VFB en Merit capital presentatie 18/2/2010 door Bruno Segers

-

Upload

realdolmen -

Category

Business

-

view

1.770 -

download

0

description

Transcript of VFB en Merit capital presentatie 18/2/2010 door Bruno Segers

APRIL 11, 2023 | SLIDE 1

www.realdolmen.com

Van idee tot economische realiteit

VFB – Merit Capital

Aarschot, 18 februari 2010

Deze presentatie staat online op http://www.slideshare.net/realdolmen

APRIL 11, 2023 | SLIDE 2

SUMMARY Single-source provider of integrated ICT solutions

Active in Benelux and France

Employing almost 1600 professionals

Succesfull merger of Real with Dolmen in 2008, with benefits coming through

FY2008/09 : €265,6m revenue / €18,4m Ebitda

HY 2009/10: €111,6m revenue / € 3,7m Ebitda

YTD Q3 2009/10: €170,7m revenue

Strong cash position of €39,3 m with positive cash flow generation of €6,2m in H1

€56m tax asset of which €20m recognized

Strong market position, good spread of customers and sound financial structure

APRIL 11, 2023 | SLIDE 3

www.realdolmen.com

Van idee tot bedrijf

APRIL 11, 2023 | SLIDE 4

1999Listing on EuroNext Brussels

1997Listing on EuroNext Brussels

2007€75 mio convertible bond Acquisition Axias

1986Start of Real Software NV

2007 - 2008Growth and return to sound operations

2004Acquisition JConsults

September 2008Merger

2007Acquisition NEC Philips

1982Start of Dolmen NV out of Colruyt IT department

2004 – 2007RestructuringEstablishing solid platform for growth

2001 – 2004Distressed situationInvestment by Gores

HISTORY

APRIL 11, 2023 | SLIDE 5

From: Segers BrunoSent: woensdag 12 december 2007 22:52To: Abdo AshleySubject: Diesel Romeo honeymoon hotel

Ashley,

As discussed.

All details about Hotel De Schelde via this link http://www.hoteldeschelde.nl/nl/ As it’s only in Dutch a few additional comments

I know this hotel, small, modest and cheap (Jef will like this) It’s not in Belgium (they will not know us) It’s 1 hour drive from Brussels and 1 hour drive from Antwerp They have wireless They have a few meeting rooms We can eat, swim, drink, sauna and go for bowling If we don’t have a solution for big problems we can go for a beachwalk to catch fresh air They still have 10 rooms available this Friday and/or Saturday We can meet and work there We can work and meet full days while our partners (even children) could enjoy the environment (if we decide to do this) Jef and Francois could join us Saturday night for dinner Etc …

I took an option for at least 10 rooms this Saturday. Ideally we should bring the new mgt team and the merger taskforce together in this warroom concept. We will save a lot of money and time while we start building the Newco Mgt Team in one go.

Think about it.

Bruno

PS If needed some of us can go there as from Friday night to prepare while we start formally Saturday at 10 AM and end Sunday night at …

APRIL 11, 2023 | SLIDE 6

Timeline

Diesel Project 14-21 December 2007

December 14-19 Complete Business Plan & NewCo Presentation Complete Draft Prospectus Complete Antitrust Filing December 19 3pm Present to Board Diesel – Obtain Support Letter 8pm Present Board Romeo – Approve Prospectus December 20 AM Present Draft Prospectus and Industrial Project to CBFA December 21 AM Public Announcement of Deal by CBFA 9am Work’s Counsel Briefings 10am Press Conference 12pm Analysts 3pm Associates December 25 Enjoy Christmas with Families

APRIL 11, 2023 | SLIDE 7

KEY MILESTONES – FROM PROJECT TO NV

December 21, 2007

February 20, 2008

March 5, 2008

March 26, 2008

September 1, 2008

Announcement of the tender offer and subsequent merger

CBFA approval and publication of the prospectus

Closing of the tender acceptance period

Successfull closing of the tender offer with 82,45% Dolmen shares tendered

Extraordinary General Assembly of Shareholders to approve the merger

APRIL 11, 2023 | SLIDE 8

REALDOLMEN HAS A CLEAR VISION AND MISSION Vision: To be the reference in the local market for

integrated solutions supporting the complete ICT-lifecycle. Reference: be the preferred & trusted choice for customers,

partners and employees Local: proximity to our customers in the Benelux and France Integrated solutions: complete ICT offering covering the full

lifecycle, including infrastructure, applications and communications

Complete ICT-lifecycle: supporting all plan-build-operate activities

Mission: We make ICT work for your business.

