tariq ali 1

-

Upload

hafeezullah-shareef -

Category

Documents

-

view

228 -

download

0

Transcript of tariq ali 1

-

8/6/2019 tariq ali 1

1/62

Customer Satisfaction towards HDFC LIFE

EXECUTIVE SYNOPSIS

STATEMENT OF PROBLEM:

The objective of every company is to ensure customer satisfaction, which in

turn creates loyal customers. Measuring customer satisfaction is always a challenge, as

customer either would not disclose or sometimes do not assess their satisfaction level

clearly. Many times the customer can not specify the reasons for his satisfaction.

NEED FOR THE STUDY:

HDFC Life believes in satisfactory delivery of service quality to the customer,

but due to unknown reasons that the customer satisfaction analyzed by the company is

not up to the make. The company intends to find out the causes and remedies for thelow customer satisfaction.

OBJECTIVES OF THE STUDY

To understand the customer satisfaction levels with HDFC Standard Life.

To identify the factors influencing the customers to deal with HDFC Standard

Life.

To identify the customers suggestions with respect to HDFC Standard Life.

To understand the marketing strategies adopted by HDFC Standard Life.

To understand the different services provided by HDFC Standard Life.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA1

-

8/6/2019 tariq ali 1

2/62

Customer Satisfaction towards HDFC LIFE

LIMITATIONS OF THE STUDY

It is primarily a micro level study.

Due to constraints of time only Kadapa Dist. is selected and so it cannot claim

to be a comprehensive study of the population.

The sample size is restricted to 100 respondents.

The data is obtained through a structured questionnaire and it has its own

limitations in its analysis and interpretation.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA2

-

8/6/2019 tariq ali 1

3/62

Customer Satisfaction towards HDFC LIFE

FINDINGS

1. From the survey it is found that every body is aware of HDFC life.2. Nearly 60% of the respondents are highly satisfied with the quality of HDFC

life.3. From the study it is found that when compared to other brands, HDFC life

giving services to their customer in highly manner.4. 65% of the customers are satisfied with the after sales service provided by

HDFC life.5. 4% customers are known about The HDFC life through print media, 2%

customers are known about the Heft life through television 64% through friendsand 30% through dealers.

6. 39 % customers have strongly agreed that the HDFC life company is bestcompany in a AP while 33% have not decided, 28% of disagreed.

7. 50 % of the people are regular customers and 50% people are not regular customers to the HDFC life insurance.

8. 10% customers are interested to buy the insurance directly from company while47% through dealers, 3 % through brokers, 2% through friends and 38%through sales.

9. 2% have strongly agreed that the HDFC life company mainly concentrates onagricultural sector, while 44% have agreed and 54% have not decided.

10. 61 % are customers of HDFC life Company less than 6 month while 32% aresince 6- 12 months, 3% 1to 2 years and 4% are since more than 8 years.

11. 38 % customers have strongly agreed that they share the information with thefriends and relation while 61% have agreed and 1% has strongly disagreed.

12. 27% customers have strongly agreed that the company concentrates on the ruralmarket more than urban market while 43% customers have agreed 26 % havedisagreed and 4% have strongly disagreed.

13. 10 % have strongly agreed that HDFC life has highest market share in south

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA3

-

8/6/2019 tariq ali 1

4/62

Customer Satisfaction towards HDFC LIFE

India while 62% have agreed 28 % have not decided.

SUGGESTIONS

1. T he company has to improve the communication of marketing strategies .

2. The company has to increase the sales promotion activities to counteract the

competitors effectively.

3. The company has to enhance the service quality by being empathetic,

responsive and reliable towards the customers complaints.

4. The company executives have to visit the regular customers to diagnose the

problems and to find a feasible solution to them.

5. The employees of the company have to be more responsive towards thecustomers problems.

6. The company has to enhance the lead time to 3 weeks ( as the majority of the

customers are requesting for it and other companies are offering it )

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA4

-

8/6/2019 tariq ali 1

5/62

Customer Satisfaction towards HDFC LIFE

INTRODUCTION

CUSTOMER SATISFACTION

Meaning: -

The contentment which the customer gets when the performance of the productmeets the customers expectations, it is termed as Customer Satisfaction.

Definition: -Customer satisfaction, a business term, is a measure of how products and

services supplied by a company meet or surpass customer expectation. Customer satisfaction is defined as "the number of customers, or percentage of total customers,whose reported experience with a firm, its products, or its services (ratings) exceedsspecified satisfaction goals."

It is seen as a key performance indicator within business and is part of the four

of a Balanced Scorecard. In a competitive marketplace where businesses compete for customers, customer satisfaction is seen as a key differentiator and increasingly has become a key element of business strategy

If the consumers are satisfied with the product they can be easily get intoutilization. So these preferences should be satisfied with the utilization Survey. TheConsumers are becoming very conscious about the quality, credit price, strengthens,durability of the product. They need better at competitive price. To know about the preferred media of advertising and other factors.

An opinion survey has been conducted in Andhra Pradesh for a period of onemonth and the findings have been presented with suitable a suggestion for theimprovement .It has been felt that well conceived and organized industries have to bedeveloped in rural areas. Which would be essential for the speedy growth of cement production in the country and the major survey is based on the responses of theCustomers

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA5

-

8/6/2019 tariq ali 1

6/62

Customer Satisfaction towards HDFC LIFE

CHAPTER-I

INDUSTRY PROFILE

INTRODUCTION:

In recent times, there has been growing awareness about life insurance productsand the various benefits they offer to individuals. Offerings like unit linked insurance plans (ULIPs) have done their bit to draw individuals towards the insurance segment.Also tax benefits, presently under Section 80C of the Income Tax Act, have contributedto their allure and helped in popularizing insurance products. Conversely, there are products like medical insurance or mediclaim as it is commonly referred to, which canadd value to an individuals insurance portfolio, but are relatively lesser known.

Lets start off with why people need Life Insurance in the first place. Aninsurance policy is primarily meant to protect the income of the familys breadwinners.The idea is if any one or both die, their dependents may hereto continue to livecomfortably. The circle of life begins at birth, followed by education, marriage andeventually, after a lifetime of work, we look forward to a life of retirement. Our finances too tend to change as we go through the various phases of our life. In the firsttwenty years of our life, we are financially and emotionally dependent on our parentsand there are no financial commitments to be met.

In the next twenty years, we gain financial independence and provide for our families. This is also the stage when our income may be insufficient to meet thegrowing expenses of a young household. In the following twenty years, as our childrengrow and become financially independent, we see our savings grow, a nest egg putaway for life after retirement. The final twenty years of life, post retirement is the time

to reap the rewards of our hard work. It is important to remember that with time, our

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA6

-

8/6/2019 tariq ali 1

7/62

Customer Satisfaction towards HDFC LIFE

needs and aspirations tend to change and we have to ensure that we have a suitablydynamic financial plan

WHY LIFE INSURANCE?

Very often it is said that before you let the worry get into your head, buy LifeInsurance. Why? Life Insurance provides protection to your family - your family gets aspecified sum in a lump sum when they need it the most i.e. when you are not around.

While the emotional loss cannot be mitigated, the lump sum received from an insurancecompany can help take care of your familys financial future.

Life Insurance policies also offer tax benefits though tax saving should not bethe primary reason an individual should look at a Life Insurance policy. Finally, LifeInsurance contracts allow an individual to save money in a tax efficient manner andallow savings to grow to help meet our future financial obligations. The most important

question is what is the value of your life? Heard of this Yaksha question: What is thegreatest mystery on earth? Yudhisthir answers, Every one has to die. But no one thinksthat for himself. This is the greatest mystery.

That is the paradox that makes people avoid life insurance, That also makesagents take the wrong line of selling Insurance as a tax saving and/or Investment product (ULIP). So what should we do? Start with calculating the Human Life Value(HLV). A very simple way of looking at it is as following: Imagine a monthly income

of Rs 10000 and the net income provided to the family is Rs./- 8000 after deducting Rs2000 for personal expenses.

