TRANS OCEAN MARINE CARGO TRANSIT INSURANCE … · TRANS OCEAN MARINE CARGO TRANSIT INSURANCE...

Click here to load reader

Transcript of TRANS OCEAN MARINE CARGO TRANSIT INSURANCE … · TRANS OCEAN MARINE CARGO TRANSIT INSURANCE...

1

CCuussttoommeerr MMaannuuaall

20th July 2009

TTRRAANNSS OOCCEEAANN

MMAARRIINNEE CCAARRGGOO

TTRRAANNSSIITT

IINNSSUURRAANNCCEE

2

2

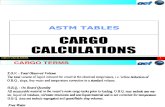

WHEN SHOULD YOU INSURE YOUR CARGO?

In international trade, the responsibility to insure the goods during the various stages of transport is

clarified by the use of INCOTERMS. The diagram below helps you to determine which stage of transport is

covered by the seller’s marine cargo transit insurance and which part of the transport is covered by the

buyer’s marine cargo transit insurance.

Incoterms Who buys From Port of loading Port of discharge To

Note:

EXW, DDU and DDP are commonly used for any mode of transportation.

FOB, CFR, CIF are used for sea and inland waterway

Freight

Risk

Insurance

Warehouse

Warehouse

Warehouse

Freight

Risk

Insurance

Warehouse

Warehouse

Warehouse

Freight

Risk

Insurance

Warehouse

Warehouse

Warehouse

Freight

Risk

Insurance

Warehouse

Warehouse

Warehouse

Freight

Risk

Insurance

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Warehouse

Ex Works

FOB

CFR

CIF

DDU/ DDP

Seller

Buyer

3

3

WHY SHOULD YOU INSURE YOUR CARGO?

Origin Haulage

Origin Handling

Vessel Shipment

Destination

Handling

Destination

Haulage

FOB

Ex Works

CIF

DDU

4

4

SUMMARY OF BENEFITS OF INSURING THROUGH

TRANS OCEAN MARINE CARGO TRANSIT INSURANCE

Coverage

� Cover specifically tailored for flexitank shipments

� Ability to offer flexible cover in line with INCOTERMS 2000

� Mitigation costs including debris removal up to € 250,000

(USD 300,0001)

� Deliberate storage in the course of transit up to € 500,000

(USD 600,0001)

� For any one loss or incident, up to € 5,000,000

(USD 6,000,0001)

Excess for all cargo claims during transport

� Nil

Premium

� Import/Export:

o Agreed percentage of CIF cost + 10%

� Inland Transit and/or FOB or similar terms:

o Agreed percentage of FOB cost +10%

1 Subject to Currency Fluctuation

5

5

MARINE CARGO TRANSIT INSURANCE

1. What does “Carrier’s liability” mean?

When Trans Ocean and/or a carrier accept to transport the goods, they have an obligation to deliver them

in the same conditions as received. If the goods are delivered damaged, the customer is allowed to claim

compensation for their loss, from Trans Ocean and/or the carrier.

Trans Ocean and/or a carrier trade under Terms and Conditions, or International Conventions, which limits

their liability. This means that the compensation payable by Trans Ocean and/or the carrier for loss or

damage to the goods could be below the actual value of the goods. Trans Ocean standard trading

conditions limits Trans Ocean’s liability to USD 500 per tonne of product lost up to a maximum of USD

12,000.

2. What is Marine Cargo Transit Insurance?

Marine Cargo Transit Insurance covers goods lost or damaged whether carried by land, sea or air. It

protects the cargo owner against Carriers/ Forwarders limitations of liability.

When you chose to buy Marine Cargo Transit Insurance through Trans Ocean, Trans Ocean will raise the

Marine Insurance Certificate, which evidences that your shipment is insured.

3. What is the role of Trans Ocean?

Trans Ocean is authorised to offer Marine Cargo Transit Insurance to their customers in accordance with

Incoterms 2000 by the Insurers with whom the policy is placed.

By customers, we mean Cargo Owners, to whom the local Trans Ocean office provides freight forwarding

services, including fitting of the Flexitanks.

The term customers do not include Freight Forwarders or Traders who do not own the goods during transit.

Trans Ocean offices can sell insurance to the Cargo Owner through other freight forwarders subject to the

forwarders not charging any premium and subject to the certificate of insurance being issued in the name

of the Cargo Owner.

4. What is insured under the Trans Ocean Marine Open Cover?

The cover offered under Trans Ocean’s Marine Open Cover is a ”Comprehensive” cargo transit insurance,

the widest form of coverage available in the market. It covers any actual unforeseen physical loss or

damage which may occur during the course of an insured voyage.

