SIMONA worldwide · 2015. 11. 13. · SIMONA AG Investor Relations Teichweg 16 D-55606 Kirn Phone...

Transcript of SIMONA worldwide · 2015. 11. 13. · SIMONA AG Investor Relations Teichweg 16 D-55606 Kirn Phone...

-

SIMONA AGInvestorRelationsTeichweg16D-55606Kirn

Phone+49 (0) 67 5214-0Fax +49 (0) 67 5214-211

11FinancialReportofSIMONAGroupandSIMONAAG 02May2011

AnalystConferencefor2010AnnualResults(Frankfurt) 04May2011

InterimAnnouncementwithintheFirstHalf 04May2011

AnnualGeneralMeeting 01July2011

PublicationofGroupFinancialReport(Half-Year) 24August2011

InterimAnnouncementwithintheSecondHalf 09November2011

FinancialCalendar

SIMONAworldwide➝

01 COMpANY

ManagementBoard 02

LettertoShareholders 03

KeyEvents 04

StockPerformanceandCapitalMarkets 06

ReportbytheSupervisoryBoard 07

CorporateGovernanceReport 11

GoverningBodies 14

Shareholdings 15

02 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions 17

FinancialPerformance 23

FinancialAssetsandLiabilities 24

FinancialPosition 24

EventsaftertheReportingDate 26

RiskReport 26

ReportonExpectedDevelopments 27

OtherInformation 28

03 GrOup FINANCIAl StAteMeNtS

GroupIncomeStatement 36

GroupStatementofComprehensiveIncome 37

GroupStatementofFinancialPosition 38

NotestoConsolidatedFinancialStatements 39

GroupStatementofCashFlows 74

GroupStatementofChangesinEquity 75

DetailsofShareholdings 76

Auditor’sReport 77

OtherInformation 78

04 FINANCIAl StAteMeNtS OF SIMONA AG (eXCerpt)

BalanceSheet 80

IncomeStatement 82

OtHer

Imprint 84

FinancialCalendar Cover

SIMONAWorldwide Cover

2010SIMONA Group – Consolidated Financial Statements

-

SIMONA AMerICA Inc.

SIMONA S.A. paris

SIMONA AG Werk III

SIMONA-plAStICS CZ, s.r.o.

SIMONA FAr eASt lIMIted

SIMONA uK lIMIted

SIMONA AG SCHWeIZ

SIMONA pOlSKA Sp. z o.o.

SIMONA eNGINeerING plAStICS (Guangdong) Co. ltd.

SIMONA eNGINeerING plAStICS trAdING (Shanghai) Co. ltd.

SIMONA AG SIMONA plast-technik s.r.o.

SIMONA IBerICA SeMIelABOrAdOS S.l.

SIMONA S.r.l. ItAlIA

SIMONAworldwide

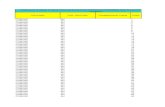

SIMONA GrOup*

2010 2009 2008

Revenue € m 267.4 215.1 303.7

Year-on-yearchange % 24.3 –29.2 1.3

ofwhichabroad € m 176.8 138.6 191.6

ofwhichabroad % 66.1 64.4 63.1

Staffcosts € m 55.9 55.3 58.2

Profitbeforetaxes € m 10.5 7.1 20.2

Profitfortheyear € m 7.2 5.0 13.9

Netcashfromoperatingactivities € m 3.1 28.2 44.7

EBIT € m 10.1 7.3 19.8

EBIT % 3.8 3.4 6.5

EBITDA € m 22.7 21.9 32.3

EBITDA % 8.5 10.2 10.6

Totalassets € m 245.0 244.7 244.8

Equity € m 162.2 157.5 157.6

Non-currentassets € m 89.4 94.3 97.1

Investmentsinproperty,plantandequipment € m 6.5 11.6 21.2

Employees(annualaverage) 1,218 1,230 1,237

*basedonIFRS

KeyFinancials

reVeNue ANd eBIt SIMONA GrOup

in € millions

300 24

250 20

200 16

150 12

100 8

50 4

0 0 Totalrevenue

2008 2009 2010 EBIT

reVeNue BY reGION SIMONA GrOup

in%

Germany

RestofEurope&Africa

Asia,America&Australia

51.9 53.4 49.6

11.3 11.2 16.6

36.8 35.4 33.8

2008 2009 2010

prOduCtION SIteS

plant I/IITeichweg16D-55606KirnGermanyPhone +49 (0) 67 5214-0Fax +49 (0) 67 5214-211

plant IIIGewerbestraße1–2D-77975RingsheimGermanyPhone +49 (0) 7822436-0Fax +49 (0) 7822436-124

SIMONA plast-technik s.r.o.UAutodílen23CZ-43603Litvínov-ChudeřínCzechRepublic

SIMONA AMerICA Inc.64N.ConahanDriveHazleton,PA18201USA

SIMONA eNGINeerING plAStICS (Guangdong) Co. ltd.No.368JinouRoadHigh&NewTechnologyIndustrialDevelopmentZoneJiangmen,GuangdongChina529000

SAleS OFFICeS SIMONA S.A. parisZ.I.1,rueduPlantLogerF -95335DomontCedexPhone +33 (0) 139 35 4949Fax +33 (0) 139 [email protected]

SIMONA uK lIMItedTelfordDriveBrookmeadIndustrialParkGB-StaffordST163STPhone +44 (0) 1785222444Fax +44 (0) [email protected]

SIMONA AG SCHWeIZIndustriezoneBäumlimattstraße16CH-4313MöhlinPhone +41 (0) 618 55 9070Fax +41 (0) 618 55 [email protected]

SIMONA S.r.l. ItAlIAViaPadanaSuperiore19/BI -20090Vimodrone(MI)Phone +390225 08 51Fax +390225 08 [email protected]

SIMONA IBerICA SeMIelABOrAdOS S.l.DoctorJosepCastells,26–30PolígonoIndustrialFonollarE-08830SantBoideLlobregatPhone +3493 635 4103Fax +3493 630 88 [email protected]

SIMONA AG

teichweg 16d-55606 KirnGermanyPhone +49 (0) 67 5214-0Fax +49 (0) 67 [email protected]

SIMONA-plAStICS CZ, s.r.o.Zděbradskául.70CZ-25101Říčany-JažlovicePhone +420 323 6378 3-7/-8/-9Fax +420 323 6378 [email protected]

SIMONA pOlSKA Sp. z o.o.ul.H.Kamieńskiego201–219PL-51-126WrocławPhone +48 (0) 713 52 80 20Fax +48 (0) 713 52 [email protected]

SIMONA FAr eASt lIMItedRoom501,5/FCCTTelecomBuilding11WoShingStreetFoTanHongkongPhone +85229 47 01 93Fax +85229 47 01 [email protected]

SIMONA eNGINeerING plAStICS trAdING (Shanghai) Co. ltd.RoomC,19/F,BlockAJiaFaMansion129DaTianRoad,JingAnDistrictShanghaiChina200041Phone +862162670881Fax [email protected]

SIMONA AMerICA Inc.64N.ConahanDriveHazleton,PA18201USAPhone +1866 501 2992Fax +1800 522 [email protected]

StOCK dAtA

2010 2009 2008

Earningspershare € 12.00 8.31 23.20

Dividend € 6.50 6.00 8.50

Dividendyield 2.1 1.9 2.6

P/Eratio* 26.3 38.1 14.0

Marketcapitalisation-over-equityratio* 1.17 1.21 1.23

sharepriceasatDec.31 € 315.00 317.00 324.00

*Eachcalculatedonconsolidatedbasis

2

-

01 GrOup MANAGeMeNt repOrt

1.BusinessActivitiesand

GeneralConditions 5

2.FinancialPerformance 11

3.FinancialAssetsandLiabilities 12

4.FinancialPosition 12

5.EventsaftertheReportingDate 14

6.RiskReport 14

7.ReportonExpectedDevelopments 15

8.OtherInformation 16

02 GrOup FINANCIAl StAteMeNtS

GroupIncomeStatement 24

GroupStatementofComprehensiveIncome 25

GroupStatementofFinancialPosition 26

NotestoConsolidatedFinancialStatements 27

GroupStatementofCashFlows 62

GroupStatementofChangesinEquity 63

DetailsofShareholdings 64

Auditor’sReport 65

OtherInformation 66

03 SIMONA WOrldWIde

Contents

3

-

1.BusinessActivitiesandGeneralConditions 05

2.FinancialPerformance 11

3.FinancialAssetsandLiabilities 12

4.FinancialPosition 12

5.EventsaftertheReportingDate 14

6.RiskReport 14

7.ReportonExpectedDevelopments 15

8.OtherInformation 16

GroupManagementReport

-

1. BuSINeSS ACtIVItIeS ANd GeNerAl CONdItIONS

1.1. Organisation and legal structure of the SIMONA

Group

TheSIMONAGroupdevelops,manufacturesandmar-

ketsarangeofsemi-finishedthermoplastics,pipesand

fittingsaswellasfinishedparts.Thematerialsused

includepolyethylene(PE),polypropylene(PP),polyvinyl

chloride(PVC),polyethyleneterephthalate(PETG),poly-

vinylidenefluoride(PVDF)andethylene-chlorotrifluor-

oethylene(E-CTFE)aswellasvariousspecialistmateri-

als.Theproductionmethodsappliedwithinthisarea

rangefromextrusion,pressingandinjectionmouldingto

CNCmanufacturing.SIMONAalsomaintainsitsown

plasticslaboratoriesandworkshopsfortheproduction

ofcustomisedfittings.Semi-finishedproductsare

deployedmainlywithintheareaofchemicalequipment

andmechanicalengineering,thetransportindustry,the

constructionsector,theexhibitionanddisplaysectoras

wellastheautomotiveindustry.Pipesandfittingsare

usedprimarilyfordrinking-watersupply,sewagedis-

posalandindustrialpipingsystems,includingthe

chemicalprocessindustry.Finishedpartsaredestined

inparticularforthemechanicalengineeringandtrans-

porttechnologysectors.

