Informatie over tender Studiekeuzegesprekken wat werkt? - Janina van Hees

Jee Tender

-

Upload

jeetender-kumar -

Category

Documents

-

view

220 -

download

0

Transcript of Jee Tender

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 1/20

REPORT ON BASEL

SUBMITTED TO

Mr. Javed Hussain Baloch

SUBMITTED BY

1. JEETENDER KUMAR (SP09-MM-0027)

2. KULSOOM (SP08-BB-0049)

Report on basel 1 1

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 2/20

LETTER OF ACKNOWLEDGEMENT

November 8, 2010

The name of this report is Basel 1 has been prepared as part of

the course requirement for Risk management in banking.

This report has proved to be a great experience. For this, we

would like to thank our course instructor Mr. Javed Hussian

Baloch who provided the great opportunity as well as his

guidance in the light of vast experience

Sincerely,

1. JEETENDER KUMAR (SP09-MM-0027)

2. KULSOOM (SP08-BB-0049)

Report on basel 1 2

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 3/20

Table of contents

1. INTRODUCTION

Report on basel 1

DESCRIPTION PAGE NUMBER

• Introduction 4

• History 5

• Basel 1 8

• How basel one effected banks 10

• Pitfallas of basel 1 11

• Capital requirement 12

• Five c’s 13

• Regulatory capital 14

• Common capital ratio 16

• G-30 policy recommendation 18

• Conclusion 20

3

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 5/20

The town of Basel was called Basilea or Basilia in Latin and this name is documentedfrom 374 AD.

In 1495, Basel was incorporated in the Upper Rhenish Imperial Circle; the Bishop of

Basel was added to the Bench of the Ecclesiastical Princes. In 1500 the construction o of the Basel Münster was finished.

In 1501 Basel joined the Swiss Confederation as its eleventh canton. In 1543 De humani

corporis fabrica, the first book on human anatomy, was published and printed in Basel byAndreas Vesalius. On July 3, 1874 Switzerland's first zoo (the Zoo Basel) opened itsdoors in the south of the city towards Binningen.

Basel as international meeting place

Basel has often been the site of peace negotiations and other international meetings. The

Treaty of Basel (1499) ended the Swabian War. the Second International held anextraordinary congress at Basel in 1912. In 1989, the Basel Convention was opened for signature with the aim of preventing the export of hazardous waste from wealthy todeveloping nations for disposal.

Transportation

The first-class location and the transportation infrastructure make Basel the top logistics

center for Switzerland.

The outstanding location benefits logistics corporations, which operate globally fromBasel. Trading firms are traditionally well represented in the Basel Region.

Port

Basel has Switzerland's only cargo port, through which goods pass along the navigablestretches of the Rhine and connect to ocean-going ships at the port of Rotterdam.

Air transport

Report on basel 1 5

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 6/20

EuroAirport Basel-Mulhouse-Freiburg is operated jointly by two countries, France andSwitzerland. The airport itself is split into two architecturally independent sectors, onehalf serving the French side and the other half serving the Swiss side.

Railway

Three railway stations — those of the German, French and Swiss networks. Basel's localrail services are supplied by the Basel Regional S-Bahn.

Roads

Within the city limits, five bridges connect greater and lesser Basel, from upstream todownstream:

• Schwarzwaldbrücke (built 1972)• Wettsteinbrücke (current structure built 1998, original bridge built 1879)• Mittlere Brücke (current structure built 1905, original bridge built 1225 as the

first bridge to cross the Rhine River)•

Johanniterbrücke (built 1967)• Dreirosenbrücke (built 2004, original bridge built 1935)

Ferries

ferry boats links the two shores. There are four ferries, each situated approximatelymidway between two bridges

Public transport

Basel has an extensive public transportation network serving the city and connecting tosurrounding suburbs, including a large tram network

Border crossings

Basel is located at the meeting point of France, Germany and Switzerland and hasnumerous road and rail crossings between Switzerland and the other two countries.

Quarters

Report on basel 1 6

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 7/20

Basel is subdivided into 19 quarters (Quartiere). The municipalities of Riehen andBettingen, outside the city limits of Basel, are included in the canton of Basel-City asrural quarter

Main sights

Heritage sites

These include the entire Old Town of Basel as well as the following buildings andcollections:

• Churches and monasteries• Secular buildings• Archaeological sites• Museums, archives and collections

Education

Basel hosts Switzerland's oldest university, the University of Basel, dating from 1459.Basel counts several International Schools, including the International School of Basel,the Schule für Gestaltung Basel, the Minerva School and the Rhine Academy.

