Paper 1 Vol 4 No 1

Transcript of Paper 1 Vol 4 No 1

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 1/20

1

OPERATIONS AND SUPPLY CHAIN MANAGEMENT

Vol. 4, No. 1, January 2011, pp. 1-20ISSN 1979-3561|EISSN 1979-3871

Yosi A. Hidayat†1, Katsuhiko Takahashi2, Katsumi Morikawa3, Kunihiro Hamada4

Department of Artificial Complex Systems Engineering1, 2, 3

Department of Social and Environmental Engineering4

Graduate School of Engineering,Hiroshima University, Higashi Hiroshima 7397527, JAPANEmail: [email protected], [email protected],[email protected]

Lucia Diawati5, Andi Cakravastia6

Department of Industrial Engineering1, 5, 6

InstitutTeknologi Bandung, Bandung 40132, INDONESIAEmail: [email protected]†1, [email protected],[email protected]

Partner Selection in Supplier-Buyer Relationship

with Integration of Leadtime Decisions

under Demand Uncertainty Situation

Abstract

We developed a procurement decision model, which takes into account partner selection and optimal orderquantity with the integration of a planned production leadtime operational decision. Leadtime is taken intoaccount in time and cost performance to achieve on-time delivery of a supply chain (SC) system. We contrastthe three following original equipment manufacturer (OEM) conditions, (1) longer leadtime to the buyer butat a lower cost for the supplier, so the buyer has to add crashing cost to reduce the leadtime; (2) less leadtimeto the buyer but at a higher cost for the supplier; (3) shorter leadtime to the buyer by adding crashing cost to

reduce the inventory cost. Taking into consideration the impact of demand uncertainty directly to the buyers,we focus on simultaneous procedures in achieving an optimal solution. Our model considers an objectivefunction consisting of operational costs and lead time decision under integrated supply chain entities (suppliers,sub-assembly manufacturers (OEMs), and buyers). Based on our numerical results, by trading-off inventorycost and leadtime crashing cost, the best possible combinations of partners in fulfilling demand from themarket are B

1-A

2-S

2and B

2-A

1-S

3. We found that these two combinations give $141,102.95 total profit per year

to the SC system. We proposed appropriate strategies that could be applied at OEM by considering orderarrival timing and leadtime.

Keywords: demand uncertainty,optimum leadtime decision, partner selection, supply chain management.

1. IntroductionSupply chain management (SCM) is the

management of activities that transforms rawmaterials into intermediate goods and final products,and then delivers those final products to customers.These supply chain activities involve purchasing,manufacturing, distribution, and transportation tomarket. From an operational perspective, the goal ofSCM is to integrate suppliers, manufacturers,

warehouses, and stores, so that merchandise isproduced and distributed at the right quantities, to theright locations, and at the right time to minimizesystem-wide cost while satisfying service requirementsin the most effective way (Simchi-Levi et al., 2000).Attainment of this goal may be hindered when theappropriate strategic partner decision is separatedfrom important operational decisions due to demanduncertainty, which directly impacts buyers.

*Corresponding Author

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 2/20

2

Considering the fact that the buyer must builddifferent kind of products to meet anticipatedcustomer demand, and since future demand is usuallyuncertain, it is difficult to set plans at the right level

in procuring the appropriate material. Subsequently,demand uncertainty is one of the most importantfactors significantly impacting SC performance.Because procurement can only be done once withinone period, the optimal procurement lot size shouldbe properly determined. In a probabilistic inventory,the overstock inventory still can be used in the nextplanning period, so it only impacts the holding cost.While at the end of the selling season, the product’sprice will be decreased or discounted because of thedeterioration of function, model, and technology willbe outdated (Hidayat et al., 2009).

In fact, the on-time delivery of an assemblysystem generally diminishes due to product orcomponent shortages. The cost considered in thissituation is the under-stock cost. Shortages often resultin losses in production capacity and/or customers’goodwill induced by missed product delivery dates.The primary cause of component shortage is theinherent uncertainty associated with procurementand/or manufacturing leadtimes, which can beattributed to a variety of reasons ranging fromunexpected delays in shipping, transportation, andreceiving times to variable setup, processing, andinspection times.

In inventory with uncertainty, leadtime can bereduced at an added cost. By reducing the leadtime,customer service and responsiveness to production-schedule changes can be improved and reduction insafety stocks can be achieved. Manufacturers also tendto reduce the total operation cost while trying to satisfyobjectives in leadtime and delivery promptness, sothat more profit can be attained.

Our model integrates uncertainty in forms ofmarket demand probability information with strategic

and operational decisions in a single framework. Themodel will be able to capture the costs of tactical and/or operational functions of the supply chain underuncertainty. Optimal leadtime decisions betweenbuyers and original equipment manufacturers(OEMs) that minimize the total amount of items outof stock and inventory holding costs by adding thepossibility to reduce them, which is reflected in theleadtime crashing cost, together with optimalprocurement, economic order quantity (EOQ), and

partner decisions under demand uncertainty are alsointegrated in our multi-echelon inventory model.

Our purpose is to develop procurement decisionregarding strategic partner selection and optimal

order quantity with the integration of leadtimeoperational decisions. Taking into consideration thedirect impact of demand uncertainty to buyers,subsequently to the amount of inventory of OEMs asthe decoupling point in our SC system, we focus onsimultaneous procedures in achieving an optimalsolution. Three entities in SC networks (suppliers, sub-assembly manufacturers (OEMs), and buyers) areintegrated into one objective function, maximizingtotal SC profit, which contrasts leadtime crashing costversus inventory cost in the total operational cost.Previous studies related to the issues of supplierselection in the supplier-buyer relationship anduncertainties in terms of demand and leadtime inSCM are discussed in Section 2. In Section 3, we statethe problem to be addressed which selects appropriateSC partner by considering demand uncertainty andlead time decision and contrasting inventory versuscrashing costs. In Section 4, we formulate a mixed-integer linear programming model for integratedstrategic partner selection and operational leadtimedecision by considering demand uncertainty. We thenpresent and discuss some computational results andanalysis in Section 5. Finally, Section 6 highlights theresults of the study and discusses the direction forfuture work.

2. Literature Review

There are a significant number of documented studiesin the area of operations research and managementscience in SC that address some of these issues relatedto partner selection and uncertainty.

In a supplier-buyer relationship, the partnerselection process becomes an important strategic

decision. Focusing on a single element (buyer only orsupplier only) in the SC cannot assure the effectivenessof the network (Croom, 2001). In partner selection,there has been plenty of research since the seminalwork by Dickson (1966). Also, Chan et al. (2004)provide a comprehensive review and classification ofpricing and inventory coordination problemsdiscussed in the literature of SC. Weber and Current(1993) discussed a multi-criteria analysis for vendorselection. They developed a model for minimizing

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 3/20

3

total cost, late deliveries, and supply rejection dueto both infrastructure constraints and constraintsimposed by the company’s policy. Chaudhary et al.(1993) developed a linear programming model for

vendor selection with price breaks. Degraeve et al.(2000) reviewed and evaluated a number of vendorselection models, by using the total cost of ownershipas a basis for comparison. They obtained the relativeefficiency of the models and showed thatmathematical programming models outperformrating models by solving all the models for a singlereal-life dataset of a purchasing problem. Currentand Weber (1994) extended the extensive literaturein facility location problems to the solution of vendorselection problems. de Boer et al. (2001) provided acomprehensive review of published decision

methods for vendor selection and classified themunder a framework that takes into account thediversity of purchasing scenarios and covers allphases of the vendor selection process. Most of theresearch mentioned above only considered thetactical or strategic level in these decisions. Fewconsidered the operational level in this strategicdecision.

With regards to uncertainty, Snyder (2006)concluded his research by identifying four researchavenues applicable within today’s operationresearch technology. One of the avenues is the multiechelon model. In this avenue, Snyder (2006) statedthat there is a need for models that capture the costsof tactical and/or operational functions of thesupply chain under uncertainty.