TheSIMONAGroupmarketsitsproductsworldwide.The

salesstructureisprimarilybasedonthefollowingthree

salesregions:

� Germany

� RestofEuropeandAfrica

� Asia,AmericaandAustralia

Thesecondarysegmentsarecentredaroundproduct

areas(semi-finishedproductsaswellaspipesandfit-

tings).SalesactivitiesatGrouplevelareconductedby

SIMONAAGandsubsidiariesintheUnitedKingdom,

Italy,France,Spain,Poland,theCzechRepublic,Hong

Kong,ChinaandtheUnitedStates,bothdirectlyandvia

tradingpartners.Beyondthis,theAG(i.e.theparent

company)operatesasalesofficeinMöhlin,Switzerland.

Theparentcompany,SIMONAAG,hasitsregistered

officein55606Kirn(Germany).Intheperiodunder

review,theSIMONAGroupoperatedfacilitieslocatedin

Germanyandabroad.Semi-finishedproducts(sheets,

rods,weldingrods)aremanufacturedattwoplantsin

Kirn(Rhineland-Palatinate),whilesheetswereproduced

atthecompany’splantinKirchhundem-Würdinghausen

(NorthRhine-Westphalia)andpipes,fittingsandfinished

partsatafacilityinRingsheim(Baden-Württemberg).

ThefacilitybasedinHazleton(Pennsylvania,USA)man-

ufacturesextrudedsemi-finishedproductsdestined

mainlyfortheAmericanmarket.TheplantinLitvinov,

CzechRepublic,producessheetsandpipes,primarily

fortheEasternEuropeanmarket,whilethesiteinJiang-

men,China,manufacturesextrudedsheets.Thefactory

inKirchhundem-Würdinghausenwascloseddowneffect-

ivefrom30September2010.

InthefinancialyearunderreviewtheManagement

BoardconsistedofWolfgangMoyses(Chairman/CEO),

DirkMöller(DeputyChairman,since1May2010),

DetlefBeckerandJochenFeldmann(until10August

2010).In2010,themembersoftheSupervisoryBoard

includedHans-WernerMarx(Chairman),Dr.RolfGößler

(DeputyChairman),RolandFrobelandDr.RolandReber

asshareholderrepresentatives,aswellasBernd

MeurerandKarl-ErnstSchaab(until31August2010),

whorepresentedstaffinterests.

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS 04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

5

-

1.2. Business review

Significant growth in revenue

Theoverallrecoveryoftheworldeconomywasfaster

thananticipatedfollowingtheslumpinducedbythe

globalfinancialandeconomiccrisis.Afteradownturn

of0.9percentin2009,globalgrossdomesticproduct

rosesignificantlybyanestimated5percent.Having

saidthat,theworldeconomylostitsforwardmomentum

astheyearprogressed,withglobaltradefailingto

expandsignificantlyinthesecondhalfof2010.Global

economicperformancein2010clearlyillustratedthe

growingimportanceoftheemergingmarketswithinthe

contextofinternationaltrade.Whiletheemergingmar-

ketsinAsiareturnedtotheirpre-crisislevelsin2010,

productionintheindustrialisedcountriesagainfell

shortofthefiguresrecordedpriortotheeconomic

downturn.

Againstthisbackdrop,SIMONAAGsawitssalesrev-

enuerisesignificantlyfromMarch2010onwards,after

asluggishstarttotheyear.Remainingbuoyantuntilthe

endofthefinancialyear,salesrevenueincreasedby

24.3percentyearonyearto€ 267.4millionforthe

annualperiodasawhole(2009:€ 215.1million).Much

oftheimpetuscamefrommoreexpansiveinvestments

inmachineryandequipment,particularlyinthechemi-

calandmechanicalengineeringindustry.Revenuegen-

eratedbytheparentcompany,SIMONAAG,rosefrom

€ 191.1millionayearagoto€ 232.5millionin2010,

ayear-on-yearincreaseof21.7percent.

Germany

InGermany,GDPgrewby3.5percentin2010asa

whole–adjustedforpricesandworkingdays–andwas

dominatedbyreboundingmarketsastheeconomy

emergedfromthecrisis.Facedwithadouble-digitdown-

turnineconomicoutputoverthecourseof2009,the

manufacturingsector,inparticular,recordedastrong

performanceintermsofgrossvalueadded,whichrose

byanimpressive10.3percentin2010.Exportsrose

by14.2percentinthesameperiod.Investmentsin

machineryandequipmentwereup9.4percentonthe

figurerecordedin2009,althoughthisareahadbeen

worsthitbytheeconomicdownturn.Recoveryslowed

downslightlyinthefourthquarter,withGDPrisingby

just0.4percentcomparedtothepreviousquarter.

Exportsalsoprovedbuoyantinthefourthquarter,witha

year-on-yearincreaseof15.9percentintermsofgoods

andservicessoldabroad.

deVelOpMeNt OF reVeNue SIMONA GrOup

in€ m

300

275

250

225

200

175

150

125

100

2008 2009 2010

GrOup MANAGeMeNt repOrt

+1.3%

– 29.2%

+ 24.3%

6

-

review of the principal sales segments and plastics

processing industry in 2010

TheGermanchemicalindustryrecordedan11percent

increaseinproductionvolume,withrevenuesexpanding

by17.5percent.Withinthiscontext,foreignmarkets

providedmuchoftheimpetus.Growthwaslesspro-

nouncedinthesecondhalfoftheyear.Germany’s

mechanicalandplantengineeringindustrymanagedto

expanditsproductionoutputby8.8percentin2010.

Orderintakeroseby36percentinrealterms,with

domesticordersincreasingby29percentandnon-

domesticordersexpandingby39percent.Theoverall

exportratiowithinthissectorroseto74.8percent

(2009:73.6percent).Thesolidperformancein2010is

reflectedinthelevelofcapacityutilisation,whichwasup

from72.5percentin2009to79.8percentin2010.

Afterthesignificantdeclinerecordedin2009,theinter-

nationalexhibitionandtradefairindustryinGermanywas

facedwithasluggishrecoveryintheperiodunderreview,

mainlyduetothefactthatstreamliningmeasuresagreed

in2009remainedinplacetosomeextent.Basedonini-

tialestimates,exhibitornumbersroseby1percent

(2009:–4percent),whiletheoverallnumberofvisitors

recededslightlyby2percent(2009:–8percent).

TheGermanconstructionindustryalsofailedtokeepup

withthegeneralpaceofeconomicrecoveryintheperiod

underreview.Revenuesintheprincipalconstruction

sectorcontractedby1percent(2009:–4percent)in

nominalterms.Thisdeclinewasattributabletothe

adverseeffectsfeltwithinthecommercialconstruction

sector(–4.5percent)andinthepublic-sectorsegment

(–3percent).

Basedonpreliminaryfigures,Germany’splastics-

processingindustrymanagedtoliftrevenuesby14per

centto€ 51.3billionin2010,thusalmostreturningto

thelevelrecordedin2008.At12.2milliontonnes,the

volumeofplasticsprocessedalsomovedcloser

towardsthefigureachievedin2008.Amongthe

principalgrowthdriversweresuppliersoftechnicalcom-

ponents,whoaccountedfor23percentofoverall

growth.Withintheareaofconsumerandotherplastic

goods,totalrevenueincreasedby14.7percentto

€ 16.4billion.Theconstructionsectorrecordedgrowth

of5percent,takingitstotalrevenueto€ 10.8billion.

Theplasticspackagingindustry,thelargestsegment

withintheplastics-processingsector,sawitsgrossout-

putriseby14percentto€ 12.2billion.Intermsof

value,however,thefigurewasdown2percentonlast

year’stotal.Thepositiveperformancewasdrivenmainly

byforeigntrade.At+15.5percent,exportsattributable

totheplastics-processingindustryoutpaceddomestic

sales(+14percent).Theexportratiorosefrom34.3

percentto35.7percentin2010.

Withcustomersinthechemicalandmechanicalengi-

neeringindustry–akeymarketforSIMONA–expanding

theircapitalexpenditureonmachineryandbenefiting

frombuoyantexports,SIMONAsawitsrevenuesurgein

theperiodunderreview.Salesrevenuesgeneratedin

Germanyroseby18.4percentto€ 90.6million(2009:

€ 76.5million).