Report on basel 1 7

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 8/20

Basel I

Basel I is the round of deliberations by central bankers from around the world, and in1988, the Basel Committee (BCBS) in Basel, Switzerland, published a set of minimalcapital requirements for banks. This is also known as the 1988 Basel Accord, and was

enforced by law in the Group of Ten (G-10) countries in 1992 . Basel I is now widelyviewed as outmoded. Indeed, the world has changed as financial conglomerates, financialinnovation and risk management have developed.

Background

The Committee was formed in response to the messy liquidation of a Cologne-based bank (Herstatt) in 1974. On 26 June 1974, a number of banks had released. the BaselCommittee on Banking Supervision, under the auspices of the Bank of International Settlements (BIS) located in Basel, Switzerland.

About the Basel Committee

The Basel Committee on Banking Supervision provides a forum for regular cooperationon banking supervisory matters. Its objective is to enhance understanding of keysupervisory issues and improve the quality of banking supervision worldwide. It seeks todo so by exchanging information on national supervisory issues, approaches andtechniques, with a view to promoting common understanding. At times, the Committeeuses this common understanding to develop guidelines and supervisory standards in areaswhere they are considered desirable. In this regard, the Committee is best known for itsinternational standards on capital adequacy; the Core Principles for Effective BankingSupervision; and the Concordat on cross-border banking supervision.

Report on basel 1 8

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 9/20

The Committee's members

The Committee's members come from Argentina, Australia, Belgium, Brazil, Canada,China, France, Germany, Hong Kong SAR, India, Indonesia, Italy, Japan, Korea,Luxembourg, Mexico, the Netherlands, Russia, Saudi Arabia, Singapore, South Africa,Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. The present Chairman of the Committee is Mr Nout Wellink, President of the NetherlandsBank.

The Committee encourages contacts and cooperation among its members and other banking supervisory authorities. It circulates to supervisors throughout the world both published and unpublished papers providing guidance on banking supervisory matters.Contacts have been further strengthened by an International Conference of BankingSupervisors (ICBS) which takes place every two years.

The Committee's Secretariat is located at the Bank for International Settlements in Basel,Switzerland, and is staffed mainly by professional supervisors on temporary secondmentfrom member institutions. In addition to undertaking the secretarial work for theCommittee and its many expert sub-committees, it stands ready to give advice to

supervisory authorities in all countries. Mr Stefan Walter is the Secretary General of theBasel Committee.

Main Expert Sub-Committees

The Committee's work is organised under four main sub-committees (organisation chart):

• The Standards Implementation Group • The Policy Development Group • The Accounting Task Force• The Basel Consultative Group

Report on basel 1 9

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 10/20

How Basel 1 Affected Banks

From 1965 to 1981 there were about eight bank failures (or bankruptcies) in the UnitedStates. Bank failures were particularly prominent during the '80s, a time which is usuallyreferred to as the "savings and loan crisis." Banks throughout the world were lendingextensively, while countries' external indebtedness was growing at an unsustainable rate.

As a result, the potential for the bankruptcy of the major international banks becausegrew as a result of low security. In order to prevent this risk, the Basel Committee on Banking Supervision, comprised of central banks and supervisory authorities of 10countries, met in 1987 in Basel, Switzerland.

The committee drafted a first document to set up an international 'minimum' amount of capital that banks should hold. This minimum is a percentage of the total capital of a bank, which is also called the minimum risk-based capital adequacy.

In 1988, the Basel I Capital Accord (agreement) was created. The Basel II Capital Accord follows as an extension of the former, and was implemented in 2007. In this article, we'lltake a look at Basel I and how it impacted the banking industry.

The Purpose of Basel I

In 1988, the Basel I Capital Accord was created. The general purpose was to:

1. Strengthen the stability of international banking system.

2. Set up a fair and a consistent international banking system in order to decreasecompetitive inequality among international banks.

In order to set up a minimum risk-based capital adequacy applying to all banks andgovernments in the world, a general definition of capital was required. Indeed, before thisinternational agreement, there was no single definition of bank capital. The first step of the agreement was thus to define it.

Pitfalls of Basel I

Report on basel 1 10

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 11/20

Basel I Capital Accord has been criticized on several grounds. The main criticismsinclude the following:

• Limited differentiation of credit risk

There are four broad risk weightings (0%, 20%, 50% and 100%),

• Static measure of default risk

The assumption that a minimum 8% capital ratio is sufficient to protect banksfrom failure does not take into account the changing nature of default risk .