APRIL 11, 2023 | SLIDE 9

3271

5033

BILLABLE YEARS OF SERVICEEMPLOYEES PER

AGE CATEGORY

81%

80%

19%

20%

EDUCATION

REALDOLMEN HAS MORE THAN 10000 MANYEARS OF EXPERIENCE

APRIL 11, 2023 | SLIDE 10

REALDOLMEN HAS EXTENDED GEOGRAPHICAL REACH

France

Luxemburg

Belgium

Headcount Belgium 1242 France 286 Luxemburg

71

Total1599

APRIL 11, 2023 | SLIDE 11

REALDOLMEN HAS A SINGLE-SOURCE OFFERING

Infrastructure Products

Business Solutions

Professional Services

Service Oriented Architecture Unified Communications Supply Chain Mgmt CAD/GIS Mobility Enterprise Asset Mgmt Clinical Trial Mgmt Systems

Development Outsourcing Managed Services Project Management Training Services Business Process

Management

Data Center Front-end Networking

IP Communications Voice Over IP Security

Turnkey Solutions Enterprise Resource

Planning Customer Relationship

Management Business Intelligence ECM/WCM Web Solutions

Networking Testing Support & Helpdesk Security Enterprise Application Integration Service Oriented Architecture

Solutions built with own software or on top of 3rd party platforms. In this area we sell services and products (such as 3rd party software or own IP) under the form of licenses.

Encompasses services (both development and infrastructure competences) and products (own IP under the form of courseware, development methodologies, project management methodologies, building blocks, etc).

Hardware products and software licenses

APRIL 11, 2023 | SLIDE 12

A SOLID AND REFERENTIAL CUSTOMER BASE IN BOTH THE MID-MARKET AND LARGE ACCOUNTS

Logistics and Distribution Industry

Life Science

Government/Healthcare/Education

Services

APRIL 11, 2023 | SLIDE 13

STRONG PARTNERSHIPS

APRIL 11, 2023 | SLIDE 14

GOOD REVENUE SPREAD ACROSS SECTORS

Govern-ment / Health-care / Educa-

tion33%

Telecom3%

Industry29%

Distribu-tion /

Logistics / Energy

9%

Services (Financial)

7%

Services (Other)

19%

APRIL 11, 2023 | SLIDE 15

Fam. Colruyt

(3)16%

Free Float47%

The Gores Group (1)28%

Cegeka4%

Institutionals (2)5%

COMPLEMENTARY SHAREHOLDER OWNERSHIP

Notes These figures represent the shareholdings on a non-diluted basis, i.e. without taking into account the possible conversion of warrants, convertible bonds or other financial instruments which may result in the creation of RealDolmen shares. They are based on the shareholder's declarations made in accordance with the applicable transparency legislation, which are also made available on this website. (1) Includes stock held by Gores (Real Holdings LLC) and KBC Financial Products. Further to the issuance of the 2007 Convertible Bond, Real Holdings LLC and KBC Financial Products have entered into a stock loan agreement according to which KBC FP has currently borrowed up to 40 million shares for up to 3 years. According to their most recent declarations, Gores and KBC Financial Products respectively hold 20,46% and 7,51% of the issued share capital. (2) “Institutionals” includes Fortis Investment Management NV, holding 3,00% of the issued share capital, Deutsche Bank AG, holding 2.64% of the issued share capital, and KBC (other than KBC Financial Products, which is already taken into account under (1)), holding 0,20% of the issued share capital.(3) “Fam. Colruyt” refers to a number of related parties that made a joint declaration, the details of which are available on this website.

Reverse stock splitConsolidation of shares to benefit shareholders by reducing stock volatility and allowing the stock price to better reflect value changes

APRIL 11, 2023 | SLIDE 16

www.realdolmen.com

Van bedrijf tot economische realiteit

APRIL 11, 2023 | SLIDE 17

Verizon

Xerox

Avaya

Siemens Enterprise

Atos Origin

Accenture

Cronos

Econocom

Sun

Siemens IT Solutions

Mobistar

RealDolmen

Telenet

SAP

Oracle

Cisco

IBM

HP

Belgacom

Microsoft

3.00%

3.00%

3.00%

4.00%

4.00%

4.00%

4.00%

4.00%

4.00%

5.00%

6.00%

6.00%

7.00%

10.00%

10.00%

14.00%

19.00%

30.00%

31.00%

34.00%

ONE OF THE TOP INDEPENDENT ICT SUPPLIERS IN BELGIUM

Results are based on a Data News survey amongst 1.100 Belgian companies inquiring about their top 3 most important suppliers.© Data News, May 2009.