Thus the annual income provided to your family is Rs 96000. The amount of money that will earn Rs 96000 p.a. at 8% interest rate is Rs 12,00,000. This is only arepresentation of the value of HLV. It is not the exact way of calculating your HLV.The future income growth, your income generating assets, liabilities, spouse income,

childrens education, etc are also to be factored in. Various private insurers like Bajaj

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA7

-

8/6/2019 tariq ali 1

8/62

Customer Satisfaction towards HDFC LIFE

Allianz, Met Life etc. have placed on their websites the HLV calculators to make youunderstand the HLV and your life insurance needs better.

Indian consumers have bought life insurance for reasons of tax saving rather than the core need of providing for ones family in case of death of breadwinner. Withlargest number of life insurance policies in force in the world, Insurance happens to bea mega opportunity in India. It is a business growing at the rate of 15-20 percent

annually and presently is of the order of Rs 450 billion. Together with banking services,it adds about 7 per cent to the countrys GDP. Gross premium collection is nearly 2 per cent of GDP and funds available with LIC for investments are 8 per cent of GDP.

MYTHS ABOUT LIFE INSURANCE

Nearly 80 per cent of Indian population is without life insurance cover whilehealth insurance and non-life insurance continue to be below international standards.

And this part of the population is also subject to weak social security and pensionsystems with hardly any old age income security. This itself is an indicator that growth potential for the insurance sector is immense. Life insurance is not bought in India.

General insurance is often bought because there are compulsions under the law(motor vehicles, public liability, workmen etc.) or from the financiers asking for insurance as collateral security. In the case of life insurance, there is very littlecompulsion. The tendency is to defer the decision. The possibility of death is either

ignored or not considered imminent.Most people never do believe that they can succumb to destiny and they think,

they will live a long and healthy life. Sadly, that is not always true. A prudent financial plan needs to build in the risk of dying too early to ensure that our familys financialfuture is protected. There are financial tools that help us determine the risk of dyingearly leading to the quantum of Life Insurance required.

While the algorithms may be different, conceptually, all that these tools try anddetermine is the present value of your future earnings keeping in mind your future goalsGLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

8

-

8/6/2019 tariq ali 1

9/62

Customer Satisfaction towards HDFC LIFE

and aspirations. It is important that each one of us put some thought into the potentialexposure of our family to the risk of the primary wage earners risk of dying too early

and arrive at the level of protection required.

Before we get into the recommended approach to Life Insurance, let us delve onsome of the myths surrounding Life Insurance in India. These myths will help explainwhy the number of individuals insured and the average amount of insurance cover per individual is so low in our country. Life insurance protects you and your loved ones in

the event that you meet with an untimely demise.

You are accustomed to a certain standard of living, and you would like tosustain the same standard of living for your wife in your absence. Maybe you wouldlike your grandchildren to receive some money from you as well, even in your absence.Life insurance can help you achieve such goals.

TAX SAVING CONCEPT

The question that we should ask ourselves is - do we believe that destiny willannounce its arrival in our lives? Will destiny always allow you to complete your tax planning for the year and then strike? The answer is a resounding no. However, lack of education has made customers believe that insurance is a tax-planning tool and the protection element is only a marketing strategy. Sad, but true; this is the way LifeInsurance has been largely sold in this country.

Individuals buy enough Life Insurance to get tax breaks just before thefinancial year ends. The moot question is - are we buying Life Insurance to save taxesor are we buying it to protect our familys financial future? Since people believe thatnothing ever can happen to them, the decision on quantum of insurance cover andtiming is made just before the financial year ends.

Tax benefits have been driving LICs business over the years and the same willdrive private players too, since the same incentives are available to all insurance

companies. There is a large potential in rural India. As stipulated by the Insurance

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA9

-

8/6/2019 tariq ali 1

10/62

Customer Satisfaction towards HDFC LIFE

Regulatory Development Authority, five per cent of our new business must cover ruralIndia and the figure must reach 15 per cent by the fifth year.

All of this is very encouraging for the life insurance sector. Innovative products,smart marketing and aggressive distribution, thats the triple whammy combination thathas enabled fledgling private insurance companies to sign up Indian customers faster than anyone ever expected. Indians, who have always seen life insurance as a taxsaving device, are now suddenly turning to the private sector and snapping up the newinnovative products on offer.

GUARANTEED RETURNS

The question we need to ask is - how much is the guaranteed return that a LifeInsurance contract can give. The answer is, I do not know. Unfortunately, individualsexpect life insurance companies to give high guaranteed returns. What mostindividuals fail to understand is that life insurance contracts are long-term contracts.The way in which the contract works is that the premium that each of us pays getsinvested after deducting for the cost of mortality and other administrative expenses of

the insurance company.

Since the premium is paid over a period of time, the investment return that theinsurance company can generate on our savings depends upon the prevailinginvestment opportunities at the time when the premium is paid. With volatility ininterest rates and capital markets, the level of investment return that an insurancecompany can generate can vary substantially.

In such a scenario, where is the scope for the insurance company to offer a fixedreturn to their policy holders but have an earning stream that is highly volatile andvariable? Interest rates on Government of India securities have fallen by over threehundred basis points in the last three years. Given such an economic environment, it isfoolhardy to expect that the high guaranteed return policies can continue for verylong.

The classic example is Japan where with interest rates at sub zero levels,insurance companies that offered guaranteed return policies to their policyholders aregoing down. Again, if you are buying Life Insurance for the high guaranteed return

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA10

-

8/6/2019 tariq ali 1

11/62

Customer Satisfaction towards HDFC LIFE

the policy offers, please examine the company and the product again. Your insurancecompany may not be able to pay you the promised return when your family needs the

money most.

SELECTION OF RIGHT PRODUCT

Almost all the insurance companies offer what is called an illustration tocustomers the illustration is designed to help the customer understand the policy values better. From a customer point of view, it is imperative that each customer understandsand is able to determine the benefits of the product. Given the long-term nature of theLife Insurance contract, it is important to look at the profile of the life insurancecompany that is underwriting the risk.

Given that all the private sector insurance players are new to the business, itwould help to look at the past record of the foreign partner in the joint venture and theability of the Indian partner to continue to infuse capital, given the capital-intensivenature of the business. Again, it is very simple to compare the product with other company products because almost all insurers have their web portals with their productdetails.

Even cost comparisons can be made through premium calculators. What isneeded most is the guaranteed return and wider risk coverage. Riders are veryeconomical and one should always choose the desired riders along with the basic lifeinsurance policy.

THE STIFF COMPETITION

The competition is stiff and, besides, theres a behemoth to contend with.Private players realize what they are up against and are, consequently, tailoring their strategy to suit the circumstances. There is no question of competing with LIC. Italready has about 10 lakh agents and that number is likely to go up to 11 lakh by theend of the current fiscal. No company is allowed to poach on anothers agents, least of all on LICs.

Private players only select fresher and, five years down the line, they hope to

have about 1-lakh agents. Right now most of them have about 5000 to 8,000 agents,

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA11

-

8/6/2019 tariq ali 1

12/62

Customer Satisfaction towards HDFC LIFE

either undergoing training or already on the streets. Unlike the non-life segment, sellinglife insurance requires a more personal touch, which is why good agents are important

in this business. In life insurance, policies are sold not bought.

As of now about 60 per cent of the agents work on a part-time basis, but theratio will come down to 50 per cent by the end of their 10th year in operation. Allinsurance agents earnings are commission-based. They make a 40 per cent commissionin the first year on new business and 7.5 per cent in the next two years on renewable business. The commission rate declines to 5 per cent in the fourth year.