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS 04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

7

-

Revenuebyproductgroup

70,6 € MIllIONS

SIGNIFICANt GrOWtH IN SAleS VOluMeS

Intheareaofsemi-finishedproducts,salesvolumesofPEandPPsheetsusedintankandapparatusconstructionrosesharply.Busi-

nessrelatingtofinishedpartsaswellasplasticsheetsdestinedforthephotovoltaicsandsolarpowerindustryalsodevelopedwell.The

GrouprecordedsignificantgrowthintheareaofPPpipesforindustrialapplications,whereasrevenuegeneratedthroughPEpipescon-

tracted.

+31,6 %+7,8 %

196,8 € MIllIONS

SeMI-FINISHed prOduCtS

pIpeS ANd FIttINGS

8

-

europe and Africa

Grossdomesticproductintheeurozoneexpandedby

1.7percentin2010(prev.year:–4.0percent),while

theEU27regionrecordedgrowthof1.8percentinthe

sameperiod(prev.year:–4.2percent).

EconomicgrowthintheMiddleEastandNorthAfrica

stoodat3.9percentin2010.

RevenuefromsalesintheRestofEuropeandAfrica

alsorosesharplyduringtheperiodunderreview.In

WesternEurope,themostimportantmarketfor

SIMONA,thedownturnseenin2009hadnotbeenas

pronouncedasinotherregions.Asaresult,revenue

growthin2010wasbelowaverage.Intotal,theRestof

EuropeandAfricaaccountedforsalesrevenueof

€ 132.7million(2009:€ 115.4million).Thisrepres-

entsanincreaseof15.0percentcomparedto2009.

Asaregion,theRestofEuropeandAfricaaccountedfor

49.6percentoftotalrevenuegeneratedbySIMONA

AG,downonlastyear’sfigureof53.6percent.

America, Asia and Australia

At2.8percent(2009:–2.6percent),theUSeconomy

grewatalesspronouncedratethanmanyoftheother

industrialisedeconomies.NotonlyweretheAsianmar-

ketsthefirsttobeaffectedbytheeconomicandfinan-

cialcrisis,theyalsoborethebruntofthedownturn.On

amorepositivenote,theyledthewaywhenitcameto

economicrecovery.BothChina(+10.3percent)and

India(+9.7percent)returnedtotheirpre-crisislevelsof

growthin2010.SIMONAwasabletoreaptherewards

ofthistrendbygeneratingabove-averagerevenue

growthinAsia.InNorthAmerica,bycontrast,business

grewatalowlevel.Intotal,revenuefromsalesinAsia,

AmericaandAustraliaroseby82.9percentto€ 44.5

million.Asaresult,thisregionaccountedfor16.6per

centoftotalsalesrevenue,asignificantyear-on-year

increase.

Strong expansion of sales volumes of pe and pp

sheets as well as specialty plastics – Above-average

revenue growth for pipes and fittings

Intheareaofsemi-finishedproducts,salesvolumesof

PEandPPsheetsusedintanksandapparatusengin-

eeringrosesharplyin2010.Businessrelatingtoplastic

sheetsusedbythephotovoltaicsandsolarindustry

alsodevelopedwellintheperiodunderreview.Bycon-

trast,businesscentredaroundPVCsheetswasmore

sluggish.SIMONAalsosawafurtherincreaseinthe

overallsalesvolumeoffinishedparts.Productsmade

ofspecialtyplasticsshowedmoreforwardmomentum

thanbusinesswithintheareaofsemi-finishedplastics.

Intotal,revenuegeneratedfromsemi-finishedproducts

stoodat€ 196.8million,ayear-on-yearincreaseof

31.6percent.

SIMONA reVeNue BY reGION

in%

Germany

RestofEuropeandAfrica

Asia,America,Australia

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS

2010

17

34

50

2009

11

35

54

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

9

-

Withintheareaofpipingsystems,thecompanyalso

succeededinexpandingsalesrevenues,albeitata

muchlesspronouncedratethanintheareaofsemi-fin-

ishedplastics.SalesvolumesofPPpipesforindustrial

applicationsrosesignificantly,whereasrevenuesgener-

atedintheareaofPEfittingsweredown.Thepipesand

fittingsproductsegmentrecordedrevenuegrowthof7.8

percentto€ 70.6millionintotal.

product development for safety-critical and

eco-specific applications

SIMONApursuesproductdevelopmentatvariouslevels.

OurTechnicalServiceCentreisresponsibleforreviewing

customerrequirementsandrefiningexistingproductsby

makingwell-judgedalterationstopolymerproperties,e.g.

bychangingthebasicformula.TheNewProducts&Applica-

tionsunitworksinclosecollaborationwithourproduct

managementtotestnewmaterialsanddevelopplastics

fornewfieldsofapplication.Committedtopromoting

energy-efficientartificialicerinks,SIMONAdeveloped

SIMONA®Eco-Ice®andlaunchedthenewproductatthe

beginningof2010.Incontrasttoconventionalicerinks,

installationsusingSIMONA®Eco-Ice®canbeoperated

withoutcoolingpipesandcoolantsforiceproduction.

Theiceskatescanbeuseddirectlyontheplasticpanels,

whicharesecurelyjoinedtooneanothertoformanice

rinksurface.SIMONA®Eco-Ice®issuppliedinvariouspol-

yethylenedesigns:PE-HD(highheatresistance),PE-HMW

(highmolecularweight)andPE-UHMW(ultra-highmolecu-

larweight).Inmid-2010,thesystemwasextendedto

includeperimeterboardsmadeofPEFOAMtwin-wall

sheets.Indehoplast®x-detect,anultrahigh-molecular-

weightpolyethylene,SIMONAhasdevelopedapremium

productforthefoodandpharmaceuticalindustries.In

theeventofafracture,evensmallplasticparticlescan

bedetectedinfoodbymeansofmetaldetectors.Devel-

opedin2009,thePVCsheetSIMOSHIELDfordoors,

manufacturedonthebasisofinlinefoilingtechnology,

waslaunchedontothemarketinearly2010.ThePVC

free-foamsheetSIMOPOR-DIGITAL,whichwasdeveloped

fordigitaldirectprinting,wasalsolaunchedontotheEuro-

peanmarketin2010.Withintheareaofpolyolefins,we

carriedouttechnicalrefinementstothefoamedsheets

PEFOAMandPPFOAM.ThePEFOAMlinewasextended

toincludeatwin-wallsheetthatisusedprimarilyfor

perimeterboardsandhousingsaswellasnoiseandheat

insulation.

Inthefieldofpipingsystems,welaunchedanadvanced

SIMONA®PP-HAlphaPlus®pipingsystemtailoredspecific-

allytothegeothermalindustry;itiscapableofwithstand-

ingextremethermal,mechanicalandhydraulicstresses.

Elsewhere,theSIMOFUSE®joiningmethod,firstdevel-

opedforwastewatermanagementinnon-pressurised

applications,hasbeenrefinedtomeettherequirements

ofthepowersupplyindustryanditsdemandsforsustain-

ablesolutions.SIMOFUSE®pipemodulescanbesupplied

indiametersofupto1,000mm.Followingthesuccessful

marketlaunchofprotective-jacketpipesmadeofPE,

SIMONA–asthefirstmanufacturerworldwide–commis-

sionedanindependenttestingunittoassessthefullRC

(ResistancetoCracking)fittingsportfolioinaccordance

withPAS1075.Thetestresultswerehighlyencouraging.

Inpipeextrusion,initialproductiontestingwasconducted

forpipeswithawear-resistantinteriorskin.Theaimisto

developapipewithahighlevelofabrasionresistancefor

thetransportofsolidmaterials.

Researchanddevelopmentexpensesaremainlycom-

prisedofstaffcosts,materialcostsanddepreciation/

amortisationofnon-currentassets.Owingtotheinterrela-

tionshipbetweencustomer-specificmanufacturingproce-

dures,optimisationmeasureswithintheareaofprocess

engineeringandformulaeaswellasproductdevelopment

itself,theabove-mentionedexpensescannotbeclearly

segregatedfromproductioncosts.

GrOup MANAGeMeNt repOrt

10

-

2. FINANCIAl perFOrMANCe

earnings

Againstthebackdropofgradualeconomicrecovery,the

SIMONAGroupsawitsearningsbeforeinterest,taxes

andincomefromequityinvestments(EBIT)riseby€ 2.8

millionto€ 10.1million.TheEBITmarginstoodat3.8

percent,upfromamarginof3.4percentlastyear.

Rawmaterialpricescontinuedtospiraloverthecourse

of2010.Withinthiscontext,theGroupwasunableto

passonthesepricehikesinfull.Asaresult,theper-

centageincreaseinexpensesrelatingtorawmaterials

andconsumableswasmorepronouncedthanthelevel

ofrevenuegrowth.Intotal,thecostofmaterialsroseby

49percentyearonyearto€ 154.4million(2009:

€ 103.7million).Followingasignificantreductionin

2009,thecostsattributabletoenergyandwateredged

upby€ 0.9millionintheperiodunderreviewasa

resultofhigherproductionoutput.

Inviewofexpandingsales,thegrossprofitfor2010

roseby€ 8.5millionto€ 125.5million,whichrepre-

sents47percentofrevenue.