Demand uncertainty is the most obvious andsignificant source of uncertainty for most systems(Arda and Hennet, 2006). Therefore, managinguncertainty is inevitable for a component thatrequires sophisticated technology and themanufacturer guarantees that the damageprobability of this component is very low for the

life of the product. The manufacturer produces onlya limited number of components based only onorder, and reorder usually is not allowed.

Sabri and Beamon (2000) stated in theirresearch that uncertainty (e.g. customer demands,exchanges rates, travel times, amount of returns inreverse logistics, supply leadtime, transportationcosts, and holding costs) is one of the mostchallenging but important problems in supply chainmanagement.

If a probabilistic behavior is associated withuncertain parameters (either by using probabilitydistributions or by considering a set of discretescenarios each of which with some subjectivity

probability of occurrence), then a stochastic modelmay be the most appropriate for this situation (Meloet al., 2009). Another modeling possibility ariseswhen some parameters predictably change over time(e.g. demand levels and costs).

Under uncertainty, an overstock product cannotbe used in the future because of its life cycle, and itsfunction, model and technology are outdated(Hidayat et al., 2009). In this research, they found thatby considering demand uncertainty, the buyer willbecome more responsive to the market, thus affectingthe expected leadtime delivery delay and more ableto reduce the risk of under-stock and over stockconditions that impact the expected total cost.

Demand uncertainty with regards to inventoryproblems also encourages us in integrating this issuein a strategic partner selection decision. Hillier (2002)developed a model for considering purchasing,ordering, inventory, and shortage costs wherecomponents are replenished independentlyaccording to lot size and reorder point policy.

Ma et al. (2002) developed a multi-period andmultistage assembly network model with multipleproducts and stochastic demands, and proposed ascheme to express the desired base-stock level at eachstocking point as a function of the correspondingachieved fill rate. Lin et al. (2006) analyzed thequantitative relationship between leadtime and theinventory level of common components and foundefficient ways to determine customization level,optimize inventory management, and lower costs ina multi-period model of component commonalitywith leadtime.

Mohebbi and Choobineh (2005) studied theimpact of introducing component commonality into

an assemble-to-order environment when demand issubject to random variations and componentprocurement orders experience random delays. Byusing simulated data, they showed that componentcommonality significantly interacts with demand andSC uncertainties, and the benefits of componentcommonality are most pronounced when bothuncertainties exist.

Nonas (2007) considered the problem of findingthe optimal inventory level for components in an

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 4/20

4

assembly system where multiple products sharecommon components in the presence of randomdemand. The inventory problem he considered ismodeled as a two-stage stochastic recourse problem

where the first stage is to set the inventory levels tomaximize expected profit, while the second stage isto allocate components to products after observingdemand.

Regarding the issue of leadtime uncertainty inassembly systems, several studies took the dual-sourcing technique into consideration when thesuppliers’ leadtimes are stochastic, but much lessresearch was concerned with the coordinationproblem in supply leadtime uncertainty. Yano (1987)considered the coordination problem when thesupply leadtimes are stochastic for differentcomponents in an assembly system. Hopp andSpearman (1993) considered the problem of settingoptimal leadtimes in an assembly system where allcomponents are purchased and the onlymanufacturing operation is the final assembly. Theydescribed two formulations of the problem: (1)minimizing total inventory-carrying and tardinesscosts and (2) minimizing inventory-carrying costssubject to a service constraint. Hegedus and Hopp(2000) described a practical method for setting safetyleadtimes for purchased components in assemblysystems with uncertainty in the supply process.

Tang and Grubbstroom (2003) studied a detailedcoordination problem in a two-level assembly systemwith stochastic leadtimes for lower-level items anddeterministic demand for the finished item. Theyfound that the optimal safety leadtime is the differencebetween planned and expected leadtimes. In thisresearch, we enhanced their research in solving theoptimal planned leadtimes to minimize the totalamount of out-of-stock items/components andinventory holding costs by adding the possibility toreduce them, which is reflected in the leadtime

crashing cost, together with optimal procurement,EOQ, and partner decisions under demanduncertainty.

According to our literature studies regardingsupplier selection, most of the research mentionedabove only considered a tactical or strategic level intheir decisions. Few researchers considered theoperational level in this strategic decision. Li andO’Brien (1999) developed a model of the supplier-buyer relationship in a hierarchical way of both

strategic and operational levels, but in a sequentialflow. In their research, after the partner selectionprocess, then at the operational level, manufacturingand logistics activities were optimized under given

targets. We enhanced this sequential flow with asimultaneous one and by adding new factor, demanduncertainty and leadtime decisions.

Regarding leadtime as an operational decision,the previous research only considered leadtimedecisions as time unit measurement decisions toachieve on-time delivery performance. They did notintegrate leadtime delivery decisions with the totalSC cost or profit. We integrated these decisions withthe expected total SC cost; which finally affects thetotal SC profit as the integrated objective function.

3. Problem Statement

We assume an SC which comprises a number ofcomponent suppliers, sub-assembly manufacturersfacilities (OEM facilities), and buyers in differentgeographical locations and interacting throughglobal marketplaces. We assume a globalmarketplace for components through whichcomponent suppliers sell a variety of componentsto a sub-assembly manufacturer (OEM). The OEMuses these components in the production of a variety

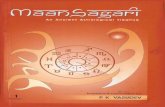

of sub-assemblies in its manufacturing facilities.These sub-assemblies are then sold to buyersthrough sub-assemblies marketplaces. The buyerscan be defined as multinational-sales companies ofOEMs or independent distributors. Our SCconfiguration is shown in Figure 1.

Demand uncertainty as a new factor in thisproposed model is affected by customer buyingbehavior, which is reflected by potential benefits ofdemand forecasting and its probability to reduce therisk of overstocking or shortage. There are threeconditions (two non-ideal and one ideal) that might

exist, (1) real demand is more than procurementquantity (under-stock condition exists) (2) realdemand is less than procurement quantity (overstockcondition exists), and (3) real demand is the same asprocurement quantity (no overstock and under-stock). For achieving a win-win solution among thesethree conditions, we should find the optimal quotedprocurement quantity per year and quoted EOQ perorder that maximizes profit by considering demanduncertainty in forms of probability. One of these three

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 5/20

5

S1

S2

S3

A1

B1

A2

B2

physical flows of component and product

Candidates of Component Suppliers( )

Candidates of AssemblyManufacturer (OEM’s)( )

Candidates of Buyers ( i )

Demanduncertainties

)Pr,),( ,( :

, u s C C DP D Parameters

Economicorder quantity

(Q*)

Optimumprocurement lot

size quantity (K*)

Binary variables that show

supply from OEMs j to buyer i and supply from supplier k to

OEMs j

Decision variables

Planned productionleadtime (L)

1 unit of product ~

1 unit of component

Parameters

Unit material,transportation,

production, carrying,

ordering costs

Minimum productionthroughput time

Normal productionleadtime

conditions is faced by buyers because of the direct

effect of demand uncertainty from the market.To anticipate leadtime uncertainty among

suppliers and contingent orders from buyers, OEMsshould act as a product decoupling point. The effortin reducing the leadtime will induce an increase inthe crashing cost, but the decrease in leadtime canreduce the safety stock of OEMs. The determinationof the optimum leadtime leads to the determinationof demand during leadtime and the optimum orderquantity. The optimum order quantity will induce theordering cost, so the change in leadtime leads to achange in inventory and optimum order quantity, andfurthermore to the ordering cost.