6

6

5. Territories where we cannot sell Marine Cargo Transit Insurance without prior

agreement from Trans Ocean Risk Management team and current insurers:

Customers in From / To Armenia No Yes

Bahrain No Yes

Belarus No Yes

Brazil No Yes

Chile No Yes

Egypt No Yes

Georgia No Yes

Ghana No Yes

India No Yes

Iran No Yes

Jordan No Yes

Kazakhstan No Yes

Kuwait No Yes

Kyrgyzstan No Yes

Mexico No Yes

Oman No Yes

Pakistan No Yes

Philippines No Yes

Qatar No Yes

Tajikistan No Yes

Ukraine No Yes

Uruguay No Yes

Uzbekistan No Yes

Yemen No Yes

7

7

Main policy features; The summary below does not supersede or replace the policy wording, copy of which is available on request.

Insured Customers who have instructed Trans Ocean to insure their cargo under the policy.

Insured Goods 1. Bulk liquid products carried in flexi tank, steel tank containers, drums

2. Temperature sensitive products carried in refrigerated or insulated containers

* Excludes loss or damage, liability or expenses to the actual shipping container or any liability

arising from their use.

Main Risks Covered 1. Loss or damage to goods resulting from a transport fortuity eg. sinking of a vessel.

2. War Risks (while on board a seagoing vessel or an aircraft only).

3. Physical risks of loss or damage as a result of Strikes, Riots and Civil Commotions

4. Debris removal (of the product) if damage caused by an insured peril and cost are

reasonably incurred, up to a maximum of EUR250,000.

5. Terrorism except when deliberately stored.

Excludes any costs incurred in respect to damage to Third Party equipment or costs incurred to

prevent or mitigate pollution and/or contamination.

Main exclusions 1. Inherent vice or nature of the subject matter insured.

2. Fermentation.

3. Fear of Contamination

4. Wilful misconduct of the assured.

5. Ordinary leakage, ordinary losses in weight or volume or ordinary wear and tear eg. volume

differential due to temperature fluctuation

6. Delay.

7. Insolvency or financial default of carrier (only if aware).

8. Deliberate damage to or deliberate destruction of the subject matter insured.

9. Loss arising from nuclear weapons

Voyages From World to World

Duration • The insurance attaches from the time the product is loaded (pumped through pipe

line) into the flexi tank/ steel tank containers or other receptacle for the imminent

commencement of transit until unloaded/ pumped out immediately after arrival

provided that the maximum period of cover from the time of discharge from the

vessel/or aircraft at the final port/airport is 60 days

It also includes:

• 60 days for deliberate storage in warehouses that takes place between the places of

departure and final destination, if the insured decide to do so.

• Should you require storage cover during the course of transit in excess of 60 days,

please contact us and we will be able to arrange adequate insurance for you at

favourable rate.

N.B: In respect of specific Institute cargo and Commodity clauses (for example War Risk;

Strikes Risk; Termination of Transit Clause (Terrorism) and Frozen Food Clauses) attachment

and expiry may differ. It is important that the attachment and expiry dates are assumed only

after consulting the relevant institute commodity Clause.

8

8

Policy limit 1. EUR 5 Million any one loss or incident

2. EUR 500,000 for deliberate storage in the course of transit (see above in Duration clause).

Basis of valuation As declared by the insured subject to CIF + 10%

Premium Example Import / Export

For a premium of 0.3% of CIF + 10%

Example

Basis of valuation CIF + 10%

Costs of the goods 14,000.00

Freight charges incurred 2,000.00

Import taxes * (if you want such costs to be recoverable as per * below ) 3,500.00

C&F 19,500.00

Provision insurance premium @0.3% of CIF 58.50

Total CIF 19,558.50

Insured value CIF + 10% 21,514.35

Insurance Premium @0.3% 64.41

Import Taxes*: Insurance does not cover import taxes which are costs born from import

procedure and do not result from an incident. The policy will not cover import taxes on goods

that are lost prior to the point where import taxes are due. These are recoverable by the

customer in accordance with import custom procedure. Only taxes paid on goods lost in free

circulation are recoverable, subject to such taxes being included in the basis of valuation for the

calculation of the premium as shown above.

Excess 1. NIL for loss or damage during transport

2. 1.0 % on total insured value lost through loading and discharge operation

Institutes clauses The following institutes clauses form part of the policy (please contact us for more information

regarding the institute clauses and extensions which form part of this policy);

DVT Cargo transit insurance conditions 2000 (DVT Cargo 2000/2008)

Institute Cargo Clauses (A) CL.252

Institute War Clauses (Cargo) CL.255

Institute Strikes Clauses (Cargo) CL.256

Institute Radioactive Contamination Chemical Biological and Electromagnetic

Weapon Exclusion Clauses

CL.370

Returned Shipment Subject to being immediately reported to underwriter and to the payment of an additional

premium equivalent to the full transit premium, return shipment are covered eg. port

blockage or the buyer refuses the goods.

1. Until finally disposed or

2. For a period not exceeding 30 days whilst in transit or storage whichever shall first occur.

Reforwarded goods Goods forwarded as intended and refused at destination are covered until such goods are

finally disposed of subject to:

1. Subsequent transit and/or storage risk being immediately advised to underwriters

2. Payment of an additional premium if required

9

9