• No recognition of term-structure of credit risk

The capital charges are set at the same level regardless of the maturity of a creditexposure.

• Simplified calculation of potential future counterparty risk

The current capital requirements ignore the different level of risks associated withdifferent currencies and macroeconomic risk.

• Lack of recognition of portfolio diversification effects

In reality, the sum of individual risk exposures is not the same as the risk reductionthrough portfolio diversification. Therefore, summing all risks might provideincorrect judgment of risk. A remedy would be to create an internal credit risk model- for example, one similar to the model as developed by the bank to calculate marketrisk. This remark is also valid for all other weaknesses.

These listed criticisms have led to the creation of a new Basel Capital Accord, known asBasel II, which added operational risk and also defined new calculations of credit risk.Operational risk is the risk of loss arising from human error or management failure. BaselII Capital Accord was implemented in 2007.

Report on basel 1 11

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 12/20

Capital requirement

The capital requirement is a bank regulation, which sets a framework on how banks anddepository institutions must handle their capital. The categorization of assets and capitalis highly standardized so that it can be risk weighted Internationally, the Basel Committee on Banking Supervision housed at the Bank for International Settlements influence each country's banking capital requirements.

In 1988, the Committee decided to introduce a capital measurement system commonlyreferred to as the Basel Accord. This framework is now being replaced by a new andsignificantly more complex capital adequacy framework commonly known as Basel II.While Basel II significantly alters the calculation of the risk weights, it leaves alone thecalculation of the capital.

The capital ratio is the percentage of a bank's capital to its risk-weighted assets.Weights are defined by risk-sensitivity ratios whose calculation is dictated under therelevant Accord.

Each national regulator normally has a very slightly different way of calculating bank capital, designed to meet the common requirements within their individual national legalframework.

Report on basel 1 12

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 13/20

The 5 Cs of Credit –

1. Character

2. Cash Flow,

3. Collateral,

4. Conditions

5. Capital

It have been replaced by one single criterion. While the international standards of bank capital were laid down in the 1988 Basel I accord, Basel II makes significant alterationsto the interpretation, if not the calculation, of the capital requirement.

Depository institutions are subject to risk-based capital guidelines issued by the Board of Governors of the Federal Reserve System (FRB). These guidelines are used to evaluatecapital adequacy based primarily on the perceived credit risk associated with balance sheet assets, as well as certain off-balance sheet exposures such as unfunded loan commitments, letters of credit, and derivatives and foreign exchange contracts. The risk- based capital guidelines are supplemented by a leverage ratio requirement.

a bank holding company must have a

• Tier 1 capital ratio of at least 4%,

•

a combined Tier 1 and Tier 2 capital ratio of at least 8%,

• and a leverage ratio of at least 4%,

To be well-capitalized under federal bank regulatory agency definitions, a bank holding company must have a

• Tier 1 capital ratio of at least 6%,

• a combined Tier 1 and Tier 2 capital ratio of at least 10%,

• leverage ratio of at least 5%,

Report on basel 1 13

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 14/20

Regulatory capital

In the Basel I accord bank capital was divided into two "tiers", each with somesubdivisions.

Tier 1 capital

Tier 1 capital, the more important of the two, consists largely of shareholders' equity.This is the amount paid up to originally purchase the stock (or shares) of the Bank (notthe amount those shares are currently trading for on the stock exchange), retained profitssubtracting accumulated losses, and other qualifiable Tier 1 capital securities.

Tier 2 (supplementary) capital

There are several classifications of tier 2 capital, which is composed of supplementarycapital and are called temporary capital unlike, tier 1 which is permanent capital. In theBasel I accord, these are categorized as undisclosed reserves, revaluation reserves,general provisions, hybrid instruments and subordinated term debt.

Undisclosed Reserves

Undisclosed reserves are not common, but are accepted by some regulators where a Bank has made a profit but this has not appeared in normal retained profits or in generalreserves. Most of the regulators do not allow this type of reserve because it does notreflect a true and fair picture of the results.

Revaluation reserves

A revaluation reserve is a reserve created when a company has an asset revalued and an

increase in value is brought to account. A simple example may be where a bank owns theland and building of its headquarters and bought them for $100 a century ago. A currentrevaluation is very likely to show a large increase in value. The increase would be addedto a revaluation reserve.