All insurers are careful about selecting and training their agents. They wantthem to remain committed. Insurers know that there is enough business for everybody.Even if an insurer gets 1 to 2 per cent of the 250 to 300 million insurable Indians, itwould have covered a lot of ground. The growing popularity of the private insurersshows in other ways.

They are coining money in new niches that they have introduced. The state

owned company still dominates segments like endowments and money back policies.But in the annuity or pension products business, the private insurers have alreadywrested over 33 percent of the market. And in the popular unit-linked insuranceschemes, they have a virtual monopoly with over 90 percent of the customers.

FEW PROMINENT REASONS OF FAILURE

1. Beneficiary :

The most prominent feature of a life insurance policy is the beneficiary clause,which facilitates the easy transfer of your money to your successors. However, youneed to be aware of the different kinds of beneficiaries in life insurance. You can haveyour children as multiple beneficiaries. All you have to do is to indicate the names of these recipients and the amount of proceeds that they are going to get.

Naming a contingent beneficiary is always practical. Suppose that your first beneficiary dies near the time of your own death. In that case, your children will qualify

for your insurance money if you nominate them as contingent or secondary

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA12

-

8/6/2019 tariq ali 1

13/62

Customer Satisfaction towards HDFC LIFE

beneficiaries. A contingent beneficiary can get life insurance proceeds if the primary beneficiary dies before he or she can receive the assets.

If you have named your minor child as a beneficiary, you will have to appoint aguardian/appointee who will administer the insurance proceeds upon your death. Asrevocable beneficiary, the recipient can be changed any time during the policy. Whilein irrevocable beneficiary clause as in the case of absolute assignments, you cannotchange your assignees name unless they consent to it. With an irrevocable assignee,

creditors cannot touch the policy proceeds, as these monies are not considered to be a part of your assets.

2. Lapsation of policy :

It can happen that due to certain circumstances you forget to pay your premiums, even in the specified grace period. Unfortunately, because you have missedthe deadline your policy will lapse. Consequently, your insurance company can stopcovering you or may provide you reduced insurance coverage equivalent to the total premiums paid formerly (also called paid-up policies).

Nonetheless, a lapsed policy may be renewed in some plans, although the exactrenewal procedure varies among different insurers. Revival of policy is not simple.Other than payment of interest the life insured has to undergo the medical examinationand accordingly the policy terms may be revised.

3. Cash Surrender Value :

Permanent life insurance policies like universal life insurance, whole lifeinsurance and variable life insurance are more attractive because of the presence of built-in cash value. Term life insurance policies do not offer cash values. Theinteresting aspect of these policies is that you can surrender your policy and get theaccrued cash value in your hands provided you have a substantial amount of cash value.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA13

-

8/6/2019 tariq ali 1

14/62

Customer Satisfaction towards HDFC LIFE

Cash Value is a part of your premium is put in savings or another investmentaccount according to the type of policy you purchase. As a result, the ongoing interest

you receive from your investment account gradually increases your cash value.

4. Non-Forfeiture Options:

In permanent life insurance policies, if you fail to pay the premiums in the grace period, you wont lose your life insurance - your accumulated cash value will come toyour rescue with the following options. The above non-forfeiture options may differ from one insurance company to another.

5. Surrender :

It is always easy to terminate (surrender) your policy and get the entire cashsurrender value, which will solve your liquidity problems. However, you need toconsider many factors before surrendering your policy, such as the increase in the cash

surrender value if your policy is maintained for the full term. Consult your insuranceadvisor to about the full consequences of these issues before deciding whether the policy should be cashed or kept.

6. Policy Loan :

Another positive characteristic of a life insurance policy is that you can take outa policy loan against your policy to cater to your emergency needs. The interest is

relatively low and the policy loan can be repaid in a lump sum or installments. If youare incapable of repaying your policy loan, your insurance company will use your cashvalue to settle the loan.

7. Dividends :

Dividends are the earnings paid out by the insurer to its shareholders and/or policyholders. You are entitled to enjoy the fruits of your insurance companys labor,

for example, dividends if you own a participating policy.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA14

-

8/6/2019 tariq ali 1

15/62

Customer Satisfaction towards HDFC LIFE

THE INDIAN PSYCHE

Traditionally, the psyche of the Indian insurance seeker has been such that theyhave been averse to term insurance plans. Term plans require regular premium payments to be made throughout the tenure of the policy; the sum assured is paid onlyupon the unfortunate death of the policyholder during the policy tenure.

If the policyholder survives the tenure, he is paid nothing; in other words, thereare no survival benefits. The absence of survival benefits makes these plans rather unpopular among policyholders, as they like to receive a return as a reward for investing. They fail to appreciate that insurance is about insuring and not investing,so typically there should not be any expectations of a return.

A mediclaim policy or car insurance or home insurance or factory/warehouseinsurance doesnt offer returns. Similarly, there are no returns from a term plan. Toworsen matters, insurance advisors werent interested in educating insurance seekersabout why term plans are a must-have for every individual regardless of age. This gavea fillip to endowment plans not only because they pay the sum assured on theunfortunate death of the policyholder during the policy term, but also because they paya survival benefit if the policy holder survives the term.

Jeevan Anand, given the LIC tag, has always been among the preferred plans,since it is a combination of both endowment term insurance. It provides financial protection against the death of the policyholder, throughout his lifetime. However, nowsome private players have introduced the Term Plans where the proceeds are also paidon maturity of the policy if the insured survives.

MONOPOLY REGIME AND OPENING UP

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA15

-

8/6/2019 tariq ali 1

16/62

-

8/6/2019 tariq ali 1

17/62

Customer Satisfaction towards HDFC LIFE

Indias life insurance market has grown rapidly over the past six years, with

new business premiums growing at over 40% per year. The premium income of Indiaslife insurance market is set to double by 2012 on better penetration and higher incomes.Insurance penetration in India is currently about 4% of its GDP, much lower than thedeveloped market level of 6- 9%.

In several segments of the population, the penetration is lower than potential.For example, in urban areas, the penetration of life insurance in the mass market is

about 65%, and its considerably less in the low-income unbanked segment. In ruralareas, life insurance penetration in the banked segment is estimated to be about 40%,while it is marginal at best in the unbanked segment.

The total premium could go up to $80-100 billion by 2012 from the present $40 billion as higher per capita income increases per capita insurance intensity. The averagehousehold premium will rise to Rs 3,000-4,100 from the current Rs 1,300 as will penetration by the existing and new players. Indias ratio of life insurance premium toits GDP is around 4 per cent against 6-9 per cent in the developed world.

It could rise to 5.1-6.2 by 2012 in tandem with the countrys demographic profile. India has 17 life insurers and the state owned Life Insurance Corp. of Indiadominates the industry with over 70 percent market share, though private players have been growing aggressively. Considering the worlds largest population and an annualgrowth rate of nearly 7 per cent, India offers great opportunities for insurers.

US based online insurance company ebix.complans to enter the Indian marketfollowing deregulation of its insurance sector. Online insurer ebix.coms expansion intoIndia is a major step for the company to become a global supplier of internet-basedinsurance tools for consumers and insurance professionals. In a diverse country such asIndia it is imperative that a universal insurance infrastructure be created to maximizeefficiency in the insurance industry.

Online insurer ebix.com can offers the Indian market a business-to-consumer

internet portal where consumers have more choice while purchasing insurance and an

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA17

-

8/6/2019 tariq ali 1

18/62

Customer Satisfaction towards HDFC LIFE

internet-based agency management system that will help agents work more efficientlywith multiple carriers.

Foreign holding in Indian insurance companies is limited to 26 per cent. Thegovernment wants to increase the cap to 49 percent, but its communist allies opposesuch a move. The market is moving beyond single-premium policies and unit linkedinsurance products which are easier to sell.