APRIL 11, 2023 | SLIDE 18

CROSS-SELLING PIECHART *

27%

40%

24%

8% 1%

1 domain 2 domains 3 domains 4 domains 5 domains* Based on RealDolmen Top 300 customers (situation Nov ‘09)

APRIL 11, 2023 | SLIDE 19

Creating a concept for the future integrated IT vision

Making a data integration study

Better alignment & prioritizing the needs of the different epartments by commencing PortfolioManagement

Building BI platform Integration of WebPortal with

MS Dynamics CRM

Maintain the different processes

Take care of the proper infrastructure

A TRUE SINGLE-SOURCE SUPPLIER

Operational & Strategic Program Management

Technical architecture both applicative & infrastructural

Custom made applications Technical projects such as

migration / conversion / consolidation

Standardize, virtualize, consolidate & secure IT infrastructure

Managed Services on the infrastructural & Applicative platform

Change management Hosting & housing of the IT

development / testing & production environment

Business Solutions Microsoft AX Finance CRM (Microsoft) /ECM (Sharepoint)

Infrastructure Products Datacenter fully based on HP Hardware PC’s, Laptops, … Multifunctionals + integration Licences Microsoft/McAfee/VMware/…

Day-to day operational IT resources (even in Fost Plus IT management) Project & T&M consultancy/development/project management

Professional Services

Professional Services Managed Services Applications: maintenance @ntry application

(VB6) Project Management regarding Enterprise Application Integration Enterprise Application Integration from Scribe to Microsoft Bizztalk server

Business Solutions MOSS 2007 (intranet Vlerick & student portal

Eduweb) Microsoft CRM (E-HRM,XRM, helpdesk & case mgt) BI SQL 2005 (datawarehouse & reporting tool)

Infrastructure Products Only software licensing: Microsoft Academic

Contract Microsoft Software Advisor Partner

APRIL 11, 2023 | SLIDE 20

TURNOVER FY 2008/09

ProfessionalServices

Infrastructure Products

Business Solutions

FY2007/08

FY2008/09

€142m 10,5% margin

FY2008/09

€40,5 mio10,1% margin

FY2007/08

FY2008/09

€83,1mio 4,2% margin

Total Group

FY2008/09

€265,6 mio6% margin

APRIL 11, 2023 | SLIDE 21

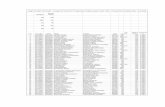

REALDOLMEN P&L (FY 2008/2009)

Single source provider delivering high margin Services supported by lower margin Infrastructure products

FY 2008/2009(in k€)Infra

ProductsProfessional

ServicesBusiness Solutions Corporate Total

Total Group REVENUE 83.1 142 40.5 265.6

As % of total Revenue 31% 54% 15% 100%

Total Group REBIT FY 3.5 14.9 4.1 -6.6 15.9

As % of Revenue 4.2% 10.5% 10.1% -2.5% 6%

APRIL 11, 2023 | SLIDE 22

TURNOVER YTD Q3 2008/09 TO YTD Q3 2009/10

ProfessionalServices

Infrastructure Products

Business SolutionsQ3

2008/09Q3

2009/10

€27,8 mio

€30,1 mio

Q32008/09

Q32009/10

€49,3mio

€64,4 mio

Total Group

Q32009/10

€170,7 mio

€201,4mio

Q32008/09

-23,4%

-7,5%

Q32008/09

Q32009/10

€93,5 mio

€106,9 mio

-12,6%-15,3%

Services

-11,5%

APRIL 11, 2023 | SLIDE 23

MARGINS H1 2008/09 TO H1 2009/10

H12008/09

H12009/10

-1,5%-1,6%

Corporate

H12008/09

H12009/10

6,3%

8,6%

Professional Services

H12009/10

3,2%

5,6%

H12008/09

Total Group

H12008/09

H12009/10

3,5%

11,6%

Business Solutions

H12008/09

H12009/10

2,3%

2,9%

Infrastructure Products

APRIL 11, 2023 | SLIDE 24

H1 NET PROFIT BREAKDOWN

H12009/10

€-2,3mio

€-1,4 mio

Non recurring-€0,9 mio

H12008/09

H12009/10

€-2,6 mio€-3,3

mio

Financial Result+€0,7 mio

H12008/09

H12009/10

€3,5mio

€7,4 mio

REBIT-€3,9 mio

H12009/10

Taxes+€0,2 mio

H12008/09

H12009/10

€-1,7 mio

€2,0 mio

Net Profit-€3,7 mio

H12008/09

€-0,6 mio

€-0,4 mio

H12008/09

€23,6 mioDTA

OUTLOOK:Some optimization still to be completed

OUTLOOK:Improved margins in H2 compared to H1, but lower than H2 2008/2009

OUTLOOK:Impact of Bond Buy Back

OUTLOOK:Further reduction following retroactive merger of operational units in BE

