tata motors

Transcript of tata motors

TATA Motors Worldwide

TЛTЛ MOTORS

Objective

Mission To be passionate in anticipating and providing the best vehicles and experience that excite our customers globally.

VisionMost admired by our customers, employees, business partners, and shareholders for the experience and value they enjoy from us being with us.

ValuesInclusion, Integrity, Accountability, Innovation, CustomerPassion of Excellence, Agility, Concern for Environment

COMPANY PROFILETata Motors limited is India's largest automobile company, with consolidated revenues of INR 1,88,818 crores in 2012-13. It is also the world's fourth largest truck and bus manufacturer.

The Tata Motors group's over 60,000 employees established in 1945. The company's dealership, sales, services and spare parts network comprises over 3,500 touch points.

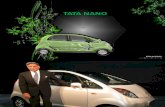

Tata Motors also introduced India's first sports utility vehicle in 1991 and in 1998, the Tata Indica, India's first fully indigenous passenger car. In January 2008, Tata Motors unveiled its people's car, the Tata Nano.

Tata Motors, also listed in the New York Stock Exchange has emerged as an international automobile company.

Strategic alliance with Fiat in 2005. Premier Acquisitions Jaguar, Land rover and Daewoo, acquired in 2008 and 2004.

The company's manufacturing base in India is spread across Jamshedpur, Pune, Lucknow,

Pantnagar, Sanand and Dharwad.

Cars & Utility Vehicles

Trucks & Buses

Defense & Homeland Security Vehicles Jaguar & Land Rover

Rs Crores FY 13 FY 12 % Change Q4 FY 13 Q4 FY 12 % Change Net Revenue 188,818 165,654 14% 56,002 50,908 10% EBITDA 26,569 23,700 12% 8,329 7,179 16% EBITDA % 14.1% 14.3% (20 bps) 14.9% 14.1% 80 bps PAT 9,893 13,517 (27%) 3,945 6,234 (37%)

Jaguar Land Rover continues to drive improved business performance.

The Board of Directors recommended a dividend of Rs. 2 per Ordinary Share of Rs. 2/- each and Rs. 2.10 per A Ordinary Share of Rs. 2/- each for FY 2012-13 ( Rs 4.00 per Ordinary Share of Rs. 2/- each and Rs. 4.10 per A Ordinary Share of Rs. 2/- each in FY 2011-12 )

Consolidated Financials

Encouragement to fuel efficient vehicles.

Infrastructure for testing, Certification and homologation will be created under NATRIP in the three major auto hubs in the country.

Encourage collaboration of industry with research and academic institutions.

Working hours to be increased from 48 to 60 per week from 9 to 11 per day spread over from 10.5 to 13.0hours per day to enhance competitiveness of the industry. Ensure availability of trained manpower by creating automotive training institute (ATI) for providing ‘mechanics’ training to all segments.

One-stop clearance for FDI proposals in automotive sector. Road infrastructure- Further road development, Developing urban transportation system, Flyovers, ensuring better connectivity.

State Government to be urged to offer Preferential allotment of land to automotive plants, Continuous uninterrupted power supply and promote Captive Generation

The Automotive MISSION PLAN 2006-2016

Business & MarketsMarket Availability, Competition, Market Value Share

Indian and International Market – Hatchbacks, Sedans and LCV, M and HCV.

Prime Focus on base of 14-15 countries where market conditions are similar to that of India. i.e. Korea, South Africa, Thailand and Latin America.

Competitors are Maruti Suzuki, Ashok Leyland, Eicher, Hyundai, M&M across all segments in Utility, Commercial Vehicles.