The agency model is the dominant sales channel accounting for more than 85

per cent of fresh premiums but overall inactivity and attrition is much higher at 50-55 per cent than the global average of 25 per cent. Opportunities include health insuranceand pensions, the report said, adding only 1.5-2 per cent of total healthcare expenditurein India was currently covered by insurance.

A life insurance policy covers ones personal self. Unlike with generalinsurance, it is not like insuring a vehicle. Having said that, if we consider that Indias population is over one billion and growing, we get a picture of the true potential of the

life insurance sector in India. LIC Bimaquest - Vol. VIII Issue I, January 2008 q 49 Life Insurance Industry-Past, Present & the Future has been in business for 50 years now and has notcovered the entire population base yet. About 250 to 300 million Indians are stillinsurable.

LIC has issued about 120 million policies till now, with new premium incomeof US$ 1 billion. Its assets have been estimated at $37 billion and in the last quarter itreported a 60 per cent growth in new business. LICs business is growing at the rate of

20 per cent every year. That is the kind of potential one is talking about in lifeinsurance in India. It would not be wrong to say that a lot of the advantage of advertising by new private sector insurance companies has by default gone to LIC.

While they have created a lot of awareness through private insurersadvertisements, LIC has benefited. Why? Because LIC has a much wider branchnetwork, and buyers are surer of LIC because it has been in existence for long; they aremore comfortable about its safety. Some LIC agents continue to follow the unethical

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA18

-

8/6/2019 tariq ali 1

19/62

Customer Satisfaction towards HDFC LIFE

practice of offering discounts from their commissions to new policy buyers; this makesa difference.

PENETRATION- LOWER THAN POTENTIAL

Management consultancy firm McKinsey has forecast that Indias life insuranceindustry will be double in the next five years from $40 billion to $80-100 billion in2012. This growth would improve the level of insurance penetration from 5.1% of gross domestic product to 6.2% in 2010-2012.

The Indian life insurance industry could witness a rise in the insurance sector premiums between 5.1% and 6.2% of GDP in 2012, from the current 4.1%. Totalmarket premiums are likely to more than double during this period, from about $40 billion to $80-100 billion. This implies a higher annual growth in new business annual premium equivalent (APE) of 19% to 23% from 2007 to 2012. The large part of thegrowth would come from second- and third-tier cities and small towns. Based on MGIforecasts, 26 tier-II cities with

Population greater than one million and 33 tier-III towns with the population of more than 5 lakh will account for 25% of the middle class and newly bankable class in2025. Over 5,000 tier-IV small towns will account for as much as 40% of these twoclasses in 2025.

However, if an insurer decided to be a niche player and concentrated on metrosand their suburbs, they will have a big market, since 60% of the very rich (annualincome over Rs 10 lakh) would be concentrated in the top eight cities. Although these

consumers will be highly accessible, players will have to reckon with intensecompetition that is only going to increase and extend to other segments as well.

LIC- AHEAD OF ALL

LIC of India has mobilized Rs 12,361 crore of new business premiums in March07 the highest recorded by the corporation in any single month. This has enabled thecorporation post new business premium of Rs 55,934 crore in 06-07, a 118% growthover the previous year. LICs premium collection in March 07 was higher than the premium collected in the whole of whole of 03-04. LICs has been the growth driver GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

19

-

8/6/2019 tariq ali 1

20/62

Customer Satisfaction towards HDFC LIFE

for the entire life insurance industry which grew 110.7% to Rs 75,406 crore from Rs35,897 crore during the current financial year.

The rise in premium gives LIC a market share of over 74% of the total new business premium mobilized in India, which is substantially higher than the 72% as onMarch 106. The rise in premium is on the back of unit-linked policies which accountfor nearly 70% of the total individual premium. The surge in sales in March attributedto higher sales of unit linked insurance and group insurance business.

In March the corporation booked over Rs 4,826 crore in group insurance, whichaccounted for nearly 30% of total collections. Collection from single premium plansamount to Rs 24,927 crore, which is nearly 44% of the premium raised by thecorporation during the current fiscal. Single premium plans are a demand of the market.

There are a large section of people who do not want to commit premium

payments for every year. Meanwhile, the private life insurance industry has recorded agrowth of 89% with total new business premium for the year standing at Rs 19,471crore as against Rs 10,252 crore in the corresponding period last year. ICICI Prudentialcontinues to be the largest private life insurance player with a market share of 7%followed by Bajaj Allianz Life Insurance which has a market share of 5.7%.

The companies that have recorded the fastest growth in the current year include

Reliance Life Insurance, which grew 381% recording new business premium of Rs 931crore, followed by SBI Life Insurance which grew 209% to Rs 2,566 crore. The highgrowth has enabled SBI Life to move into the number three positions after BajajAllianz Life Insurance.

NEW JOINT VENTURE SET UPS

Canara Bank, Oriental Bank of Commerce (OBC) and HSBC Insurance (Asia-Pacific) Holdings Ltd have signed an agreement to jointly establish a life insurancecompany in the country. The company has been christened Canara HSBC OrientalGLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

20

-

8/6/2019 tariq ali 1

21/62

Customer Satisfaction towards HDFC LIFE

Bank of Commerce Life Insurance Company Limited. Canara Bank would take a 51 per cent stake in the company, while HSBC and OBC will hold 26 per cent and 23 per

cent stake respectively.The new life insurance company will be capitalized at Rs 325 crore, of which

Canara Bank will contribute Rs 102 crore, HSBC Rs 177 crore and OBC Rs 46 crore.Under the terms of the agreement, HSBC would provide a range of managementservices, which would include nominating executives for certain senior roles.

While both Canara Bank and OBC offer an extensive client base,complementary distribution networks and broad local market knowledge, HSBC bringsto the partnership its considerable insurance experience, product range and proven bancassurance capabilities. IRDA gave clearance to a joint venture between KishoreBiyanis Pantaloon Retail India and Italian insurance firm The Generali Group to startinsurance businesses.

The joint venture, Future Generali India Life Insurance Company Ltd, wouldtransact life insurance business. Besides, it also granted approval to Future GeneraliIndia Insurance Company to transact general insurance business. Generali is one of thelargest insurance groups in the world, operating in 40 countries through 107 companies.It ranks 22 in the list of Fortune 500 companies and is the largest corporation in Italywith an asset base of\ over 300 billion euro.

EYING ABROAD

Although Japanese insurance companies account for one-fifth of the total lifeinsurance premium in the world, they have been slow to expand internationally as mostcompanies were going through a consolidation phase locally. The crash in interest ratesto near-zero levels in Japan had made it difficult for insurance companies to generatesurpluses to cover costs. Financial sector juggernaut LIC of India is now on the look out for a potential buy abroad.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA21

-

8/6/2019 tariq ali 1

22/62

Customer Satisfaction towards HDFC LIFE

The company is planning to use its massive cash reserve to finance theacquisition of a company in the New Zealand and Australia markets. If approved, LIC

would become the second public sector financial institution, after State Bank of India,to acquire a company abroad. For LIC, a buyout of an insurance company Down Under could make sense, as it has already established its presence in some of the Oceaniamarkets, like Fiji.

The plan would, however, require prior passage of the amendments to the LICAct, to enable the company to raise its paid-up capital from Rs 5 crore to Rs 100 crore,at par with private insurers. The government plans to amend the Act passed in 1956 to

give more flexibility to the largest insurance company to expand its footprint.

LIC commands a 77% market share. Its premium income soared to 182.26%during the period against the industry average of 177.44%. Its new premium grew191% to Rs 10,381.57 crore as in August 06. It has offices in the UK, Nepal, Bahrain,Kenya and Mauritius other than Fiji. But its UK operations have not been able to growat the expected rate. While the insurance industry in the UK is growing at 10- 12%, LIC

has been growing at 4-5% annually. It is understood that it has been capitalized acouple of times.