Our research also integrates the leadtimeoperational decision that will impact inventory andcrashing costs, and finally will be imposed on the totaloperational cost and the strategic partner selectiondecision. The basic idea to add this consideration isto get some trade-offs with the following three OEMcondition, (1) longer leadtime to the buyer but at alower cost for the supplier, so the buyer has to add

crashing cost to reduce the leadtime; (2) less leadtime

to the buyer but at a higher cost for the supplier; (3)shorter leadtime to the buyer by adding crashing costto reduce the inventory cost.

According to the above situation, we classify twotypes of stock points that are necessary betweenOEMs and buyers in our SC structure. Before aproduct is sold to a buyer, considering the leadtimebetween OEMs and buyers, OEMs should have someinventory to anticipate contingent orders(counteracted by the demand safety factor) frombuyers and some delay from suppliers. Therefore, thesafety stock level of OEMs is a function of leadtime.Excess inventories of OEMs for both products andcomponents can be stored and used for the nextperiods. The holding cost of an OEM product beforeit is sold to buyers is calculated using Eq. (19). Weassume that the leadtime of the supplier to the OEMis zero for components. The holding cost of an OEMcomponent is calculated using Eq. (20).

On the other hand, after the finished product issold to buyers, it becomes the inventory of these

Figure 1. Supply chain configuration

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 6/20

6

buyers. This inventory of buyers is similar to thenewsboy inventory problem, where excess inventoriesare salvaged. There are only overstock and under-stock costs, calculated using Eqs. (1) to (11). This is

due to the fact that a high-technology content productas defined in Hidayat et al. (2009), such as automobilesproducts, has a distinctive life cycle pattern. Underuncertainty, an overstock product cannot be used inthe future because of its life cycle and because itsfunction, model and technology are outdated(Hidayat et al., 2009). This principal is used by buyersin determining the optimal demand lot size byconsidering the probability of demand, under-stock,and overstock costs.

After deciding the optimal lot sizes, buyers sendthe order information to the OEMs and later, theOEMs send the information to the suppliers. Thisflow of information means that buyers do not haveinventory stock. Moreover, excess inventories ofbuyers are salvaged. However, for OEMs andsuppliers, excess product and componentinventories can be stored and used for the nextperiods. The number of inventories in OEMs is alsoinduced by the leadtime between buyers and OEMs.In brief, buyers own the overstock and under-stockcosts, while OEMs own the inventory holding cost.

Regarding crashing cost, the OEMs inform thebuyers of their minimum production throughput time(days) and normal production leadtime (days) for aproduct. To avoid overstock and under-stockconditions, and also considering demand uncertainty(demand probability from the market), buyers alsoconsider the possibility of shortening the deliveryleadtime to fulfil market demand by paying crashingcost. These flows are closed-loop flows. According tothe flow of information, the related costs of suppliers,OEMs, and buyers that finally induce the total supplychain profit are developed in our model.

4. Model Development

We developed a model for supply chain planning thatharnesses the information within global marketplaces.Specifically, we determine the optimal procurementquantities within the selected partner in thedownstream and upstream marketplaces and selectthe SC configuration within marketplaces that willallow us to meet the demand. This decision is basedupon the product demand in the downstream

marketplaces in the SC after the members ofdownstream marketplace consider demanduncertainty and leadtime factors from the market andsupply of materials in the upstream marketplaces of

the SC. In particular, this research will inevitably playan important role in this SC in the context of the globalSC for components and sub-assembly products.

Model Assumptions

The following assumptions were used in developingour model:

1. The leadtimeL is deterministic, and the demandis stochastic.

2. Demand of a product is derived from the marketby stochastic conditions with the information ofits probability of event.

3. Products and components will be ordered at thebeginning of each planning period in one planninghorizon. Products decrease at a constant speed,whereas components decrease at a lot sizeconsumed by their supported products.

4. Considering the leadtime between OEMs andbuyers, the OEMs should have safety stock toanticipate fluctuant and uncertain demand. In thiscase, leadtime affects safety stock and finally theinventory cost of the OEMs.

5. After determining the optimal leadtime andoptimal order quantity, buyers release orders to

OEMs, who in turn release orders to theirsuppliers. The release orders from the buyers arefixed and contain only the quantity of componentsand products that will be supplied from the OEMsto the buyers and from the suppliers to the OEMs.There is some leadtime between OEMs and buyersand zero leadtime between OEMs and theirsuppliers. The existence of leadtime results in theneed of product safety stocks in OEMs.

6. A lot-for-lot (L4L) policy is used to determine thesizes of component procurement orders that willbe attached to products. This policy is integrated

using the concept of a multi- echelon deterministicinventory system.

7. The ordering lot size is fixed for every order.

8. The ordered parts will be supplied at the time oforder but will be consumed lot-per-lot.

9. The price of components does not depend on theorder lot size (no discounted price).

10. There are no production capacity or storageconstraints.

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 7/20

7

Variables

Parameters

Model Notations

By referring to the supply chain structure in Figure 1,together with the model assumptions, we developeda list of parameters and variables in the developed

model, as listed in Table 1.

4.1 Objective Function

The expected total profit is considered in our modelas an integrative objective function to obtain optimaldecision variables. This integrated objective functiontakes into account the expected total operationalcosts by trading-off inventory and leadtime crashingcost together with the under-stock and overstockcosts faced by buyers.

Demand uncertainty, as a new factor in thisproposed model, is affected by customer buyingbehavior that is reflected by potential benefits ofdemand forecasting and its probability in order toreduce the risk of overstocking or shortage. In this

case, potential demand and its probability, costs formaterial (C

m) fixed production (C

p) transportation

(Cr), under-stock condition (C

u), overstock cost

condition (Cs), carried materials (HCM), carried

finished products (HCP), ordered materials (EAM),ordered finished products (EAF), and leadtimecrashing cost (LCC) together with product price (P

r)

are considered to determine the total expected profitas, shown in Eq. (1).

Equation (1) shows the relationship betweentotal expected profit, expected profit if the buyerprocures K units of a component when the realdemand is D units, and the probability of demandalong the planning period. Subsequently, Eq. (1) isimpacted by the operational cost of the SC system.This relationship will interconnect the influence ofdemand uncertainty and the decision of partnerselection. The indexes i, j, k, t indicate that all pricesand costs depend on where to produce and fromwhich suppliers the component is supplied. Thedecisions that show “where to produce” and “from

Table 1. Notations and definitions of parameters, variables, anddecision variables

Index

i Buyer ’s index ( i=1,2,.. .,n)

j Assembly component manufacturer’s (OEM’s) index (J=1,2,....,o1)

k Component supplier’s index (k=1,2,...., uij)

t Alternatives of demand lot sizes(t= 1,2,....,z), z is maximum demand

lot sizes during planning horizon.l Number of crashing component (l=1,2,..., w)

s Safety fac tor o f demand

D Forecasted market demand (unit/year)

P(D) Probability of demand D

Pr

Finished product selling price ($/unit)

Cm

Component purchasing cost ($/unit)

Cp

Fixed production cost ($/unit)

Cr

Transportation cost ($/unit)

Cu

Buyer’s under-stock cost ($/unit)

Cs Buyer’s overstock cost ($/unit)C

rtUnit costs reducing production leadtime of component ($/day)

Hm

Unit stock carrying cost of component ($/time unit)

Hf

Unit stock carrying cost of finished product ($/time unit)

Am

Unit ordering cost of component from OEMs to supplier ($/order)

Af

Unit ordering cost of finished product from buyer to OEMs ($/order)

PLmin

Minimum production throughput time (days)

PLnormal

Normal production leadtime (days)

Variables

ETC Expected total cost ($/year)

LCC Expected leadtime crashing cost ($/year)

HCM Total stocks carrying cost of component ($/year)

HCF Total stocks carrying cost of finished product ($/year)

EF(K) Expected profit of buyer when buyer procures K unit

EAM Total ordering cost of component ($/year)

EAF Total ordering cost of finished product ($/year)

F(K →D) Profit pay off if buyer procures K unit of component, when real

demand is D units

r Reorder point

DL Expected demand during leadt ime

DecisionVariables

bji

Binary variable that shows supply from OEMs j to buyer i

bkj

Binary variable that shows supply from supplier k to OEMs j

L Planned production leadtime (time unit)

K* Optimal procurement quantity (unit/year)

Q* Economic order quantity (unit/order)

sσ√L Safety s tock level

t* Optimal lot sizes when demand unit is equal to procurement unit

(ideal condition, no shortage or overstock). In this case, demandunit equals procurement unit. Otherwise, if 1≤ t <t*, then overstock

condition exists, and t*<t <z , then under-stock condition exists.