APRIL 11, 2023 | SLIDE 25

March ‘08

€36,6 mio

€73,7 mio

€16,7 mio

€57,0 mio

March ‘09

€33,1 mio

€54,9 mio

€18,4 mio

€36,5 mio

Net debtEbitda (1)

CASH/DEBT POSITION (H1)

Cash (2)

Convertible debt (July 2012)

Other debt

(1) Last Twelve Months (LTM) Ebitda(2) Cash = Cash + Assets held for trading

2,0 1,161,2

September ‘09

€39,3 mio

€55,0 mio

€16,6 mio

€38,4 mio

APRIL 11, 2023 | SLIDE 26

REALDOLMEN BALANCE SHEET (SEPTEMBER 2009)

Strong cash position with limited leverage and strong Cash flows Net debt of €15.7m Cash position of €39.3m exceeds

working capital needs of company €20,6m tax asset recognized based on

5 year projection of taxable earnings in RealDolmen NV and a tax loss carry forward of €170m

Debt of €54,9m consists mainly of Convertible bond valued at €38.4m under IAS 32. Senior unsecured CB issued in July 2007 over 5 years with 5,25 % yield ( of which 2% semi annual coupon). Conversion price €50.

Goodwill results mainly from acquisitions ( Dolmen NV ( €63m) and Axias ( €5m)). Remainder (€28m) relates to former acquisitions of our international operations.

Balance Sheet Summary (in k€) 30/03/2009

Assets

Goodwill 97.714

Property, plant & equipment 21.779

Deferred tax assets 20.604

Inventories 3.128

Trade & other receivables 72.907

Cash and equivalents 39.296

Other 898

Total Assets 256.326

Equity and liabilities

Equity 128.838

Debt 54.970

Retirement benefit obligations 4.028

Provisions 3.273

Trade and other payables 63.196

Current and deferred tax liabilities

2021

Other liabilites 0

Total equity and liabilities 256.326

APRIL 11, 2023 | SLIDE 27

TAX ASSET

2007/08: Legal merger with Dolmen Computer Applications NV allows faster utilization of unused tax loss carry forward in RealDolmen NV

2008/09: Conservative projection 5 years taxable profit considering economic environment

(1) assuming tax rate of 33%

in mio€Tax loss carry

forwardDeferred tax

asset (1) Tax rate

Tax loss carry forward December 2007 275,0

Estimated tax loss surviving merger Dolmen NV 170,0 56,1 33,0%

Deferred tax asset recognized in March 2008 -53,3 -17,6 33,0%

Additional DTA recognized in March 2009 -7,8 -2,6 33,0%

Remaining unused tax losses for future years 108,9 35,9 33,0%

APRIL 11, 2023 | SLIDE 28

SUCCESFULL MERGER

In line with our single-source model we now have an integrated sales force

Migration onto a single administrative platform has been achieved

ISO9001 recertification finalizes integration with visible positive REBIT impact

Cross-selling opportunities are being converted

Synergy benefits coming through in line with expectations

APRIL 11, 2023 | SLIDE 29

GROWTH STRATEGY

Strategy remains unchanged – pursuit of organic growth with small acquisitions where appropriate

Operate a streamlined organization with optimal framework for growth following optimization & integration projects

Current economic environment presents opportunities to continue to build market share through carefully chosen bolt-on acquisitions

APRIL 11, 2023 | SLIDE 30

SUMMARY & OUTLOOK

Revenue & Results are in line with forecasts The company has continued to invest in its long term growth Financial structure is stronger than ever Lower turnover and exceptionals have put pressure on REBIT

margins Integration synergies and optimization efforts are taking effect

Anticipate difficult market to continue, even if H2 margins will improve compared to H1 2009/10

RealDolmen is now positioned as an integrated and sustainable platform for growth

APRIL 11, 2023 | SLIDE 31

HOME for our employeesSHOWCASE for partnersSIMPLE for our customersGREEN for the environmentCAMPUS for allROCK-SOLID PASSION for ICT

![Katia Segers - mediawijsheid is nooit af .ppt [Compatibiliteitsmodus] · onderwijs 2010: "mediawijsheid" opgenomen in vakoverschrijdende eindtermen en ontwikkelingsdoelen middelbaar](https://static.fdocuments.nl/doc/165x107/5f09de197e708231d428e136/katia-segers-mediawijsheid-is-nooit-af-ppt-compatibiliteitsmodus-onderwijs.jpg)