RIDING ON WOMAN POWER

A woman has unique needs and concerns when it comes to preparing for thefuture. While the basic life insurance policy protects the bread-earner and his lovedones, he also needs some protection against health risks specific to women. In todayssociety, there is no difference in professional men and women and they both have thesame earning power and both contribute to the family kitty.

Both incomes are important for family lifestyle and standard. When the wholeworld seems to be riding on woman power, can insurance companies remain far behind? Today even banks and financial institutions are regularly churning outinnovative schemes to woo the dames? Insurance traditionally has been targeted at theearning member of the family as insurance means helping the family to maintain thestandard of living for a few years in case something unfortunate happens to the main breadwinner.GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

22

-

8/6/2019 tariq ali 1

23/62

Customer Satisfaction towards HDFC LIFE

Moreover, insurance products not only provide security for family, but also helpin savings, investment towards creating a fortune for needs in future or pension for the

golden years. There is a strong-felt need for women to also insure and invest and,therefore, insurance companies are targeting women with specially-designed products.What is more, some insurance companies also offer some discounts to women,although they dont have any specific product for them.

For instance, ING Vysya Life Insurance Company doesnt have any producttargeted specifically at women; however, women enjoy lower rates of premium thanmen owing to their longevity. Whatever be the case, insurance companies penchant for

woman customers is growing by the day and not without reasons.

Women investors have shown longer investment tenure and regular savinghabits. So, the future products are aimed to target these two specific characteristics andwould span over both health and investment domain. Insurers also feel that the women-specific insurance market is expected to grow much faster than the overall insurancesector. No wonder, this is one domain which will become a strong focus point for themin the near future.

AGENTS

A remarkable achievement is that Indias third largest private sector insurancecompany SBI life Insurance has been ranked fifth across the world in terms of number of MDRT members, which is 801. Life insurance agents from India are moving fastinto the realm of global insurance. The total number of Indian agents registering withthe Million Dollar Round Table, a prestigious international trade association of insurance agents, has more than tripled to 1,931 agents for 2007 compared with 532 in2006. The MDRT has a total of 35,781 qualifiers.Which is 1% of the total insuranceagents or advisors in the world.

Within the MDRT, there are three levels such as the basic MDRT, the Court of Table (CoT) and Top of Table ( ToT). To qualify for tht MDRT, an Indian insuranceagent has to get a premium of Rs. 23.92 lakh to his insurance company or earn a

commission of Rs. 5.98 lakh. For the agent to qualify for the CoT, he has to do thrice

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA23

-

8/6/2019 tariq ali 1

24/62

Customer Satisfaction towards HDFC LIFE

the MDRT business, while to qualify for the TOT, insurance agent has to do six timesthe business required for the MDRT.

On the other hand IRDA has taken the first step to crack the whip on agentsmisleading customers on unit-linked insurance plans. To start with, it has tightened thenorms for sale of actuarial-funded unit-linked products which are on their way out.

The Regulator intends asking customers and agents to sign illustrations on theentire gamut of ULIP products offered by insurers. While the features of ULIPs varyfrom product to product, the onus will be on agents to indicate the explanation thatcustomers have been given on the nature of investment. Agents will also have to give a break-up of the money spent on various expenses.

The objective is to enlarge the scope of disclosures made by agents and suchtransparency will be in the interest of the entire insurance sector. IRDA appears to betaking the UK route to tackle mis-selling of policies. In the UK, if an agent is accusedof mis-selling, the onus is upon the insurer to prove that the policy was explained.

Similarly, insurers in India will now have to retain documentary evidence to prove thatthe policy was properly explained to the insured.

In the UK, the experience has been the complaints of mis-selling emerge after a period when policyholders discover that their investments were performing far worsethan they were told to expect. Acturial-funded products have a complex structure,where the insurance company allocates significant sums to the policyholders accountin the first year. However, these initial allocations are notional i.e. in the form of

actuarial units, which convert into real money only in the future. The downside of such products is that there is not much balance in the policyholders account in the initialyears.

ULIP PRODUCTS

The regulator had given an indication that checks would be in place to preventmis-selling of ULIPs, which have become popular investment instruments. IRDA isunderstood to have extended the deadline for Bajaj Allianz to phase out its actuarial-

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA24

-

8/6/2019 tariq ali 1

25/62

Customer Satisfaction towards HDFC LIFE

funded product or capital unit. This is set to be replicated in other ULIPs as well in duecourse.

The regulator has asked private insurer Bajaj Allianz Life Insurance to ensurethat policyholders investing in the actuarial-funded products sign on sales illustrationgiven out by agents. This will form part of the policy document, and IRDA will havethe authority to inspect it at a later stage, if need be. The entire exercise is aimed atensuring that the customer is fully aware of the features of the product.

Aviva Life Insurance is the other company that has been asked to withdrawactuarial-funded products. IRDA justified the withdrawal of these products, saying that

its objective was to enable the policyholders of ULIP products to compare features andcharges across products and companies. However this order of IRDA is stayed by theHigh Court of Chennai.

The regulator has also introduced safeguards to see that actuarial-funded products are not sold aggressively while they are being phased out. In the case of BajajAllianz, for instance, the regulator has stipulated that the total premium collected under this product between August 2007 and September 15, 2007 should not exceed theaverage growth in sales posted in the previous quarter of July 31, 2007.

Although ULIPs may have become popular for more wrong reason that rightones, the segment does have its fair share of positives. The right reasons includesmultiple benefits to the customers like Life protection, Investment and Savings,Flexibility, Adjustable Life Cover, Investment Options, Transparency, Options to takeadditional cover against, Death due to accidents, Disability, Critical Illness, Surgeries,Liquidity and Tax Planning.

The Regulator is in the process of modifying the guidelines for ULIPs so that products with high concentration of investments will be treated as mutual funds andterm products if the proportion is tilted towards a greater risk. The reviewed is aimed at bringing in better information, transparency standards and understanding of such products among customers.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA25

-

8/6/2019 tariq ali 1

26/62

Customer Satisfaction towards HDFC LIFE

Customers should have an idea as to what the risk and the return in the policyare when they subscribe to them. IRDA has also proposed to make it mandatory for

insurance companies to issue sales of document with illustration as a part of the over all policy document. This would give an idea to policyholders about the instruments theyare investing in and risks are taking. The company, in this document, will have toexplain what component actually goes towards life cover and what towards investment.

The Regulator has clarified that the policyholders in the unit-linked schemecould remain invested in the policy for another five years after the maturity, but couldnot withdraw any amount. The decision to continue with the scheme after maturity will

be purely at the option of policyholders. The objective was to ensure that the insurancecompanies cannot act as a fund manager while it can only provide the option to the policyholder for waiting for a better NAV.

The Regulator has observed that the proportion of unit linked insurance plans inthe total product portfolio has gone up by 65-70 per cent, which ties the fortunes of the

insurance company and its investors to the vagaries of the stock market. Meanwhile, allcompanies are well above the solvency margin of 150%. The life insurance industry isgrowing at 30 per cent each year; its one of the fastest growing industries in thecountry. Private players have captured a sizeable chunk of the market in these six years,with the Life Insurance Corporation of Indias (LIC) share in the new business fallingto 74 per cent.

The upside includes improved service, riders with policies, unit linked insurance policies health care for as little as Rs100 per month, need-focused products withflexibility, and sales channels to suit the customers convenience. Theres a wide rangeof products and services competing to deliver the best value to customers, which hasincreased the market. Expansion coupled with a rapidly growing business is the bigreason for the fresh capital infusion at regular intervals.

Most private insurers have stabilized their operations in the last five years andfine-tuned their business models. Now is the time for expansion and launching their services beyond metros and big cities, to get the real benefits of mass business andGLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

26

-

8/6/2019 tariq ali 1

27/62

Customer Satisfaction towards HDFC LIFE

exponential growth. Pension and health are two areas that have tremendous growth potential in the future. Almost 90 per cent of the people in the country have no old age

benefits or health cover. New products are launched targeting niche markets. Pension products are developing in a big way, and will benefit a large section of people in theorganized and unorganized sector.