Owingtohighercommoditypricesandinventorystream-

lining,thechangeininventories,aspresentedinthe

incomestatement,amountedto€ 5.3million.

Otheroperatingincomecontractedmarginally,down

€ 0.2millionto€ 7.2million.

At€ 55.9million,staffcostswereslightlyhigherthan

thefigurerecordedayearago(2009:€ 55.3million).

Depreciationofproperty,plantandequipmentand

amortisationofintangibleassetsfellby€ 1.9millionto

€ 12.6millionasaresultofimpairmentchargesrecog-

nisedin2009.

Otheroperatingexpensesroseby€ 7.1millionto

€ 46.9million.Againstthebackdropofmoreexpansive

business,theGroupincurredhighercostsrelatingto

outwardfreightandpackaging,inparticular,aswellas

seeingariseinmaintenancecostsformanufacturing

systems.

Theperformancesoftheindividualsubsidiariesdiffered

fromregiontoregion.Withinthiscontext,earningsper-

formancewasencouraginginPoland,theUnitedKing-

domandtheCzechRepublic.Bycontrast,theresults

postedinItalyandparticularlyFrance,whichincurred

lossesasaresultofrestructuringmeasures,wereless

satisfactory.

TheproductioncompanyintheCzechRepublicisoper-

atingataprofitablelevel.

TheUS-basedsubsidiarypostedaloss,althoughits

earningsperformanceimprovedmarkedlyinayear-on-

yearcomparison.Aprofithasbeenbudgetedforfiscal

year2011.

TheperformanceofoursalescompaniesinAsia

improvedsubstantiallyintheyearunderreview.Our

plantinChinaisstillinthestart-upphaseandhasyet

togenerateaprofit.

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS 04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

11

-

eBIt margin

ThekeyfinancialindicatorsusedbySIMONAforthepur-

poseofanalysingandcontrollingoperatingresultsare

EBIT(earningsbeforeinterestandtaxes)andEBITDA

(earningsbeforeinterest,taxes,depreciationandamor-

tisation).EBITrepresentstheoperatingresultbefore

interestandtaxesaswellastheeffectsofequity

investments.InthecaseofEBITDA,non-cashdeprecia-

tionofproperty,plantandequipmentaswellasamorti-

sationofintangibleassetsareaddedtotheEBITfigure.

BothEBITandEBITDAcanthusbeusedforthepurpose

ofevaluatingacompany’searningsperformance,in

additiontoprovidinganapproximationofcashflow.

Earningsbeforeinterestandtaxesamountedto€ 10.1

million,resultinginanEBITmarginof3.8percent.

EBITDAatGrouplevelroseslightlyto€ 22.7million

(2009:€ 21.9million),withamortisationofintangible

assetsanddepreciationofproperty,plantandequip-

mentcontractingyearonyear.At8.5percent,the

EBITDAmarginremainedjustunderthefigureof10.2

percentrecordedinpreviousfinancialyear.

3. FINANCIAl ASSetS ANd lIABIlItIeS

Thefinancialassetsmainlycomprisecashandshort-

termbankdepositstotalling€ 39.3million(2009:

€ 61.5million).Additionally,theGroupmadeasecur-

itiesinvestmentincoveredbonds(Pfandbriefe)totalling

€ 10.0millionin2010.

Non-currentfinancialliabilitieswerescaledbackby

€ 2.1millionto€ 4.8millioninthefinancialyearunder

review.Thereductionwasattributabletotheearlyrepay-

mentofaloanamountingtoGBP2.0millioninrespect

ofSIMONAUKLtd.,whichwasreplacedbyGroupfunds.

In2010,currentfinancialliabilitiesdeclinedasaresult

ofthescheduledrepaymentofaUSD5.0millionloan,

theprincipalbeingdueatthefinalmaturitydate.Along-

sidecurrentfinancialliabilities,theGrouphadaddi-

tionalfinancialliabilitiesof€ 0.2millioninconnection

withaninterestrateswaptohedgetheriskassociated

withaUSdollarloan.

Otherfinancialobligationstotalling€ 2.9million(2009:

€ 3.1million)wereattributabletorentalandleaseagree-

ments.Ofthistotal,anamountof€ 1.3millionisdue

withinoneyear.Atotalof€ 1.9millionincurrentobliga-

tionsisattributabletocontractsalreadyawardedaspart

ofcapitalexpenditureprojects.

Basedonfinanceincomeof€ 1.0millionandfinance

costof€ 0.6million,netfinanceincomeamountedto

€ 0.4millionin2010(2009:€ –0.2million).

4. FINANCIAl pOSItION

Higher equity ratio

At31December2010totalassetsremainedlargely

unchangedat€ 245million.

DespitefurtherinvestmentsinnewplantsinLitvinov

(CzechRepublic)andJiangmen(China),thetotalcarry-

ingamountofproperty,plantandequipmentfellby

€ 4.7millionintheperiodunderreview,asdepreciation

andwrite-downsexceededtotalcapitalexpenditure.

Rawmaterialsandconsumablesroseby€ 1.7million

yearonyear,whilefinishedgoodsandmerchandise

increasedby€ 4.8million.

Highertradereceivables,up€ 8.5millionto€ 41.8mil-

lion,wereareflectionofmorepronouncedrevenue

growthin2010.

GrOup MANAGeMeNt repOrt

12

-

Revenuebyregion

€44,5 MIllION*

€90,6 MIllION*

€132.7 MIllION*

AM

er

IKA

Ger

MA

NY

eu

rO

pe &

AFr

ICA

AS

IeN

33,8 %

16,6 %

49,6 %

prOGrAMMe OF INterNAtIONAlISAtION BeArS FruIt

TheGroupincreaseditsrevenuemarkedlyinallsalesregions.ThebuoyantAsianmarketsaccountedforsignificantgrowthintheregion

America,Asia&Africa.Thisregiongenerated16.6percentoftotalrevenuewithintheSIMONAGroup,upfrom11.2percentayearago.

TheGroup‘ssolidperformanceisatestamenttoitsincisivestrategyofinternationalexpansion.

*RoundingdifferencesduetoGroupeliminations13

-

Otherfinancialassetscomprisecapitalisedcorporation

taxcreditsofSIMONAAGamountingto€ 4.5million,

theeconomicbenefitsofwhichwillflowtothecompany

after31December2010.Theentitlementwasrecog-

nisedasanassetinthestatementoffinancialposition

asat31December2010inanamountequivalentto

thepresentvalue.

Cashandcashequivalentsfellby€ 22.1million,mainly

asaresultofinventorydownsizing,anincreasein

receivables,asecuritiesinvestmentincoveredbonds

andtherepaymentoffinancialliabilities.Theseaspects

arepresentedintheStatementofCashFlowsinthe

notestotheconsolidatedfinancialstatements.

Equityroseby€ 4.7millioninthefinancialyearunder

review,whileliabilitieswerescaledbackbythesame

amount.

Attheendofthefinancialyear,Groupequityamounted

to€ 162.2million(2009:€ 157.5million).Thisfigure

includesannualprofitof€ 7.2millionandadividend

paymentof€ 3.6millionin2010.TheGroupequity

ratioatthereportingdatewas66percent(2009:64

percent).

Attheendofthereportingperiodtradepayables

amountedto€ 11.2million,up€ 4.3millionyearon

yearduetomorebuoyantbusiness.

Othercurrentprovisionsdeclinedby€ 3.6million,prim-

arilyduetotheutilisationofrestructuringprovisionsin

connectionwiththeclosureoftheplantinKirchhundem-

Würdinghausen.

5. eVeNtS AFter tHe repOrtING dAte

Therewerenoeventsofmaterialsignificancetothe

stateofaffairsoftheSIMONAGroupintheperiod

betweentheendofthe2010financialyearandthe

preparationofthismanagementreport.Beyondthisand

inaccordancewithstatutoryprovisions,interim

announcementswillbeissuedduring2011,outlining

thedevelopmentoftheentityandanyeventsthatare

subjecttodisclosurerequirements.

6. rISK repOrt

TheriskmanagementsystemofSIMONAAGcontrols

thefollowingmaterialrisks:risksrelatingtothegeneral

businessenvironmentandsector,financialrisksandIT-

specificrisks.

Therisksassociatedwiththegeneralbusinessenviron-

mentandthesectorinwhichthecompanyoperates

relatemainlytotheeconomicdevelopmentofcustomer

segmentsservedbySIMONA.Theyalsoincludeexchange

rateandcommoditypricevolatilityaswellastheavail-

abilityofrawmaterials.Owingtoourbroadrangeof

productsandthoroughanalysisofthemarket,weare

abletomitigatetheserisksandrespondtochanges.

TheproductionfacilitiesintheUnitedStates,Chinaand

theCzechRepublicwillhelpustoimprovethecompa-

ny’sflexibilitywhenitcomestomeetingnewcustomer

requirementsatagloballevel.

Pricerisksassociatedwithexchangeratestendto

increaseinproportiontorevenuegeneratedbySIMONA

outsidetheeurozone.Theexpansionofproductionin

foreignsalesmarketshashelpedtoscalebackrisks

withinthisarea.Sector-specificriskswillcontinueto

beafocalpointofourriskmanagementduring2011.