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 8/20

8

where to procure” are indicated in the binarydecision variables in Eq. (32), which are related tothe strategic partner selection decision.

Objective Function: Maximize

(1)

There are two non-ideal conditions that mightexist, (1) real demand is more than the procurementquantity (under-stock condition exists) (2) realdemand is less than the procurement quantity(overstock condition exists). Buyers need to find theoptimal quoted procurement quantity per year andquoted EOQ per order that maximize the totalsupply chain profit by considering demand

probability. Furthermore, we would like to set themathematical relationships related to demanduncertainty and related variables. Equations (2) to(11) are related to the determination of optimalquantity to be procured to maximize profit of SCsystems.

In a non-ideal condition, whether demandquantity is more or less than the procurementquantity, the excess or shortage of products will affectthe expected profit in each combination of situations.

(2)

(3)

If we consider under-stock cost as (Di-K

i)C and

overstock cost as (Ki-D

i) C, then a buyer can estimate

the optimal quantity to be procured by comparingthe expected total profit that can be gained if he/shedecides to procure that quantity, as shown in Eq. (4).This buyer’s decision induces the physical andinformation flow along the SC.

(4)

(5)

t t

(6)

(7)

(8)

(9)

Equations (7) and (9) lead us to the finalconclusion of the probability of the optimalprocurement unit by considering related variables,as expressed in Eqs. (10) and (11). Henceforth, theprobability value for each alternative of a supplier-buyer combination will be used as the demanduncertainty factor, (Pt*)and integrated into thematerial input and product output processes.

(10)

(11)

4.3.2 Detailed Explanation of CostComponents in Determining TotalExpected Profit

The expected total cost is the sum of the materialcost, fixed production and transportation costs,

components and products holding cost, componentsand products ordering cost, and leadtime crashingcost for the entire SC. The total relevant cost isdenoted by ETC (Q

ij, Q

ij,L

ij), as shown in Eq. (12).

(12)

i

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

t t

( ) ( ) ( ){ } ( )[ ]

( ) ( ){ } ( )[ ]∑∑∑∑

∑∑∑∑

= = = =

= = =

−

=

−−−+

−−−=

ij i

ij i

u

k

o

j

n

i

z

t t

t

ii

t

i

t

i

t

iijk i

u

k

o

j

n

i

t

t

t

i

t

iiijk

t

iii

DP CuK DK ETC

DP K CsETC DCsK EF

1 1 1 *

1 1 1

1*

1

Pr

Pr

( ) ( )( ) ( )( ) ( )( ) ( )( )

( )( ) ( )( ) ( )( ) ( )( )t

i

t

ii

t

i

t

ii

t

i

t

iijk

u

k

o

j

n

i

z

t t

t

i

t

ii

t

i

t

ii

t

i

t

iijk

t

i

t

ii

u

k

o

j

n

i

t

t

t

i

t

ii

DP K CuDP DCuDP K ETC DP K

DP K CsDP K ETC DP DCsDP DK EF

ij i

ij i

−+−+

+−−=

∑∑∑∑

∑∑∑∑

= = = =

= = =

−

=

1 1 1 *

1 1 1

1*

1

Pr

Pr

( ) ( ) iK EF K EF t

i

t

i ∀<−+ for ;01*1*

( ) ( ) ( ) k jiDP CsCuCsETC z

t t

t iiiiiijk ,,;0Pr

1*

∀<∑−+−−−+=

for

( )( )

k jiCsCu

CsETC DP

iii

iijk z

t t

t

i ,,for ;Pr 1*

∀−+

−<∑

+=

( ) ( ) iK F K EF t

i

t

i ∀<−− for ;0*1*

( ) ( ) ( ) k jiDP CsCuCsETC z

t t

t

iiiiiijk ,,for ;0Pr *

∀<−+−− ∑=

( ) ( )( )k ji

CsCuCsETC DP

iii

iijk z

t t

t i ,,;

Pr *∀

−+−<∑

=for

( )( )

( )( ) k jiDP

CsCu

CsETC DP

z

t t

t

i

iii

iijk z

t t

t

i ,,for ;Pr 1**

∀>−+

−> ∑∑

+==

( )( )

( ) k jiK z P CsCu

CsETC K z P

t i

iii

iijk t i ,,;

Pr

1** ∀≥>−+

−>≥ +

for

( )( ) ( )

∑ ∑ ∑∑

⎪⎪

⎭

⎪⎪

⎬

⎫

⎪⎪

⎩

⎪⎪

⎨

⎧

⎥⎦

⎤⎢⎣

⎡∑ −+∑ −+

⎟⎟

⎠

⎞

⎜⎜

⎝

⎛ +⎟

⎟

⎠

⎞

⎜⎜

⎝

⎛ +⎟

⎟⎠

⎞⎜⎜⎝

⎛ ++++

== = = = −

==−

iju

k

io

j

n

i

z

t w

l l ijl ij

l ijrt

w

l l ijl ij

l ijrt ij

t i

ij

t i

ijjk

t i

jk ijt iij

ijij

jk jk jk

t ijk

t i

ijjk ij

PLPLnormal cLLcQ

D

Q

DA

Q

DALs

Qh

QhCr DCmD

LQQETC 1 1 1 1 1

11)1(

,,,

min

22σ

[ ]( ) ( )t i

n

i

z

t

t i DP DK F K EF ∑ ∑ →=

= =1 1

)(

[ ]( ) ( ){ } ( ){ }[ ] t

i

t

i

u

k j

n

i

t

t

t

iiijk

t

iijk i

t

i K DK CsETC DETC DK F ij io

<−−−=→ ∑∑∑∑= = =

−

=

if ;Pr

1 1 1

1

1

*

[ ]( ) ( ){ } ( ){ }[ ] t i

t i

iju

k

io

j

n

i

z

t t i

t i

t i

t iijk i

t i K DCuK DK ETC DK F ≥∑ ∑ ∑ ∑ −−−=→

= = = = if ;Pr

1 1 1 *

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 9/20

9

4.3.2.1 Variable costs related to time-basedmeasurement

The total cost components in Eq. (12) consists of twotypes of cost categories, fixed cost (material, production,and transportation costs) and variable cost (inventory,ordering, and leadtime crashing costs) that are relatedto time-based measurement (leadtime decision). In thissubsection, we explain in more detail the variable coststhat are affected by leadtime decision.

Considering that leadtime has l components foreach OEM manufacturing facility. The lth componentfor each possible buyer i and OEM j combination has aminimum production throughput time PL

, normal

production leadtime PL

, and a crashing cost perunit time c . The leadtime components are crashedone at a time starting with the component of least

crt .

The inter-dependence among the leadtime componentsmay require crashing of more than one component ata time. In many realistic cases, the leadtime componentsare independent. We assume that there is no inter-dependence among leadtime components.

Let L be the length of the leadtime withcomponents 1,2,3,.... w, which is crashed to theirminimum, and then we obtain Eqs. (13) and (14).

(13)

(14)

The leadtime crashing cost LCC(Lij) for a given is

L < Lij ≤ L given by Eq. (15).