The annuity market has also started growing, and new players are offering a plethora of new and innovative products. Alternate channels of distribution likecorporate brokers, online selling and bancassurance are increasing their share in the business of all the companies. Increasing the insurance sector FDI limit to 49 per cent isthe foremost issue, to provide financial flexibility to the existing players and make theIndian market attractive for foreign investment.

Also, the fringe benefit tax (FBT) needs to be eased, especially for group products like superannuation schemes. FBT has caused this market to stagnate, and

most companies have withdrawn this product, as companies find it increases their costs by more than 30 per cent. Now FBT restricted to more than Rs. 1 lac contribution per member per year.

The prospects for Indias insurance sector are good on the back of expected buoyant economic growth and rising levels of wealth in society. The new insurancecompanies aims to fulfill the needs of high net worth individuals, professionals, smalland medium enterprises, farmers and also rural and semi-urban masses.

Private insurance ventures, allowed to compete with state owned Life InsuranceCorporation and non-life companies beginning 2000, are trying to tap expandingdemand for insurance in an economy growing nine percent a year. The demand, whichhas seen annual premiums double to more than 20 billion dollars since 2000, is beingdriven by the absence of a social security system and low penetration dating back to thedecades when government-owned insurers enjoyed a monopoly.

Dismally low life insurance penetration rates, a growing need for social and old

age security, strong GDP growth and the expected rise in savings The life insurance

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA27

-

8/6/2019 tariq ali 1

28/62

Customer Satisfaction towards HDFC LIFE

industry is close to eclipsing the mutual fund sector in terms of its total investment inequities through the success of unit-linked products. The MF industry registered a total

AUM of Rs 4.86 lakh crore till July 2007, while the investment in equities stood at Rs1.59 lakh crore. As per figures compiled by the Life Insurance Council.

Life insurers total investment in equities was close to Rs 1.5 lakh crore as of March 2007, while total AUM stood at about Rs 6.1 lakh crore. As much as 75% of investments made in ULIPs get routed to the stock markets at SBI Life. At least 60% of the funds from unit-linked products are invested in the equity market. With the growthin ULIPs, the total investment in equities rose sharply over the last few years. ULIPs

are sold like hot cakes but still they are under constant scrutiny. ULIPs have given LifeInsurance market a big boost to grow and expend.

The reason behind foreign companies making a beeline to enter the insurance business in the country is pretty obvious: Insurance in India is only 3.14 per cent of its

GDP compared with the global average of 7.52 per cent. And this is expected to rise toonly 4 per cent. This means a vast majority of Indian population is left to be covered byinsurance.

At present, there are 16 companies providing life insurance in the country. InIndia, insurance is seen with an improper perspective. Insurance products are soldrather than bought, as most people do not realize that insurance is for the security and benefits of their dependants. While the objective of life insurance is to provide a lump

sum amount in the eventuality of untimely death of the insured, most Indians buyinsurance to save taxes.

This is evident from that around 40 per cent of the insurance business of anyinsurer takes place in March, which marks the deadline for submission of investmentdetails for computation of income-tax liabilities. The IRDA is currently toying with theidea of allowing insurance companies to issue composite policies for micro-insuranceBuyers soon be able to insure their life as well as their motor pump by buying a single

policy.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA28

-

8/6/2019 tariq ali 1

29/62

Customer Satisfaction towards HDFC LIFE

In India micro-insurance is defined by the size of the policy (Rs 5,000-Rs50,000 sum assured) and covers health, household, fire and motor insurance portfolios

that are non-commercial or of lower asset value. As per the new regulation, individualcompanies will now be allowed to design composite products within broad parameters.They will be branded as micro-insurance products for file and use. A single agencysystem can sell these packaged composite products. The IRDA will soon issue broadguidelines authorizing composite products for micro-insurance.

CHAPTER-II

COMPANY PROFILE

Introduction:

HDFC Standard Life, one of India's leading private life insurance companies,offers a range of individual and group insurance solutions. It is a joint venture betweenHousing Development Finance Corporation Limited (HDFC), India's leading housingfinance institution and Standard Life plc, the leading provider of financial services inthe United Kingdom.

HDFC Ltd. holds 72.43% and Standard Life (Mauritius Holding) Ltd. holds26.00% of equity in the joint venture, while the rest is held by others.

HDFC Standard Life's product portfolio comprises solutions, which meetvarious customer needs such as Protection, Pension, Savings, Investment and Health.Customers have the added advantage of customizing the plans, by adding optional

benefits called riders, at a nominal price. The company currently has 32 retail and 4

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA29

-

8/6/2019 tariq ali 1

30/62

Customer Satisfaction towards HDFC LIFE

group products in its portfolio, along with five optional rider benefits catering to thesavings, investment, protection and retirement needs of customers.

HDFC Standard Life continues to have one of the widest reaches among newinsurance companies with 568 branches servicing customer needs in over 700 cities andtowns. The company has a strong presence in its existing markets with a base of 2,00,000 Financial Consultants.

Associate Companies

Other Companies

HDFC Trustee Company Ltd.GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

30

http://www.hdfc.com/http://www.hdfcbank.com/personal/default.htm -

8/6/2019 tariq ali 1

31/62

Customer Satisfaction towards HDFC LIFE

GRUH Finance Ltd.

HDFC Developers Ltd.

HDFC Property Ventures Ltd.

HDFC Ventures Trustee Company Ltd.

HDFC Investments Ltd.

HDFC Holdings Ltd.

Credit Information Bureau (India) Ltd

HDFC Securities

HDB Financial Services

Board Members

Brief Profile of The Board of Directors

Mr. Deepak S. Parekh is the Chairman of the Company. He is also the

Chairman and Director of Housing Development Finance Corporation Limited (HDFCLimited). He joined HDFC Limited in a senior management position in 1978. He wasinducted as a whole-time director of HDFC Limited in 1985 and was appointed as itsChairman in 1993. Mr. Parekh is a Fellow of the Institute of Chartered Accountants(England & Wales).

Mr. Keki M. Mistry joined the Board of Directors of the Company inDecember, 2000. He is currently the Vice Chairman and Chief Executive Officer of

HDFC Limited. He joined HDFC Limited in 1981 and became an Executive Director in1993. He was appointed as its Managing Director in 2000. Mr. Mistry is a Fellow of theInstitute of Chartered Accountants of India and a member of the Michigan Associationof Certified Public Accountants.

Ms. Renu S. Karnad is the Managing Director of HDFC Limited. She is a

graduate in Law and holds a Master's degree in Economics from Delhi University. She

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA31

-

8/6/2019 tariq ali 1

32/62

Customer Satisfaction towards HDFC LIFE

has been employed with HDFC Limited since 1978 and was appointed as the ExecutiveDirector in 2000 and Deputy Managing Director in 2007. She is responsible for

overseeing all aspects of lending operations of HDFC Limited.

Mr. David Nish joined Standard Life on 1 November 2006 as Group FinanceDirector and remained in that position until December 2009. He is appointed as theExecutive Europe on 1st January 2010. In 2000 he was awarded the Scottish BusinessAwards Finance Director of the Year and from 2004 to 2005 he served on theGovernment Employers Pension Task Force. He is a member of the Institute of Chartered Accountants of Scotland. He joined the Board of Directors in February 2010.

Mr. Nathan Parnaby is appointed as the Chief Executive, Europe & Asia of Standard Life in the year 2010. Nathan joined Standard Life in 1982 as InvestmentManager, responsible for all UK net funds. He was appointed a Director of the StandardLife Investments board. He is a Mathematics graduate from Oxford University andthe Member of the Securities Institute. He joined the Board of Directors in December 2009.