Bothrevenueandearningsperformancein2011willbe

dependenttoalargeextentondevelopmentswithinthe

salesmarketsprimarilytargetedbySIMONA.Against

thebackdropofamorefavourableeconomicclimate,

therisksituationisnowconsideredmuchlesspro-

nounced.Bycontrast,therisksassociatedwithcom-

GrOup MANAGeMeNt repOrt

14

-

moditypriceshaveincreasedduringthefirstmonthsof

2011andarelikelytobeakeyfactorinearningsper-

formancefor2011asawhole.Initiatedtwoyearsago,

thetransitionfromquarterlytomonthlycontractsfor

ethyleneandpropylenehasledtosignificantpricevol-

atilityfordownstreamproducts.

Asregardsreceivables,theriskofdefaultismitigated

bymeansofextensivecreditratingchecksinthecase

ofnewaccountsandongoingassessmentsofthecredit

ratingsofexistingcustomers.Default-relatedriskasso-

ciatedwithspecificcustomersislimitedbycreditinsur-

anceandthecut-offofdeliveriesinthecaseofout-

standingpayments.Thecarryingamountsofinventories

areassessedonaregularbasis,andadjustmentsin

theformofallowancesweremadeforspecificunsale-

ableproducts.

Risksattributabletoinformationtechnologyarecon-

trolledGroup-widebythecompany’sownITdepartment,

whosetaskistomanage,maintain,refineandprotect

theITsystemsonacontinualbasis.

Attheendofthe2010financialyear,weareofthe

opinionthattheoverallrisksituationforthecompany

hasimprovedslightlyasaresultofthefactorsoutlined

above.

Corporate Governance Statement

Thedeclarationoncorporategovernancepursuantto

Section289a(1)sentences2and3oftheGerman

CommercialCode(Handelsgesetzbuch–HGB)hasbeen

publishedbySIMONAAGonitscorporatewebsiteat

www.simona.de.

7. repOrt ON eXpeCted deVelOpMeNtS

Growth with considerable risks

Theglobaleconomylostmostofitsdynamismtowards

mid-2010,withthemajorityofthedevelopedcountries

recordingsubduedGDPgrowthinthefourthquarterof

2010.However,indicatorsimprovedagaintowardsthe

endoftheyear,whichwasunderlinedbythesignificant

expansionoftheworldeconomysincethebeginningof

2011.Havingsaidthat,therearesignsofbifurcation:

theemergingmarkets–particularlyinAsia–have

returnedtoorexceededtheirpre-crisislevelsandcur-

rentlyruntheriskofoverheating,whereasmanyofthe

developedeconomies–suchastheUnitedStates,the

UnitedKingdomandSpain–havebeensluggish.The

globaleconomyisexposedtocertainriskswithregard

toitsfutureperformance.Withinthiscontext,spiralling

commoditypricesrepresentoneofthemostpotent

risks.Thepriceofcrudeoilhassurgedinthewakeof

thepoliticalupheavalwitnessedthroughouttheArab

world.Governmentsintheemergingmarketswillbe

forcedtocounteracttherisktostabilitythatisgenerally

associatedwithaneconomicboom.Itremainstobe

seentowhatextentthepriceofcrudeoilandglobal

economicperformanceasawholewillbeaffectedby

thenaturalandnucleardisasterinJapan.

InJanuary,theInternationalMonetaryFund(IMF)pro-

jectedglobaleconomicgrowthof4.4percentfor2011.

However,thelatestforecastsissuedbyeconomistssug-

gestthatgrowthwillbelesspronounced.TheIMFagain

anticipatesstronggrowthforChina(+9.6percent)and

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS 04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

15

-

India(+8.4percent).TheRussianeconomyisexpected

toexpandby4.5percent.Recoverythroughoutthe

eurozoneremainssluggish;againstthisbackdrop,GDP

isforecasttogrowbyjust1.7percent.TheUSeco-

nomyisexpectedtogainsomemomentum,withesti-

matedgrowthof3.0percentin2011.

SIMONAanticipatesthattheoverallordersituationwill

remainsolidin2011.Orderintakeremainsstableata

highlevel.Followingthedownturn,thereremainssignifi-

cantpotentialwithregardtocapitalexpenditureon

machineryandequipment–ofparticularrelevanceto

ourbusiness–withinkeysalesmarkets.Inaddition,

demandislikelytobebuoyedbyexporttradeonthe

partofcustomersoperatingwithinthechemicaland

mechanicalengineeringindustry.Pipingsystemsengin-

eeringisexpectedtodevelopatamoresubduedrate.

Short-timeworkwaspartiallyintroducedattheRings-

heimplant,whichproducedpipesandfittings.

Elevatedcommoditypricescontinuetoexertdownward

pressureonourgrossprofitmargin,asthepercentage

ofmaterialcostsattributabletoourproductsissignifi-

cant.Itwillbedifficulttopassthesehighercostsonto

customerswithinthehighlycompetitivemarketsof

Europe.

TheSIMONAGroupwillbelookingtopropelrevenue

furthertoatleast€ 290millionforthefinancialyear

2011asawhole.Despitethecontinuedriseincom-

modityprices,profitablegrowthremainsatoppriority

forSIMONA;thetargetforGroupearningsbeforetaxes

hasbeensetat€ 15million.Ourfocusforthefuture

willbeonextrudedsemi-finishedthermoplasticsand

relatedproductsforsafety-criticalandeco-specific

applications.Wehavealsoidentifiedopportunitiesfor

growthwithintheareaofenergyutilitiesandcommo-

dities,environmentalengineeringandagriculture/food

manufacturing.

Owingtotheuncertaintiesassociatedwiththecommod-

itymarketsaswellastheinconsistenteconomictrends

andtheriskofunforeseenevents,suchasrecentdevel-

opmentsinJapan,providingaperformanceoutlookfor

2012isdifficult.Giventhegrowthopportunitieseman-

atingfromtheemergingmarketsandthenewfocuson

safety-criticalandeco-specificapplications,SIMONA

anticipatesthatitsbusinessperformancewillremain

favourablebeyondthefinancialyear2011.

8. OtHer INFOrMAtION

employees

Inaggregate,thenumberofpeopleemployedwithinthe

SIMONAGroupremainedstablein2010.Attheendof

thereportingperiod,theGroupheadcountstoodat

1,236(2009:1,234).Withinthiscontext,theclosureof

ourplantinKirchhundem-Würdinghausenandthedis-

continuationoftwologisticssitesinFrancepushedthe

Group’sheadcountdown,whiletherecruitmentefforts

atthenewproductionfacilityinJiangmen,China,

resultedinnewjobsbeingcreatedwithintheGroup.The

averagenumberofemployeeswithintheGroupwas

1,218.Asat31December2010,theheadcountforthe

parentcompany,SIMONAAG,was910(2009:957).

Attheendof2010,54youngpeople(2009:59)were

enrolledinvocationalprogrammesrelatingtooneof

seventechnicalandcommercialtrainingcourses.In

total,18apprenticessuccessfullycompletedtheirvoca-

tionaltrainingprogrammes;nineofthemwereoffered

permanentemploymentcontracts.Twoapprentices

optedforanintegrateddegreecourseofferedby

SIMONAincooperationwiththeUniversityofApplied

SciencesLudwigshafen.At31December2010,6

femalemembersofstaffwereonparentalleave.Atthe

endof2010,60membersofstaff(2009:64)had

optedforearlypart-timeretirement.

GrOup MANAGeMeNt repOrt

16

-

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS

In2010,SIMONAextendeditsBalancedScorecardasa

strategicmanagementinstrumenttoincorporateother

organisationallevelswithinthecompany.In-housetrain-

ingwithinthecontextofacross-companyprojectaimed

atimprovingtheorderprocessformedoneofthefocal

pointsofHRdevelopmentintheyearunderreview.Addi-

tionally,thecompanyorganisedanumberofpersonal-

isedspecialisttrainingschemesanddrewupaconcept

fortheestablishmentofatalentpromotioncircle,which

willcommencein2011.

In2011,theemphasiswithregardtoITwasonstand-

ardisingtheSAPmodulesusedwithintheGroupand

introducingSAPinfullatSIMONAAMERICAInc.Further-

more,therollouttemplaterelatingtotheSAPmodule

HumanResourceswasextendedandinitialpreparations

weremadeforreleasemigration.

Significant elements of the internal control and man-

agement system

Overallresponsibilityfortheinternalcontrolsystemwith

regardtothefinancialandtheGroupfinancialreporting

processrestswiththeManagementBoard.Allentities

includedwithintheconsolidatedgrouphavebeeninteg-

ratedwithinthissystembymeansofclearlydefined

managementandreportingstructures.

Theinternalcontrolsystem,whichimplementsspecific

controlswithregardtothefinancialreportingprocess,

isaimedatprovidingreasonableassurancethatannual

financialstatementscanbepreparedinaccordance

withstatutoryrequirementsdespitepossiblerisks.The

riskmanagementsystemincludesthefullrangeof

guidelinesandmeasuresrequiredtoidentifyriskandto

manageriskassociatedwithcommercialoperations.