(15)

The reorder point is given by Eq. (16), which is

related to leadtime decision. Di Lij in Eq. (16) is theexpected optimal demand of buyer i during theleadtime consumed by OEM j to deliver products tobuyer i, and s

ijσ

i√L

ijin Eq. (16) is the product safety

stocks for buyer i

(16)

minl

normall

rtijl

ijl

jiLPLnormal LPLL ij

w

l l ijij

w

l l ijij ,;min

max11

min∀=∑≤≤∑=

==

jiPLPLnormal LLw

l l ijl ijijij ,;min

1

1max

∀⎟⎠

⎞⎜⎝

⎛ ∑ −−=−

=

ijl

ijl -1

( ) ( ) ( )∑ −+−=−

=−

1

1)1(

minw

l l ijl ijl ijrt l ijl ijl ijrt ij PLPLnormal cLLcLLCC

t

t

Where sij

is known safety factor of OEM j foranticipating contingent order from buyer i. Indetermining the optimal safety factor, we use theechelon holding cost concept, shown as Eq. (17).

(17)

To anticipate leadtime and demand uncertaintyand avoid production delay, the OEMs in the SCsystem need some product safety stocks. On the otherhand, the leadtime between the OEMs and suppliersis zero. In this case, the OEMs and suppliers do notnecessary provide safety stock for components.Subsequently, the inventory consumption pattern of

the product from OEMs to buyers and the inventoryconsumption pattern of the component from suppliersto OEMs are different.

For OEMs, the inventory-carrying cost per yearis h

ijI

ij(Q

ij,r

ij), where I

ij(Q

ij,r

ij), is the average on-hand

inventory that can be approximated by the averagenet inventory if the back-order during a replenishmentcycle is small or even zero compared with the cyclelength. The expected net inventory immediatelybefore and after the receipt of an order of size Q

ijis

rij- D

iand Q

ij+ r

ij- D

iL

ij, respectively. If we assume a

linear de crease over the cycle, then we obtain Eq.

(18).

(18)

In developing the inventory cost, we use theconcept of a multi-echelon serial inventory system.According to this concept, we assume that oneproduct is produced from one unit of components,which, in turn, is obtained from a supplier. Whendelivering a batch, all the components are deliveredat the same time but consumed per lot. No

backorders are allowed. The product will bedelivered at the same time based on the order fromthe buyers and the number of the product willconstantly decrease. The above explanations bringus to Eqs. (19) to (23).

(19)

t jiLsLDr ijt iijij

t iij ,,;∀+= σ

rij

= expected demand during lead time + product safety stock (SSij)

SSij

= ssij

x (standard deviation of lead time demand);

( )jk ij

jk ijjk ij

hA

hhAs

−=

t* t*

( ) t jiLsQ

LDr Q

r QI ijt iij

ijij

t iij

ijijij

t ij ,,;

22, ∀+=−+≅ σ

( )( )

∑ ∑∑

∑∑ ∑∑∑

= = =

= = == =

⎟⎟⎠

⎞⎜⎜⎝

⎛ +=

⎟⎟⎠

⎞⎜⎜⎝

⎛ −+≅=

=

i

ii

o

j

n

iij

t iij

ijz

t ij

ij

t

iij

ijo

j

n

i

z

t ij

o

j

n

iijijijij

LsQ

h

LDr Q

hr QI hHCF

1 1 1

1 1 11 1

2

2,

OEM)(byproducts of costcarrying stocks Total

σ

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 10/20

10

(20)

(21)

(22)

(23)

⎟⎟⎠

⎞⎜⎜⎝

⎛

==

∑∑= = 2

OEM)(bycomponents of costcarrying stocks Total

1 1

jk u

k

o

jjk

Qh

HCM

ij i

⎟⎟

⎠

⎞

⎜⎜

⎝

⎛ ==→

∑∑ ∑= = = jk

t

i

u

k

o

j

z

t

jk Q

DA

EAM ij i

1 1 1

supplier)(OEM components of costordering Total

⎟⎟

⎠

⎞

⎜⎜

⎝

⎛

==→

∑∑ ∑= = = ij

t i

o

j

n

i

z

t

ijQ

DA

EAF

i

1 1 1

OEM)(buyer products of costordering Total

( )

( ) ( )⎥⎦

⎤⎢⎣

⎡−+−

==

∑∑∑∑ ∑−

=== = =− l ijl ij

w

l l rt ijij

w

l rt

o

j

n

i

z

t ij

t i

ij

PLPLnormal cLLcQ

D

LLCC

l l ij

i

min

(buyer)costcrashing Expected

1

111 1 11

Notice that in Eq. (12), for fixed Lijk

ETC(Qij,Q

jk,L

ij)

is convex in Qij

dan Qjk

(see Eqs. (24) and (25)).However, for fixed Q

ij,ETC

ijk(Q

ij,Q

jk,L

ij) is concave in

Lijin the interval (L

ij, L

ij] see Eq. (26)). Therefore,

for fixed , the minimum leadtime occurs at the endpoints of the interval.

(24)

(25)

(26)

According to these facts, we developed the

following procedure for finding optimal Qjk, Qij, andL

jk.

(1) For each break point Lij

in Eq. (14), compute inEq. (24).

(2) Compute Qjk

by using the concept of a serialmulti-echelon inventory system in Eq. (25).

(3) Compute the corresponding expected total costin Eq. (12).

( ) ( ) ( ) 0min

2

,, 1

1

)1(22=⎥

⎦

⎤⎢

⎣

⎡∑ −+−−⎟

⎟

⎠

⎞

⎜⎜

⎝

⎛ −⎟

⎟

⎠

⎞⎜⎜

⎝

⎛ =

∂

∂ −

=

−

w

l l ijl ijl rt l ijl ijl rt

ij

t i

ij

t i

ijij

ij

jk jk ijPLPLnormal cLLc

Q

D

Q

DA

h

Q

LQQETC

( ) ( ) ( )[ ]( ) 2

12

1

1

1)1( 2

min2

⎪⎭

⎪⎬⎫

⎪⎩

⎪⎨⎧ +

=

⎪⎪

⎭

⎪⎪

⎬

⎫

⎪⎪

⎩

⎪⎪

⎨

⎧⎟⎟⎠

⎞⎜⎜⎝

⎛ ⎥⎦

⎤⎢⎣

⎡∑ −+−

=

−

=−

ij

ijijt i

ij

w

l l ijl ijl rt l ijl ijl rt

t i

ijh

LLCC AD

h

PLPLnormal cLLcD

Q

)0

,,=

∂

jk

jk jk ij

Q

LQQETC

jk

t ijk

jk h

DAQ

2=∂

)0

2

1,,2

1

=−=∂ −

l rt jk

t i

jk jk ijijij

jk jk ijc

Q

DLsh

L

LQQETC σ

(4) Optimal Qij, Q

jk, L

ij, and will be the values for

which the total expected cost is minimum.

4.3.3 Constraints

The first constraint in Eq. (27) is related to the optimalleadtime decision that should occur between thecumulative minimum and maximum duration times.This condition guarantees that there is no delay onthe SC system.

(27)

(28)

(29)

Equations (30) and (31) show that if there isactivity in variable K

jk, then the value of b

jkwould

be 1. Otherwise, binary variable that showscomponent supply from supplier k to OEM j to buyeri (b

jk) would be zero. M indicates a very large number.

(30)

(31)

1−≤<

l ijijl ij LLL

10 or=ijb

( )ijt ij bM K ≤*

10 or=jk b

( )jk

t

jk bM K ≤

*

Finally, Eq. (32) shows that every stage in theSC can only be supplied from one vendor from theprevious stage.