Mr. Norman K. Skeoch is currently the Chief Executive in Standard Life

Investments Limited and is responsible for overseeing Investment Process & Chief Executive Officer Function. Prior to this, Mr. Skeoch was working with M/s. JamesCapel & Co. holding the positions of UK Economist, Chief Economist, ExecutiveDirector, Director of Controls and Strategy HSBS Securities and Managing Director International Equities.

He was also responsible for Economic and Investment Strategy research produced on a worldwide basis. Mr. Skeoch joined the Board of Directors in November

2005. Mr. Skeoch is a Fellow of the Securities Institute, Fellow of the Royal Institutefor the Encouragement of the Arts, Manufacture and Commerce, BA, MA.

Mr. Gautam R. Divan is a practising Chartered Accountant and is a Fellow of the Institute of Chartered Accountants of India. Mr. Divan was the Former Chairmanand Managing Committee Member of Midsnell Group International, an InternationalAssociation of Independent Accounting Firms and has authored several papers of professional interest.

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA32

-

8/6/2019 tariq ali 1

33/62

Customer Satisfaction towards HDFC LIFE

Mr. Divan has wide experience in auditing accounts of large public limitedcompanies and nationalized banks, financial and taxation planning of individuals and

limited companies and also has substantial experience in structuring overseasinvestments to and from India.

Mr. Ranjan Pant is a global Management Consultant advising CEO/Boards onStrategy and Change Management. Mr. Pant, until 2002 was a Partner & Vice-President at Bain & Company, Inc., Boston, where he led the worldwide UtilityPractice. He was also Director, Corporate Business Development at General Electricheadquarters in Fairfield, USA. Mr. Pant has an MBA from The Wharton School and

BE (Honours) from Birla Institute of Technology and Sciences.Mr. Ravi Narain is the Managing Director & CEO of National Stock Exchange

of India Limited. Mr.Ravi Narain was a member of the core team to set-up theSecurities & Exchange Board of India (SEBI) and is also associated with variouscommittees of SEBI and the Reserve Bank of India (RBI). Mr . Ravi Narain is aCambridge University-trained Economist and an MBA from Wharton School,University of Pennyslvania, USA.

Mr. A. K.T. Chari has joined HDFC Standard Life as a Director on March 10,2010. Mr. Chari has completed his Electrical Engineering from Madras University in1962. He is associated with Infrastructure Development Finance Company Ltd. (IDFC)for last 11 years. Currently he is handling project finance for infrastructure projects atIDFC. Prior to this he was associated with Infrastructure Development Bank of India(IDBI) from 1975 to 1999.

Mr. Gerald E. Grimstone was appointed Chairman of Standard Life in May

2007, having been Deputy Chairman since March 2006. He became a director of theStandard Life Assurance Company in July 2003. He is also Chairman of Candover Investments plc and was appointed as one of the UKs Business Ambassadors bythe Prime Minister in January 2009. Gerry held senior positions within the Departmentof Health and Social Security and HM Treasury until 1986.

He then spent 13 years with Schroders in London, Hong Kong and New York,

and was Vice Chairman of Schroders worldwide investment banking activities

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA33

-

8/6/2019 tariq ali 1

34/62

Customer Satisfaction towards HDFC LIFE

from 1998 to 1999. He is the Alternate Director to Mr. David Nish. He hascompleted Master of Arts, Master of Science in Chemistry, Merton College, Oxford

University and NATO-CCMS Fellowship Wolfson College, Oxford University.Mr. Michael G Connarty is responsible for Standard Life's investments in life

assurance Joint Ventures in India and China. He holds a degree in Law and MBA. Hehas worked with Standard Life for 33 years in managerial positions covering a number of fields such as Pensions law, International Marketing, Operational Management,Strategy, Risk, Compliance, Company Secretarial and Banking. He has acted as ProjectManager for the start-up project of the Company in 2000. He is the Alternate Director

to Mr. Norman K. Skeoch.

Mr. Amitabh Chaudhry is the MD and CEO of HDFC Standard Life. Before joining HDFC Standard Life, he was the MD and CEO of Infosys BPO and was alsoheading an Independent Validation Services unit in Infosys Technologies. He startedhis career with Bank of America delivering diverse roles ranging from Head of Technology Investment Banking for Asia, Regional Finance Head for WholesaleBanking and Global Markets and Chief Finance Officer of Bank of America (India). He

moved to Credit Lyonnais Securities in 2001 in Singapore where he headed their investment banking franchise for South East Asia and structured finance practice for Asia before joining Infosys BPO in 2005. Mr. Chaudhry completed his Engineering in1985 from Birla Institute of Technology and Science, Pilani and MBA in 1987 fromIIM, Ahmedabad.

Mr. Paresh Parasnis is the Executive Director and Chief Operating Officer of the company. A fellow of the Institute of Chartered Accountants of India, he has been

associated with the HDFC Group since 1984. During his 16-year tenure at HDFCLimited, he was responsible for driving and spearheading several key initiatives. Asone of the founding members of HDFC Standard life, Mr. Parasnis has beenresponsible for setting up branches, driving sales and servicing strategy, leadingrecruitment, contributing to product launches and performance management system,overseeing new business and claims settlement, customer interactions etc.

Our Parentage

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA34

-

8/6/2019 tariq ali 1

35/62

Customer Satisfaction towards HDFC LIFE

HDFC Standard Life

HDFC Limited , India's premier housing finance institution has assisted morethan 3.4 million families own a home, since its inception in 1977 across 2400 cities andtowns through its network of over 271 offices. It has international offices in Dubai,London and Singapore with service associates in Saudi Arabia, Qatar, Kuwait andOman to assist NRI's and PIO's to own a home back in India. As of December 2009, thetotal asset size has crossed more than Rs. 104,560 crores including the mortgage loanassets of more than Rs.90,400 crores.

The corporation has a deposit base of over Rs. 23,000 crores, earning the trustof nearly one million depositors. Customer Service and satisfaction has been themainstay of the organization. HDFC has set benchmarks for the Indian housing financeindustry. Recognition for the service to the sector has come from several national andinternational entities including the World Bank that has lauded HDFC as a modelhousing finance company for the developing countries. HDFC has undertaken a lot of consultancies abroad assisting different countries including Egypt, Maldives, and

Bangladesh in the setting up of housing finance companies .

Standard Life

Standard Life is one of the UK's leading long term savings and investmentscompanies headquartered in Edinburgh and operating internationally. Established in1825, Standard Life provides life assurance, pensions and investment management propositions to over 6 million customers worldwide. The Standard Life Group has

around 10,000 employees across the UK, Canada, Ireland, Germany, Austria, India,USA, Hong Kong and mainland China. At the end of December 2010 the Group hadtotal assets under administration of 170.1bn. Standard Life's diverse business includesone of the largest life and pensions businesses in the UK with more than 4 millioncustomers and Standard Life Investments, currently manages assets of over 138.7bnglobally.

On 10 July 2006, after 80 years as a mutual company, Standard Life AssuranceCompany demutualised and Standard Life plc was listed on the London Stock GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

35

-

8/6/2019 tariq ali 1

36/62

Customer Satisfaction towards HDFC LIFE

Exchange. Standard Life now has approximately 1.5 million individual shareholders inover 50 countries around the world.

Corporate Governance

Introduction

The Corporate Governance Policy provides the framework under which theBoard of Directors operates. It includes its corporate structure, culture, policies and themanner in which it deals with various stakeholders. The governance policies addressthe responsibilities, authority and administration of the Board of Directors. The policiesalso include the responsibilities of the Principal Officer and define the reportingrelationships. Timely and accurate disclosure of information regarding the financialsituation, performance, board constitution, ownership of the company etc. is animportant part of corporate governance. Corporate governance arrangements are thosethrough which an organisation directs and controls itself and the people associated withit.