Thepolicies,thestructuralandproceduralorganisation

aswellastheprocessesoftheinternalcontrolandrisk

managementsystemoperatedinrespectoffinancial

reportinghavebeenincorporatedinguidelinesand

organisationalinstructionsthatarerevisedregularlyto

accountforthelatestexternalandinternaldevelop-

ments.Asregardsthefinancialreportingprocess,we

considerthoseelementstobeofsignificancetothe

internalcontrolandriskmanagementsystemthatmay

potentiallyinfluencefinancialreportingandoverall

assessmentoftheannualfinancialstatements,includ-

ingthemanagementreport.Theseelementsareasfol-

lows:

� Identificationofsignificantareasofriskandcontrol

withaninfluenceoverthegroup-widefinancial

reportingprocess

� Monitoringofthegroup-widefinancialreportingpro-

cessandanyfindingstherefromatManagement

Boardlevel

� Preventativemeasuresofcontrolwithregardto

groupaccountingaswellassubsidiariesincludedin

theconsolidatedgroup

� MeasuresthatsafeguardtheappropriateIT-based

preparationofitemsanddataofrelevancetofinan-

cialreporting

Quality and environmental management

ThegoalofSIMONA’squalitymanagementistoensure

thatthequalityofitsproductsandprocessesissafe-

guardedandoptimisedonacontinualbasis.Withinthis

context,theaimistoachieveaconsistentlyhighlevel

ofqualityawarenessatallproductionanddistribution

sites.Theincorporationofthenewproductionsiteat

Jiangmen,China,intotheSIMONAqualitymanagement

conceptprogressedwell,andcertificationoftheQM

systematourChinesemanufacturingplantcannowbe

plannedfortheendof2011.

Amongthefocalpointsofthequalitymanagementsys-

temin2010wereaninterdisciplinaryqualitycircle,

productauditsandseveralprocessoptimisationmeas-

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

17

-

Staffandrevenue

relIABle ANd AttrACtIVe eMplOYer

Despitetheeconomicupheavalseenin2009and2010,SIMONAmaintainedkeptstaffinglevelsstable.Wedemandperformanceand

encourageinitiative.Thisisillustratedbyouraward-winningvocationaltrainingprogramme,ourclosecollaborationwithuniversitiesand

thenewlycreatedSIMONATalentPromotionCircle–„YourTalent.OurFuture.“

303,7

1.236

2008

2009

2010

1.234

215,1

267,4

Revenuein€ millions

Employeesatyears-end

1.251

18

-

uresrelatingtonewautomotiveprojects.Intheareaof

pipesandfittings,anincreasingnumberofcountry-spe-

cificproductcertificationswerenecessaryinresponse

tocustomerandmarketrequirements.Thisresultedin

severalauditsaspartofwhichwewereabletoproveto

externalauditorstheefficacyoftheSIMONAmanage-

mentsystemsaswellastheexceptionallyhighquality

ofourproductsandprocesses.

Asacompanyoperatingwithintheglobalbusiness

arena,SIMONAAGiswellawareofitsresponsibilities

towardspeopleandtheenvironment.Thus,sustainabil-

ityandenvironmentalcompatibilityformanintegralpart

ofthecorporatephilosophyembracedbySIMONAAG.

SIMONAproductscontributetotheprotectionof

resources,e.g.byreplacingheaviermaterials,byfacili-

tatingwatertreatmentorbyreducingCO2emissions.

Sustainabilityhasalsobeendefinedasastrategicgoal

withregardtoourproductionprocesses.Indeed,pro-

duction-integratedenvironmentalprotectionplaysapiv-

otalrolewhenitcomestoplanningnewproduction

processesandcoordinatingfabricationmethods.

SIMONAAGiscommittedtoimprovingitsprocesseson

acontinualbasis,withtheexpresspurposeofactingin

aresource-andenvironmentally-friendlymanner.

Compensation report

Management Board compensation

TheSupervisoryBoard,basedontherecommendations

ofthePersonnelCommittee,isresponsiblefordeter-

miningtheoverallcompensationoftherespectiveMan-

agementBoardmembers.Italsoregularlyreviewsthe

compensationsystemrelatingtotheManagement

Board.ThePersonnelCommitteeconsistsofHans-

WernerMarx,ChairmanoftheSupervisoryBoard,as

wellastheSupervisoryBoardmembersDr.RolfGößler

andRolandFrobel.Compensationforthemembersof

theManagementBoardofSIMONAAGiscalculatedon

thebasisofthesizeofthecompany,itscommercial

andfinancialposition,aswellasthelevelandstructure

ofcompensationgrantedtoManagementBoardmem-

bersofsimilarenterprises.Inaddition,thedutiesand

thecontributionoftherespectivemembersoftheMan-

agementBoardaretakenintoaccount.

ManagementBoardcompensationisperformance-

based.Itiscomprisedofafixedlevelofremuneration

aswellasavariablecomponentintheformofabonus.

Bothoftheaforementionedcomponentsareassessed

onanannualbasis.Inaddition,bothcomponentsare

subjecttothoroughanalysesinintervalsoftwotothree

years,basedonacomparisonwithcompensationfig-

uresapplicabletoexecutivestaffofsimilarenterprises.

Themostrecentassessmentwasconductedin2009.

Thefixedcomponentofcompensationispaidasasal-

aryonamonthlybasis.Inaddition,themembersofthe

ManagementBoardreceiveabonus,thelevelofwhich

isdependentonattainingspecificfinancialtargets

whicharecalculatedonthebasisofthecompany’s

earningsperformance.TotalcompensationfortheMan-

agementBoardamountedto€ 1,553thousand(prev.

year:€ 1,296thousand).Totalcompensationcomprises

€ 1,034thousand(prev.year:€ 988thousand)infixed-

levelcompensationand€ 519thousand(prev.year:

€ 308thousand)inbonuspayments.Thecompanydoes

notgrantloanstomembersoftheManagementBoard.

Therearenoshareoptionplansorothershare-based

compensationprogrammesinplaceformembersofthe

ManagementBoard.

Thecompany’sArticlesofAssociationcontainnoprovi-

sionsthatarenon-compliantwiththosesetoutinthe

GermanStockCorporationActasregardstheconditions

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS 04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

19

-

applicabletotheappointmentorremovalofManage-

mentBoardmembersaswellasamendmentstothe

company’sArticlesofAssociation.Inviewofthis,readers

areaskedtorefertotherelevantstatutoryprovisionsset

outinSections84,85,133and179oftheGerman

StockCorporationAct(Aktiengesetz–AktG)forfurther

details.

RemunerationfortheformermembersoftheManage-

mentBoardamountedto€ 592thousand(previous

year:€ 853thousand).Pensionprovisionsforactive

andformermembersoftheManagementBoardwere

recognisedtothefullextentandamountedto€ 7,756

thousandasat31December2010(previousyear:

€ 8,507thousand).

Supervisory Board compensation

SupervisoryBoardcompensationiscalculatedaccord-

ingtothesizeofthecompany,aswellasthedutiesand

responsibilitiesoftheSupervisoryBoardmembers.The

ChairmanandtheDeputyChairmanaswellasmembers

involvedinCommitteesreceivesupplementarycom-

pensation.

MembersoftheSupervisoryBoardreceiveastandard

fixedlevelofcompensationamountingto€ 10,000.The

ChairmanoftheSupervisoryBoardreceivesanamount

equivalenttodoublethestandardlevelofcompensa-

tion;theDeputyChairmanreceivesanamountequival-

enttooneandahalftimesthestandardlevelofcom-

pensation.SupervisoryBoardmemberswhoare

engagedinCommitteeworkreceivesupplementary

compensationof€ 5,000.Allexpensesassociated

directlywithapositionontheSupervisoryBoard,as

wellassalestax,arereimbursed.

Inadditiontofixedcompensation,theGeneralMeeting

shallbeauthorisedtopassaresolutiononavariable

componentofcompensation,paymentofwhichshallbe

dependentonwhetherspecificcorporateperformance

indicatorshavebeenmetorexceeded.AttheAnnual

GeneralMeetingofShareholderson25June2010no

suchresolutionforvariablecompensationcomponents

waspassedforthe2010financialyear.

SupervisoryBoardcompensationfor2010amountedto

€ 121thousand(previousyear:€ 121thousand).The

companydoesnotgrantloanstomembersofthe

SupervisoryBoard.Therearenoshareoptionplansor

othershare-basedcompensationprogrammesinplace

formembersoftheSupervisoryBoard.

disclosures pursuant to Sections 289 (4) and 315 (4)

HGB and explanatory report

Asat31December2010,thesharecapitalofSIMONA

AGwas€ 15,500,000,dividedinto600,000no-par-value

bearershares(“Stückaktien”governedbyGermanlaw).

Thus,itremainedunchangedinthe2010financialyear.

ThesharesaretradedintheGeneralStandardofthe

GermanstockexchangeinFrankfurtaswellasonthe

Berlinsecuritiesexchange.Therearenodifferentcate-

goriesofshareorsharesfurnishedwithspecialrights.

