brokerage?

Intermediating involves the simultaneous issuance and purchase of different financial claims by asingle financial entity. It occurs when an institution purchases one type of financial instrument for its own account and finances the transaction by issuing a claim against its own balance sheet.Three types of such financial intermediation activity are common.These are

i) insurance underwriting whereby the issuer assumes the policy's contingent liability,

42

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 43/62

ii) loan underwriting, whereby the intermediary uses its own resources in extendingcredit to a borrower, and

iii) Security underwriting which involves buying securities as principal to distribute toinvestors.

Financial Institution's balance sheet is different from a non-Financial firm; consider howan industrial firm wields capital machinery (asset) and the loans (liabilities) it used tofinance that asset. The line is blurred in Financial Institutions, which must hold depositaccounts (liabilities) to fuel the issuance of loans (assets). The same accounts areconsidered loans as they are held in ownership not of the bank, but of the individualclient

The overall of regulation of the financial sector should be ensure that the system can perform thefunction efficiently and effectively in helping deploy, transfer and allocate the resources meanscash, securities, asset etc across the time and space under the condition of uncertainty. Hewer

actual financial regulation attempts to accomplished many objectives beyond facilitating theefficient allocate of resources. There are four broad retinal for financial regulation may beidentified

• Safeguarding the financial system against system risk.

• Protecting consumer from opportunistic behavior

• Managing the efficiency the financial system

• Achieving the broad range of social objectives.

Its means safeguarding the financial or organization system to control the risk we shouldimplement the control on the system to protect from uncertain events for example to protect theinformation and personal data for theft or illegal used the firms used the login and password tocontrol the system risk some time system may be damaged and theft so companies can implementthe plan to control the system risk.

Customers also are the asset of the company so it is duty of the company to protect the customer and try to provide the best services and to know the nature of the customer and then make productaccording to the demand of the customers.

It is the responsibility of the company to manage the system efficiency and affectivity for the betterment of the system.

Its means provides the services and doing the work for the purpose of social welfare such as banks provides the services and doing work for social welfare such as provides the loans to the people and deposits the and provides the services to the people.Its means these institution accept money from the public for safe custody which will repayable ondemand by cheque or by drafts and these institutions making loans to other people means by

taking deposits from public and making commercial loans to industrial sector, against sector

institutions trust companies means financial institution accept ornaments important documents ina bank on trust business. Bank demand some amount for these services financial institutions alsocalled mortgage loan companies. Banks advances loan against immovable property. Means

43

8/14/2019 Misbah Thesis

http://slidepdf.com/reader/full/misbah-thesis 44/62

against land building or the completion of property the immovable property con be retuned to thecustomer A bank is a financial institution which deals with money and credit. it accepts deposits fromindividual firms and companies at a lower rate of interest and gives at higher rate of interest tothose at which it lends forms the source of its profit. A bank thus is a profit earning institute,according to crowthe, “A bank is a firm which collect money from those who have it spare. It

lends money to those who require it” In the words of Mr. Parking, “a bank is a firm that takesdeposits from house holders and firms makes loans to other households and firms”

Webster’s dictionary (1974) defines the word “bank” as “a body of persons whether incorporated or not who carry on the business of banking”.Definition by judiciary “ the words banking may bear different shades of meaningdifferent period of history and their meaning may not be uniform today in countries of different habits and different degree of civilization. It was said that there were twocharacteristics usually found in bankers today.

a) they accept deposits of money from and collect cheques for their customers and

place them to their credit b) They honor ceruse or order drawn on them by their customers when presented

fore payment and debit the customs accounts accordingly.