General provisions

A general provision is created when a company is aware that a loss may have occurred but is not sure of the exact nature of that loss. Under pre-IFRS accounting standards,general provisions were commonly created to provide for losses that were expected in thefuture. As these did not represent incurred losses, regulators tended to allow them to be

counted as capital.

Subordinated-term debt

Subordinated debt is classed as Lower Tier 2 debt, usually has a maturity of a minimumof 10years and ranks senior to Tier 1 debt, but subordinate to senior debt. To ensure thatthe amount of capital outstanding doesn't fall sharply once a Lower Tier 2 issue maturesand, for example, not be replaced, the regulator demands that the amount that isqualifiable as Tier 2 capital amortises (ie reduces) on a straight line basis from maturityminus 5 years (eg a 1bn issue would only count as worth 800m in capital 4years before

Report on basel 1 14

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 15/20

maturity). The remainder qualifies as senior issuance. For this reason many Lower Tier 2instruments were issued as 10yr non-call 5 year issues (ie final maturity after 10yrs butcallable after 5yrs). If not called, issue has a large step - similar to Tier 1 - therebymaking the call more likely.

Report on basel 1 15

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 16/20

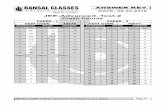

Common capital ratios

• Tier 1 capital ratio = Tier 1 capital / Risk-adjusted assets >=6%• Total capital (Tier 1 and Tier 2) ratio = Total capital (Tier 1 and Tier 2) / Risk-

adjusted assets >=10%•

Leverage ratio = Tier 1 capital / Average total consolidated assets >=5%• Common stockholders’ equity ratio = Common stockholders’ equity / Balance

sheet assets

Example

Listed below are the capital ratios in Citigroup at the end of 2003 [1].

Ratios

At year-end 2003

Tier 1 capital 8.91%Total capital (Tier 1 and Tier 2) 12.00%

Leverage (1) 5.56%

Common stockholders’ equity 7.67%

(1) Tier 1 capital divided by adjusted average assets.

Components of Capital Under Regulatory Guidelines

In millions of dollars at year-end 2003

Tier 1 capital

Common stockholders’ equity $ 96,889

Qualifying perpetual preferred stock 1,125

Qualifying mandatorily redeemable securities of subsidiary trusts 6,257

Minority interest 1,158

Less: Net unrealized gains on securities available-for-sale (1) (2,908)

Accumulated net gains on cash flow hedges, net of tax (751) (1,242) (751)

Intangible assets: (2)

Goodwill (27,581)

Other disallowed intangible assets (6,725)

50% investment in certain subsidiaries (3) (45)

Other (548)

Report on basel 1 16

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 17/20

Total Tier 1 capital 66,871

Tier 2 capital

Allowance for credit losses (4) 9,545

Qualifying debt (5) 13,573

Unrealized marketable equity securities gains (1) 399

Less: 50% investment in certain subsidiaries (3) (45)

Total Tier 2 capital 23,472

Total capital (Tier 1 and Tier 2) $ 90,343

Risk-adjusted assets (6) $750,293

Explaination

(1) Tier 1 capital excludes unrealized gains and losses on debt securities available-for-sale inaccordance with regulatory risk-based capital guidelines. The federal bank regulatoryagencies permit institutions to include in Tier 2 capital up to 45% of pretax net unrealizedholding gains on available-for-sale equity securities with readily determinable fair values.Institutions are required to deduct from Tier 1 capital net unrealized holding losses on

available-for-sale equity securities with readily determinable fair values, net of tax. (2) The increase in intangible assets is primarily due to the acquisition of the Sears credit

card portfolio in November 2003. (3) Represents unconsolidated banking and finance subsidiaries.(4) Includable up to 1.25% of risk-adjusted assets. Any excess allowance is deducted from

risk-adjusted assets. (5) Includes qualifying subordinated debt in an amount not exceeding 50% of Tier 1 capital.

(6) Includes risk-weighted credit equivalent amounts, net of applicable bilateral netting agreements, of $39.1 billion for interest rate, commodity and equity derivative contracts andforeign exchange contracts, as of December 31, 2003, compared to $31.5 billion as of December 31, 2002. Market risk-equivalent assets included in risk-adjusted assets amountedto $40.6 billion and $30.6 billion at December 31, 2003 and 2002, respectively. Risk-adjustedassets also includes the effect of other “off-balance sheet” exposures such as unused loancommitments and “letters of credit” and reflects deductions for certain intangible assets andany excess allowance for credit.