EachshareisequippedwithonevoteattheGeneral

MeetingofShareholders.Inviewofthefactthata

shareholder’srighttoacertificateofownershipinter-

estshasbeenprecludedunderthecompany’sArticles

ofAssociation,thesharecapitalofourcompanyisrep-

resentedonlyintheformofaglobalcertificate,which

hasbeendepositedwithClearstreamBankingAG,

FrankfurtamMain.Therefore,ourshareholdersonly

haveaninterestasco-ownersinthecollectiveholdings

oftheno-par-valuesharesinourcompany,asheldby

ClearstreamBankingAG,accordingtotheirinterestin

thecompany’ssharecapital.Weshallnolongerissue

effectivesharecertificates.AsfarastheManagement

Boardisaware,therearenorestrictionsaffectingvoting

rightsorthetransferofshares.

A30.79percentinterestwasheldbyDr.Wolfgangund

AnitaBürkleStiftung(Kirn),an11.64percentinterest

byDirkMöller(Kirn),an11.41percentinterestby

GrOup MANAGeMeNt repOrt

20

-

RegineTegtmeyer(Seelze),a15.0percentinterestby

KreissparkasseBiberach(Biberach),a10.0percent

interestbySIMONAVermögensverwaltungsgesellschaft

derBelegschaftmbH(Kirn)anda10.1percentinterest

byRossmannBeteiligungsGmbH(Burgwedel).The

remaining11.06percentofsharesinthecompany

wereinfreefloat.On10June2010,Dr.Wolfgangund

AnitaBürkleStiftungnotifiedthecompanyinaccord-

ancewithSection21(1)oftheGermanSecuritiesTrad-

ingAct(Wertpapierhandelsgesetz–WpHG)thatits

votingpowerinrespectofSIMONAAGhadexceeded

thethresholdof15percent,20percent,25percent

and30percentofthevotingrightson13May2010

andthatatthisdateitsinterestwas30.79percent

(correspondingto184,739votingrights).On10June

2010,Dr.WolfgangundAnitaBürkleStiftungfiledan

applicationwiththeFederalFinancialSupervisory

Authority(BundesanstaltfürFinanzdienstleistungsauf-

sicht–BaFin)forexemptionpursuanttoSection37(1)

and(2)oftheSecuritiesAcquisitionandTakeoverAct

(Wertpapiererwerb-undÜbernahmegesetz–WpÜG)in

conjunctionwithSection9sentence1no.1ofthe

WpÜGOfferOrdinance(WpÜG-Angebotsverordnung).On

thebasisofanofficialNoticeissuedbytheFederal

FinancialSupervisoryAuthorityon22July2010,Dr.

WolfgangundAnitaBürkleStiftungwasexemptedfrom

itsdutiesunderSection35(2)sentence1WpÜGtosub-

mitanofferdocumenttotheFederalFinancialSuper-

visoryAuthorityanditsdutiesunderSection35(2)sen-

tence2inconjunctionwithSection14(2)sentence1

WpÜGtopublishamandatoryoffer.Thisexemptionwas

grantedunderSection37(1)and(2)WpÜGinconjunc-

tionwithSection9sentence1no.1WpÜGOfferOrdi-

nanceinrespectofthecontrolgainedoverSIMONAAG

followingthetestamentarysuccessionof13May2010.

On22April2010,LandkreisBiberach,Biberach,Germany,

notifiedthecompanyinaccordancewithSection21(1)

WpHGthatitsvotingpowerinrespectofSIMONAAGhad

01 GrOup MANAGeMeNt repOrt

BusinessActivitiesandGeneralConditions

FinancialPerformance

FinancialAssetsandLiabilities

FinancialPosition

EventsaftertheReportingDate

RiskReport

ReportonExpectedDevelopments

OtherInformation

02GROUPFINANCIALSTATEMENTS

exceededthethresholdof3percent,5percentand10

percenton29November2006andthatatthisdateits

interestwas10.67percent(64,000votingrights).Of

thesevotingrights,10.67percent(64,000votingrights)

areattributabletotheaforementionedshareholderin

accordancewithSection22(1)sentence1no.1WpHG.

Withinthiscontext,attributablevotingrightsareheldby

theaforementionedpartyviathefollowingentityunder

itscontrolwhosevotingpowerinrespectofSIMONAAG

amountsto3percentormore:KreissparkasseBiber-

ach,Biberach,Germany.On22April2010,Landkreis

Biberach,Biberach,Germany,notifiedthecompanyin

accordancewithSection21(1)WpHGthatitsvoting

powerinrespectofSIMONAAGhadexceededthe

thresholdof15percenton2March2010andthatat

thisdateitsinterestwas15.0038percent(90,023

votingrights).

Ofthesevotingrights,15.0038percent(90,023voting

rights)areattributabletotheaforementionedshare-

holderinaccordancewithSection22(1)sentence1no.

1WpHG.Withinthiscontext,attributablevotingrights

areheldbytheaforementionedpartyviathefollowing

entityunderitscontrolwhosevotingpowerinrespectof

SIMONAAGamountsto3percentormore:Kreisspar-

kasseBiberach,Biberach,Germany.

Asat25June2010,membersoftheManagement

Boardreportedatotalholdingof70,776ownshares;

thiscorrespondsto11.8percentofthesharecapital

ofSIMONAAG.Accordingtothenotificationof25June

2010,membersoftheSupervisoryBoardheldatotalof

1,700shares.Thiscorrespondsto0.28percentof

totalsharecapital.

Totheextentthatemployeesholdaninterestinthe

company’scapital,theseemployeesthemselvesdirectly

exercisetherightsofcontrolassociatedwiththeir

shareholdings.

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

21

-

GrOup MANAGeMeNt repOrt

Theappointmentandtheremovalofmembersofthe

ManagementBoardaregovernedbythestatutoryprovi-

sionssetoutinSections84and85oftheGerman

StockCorporationAct(Aktiengesetz–AktG)aswellas

bySection9oftheArticlesofAssociationofSIMONA

AG.Undertheseprovisions,theManagementBoardof

thecompanyconsistsofatleasttwomembers.The

appointmentofdeputymembersoftheManagement

Boardispermitted.TheManagementBoardgenerallyhas

achairmantobeappointedbytheSupervisoryBoard.

TheSupervisoryBoardisentitledtotransfertoaSupervi-

soryBoardcommitteethedutiesrelatingtotheconclu-

sion,amendmentandterminationofManagementBoard

employmentcontracts.AnyamendmentstotheArticles

ofAssociationmustbemadeinaccordancewiththestat-

utoryprovisionssetoutinSection179etseq.oftheGer-

manStockCorporationAct.

AccordingtoSection6oftheArticlesofAssociation,the

companyisentitledtoissuesharecertificatesthat

embodyoneshare(singlecertificate)ormultipleshares

(globalcertificates).

Atpresenttherearenosignificantagreementscontaining

achangeofcontrolprovisionthatwouldapplyinthe

eventofatakeoverbid.

Atpresenttherearenoagreementswithmembersofthe

ManagementBoardorwithemployeesrelatingtocom-

pensationpaymentsintheeventofachangeofcontrol.

Forward-looking statements and forecasts

ThisGroupmanagementreportcontainsforward-looking

statementsthatarebasedonthecurrentexpectations,

presumptionsandforecastsoftheManagementBoard

ofSIMONAAGaswellasoninformationcurrentlyavail-

abletotheManagementBoard.Theseforward-looking

statementsshallnotbeinterpretedasaguaranteethat

thefutureeventsandresultstowhichtheyreferwill

actuallymaterialise.Rather,futurecircumstancesand

resultsdependonamultitudeoffactors.Theseinclude

variousrisksandimponderabilities,aswellasbeing

basedonassumptionsthatmayconceivablyprovetobe

incorrect.SIMONAAGshallnotbeobligedtoadjustor

updatetheforward-lookingstatementsmadeinthis

report.

Closing statement

Weherebydeclarethattothebestofourknowledgethe

managementreportconveysthecourseofbusiness,the

financialperformanceandthematerialopportunities

andrisksassociatedwiththeexpecteddevelopmentof

theSIMONAGroup.

SIMONAAG

Kirn,31March2011

TheManagementBoard

22

-

GroupIncomeStatement 24

GroupStatementofComprehensiveIncome 25

GroupStatementofFinancialPosition 26

NotestoConsolidatedFinancialStatements 47

GroupStatementofCashFlows 64

GroupStatementofChangesinEquity 65

DetailsofShareholdings 66

Auditor’sReport 67

OtherInformation 68

GroupFinancialStatements

-

in€ ‘000 Notes 01/01 - 31/12/10 01/01 - 31/12/09

Revenue [7] 267,402 215,070

Otheroperatingincome [8] 7,201 7,408

Changesininventoriesoffinishedgoods 5,314 –1,833

Costofmaterials 154,420 103,686

Staffcosts [9] 55,876 55,256

Depreciationofproperty,plantandequipment,andamortisationofintangibleassets [16],[17] 12,606 14,554

Otheroperatingexpenses [11] 46,946 39,830

Incomefromequityinvestments 500 0

Interestincome [12] 498 506

Interestexpense [12] 579 690

profit before tax 10,488 7,135

Incometaxexpense [13] 3,263 2,113

profit for the period 7,225 5,022

ofwhichattributableto:

Ownersoftheparentcompany 7,198 4,988

Non-controllinginterests 27 34

earnings per share:

in€

–basic,calculatedonthebasisofprofitfortheperiodattributabletoordinaryshareholdersoftheparentcompany [14] 12.00 8.31