(32)

11 11 1

=∑ ∑+∑ ∑= == =

io

j

iju

k jk

n

i

io

jij bb

5. Numerical Experiments

5.1 Main Numerical Analysis

To show the effectiveness of the proposed model,we illustrate the above solution procedure using thefollowing example. The problem is solved using theLINGO 8.0 program. The parameter data foroperational and strategic decisions are inputted intothe program. It is categorized as mixed-integer linearprogramming. We used the data listed in Tables 2and 3 for the numerical experiment. Table 2

l-1

t*

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 11/20

11

LeadtimeComponent from

A1

to B1

Unit Crashing Cost($/day

NormalDuration

(day)

MinimumDuration

(day

LeadtimeComponent from

A1

to B2

Unit CrashingCash

(S/day)

MinimumDuration

(day)

NormalDuration

(day)

LeadtimeComponent from

A1

to B1

Unit Crashing Cost($/day

NormalDuration

(day)

MinimumDuration

(day

LeadtimeComponent from

A1

to B2

Unit CrashingCash

(S/day)

MinimumDuration

(day)

NormalDuration

(day)

represents the data related to the market and todemand uncertainty. Table 3 represents the datarelated to operational and strategic decisions amongSC members.

According to the numerical results listed in Table4, the best buyer-OEM-supplier combinations thatmaximize the total SC profit are B

1-A

2-S

2and B

2-A

1-

S3. This is a global and integrated decision after

Table 2. Data related to demand uncertainty

Table 3. Data for operational and strategic decisions

Buyers (i) DemandLot Size

Parameter related to overstock and under-stock Conditions

t σ P(D) P(z ≥ D)

t=1 400 4 0.3 1t=2 500 5 0.2 0.7

t=3 600 6 0.2 0.5

t=4 700 7 0.15 0.3

t=5 800 8 0.1 0.15

t=6 900 9 0.05 0.05

t=1 400 4 0.3 1

t=2 500 5 0.2 0.7

t=3 600 6 0.2 0.5

t=4 700 7 0.15 0.3

t=5 800 8 0.1 0.15

t=6 900 9 0.05 0.05

11111

2 2 2 2 2

Pr = $150/unit

C u= $30/unit

C s= $50/unit

Pr = $152/unit

C u= $40/unit

C s= $45/unit

ParametersOEM Facility 1

(A1)Buyer 1

(B1)Buyer 2

(B2)OEM Facility 2

(A2)Supplier 3

(S3)Supplier 2

(S2)Supplier 1

(S1)

PPPPPrrrrr($/unit)($/unit)($/unit)($/unit)($/unit) 150 152 - - - - -

Cu ($/unit)Cu ($/unit)Cu ($/unit)Cu ($/unit)Cu ($/unit) 30 40 - - - - -

Cs ($/unit)Cs ($/unit)Cs ($/unit)Cs ($/unit)Cs ($/unit) 50 45 - - - - -

A ($/order)A ($/order)A ($/order)A ($/order)A ($/order) - - 50 (B1) 100 (B

1) 150 (A

1) 120 (A

1) 160 (A

1)

- - 40 (B2) 80 (B

2) 140 (A

2) 100 (A

2) 90 (A

2)

h ($/unit)h ($/unit)h ($/unit)h ($/unit)h ($/unit) 50 (A1) 40 (A

1) - - 20 (A

1) 20 (A

1) 20 (A

1)

60 (A2) 80 (A

2) - - 40 (A

2) 40 (A

2) 40 (A

2)

Cm ($/unit)Cm ($/unit)Cm ($/unit)Cm ($/unit)Cm ($/unit) - - - - 5 10 15Cr ($/unit)Cr ($/unit)Cr ($/unit)Cr ($/unit)Cr ($/unit) - - 2 (B

1) 3 (B

1) 2 (A

1) 2.5 (A

1) 2.5 (A

1)

- - 4 (B2) 5 (B

2) 2 (A

2) 3 (A

2) 4 (A

2)

11111 16 2 0.4 11111 15 1 0.5

22222 16 2 1.2 22222 12 5 0.9

33333 10 3 5 33333 10 3 6

11111 24 10 1 11111 15 1 0.222222 16 2 1.2 22222 11 4 3

33333 9 2 3.5 33333 9 2 5

The results from our developed model are listed in Table 4 and in Figs. 2 to 4.

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 12/20

12

considering demand uncertainty, under-stock andoverstock conditions of buyers in response to marketdemand, and also inventory costs versus leadtime

crashing cost. For B1-A2-S2, even though the S2 has ahigher cost (from the high fixed cost of thiscombination), reducing the leadtime from seven tothree weeks has significantly reduced inventory costof products, compared with adding a small crashingcost. This combination is a typical decision inchoosing OEMs with less leadtime to buyers but ata higher cost for the supplier.

For B2-A

1-S

3, reducing the leadtime from five to

two weeks has reduced inventory cost of products,which is balanced by the crashing cost. The lower fixedcost of this combination mostly contributed to theprofit. This combination is a typical decision inchoosing OEM with shorter leadtime to buyers byadding crashing cost to reduce the inventory cost ofOEM. These two combinations results in a profit of$141,102.95 per year to the SC system

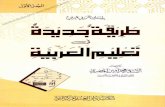

Fig. 2 shows the inventory patterns of productsby buyer and components by OEMs. OEMs have someamount of safety stocks of products that depend onthe leadtime decision (see Fig. 2(a)), where OEMs onlyhave carrying cost for their components, which is notaffected by the leadtime decision (see Fig. 2 (b)).

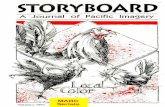

From Figs. 3 and 4, we can see the proportionand contribution of fixed and variable costs.

By reducing the leadtime for variable costs, theinventory cost of a product decreases by addingcrashing cost. Overall, by considering the optimalleadtime decision, the total variable costs are reducedfor every combination of buyer-OEM-buyer. Theeffectiveness of our model in terms of reducingvariable cost is shown in Figure 4 (d).

5.2 Sensitivity Analysis

According to Table 2 in sub-section 5.2, we choosesmall numbers (1%) of demand deviations to givesome insights on the significant effects of smalldemand deviation into optimal leadtime and safetystock decisions of OEMs. While determining theoptimal procurement lot size of buyers, however, thedemand deviation does not affect more than theprobability of demand events.

Also, our parameter setting and some keyparameter values have shown a significant difference

Table 4. Numerical results

Qj k *

Component ConsumptionPattern

Average inventory = ½ Qjk*

Figure 2. Inventory patterns of products and components

Figure 2(a). Product inventory patterns in OEMs

Figure 2(b). Component inventory patterns (black line) andcomponent consumption patterns (grey line)in OEMs

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 13/20

13

Figure 3. Contribution of fixed costs

Figure 4. Contribution of variable costs

Figure 4(a). Contribution of variable costs before considering leadtime decision

Figure 4(b). Contribution of variable costs after considering leadtime decision

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 14/20

14

Figure 4(c). Recapitulation of total variable cost improvement before and after considering leadtime decision

Figure 4(d). Model effectiveness (improved on average by 13.1% on average of operational process productivity) for all par tner combinations

between “before and after” considering leadtime anddemand uncertainties. In this sub-section, we explorea more fluctuating standard deviation of demand toshow a more significant benefit. The results wereobtained from a larger standard deviation of meandemand up to 30%. These sensitivity analysis resultsare shown in Fig. 5, and the details are attached inthe Appendix.

Figures 5(a) and 5(b) show that the greater thedemand deviates, the component ordering costincreases insignificantly, while the product orderingcost, and the component and product inventory costsdecrease significantly. A significant decreases in OEMproduct-inventory cost needs to occur reduceleadtime and the later increase in crashing cost. Afterdemand deviates more than 10% from the meandemand, optimum leadtime decisions are changed

and the leadtime should be minimized. The crashingcost only contributes 2%-9% of the total variable costs.As the demand deviation increases, the contributionof crashing cost to variable cost decreases. For the B

2-

A1-S

3combination, the contribution of crashing cost

starts to decrease after 3% of demand deviation. Thisindicates that B

2-A

1-S

3is a typical decision in choosing

shorter OEM leadtime by adding the crashing cost toreduce OEM inventory cost.