Bancassurance Partners

HDFC BANK

SARASWAT BANK

INDIAN BANK

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA36

-

8/6/2019 tariq ali 1

37/62

Customer Satisfaction towards HDFC LIFE

CHAPTER-III

Customer Satisfaction

Customer Satisfaction

Customer Satisfaction is the pillar of the marketing concept Satisfaction isconsumers fulfillment response. It is a judgment that a product or a service feature or

the product or service itself provides pleasurable level of consumption relatedfulfillment.

Customers satisfaction influenced by specific product are service features and by perceptions of quality. It is also influenced by specific service attributions, and their perceptions

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA37

-

8/6/2019 tariq ali 1

38/62

Customer Satisfaction towards HDFC LIFE

The telling factor in the companys long run fortunes will be the amount of customer satisfaction that it managers to generate. But it doesnt not mean he

companys sole aim is to maximize Customer Satisfaction. If that where the case, itshould simply put out the best product and service in the world and price is below cost.There by it would be creating substantial customer satisfaction. But in the long run itwould be also be out of business. Customer Satisfaction like happiness bet achieved byrendering substantial forma of assistance to others rather than by direct pursuit.

Companies that move towards adopting the market concept benefit themselves

and The society. It leads the societys recourse to move in the direction of social needs,there by bringing the interests of business firms and the interest of society in toharmonious relationship.

Measuring customer satisfaction

Organizations are increasingly interested in retaining existing customers whiletargeting non-customers; measuring customer satisfaction provides an indication of how successful the organization is at providing products and/or services to themarketplace.

Customer satisfaction is an ambiguous and abstract concept and the actualmanifestation of the state of satisfaction will vary from person to person and product/service to product/service. The state of satisfaction depends on a number of both psychological and physical variables which correlate with satisfaction behaviorssuch as return and recommend rate. The level of satisfaction can also vary depending

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA38

-

8/6/2019 tariq ali 1

39/62

Customer Satisfaction towards HDFC LIFE

on other options the customer may have and other products against which the customer can compare the organization's products.

Becausesatisfactionis basically a psychological state, care should be taken in theeffort of quantitative measurement, although a large quantity of research in this area hasrecently been developed. Work done by Berry, Brooder between 1990 and 1998defined ten 'Quality Values' which influence satisfaction behavior, further expanded byBerry in 2002 and known as the ten domains of satisfaction. These ten domains of satisfaction include: Quality, Value, Timeliness, Efficiency, Ease of Access,

Environment, Inter-departmental Teamwork, Front line Service Behaviors,Commitment to the Customer and Innovation. These factors are emphasized for continuous improvement and organizational change measurement.

Customer Loyalty

"It takes a lot less money to increase your retention of current customers than tofind new ones-but I know I don't give it as much effort as I should because it does take

a lot of energy and effort!"

Strategize And Plan For Loyalty!Do you even have a specific plan for building customer loyalty?I bet you haven't given it as much thought as you should- because to tell the

truth I need to give it more effort also.If you currently retain 70 percent of your customers and you start a program to

improve that to 80 percent, you'll add an additional 10 percent to your growth rate.Particularly because of the high cost of landing new customers versus the high profitability of a loyal customer base, you might want to reflect upon your current business strategy.

These four factors will greatly affect your ability to build a loyal customer base:

Products that are highly differentiated from those of the competition.

Higher-end products where price is not the primary buying factor.

Products with a high service component.

Multiple products for the same customer.GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA

39

http://en.wikipedia.org/wiki/Satisfactionhttp://en.wikipedia.org/wiki/Satisfaction -

8/6/2019 tariq ali 1

40/62

Customer Satisfaction towards HDFC LIFE

Market to Your Own Customers!

Giving a lot of thought to your marketing programs aimed at current customersis one aspect of building customer loyalty.

When you buy a new car, many dealers will within minutes try to sell you anextended warranty, an alarm system, and maybe rust proofing. It's often a very easysale and costs the dealer almost nothing to make. Are there additional products or services you can sell your customers.

Use Complaints To Build Business !When customers aren't happy with your business they usually won't complain to

you - instead, they'll probably complain to just about everyone else they know - andtake their business to your competition next time. That's why an increasing number of businesses are making follow-up calls or mailing satisfaction questionnaires after thesale is made. They find that if they promptly follow up and resolve a customer'scomplaint, the customer might be even more likely to do business than the average

customer who didn't have a complaint.

Reach Out To Your Customers !

Contact . . . contact . . . contact with current customers is a good way to buildtheir loyalty. The more the customer sees someone from your firm, the more likelyyou'll get the next order. Send Christmas cards, see them at trade shows, stop by tomake sure everything's okay.

Send a simple newsletter to your customers-tell them about the great things thatare happening at your firm and include some useful information for them. Send themcopies of any media clippings about your firm. Invite them to free seminars.

Loyal Customers and Loyal Workforces

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA40

-

8/6/2019 tariq ali 1

41/62

Customer Satisfaction towards HDFC LIFE

Building customer loyalty will be a lot easier if you have a loyal workforce-notat all a given these days. It is especially important for you to retain those employees

who interact with customers such as sales people, technical support, and customer-service people. Many companies give a lot of attention to retaining sales people butlittle to support people. I've been fortunate to have the same great people in customer service for years-and the compliments from customers make it clear that they reallyappreciate specific people in our service function.

The increasing trend today is to send customer-service and technical-supportcalls into queue for the next available person. This builds no personal loyalty and

probably less loyalty for the firm. Before you go this route, be sure this is what your customers.

MARKETING

MARKETTING JOB IS TO CONVERT SOCIETAL NEEDS IN TOPROFITABLE OPPORTUNITIES.

Definition of marketing as follows:

Marketing is a social managerial process by which individuals and groupobtain what the need and want through creating. Offering and exchanging products of value with others.

This definition of marketing rests on the following core concepts needs, wantsand elements, products (goods, services and ideas); value cost and satisfactionexchange and transactions, relationships and networks, markets and marketers and prospects.

THE MAKETING CONCEPT

The marketing concept hold that key to achieving organizations goals consistsof being more effective than competitor in integrating more effective then competitive

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA41

-

8/6/2019 tariq ali 1

42/62

Customer Satisfaction towards HDFC LIFE

in integrating marketing activities towards determining and satisfying the needs andwants of target markets.

CHAPTER-IV

DATA ANALYSIS AND INTERPRETATION

4.1. Are you Aware of HDFC life company.

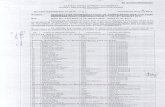

Table 4.1 Aware of HDFC life company

Decision Responses Percentages

Yes 100 100% No 0 0%Total 100 100%

Graph 4.1 Awareness of HDFC life company

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA42

-

8/6/2019 tariq ali 1

43/62

Customer Satisfaction towards HDFC LIFE

100%

0%

Yes

No

Inference:

From the above table it is inferred that out of 100 respondents, 100 % have

aware the HDFC life company.

4.2 Know about the brand HDFC life company

Table 4.2 Know about the brand HDFC life

Decision Responses Percentages

Print media 4 4%Television 2 2%Friends & Relatives 64 64%Dealers 30 30%Total 100 100%

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA43

-

8/6/2019 tariq ali 1

44/62

Customer Satisfaction towards HDFC LIFE

Graph 4.2 Know about the brand HDFC life

4% 2%

64%

30%

Print media

Television

Friends & Rel

Dealers

Inference:

From the above table it is inferred that out of 100 respondents, 4% customersare known about The HDFC life through print media, 2% customers are known about

the HDFC life through television 64% through friends and 30% through dealers.

4.3 HDFC life is the best company in A.P.

Table 4.3 HDFC life is the best company in A.P.

Decision Responses Percentages

Strongly Agree 39 39%Agree 33 33% Not decide 0 0%Disagree 28 28%Strongly disagree 0 0%Total 100 100%

GLOBAL COLLEGE OF ENGINEERING & TECHNOLOGY,KADAPA44

-