Report on basel 1 17

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 18/20

THE G-30 POLICY RECOMMENDATIONS

G30 is a private, nonprofit, international body composed of senior representatives of the private and public sectors and academia, led by Paul Volcker, former Federal Reservechairman and key economic advisor to President Obama. In its report, the organization proposed a framework for the reform of the global financial system, including a call toeliminate gaps in regulation, increase coordination among international supervisors andenhance surveillance of the core financial institutions.

The G30 report laid out four core recommendations:

• Eliminate gaps and weaknesses in the coverage of prudential regulation andsupervision, including subjecting all systemically significant financial institutions,regardless of type, to an appropriate degree of prudential oversight .

• Improve the quality and effectiveness of prudential regulation and supervision,which will require better-resourced prudential regulators and central banksoperating within structures that afford much higher levels of national andinternational policy coordination.

• Strengthen institutional policies and standards, with particular emphasis onstandards for governance, risk management, capital and liquidity. Regulatory policies and accounting standards must also guard against procyclical effects and be consistent with maintaining prudent business practices.

• Make financial markets and products more transparent, with better-aligned risk and prudential incentives, and make the infrastructure supporting such marketsmore robust and resistant to potential failures of even large financial institutions

Among the 18 specific recommendations made by the G30 was to limit the size andscope of banks by prohibiting them from managing hedge or private equity funds. Thereport also calls for the operation of major mutual funds as commercial banks, whichwould subject them to increased government oversight, and for venture capital groupsand rating agencies to be subject to increased government regulation.

Just days before the G30 report was released, the U.S. Government Accountability Office(GAO) issued its own recommendations for shoring up the nation’s financial regulatorysystem. In Financial Regulation: A Framework for Crafting and Assessing Proposals toModernize the Outdated U.S. Financial Regulatory System, the GAO noted that thecurrent system has relied on “fragmented and complex arrangements of federal and stateregulators put into place over the past 150 years that has not kept pace with major

developments in financial markets and products in recent decades. As the nation findsitself in the midst of one of the worst financial crises ever, the regulatory systemincreasingly appears to be ill-suited to meet the nation's needs in the 21st Century,” thereport states.

The GAO notes several key changes in financial markets that have highlighted thesignificant limitations and gaps in the existing regulatory system. These include:

Report on basel 1 18

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 19/20

• A failure by regulators to mitigate the systemic risks posed by large andinterconnected financial conglomerates and to ensure they adequately managetheir risks

• Problems in financial markets resulting from the activities of large and sometimesless-regulated market participants, such as nonbank mortgage lenders, hedgefunds and credit rating agencies, some of which play significant roles in today’sfinancial markets

•

• Difficulty regulating and even understanding new and increasingly complexinvestment products, such as retail mortgage and credit products

• • Growing challenges faced by standard setters for accounting and financial

regulators in ensuring that accounting and audit standards appropriately respondto financial market developments, and in addressing challenges arising from theglobal convergence of accounting and auditing standards

• • A fragmented U.S. regulatory structure that has complicated efforts to coordinate

internationally with other regulators• The GAO goes on to propose a framework for crafting and evaluating regulatory

reform proposals that consists of nine characteristics that should be reflected inany new regulatory system, including:

•

1. Clearly defined regulatory goals2. Appropriately comprehensive3. System wide focus4. Flexible and adaptable5. Efficient and effective6. Consistent with consumer and investor protection7. Regulators provided with independence, prominence, authority and

accountability

8. Consistent financial oversight9. Minimal taxpayer exposure

“By applying the elements of this framework, the relative strengths and weaknesses of any reform proposal should be better revealed, and policymakers should be able to focuson identifying trade-offs and balancing competing goals. Similarly, the framework could be used to craft proposals, or to identify aspects to be added to existing proposals to makethem more effective and appropriate for addressing the limitations of the current system,”stated the report.

Report on basel 1 19

8/8/2019 Jee Tender

http://slidepdf.com/reader/full/jee-tender 20/20

Conclusion:-

The Basel I Capital Accord aimed to assess capital in relation to credit risk, or the risk that a loss will occur if a party does not fulfill its obligations. It launched the trend towardincreasing risk modeling research; however, its over-simplified calculations, andclassifications have simultaneously called for its disappearance, paving the way for theBasel II Capital Accord and further agreements as the symbol of the continuousrefinement of risk and capital. Nevertheless, Basel I, as the first international instrumentassessing the importance of risk in relation to capital, will remain a milestone in thefinance and banking history.

R b l 1 20