From the composition of variable and fixed costsand the proportion of crashing cost to the total variablecost, B

1-A

2-S

2is a typical decision in choosing the least

amount of leadtime of OEMs but at a higher cost forthe suppliers. Another finding is that B

1-A

2-S

2and B

2-

A1-S

3are always the best combinations for maximizing

total profit to the SC system. This means that ourmodel always achieves a global optimum solution.

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 15/20

15

5.3 Managerial Insights

For sensitivity analysis, we investigated the impactof changing demand uncertainty values togetherwith changing safety factor values. We assume thatthe safety factor value is a positive integer that showsthe replenishment of stock between products andcomponents related to the single serial multi-inventory system; while the demand uncertaintyvalue is the probability related to the supply offinished-product stocks to fulfill the market’sdemand (uncertainty outbound SC). We set up threesensitivity-analysis scenarios to determine the effectsof safety factor and demand probability parameters.The sensitivity analysis data are summarized in Table5. For the concept of leadtime in Fig. 2, the analysisof results will be analyzed based on the appropriatestrategy applied by manufacturing facilities for each

condition by considering the uncertainty of orderarrival, as shown in Fig. 6.

To Observe the sensitivity of some parametersin the model, we change some of the demand

uncertainty values (indicated as P(z > D)) and safetyfactor that impacts the leadtime of components andproducts. This analysis is used for studying theappropriate production strategy to be applied inseveral demand uncertainty situations.

According to Axsater (2000), the safety factor is

strongly affected by the value of and .

If , we should use the same batch size for

both products and components, and consequently,each time we produce a batch of components, itshould be immediately used for product production.

This implies that we do not need any stock ofcomponents and that our two-stage system ofsupplier-OEM and OEM-buyer can be replaced by asingle-stage system. This condition is also sufficientin the case of time-varying demand of a product andwill become important in the leadtime decision.

In this analysis, we want to synergize ourfindings with a practical situation in each stage orpoint of event where uncertainties occur. We discussthis qualitatively (see Fig. 6) in the followingparagraphs.

Figure 5. Contribution of variable costs

Fig. 5(a) Impact of demand deviation on component cost andtotal SC profit for B

2-A

1-S

3combination

Fig. 5(b) Impact of demand deviation on component cost andtotal SC profit for B

1-A

2-S

2combination

Aij

hij- h

jk

Ajk

hjk A

ij

hij- h

jk

Ajk

hjk

≥

Figure 6. Sensitivity analysis point of view

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 16/20

16

Based on Fig. 6, which is related to the commonmanufacturing strategy characteristics, when theorder has a high probability of arriving before theprocurement (material supply) process, the best

manufacturing strategy is make-to-order (MTO). Inour model, this condition also strengthens theprocurement probability of components.

When the order has a high probability ofarriving between the procurement (material supply)and production (product manufacturing) processes,the best manufacturing strategy is assembled-to-order (ATO).

Subsequently, when the order has a highprobability of arriving between production (productmanufacturing) and shipment (product output)processes, the best manufacturing strategy is make-to-stock (MTS). In our model, this conditionstrengthens the procurement probability of products.We determined the expected profit of each benefitor loss by using one of these strategies in thebeginning of our model by taking into accountdemand uncertainty.

Furthermore, we would like to observe theimpacts of leadtime to the total performance criteriathat are directly affected by demand uncertainty andsafety factor values on the appropriate manufacturingstrategy for all alternatives of partner combinations.The results are shown in Figs.7 to 9.

According to Table 5, we choose and vary thedemand uncertainty values, procurement probabilityof components and procurement probability ofproducts to investigate their impact on the chosen

strategy (MTO, ATO, or MTS). We use all modelequations to evaluate the appropriate strategy. Whenone of the values is fixed, the other two are varied.

According to the numerical results, the cost

components mostly impacted by these parameter-ranging values are the inventory costs of componentand products. Subsequently, these cost componentssignificantly contribute to total SC profitperformance.

Based on the results of the first scenario (see Fig.7), when the safety factor is at a lower level, OEMmanufacturing facilities should apply the MTSstrategy. This is shown by the slightly higher productinventory cost compared to material inventory cost.In contrast, when the safety factor is at a higher level,OEM manufacturing facilities should apply the MTOstrategy. From the supply delay point of view, thisMTO strategy will reduce any waste in stock costsat a longer leadtime. A constantly increasing convexshape from the leadtime and inventory cost curvesfor both component and products show that alongwith the increasing values of demand uncertaintiesand safety factor, manufacturers tend to change theirstrategy from MTS to MTO.

In the second scenario, we applied different

values of and for determining the safety

factor. When the value of is lower than thevalue of (see Fig. 8), OEM manufacturing

facilities should apply the ATO strategy. This is

shown as a slightly different risk contribution of

Table 5. Sensitivity analysis data

Demand probability

value (Scenario I, II, III)Total safety factor with equal

value of and .Aij

hij- h

jk

Ajk

hjk

Scenario I Scenario II Scenario III

Ajk

hjk

Aij

hij- h

jk

Ajk

hjk

Aij

hij- h

jk

0.050.050.050.050.05 0.2 0.70 0.97 0.95 0.80

0.150.150.150.150.15 0.6 0.50 0.92 0.85 0.50

0.300.300.300.300.30 1.0 0.30 0.85 0.55 0.40

0.500.500.500.500.50 1.4 0.15 0.75 0.35 0.15

0.700.700.700.700.70 2.0 0.05 0.50 0.15 0.05

Aij

hij- h

jk

Ajk

hjk

Ajk

hjk

Aij

hij- h

jk

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 17/20

17

inventory costs of both components and products,instead of increasing leadtime. However, whendemand uncertainty (P(z > D) is high, MTS is thebest strategy. This is due to a sharp increase in theinventory cost of products compared with that ofcomponents.

A constantly increasing convex shape from thecurve for components and products shows that alongwith increasing demand uncertainty values and

decreasing safety factors (where the value of is

lower than the value of ), OEM facilities tend to

change their strategy from ATO to MTS.

In the third scenario, when the value of is

higher than the value of (see Fig. 9), the MTO

strategy is better than MTS for OEM manufacturing

facilities. This is due to the fact that the increase

in makes the material stocks in the manufacturer

ineffective. Therefore, non-stock strategies with an

acceptable leadtime may be better than the MTS

strategy. The MTS strategy will perform betterperformance than MTO in situations of higher

demand uncertainty of products that will affect thehigher leadtime. The pure concave shapes from thecomponents and products curves show that alongwith increasing demand uncertainty values and

decreasing safety factors in this situation (where the

value of is higher than the value of ),

manufacturers tend to change their strategy

drastically from MTO to MTS.

From these three scenarios, the expected totalinventory costs for both components and products

Figure 7. Results of Scenario I

Figure 8. Results of Scenario II

Ajk

hjk

Aij

hij

- hjk

Ajk

hjk

Aij

hij- h

jk

Ajk

hjk

Ajk

hjk

Aij

hij- h

jk

Figure 9. Results of Scenario III

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 18/20

18

and the length of leadtime will generally be stronglyaffected while demand uncertainty (P( z > D) is ata high level. This general finding of this research issummarized in Fig. 10. As a result, the increase in

leadtime and higher inventory conditions makes thesuggested strategy superior under a given condition

at a higher cost for the supplier, while B2-A

1-S

3is a

typical decision in choosing a shorter leadtime ofOEMs by adding crashing cost to reduce theinventory cost of OEMs. These two combinations

give a total profit $141,102.95 per year to SC systems.In practical situations, strategy analyses are

used in sensitivity analysis, which gives managerialinsights into OEM operation strategy while facingleadtime and order arrival uncertainties.

Future research can be extended by consideringsupply uncertainty in forms of procurementprobability, which is the probability related to thesupply of material components from suppliers toOEMs and finished products from OEMs to buyers(uncertainty inbound SC) and dynamic pricingbetween SC members.