Top three Competitors - Car and Utility Vehicles Market Share (April 2013)Maruti Suzuki 50.74%Hyundai 21.46TATA Motors 5.91%

Tata Motors Ltd - ₹ 291.95

Passenger VehiclesMarket

COMPARATIVE ANALYSIS

COMPARATIVE ANALYSIS- JACQUAR LAND ROVER

SWOT ANALYSISS Demand Driven, Customer Oriented, Target Costing Strategy

Long List of Portfolio, Global Presence, 3500 Touch Points

Innovative Leader

W Return on Investment is low, Not a Luxury Brand,

Relatively low market share

Low Safety Standards and 3rd and 4th generation designs

O Acquisitions like Jaquar &Land Rover, Nano Cheapest Car, Target emerging industrial nations like India, Korea, China

T Other Competitors are 40-50 yrs old, Implement

Lean Production, Intense Competition from Maruti, Fiat,

Ford, Hyundai

PEST ANALYSIS

P Operations in Europe Africa and Australia need to govern all laws governing commerce, trade and

Growth and investment.

E.g. Jaquar Tata Motors must have a full comprehension of the governing

bodies and laws regulating commerce in the UK

E Focus on individual market, if the price of the aluminum required to make engine blocks goes up in Kenya, option to get the aluminum from other suppliers in Europe or Asia who they

would normally get from for production in Ukraine or Russia.

Attention to currency where capital investment will develop and prosper.

s Beliefs, opinions, and general attitude of all the stakeholders in a

company will affect how well a company performs. i.e. Italians have a higher average income and tend to drive larger and fancier cars. Nano

may not be successful.

T Horizon Next new technology initiative to revamp the models TATA Storme, Indica, Nano.

NEW PRODUCT LINE

MOTOR CYCLES

Stallio, Aquario, Calypso

NEW PRODUCT LINE

TATA MANZA HYBRID

NEW PRODUCT LINE

LUXURY CARS TATA PRIMA

HORIZONE NEXT

Tata Motors today announced HORIZONEXT, an aggressive customer focused strategy for its Passenger Vehicles business

HORIZONEXT: Evolution in TechnologyHORIZONEXT: Evolution in HMI- Human Machine InterfaceHORIZONEXT: Evolution in Safety HORIZONEXT: Evolution in DesignHORIZONEXT: Evolution in PerformanceHORIZONEXT: Evolution in Interiors

MEGA PIXELHORIZONE NEXT

ACQUISITONS/MERGERSTata Motors is always growing and expanding and the main way they do this is through acquisitions and mergers

Jaguar Land Rover JLTROn June 2, 2008, the Company acquired the global business relating to Jaguar Land Rover. The strengths of Jaguar Land Rover include its internationallyrecognized brands, strong product portfolio of award-winningluxury and high performance cars.

Daewoo In March 2004, Tata Motors acquired 100 percent of the Korean based Daewoo Commercial Vehicle Company, Korea’s second largest truck maker, for 102 million dollars

Fiat Fiat stood at the tenth position among the major car players in the country. TheTata-Fiat dealer network was upgraded to 170 dealer facilitiesacross 129 cities as of March 31, 2012. Fiat was ranked ninth inthe JD Power 2011 India Customer Service Index Survey.

JAGUAR XFR

RANGE ROVER EVOQUE

JAGUAR XF

WAY FORWARD & RECOMENDATIONSContinue to upgrade our products, value added services & solutions for our end customers.

Future Products like Variants from Prima Range, Ultra range of LCV, ACE variants, Nano variants, refreshed car models across the portfolio. Develop production strategy in existing productions plants for new product line.i.e. Luxury & Hybrid Cars, Electric Cars, Bikes.

Acquisition and Merger Strategy - Recommendations of More acquisitions across various segments

Grow our manufacturing footprint in China.

Production Strategy of Target Costing.

Capture Growing Market in India, China, Indonesia. Create Awareness about Automotive Industry, people know how about various genre’s

Capture Market Share in Commercial Vehicles. Develop substitute for existing vehicles like e.g. Develop a substitute of Bajaj Auto Rickshaw.

Guides and References

http://www.tatamotors.com

http://www.team-bhp.com

http://autobei.com

ITM SMBA’11Mahesh Karane

Sneha Choughule

Kapil Rode SAFARI STROME