References

Arda, Y. and Hennet, J-C. (2006). Inventory control in a multi-supplier system. Int. J. Production Economics, 104 (2), pp.249-259.

Axsater, S. (2000). Inventory Control: International Series inOperations Research and Management Science, KluwerAcademic Publishers, Boston/Dordrecht/London, pp.115-169.

de Boer, L., Labro, E. and Morlacci, P. (2001). A review ofmethods supporting supplier selection. Purchasing and

Supply Management, 7, pp. 75-89.Chan, L. M. A., Shen, Z. J. M., Simchi-Levi, D. and Swann, J.

(2004). Handbook of Quantitative Supply Chain Analysis:Modelling in the e-nusiness era (eds) D. Simchi-Levi, SD Wu,Z.J.M. Shen, MA: Kluwer Academic, Boston ‘Coordinationof pricing and inventory decisions: a survey andclassification, pp. 335-392.

Chaudhry, S. S., Frost, F. G. and Zydiak, J. L. (1993). Vendorselection with price break. European J. Operations Research,70, pp. 52-66.

Croom, S. (2001). Restructuring supply chains throughinformation channel innovation. Int. J. Operations andProduction Management, pp. 504–527.

Current, J. R. and Weber, C. A. (1994). Application of facilitylocation modeling constructs to vendor selectionproblems. European J. Operations Research, 76, pp. 387-392.

Degraeve, Z., Labro, E., and Roodhooft, F. (2000). Anevaluation of vendor selection methods from a total costof ownership perspective. European J. OperationsResearch, 125, pp. 34-58.

Dickson, G. W. (1966). An analysis of vendor selectionsystems and decisions. Journal of Purchasing, 2 (1), pp.5–17.

6. Conclusions and Future Works

We proposed a mathematical model for considering

demand uncertainty, under-stock and overstockconditions of buyers in response to market demand,inventory costs versus leadtime crashing cost intoone integrated and simultaneous partner, optimalprocurement quantity, and leadtime decisions in amulti-echelon inventory SC system.

To anticipate demand and leadtime uncertaintyand avoid delay, OEMs, as decoupling points in ourSC model need some amount of product safetystocks. The inventory pattern of products and theconsumption pattern of components have differentpatterns.

The numerical result showed that leadtimedecision affects the OEM’s product safety stock. Thissafety stock leads to an EOQ decision that impactsinventory and ordering costs. By trading-offinventory and leadtime crashing costs, the bestpossible combinations of partners in fulfillingdemand from the market are B

1-A

2-S

2and B

2-A

1-S

3.

We analyzed the trade-off characteristics of eachcombination. B

1-A

2-S

2is a typical decision in

choosing the least amount of leadtime of OEMs but

Figure 10. Results summary

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 19/20

19

Hegedus M. G. and Hopp W. J. (2001). Setting procurementsafety leadtimes for assembly systems. InternationalJournal of Production Research, 39(15), pp. 3459-3478(20).

Hidayat, Y. A., Takahashi, K., Diawati, L., and Cakravastia,

A. (2009). Supply chain strategy for high technology-content product and its consequences to technologytransfer mechanism. Int. J. Intelligent Systems Technologiesand Applications, 6 (3/4), pp. 296-308.

Hillier, M. S. (2002). The costs and benefits of commonalityin assemble-to-order system with a (Q. r)-policy forcomponent replenishment. European Journal of Operational Research, 141, pp. 570-586.

Hopp W. J. and Spearman, M. L. (1993). Setting leadtimesfor purchased components in assembly systems. IIETransactions, 25, pp. 2-11.

Li, D. and O’Brien, C. (1999). Integrated decision modelingof supply chain efficiency. Int. J. Production Economics,

59, pp. 147-157.Lin, Y., Ma, S., and Liu, L. (2006). A multi-period inventory

model of component commonality with leadtime. IEEEInternational Conference on Service Operations andInformatics (SOLI), IEEE, pp. 352-357.

Ma, S. H., Wang, W., and Liu, L. M. (2002). Commonalityand Postponement in Multistage Assembly Systems.European Journal of Operational Research, 142, pp. 523-538.

Melo, M. T., Nickel, S., and Saldanha-da-Gama, F. (2009).Invited Review: Facility location and supply chainmanagement - A review.European J. Operational Research,196, pp. 401-412.

Mohebbi, E., and Choobineh, F. (2005). The impact ofcomponent commonality in an assemble-to-orderenvironment under supply and demand uncertainty.Omega, The International Journal of Management Science,

33, pp. 472-482.Nonas, S. L. (2007). Finding and identifying optimal

inventory levels for systems with common components,European Journal of Operational Research, p. Doi: 10. 1016/j.ejor. 2007. 1008. 1045.

Sabri, E. H. and Beamon, B. M. (2000). A multi-objectiveapproach to simultaneous strategic and operationalplanning in supply chain design. Omega, 28 (5), pp. 581-598.

Snyder, L. V. (2006). Facility location under uncertainty: areview. IEE Transactions, 38, pp. 537–554.

Simchi-Levi, D., Kaminsky, P., and Simchi-Levi, E. (2000).Designing and Managing the Supply Chain: Concepts,

Strategies and Case Studies. Irwin Mc-Graw Hill, Boston,MA.

Tang, O. and Grubbstroom, R. W. (2003). The detailedcoordination problem in a two-level assembly systemwith stochastic leadtimes. International Journal of Production Economics, 81–82, pp. 415–429.

Weber C. A. and Current J. R. (1993). A multiobjectiveapproach to vendor selection. European J. OperationsResearch, 68, pp. 173-184.

Yano, C.A. (1987). Stochastic leadtimes in two-levelassembly systems. IIE Transactions, 19 (4), pp. 371-378.

Yosi A. Hidayat is a faculty member of the Department of Industrial Engineering, Faculty of IndustrialTechnology, InstitutTeknologi Bandung, Indonesia. She received his Doctoral degree from HiroshimaUniversity.Her research interests include technology transfer and supply strategy in supply chainmanagement. Her email address is <[email protected]>

Katsuhiko Takahashi is a Professor at the Department of Artificial Complex Systems Engineering, GraduateSchool of Engineering, Hiroshima University. He received his Doctoral degree from Waseda University. Hisresearch interests include production system and supply chain management. His email address is<[email protected]>

Katsumi Morikawa is an Associate Professor at the Department of Artificial Complex Systems Engineering,Graduate School of Engineering, Hiroshima University. He received his Doctoral degree from HiroshimaUniversity. His research interests include production planning, scheduling, and human-computer interactivesystems. His email address is <[email protected]>

Kunihiro Hamada is an Associate Professor at the Department of Social and Environmental SystemsEngineering, Graduate School of Engineering, Hiroshima University. He received his Doctoral degree fromthe University of Tokyo. His research interests include system engineering, ship engineering, and marineengineering. His email address is <[email protected]>

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011

8/7/2019 Paper 1 Vol 4 No 1

http://slidepdf.com/reader/full/paper-1-vol-4-no-1 20/20

20

Lucia Diawati is a faculty member of the Department of Industrial Engineering, Faculty of IndustrialTechnology, Institut Teknologi Bandung, Indonesia. She received her Doctoral degree from Keio University,Japan. Her research interests include management of technology and product design & development. Heremail address is <[email protected], [email protected]>

Andi Cakravastia is a faculty member of the Department of Industrial Engineering, Faculty of IndustrialTechnology, Institut Teknologi Bandung, Indonesia. He received his Doctoral degree from HiroshimaUniversity. His research interests include supply chain management and management of technology. Hisemail address is <[email protected]>

Hidayat et al. : Partner Selection in Supplier-Buyer RelationshipOperations & Supply Chain Management 4 (1) pp 1-20 © 2011