–diluted,calculatedonthebasisofprofitfortheperiodattributabletoordinaryshareholdersoftheparentcompany [14] 12.00 8.31

GroupIncomeStatementofSIMONAAG

GrOup FINANCIAl StAteMeNtS

24

-

in€ ‘000 01/01 - 31/12/10 01/01 - 31/12/09

profit for the period 7,225 5,022

Exchangedifferencesontranslatingforeignoperationsduringtheyear 1,040 –17

Amountrecogniseddirectlyinequity 1,040 –17

total comprehensive income 8,265 5,005

Totalcomprehensiveincomeattributableto:

Ownersoftheparentcompany 8,235 4,968

Non-controllinginterests 30 37

GroupStatementofComprehensiveIncomeofSIMONAAG

01GROUPMANAGEMENTREPORT 02 GrOup FINANCIAl StAteMeNtS

GroupIncomeStatement

GroupStatementofComprehensiveIncome

GroupStatementofFinancialPosition

NotestoConsolidatedFinancialStatements

GroupStatementofCashFlows

GroupStatementofChangesinEquity

DetailsofShareholdings

Auditor’sReport

OtherInformation

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

25

-

GroupStatementofFinancialPositionofSIMONAAG

GrOup FINANCIAl StAteMeNtS

ASSetS

in€ ‘000 Notes 31/12/10 31/12/09

Intangibleassets [16] 1,294 1,412

Property,plantandequipment [17] 88,126 92,839

Financialassets [30] 23 23

Non-currenttaxassets [20] 3,773 4,320

Deferredtaxassets [13] 173 236

Non-current assets 93,389 98,830

Inventories [18] 50,515 43,994

Tradereceivables [19] 41,845 33,320

Otherassetsandprepaidexpenses [20] 9,947 6,902

Derivativefinancialinstruments [30] 0 160

Otherfinancialassets [30] 10,000 0

Cashandcashequivalents [21] 39,316 61,479

Current assets 151,623 145,855

total assets 245,012 244,685

eQuItY ANd lIABIlItIeS

in€ ‘000 Notes 31/12/10 31/12/09

equity attributable to owners of theparent company

Issuedcapital 15,500 15,500

Capitalreserves 15,274 15,274

Revenuereserves 131,425 127,755

Otherreserves –260 –1,225

161,939 157,304

Non-controlling interests 272 242

total equity [22] 162,211 157,546

Financialliabilities [23] 4,848 7,000

Provisionsforpensions [24] 38,322 36,698

Otherprovisions [26] 6,036 5,979

Otherliabilities 211 414

Deferredtaxliabilities [13] 5,654 5,271

Non-current liabilities 55,071 55,362

Financialliabilities [23] 313 3,824

Provisionsforpensions [24] 1,248 1,637

Otherprovisions [26] 2,535 5,708

Tradepayables 11,202 6,904

Incometaxliabilities 1,607 2,638

Otherliabilitiesanddeferredincome 10,670 10,771

Derivativefinancialinstruments [30] 155 295

Current liabilities 27,730 31,777

total equity and liabilities 245,012 244,685

26

-

NotestoConsolidatedFinancialStatements

[1] COMpANY INFOrMAtION

SIMONAAGisastockcorporation(Aktiengesellschaft)

foundedinGermany–registeredofficeatTeichweg16,

55606Kirn,Germany.Itssharesaretradedwithinthe

GeneralStandardoftheFrankfurtandBerlinStock

Exchanges.Theconsolidatedfinancialstatementsof

SIMONAAGforthefinancialyearended31December

2010werereleasedbytheManagementBoardonthe

basisofaresolutionpassedon31March2011forthe

purposeofforwardingthemtotheSupervisoryBoard.

TheactivitiesofSIMONAAGmainlyincludetheproduc-

tionandsaleofsemi-finishedproductsintheformof

sheets,rods,weldingrods,pipes,fittingsandfinished

partsmadeofthermoplastics.

Thesemi-finishedproductsaremanufacturedinGermany

atplantsinKirnandKirchhundem-Würdinghausen(until

30September2010),aswellasinHazleton(USA)and

Jiangmen(China).Pipesandfittingsareproducedatthe

plantinRingsheim(Germany).TheplantinLitvinov

(CzechRepublic)manufacturessemi-finishedproducts,

pipesandfittings.Theproductsaremarketedunderthe

jointSIMONAbrandaswellasarangeofseparate

brands.

SIMONAAGmaintainsasalesofficeinMöhlin,

Switzerland.

Inaddition,distributionisconductedviasubsidiariesin

theUnitedKingdom(SIMONAUKLimited,Stafford,

UnitedKingdom),France(SIMONAS.A.,Domont,France),

Italy(SIMONAS.r.l.,Vimodrone,Italy),Spain(SIMONA

IBERICASEMIELABORADOSS.L.,Barcelona,Spain),

Poland(SIMONAPOLSKASp.zo.o.,Wrocław,Poland,

DEHOPLASTPOLSKASp.zo.o.,Kwdizyn,Poland),the

CzechRepublic(SIMONAPLASTICSCZ,s.r.o.,Prague,

CzechRepublic),HongKong(SIMONAFAREASTLtd.,

HongKong,China),China(SIMONAENGINEERINGPLAS-

TICSTRADINGCo.Ltd,Shanghai,China)andtheUnited

States(SIMONAAMERICAInc.,Hazleton,USA).

[2] ACCOuNtING pOlICIeS

Basis of preparation

Theconsolidatedfinancialstatementsareprepared

usingthehistoricalcostprinciple,withtheexceptionof

derivativefinancialinstrumentsandavailable-for-sale

financialassets,whicharemeasuredatfairvalue.The

consolidatedfinancialstatementsarepreparedineuro.

Unlessotherwisestated,allamountsareroundedto

€ ‘000.

Statement of compliance with IFrS

TheconsolidatedfinancialstatementsofSIMONAAG

andtheentitiesincludedintheconsolidatedgroupfor

theperiodended31December2010,havebeenpre-

paredinaccordancewiththeInternationalFinancial

ReportingStandards(IFRS)applicableatthereporting

date,asadoptedbytheEuropeanUnion,andtheprovi-

sionsofcommerciallawtobeappliedadditionallypur-

suanttoSection315a(1)oftheGermanCommercial

Code(Handelsgesetzbuch–HGB).

Theterm“IFRS”comprisesallInternationalFinancial

ReportingStandards(IFRS)andInternationalAccounting

Standards(IAS)tobeappliedonamandatorybasisas

atthereportingdate.Additionally,allinterpretations

issuedbytheInternationalFinancialReportingInterpre-

tationsCommittee(IFRIC)–formerlyStandingInterpre-

tationsCommittee(SIC)–wereappliedinsofarastheir

applicationwasmandatoryforthe2010financialyear.

Theconsolidatedfinancialstatementsconsistofthe

financialstatementsofSIMONAAGanditssubsidiaries

asat31Decemberofeachfinancialyear(hereinafter

alsoreferredtoas“Group”or“SIMONAGroup”).

TheGroupstatementoffinancialpositionconformswith

thepresentationrequirementsofIAS1.Variousitems

reportedintheincomestatementandthestatementof

financialpositionhavebeenaggregatedforthepurpose

ofimprovingtheoverallclarityofpresentation.These

01GROUPMANAGEMENTREPORT 02 GrOup FINANCIAl StAteMeNtS

GroupIncomeStatement

GroupStatementofComprehensiveIncome

GroupStatementofFinancialPosition

NotestoConsolidatedFinancialStatements

GroupStatementofCashFlows

GroupStatementofChangesinEquity

DetailsofShareholdings

Auditor’sReport

OtherInformation

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

27

-

itemsaredisclosedanddiscussedseparatelyinthe

notestotheconsolidatedfinancialstatements.

principles of consolidation

Theconsolidatedfinancialstatementscomprisethe

accountsofSIMONAAGanditssubsidiariesforeach

financialyearended31December.Thefinancialstate-

mentsofSIMONAAGandthesubsidiariesareprepared

usinguniformaccountingpoliciesforthesamereporting

period.

Allintragroupbalances(receivables,liabilities,provi-

sions),transactions,incomeandexpensesaswellas

profitsandlossesfromtransactionsbetweenconsoli-

datedentities(“intercompanyprofits”)areeliminatedas

partofconsolidation.

Subsidiariesarefullyconsolidatedeffectivefromthe

acquisitiondate,whichisthedateonwhichtheGroup

effectivelyobtainscontrol.Inclusionintheconsolidated

financialstatementsendsassoonastheparentceases

tocontrolthesubsidiary.Changesinaparent’sowner-

shipinterestinasubsidiarythatdonotresultinaloss

ofcontrolareaccountedforasequitytransactions.

Non-controllinginterestsaredisclosedseparatelyinthe

GroupincomestatementandwithinequityoftheGroup

statementoffinancialposition.

[3] NeW FINANCIAl repOrtING StANdArdS

3.1 Accounting standards applicable for the first time

in the financial year

Theaccountingmethodsappliedtotheseconsolidated

financialstatementsareconsistentwiththoseapplied

inthepreviousyear,withtheexceptionofthefollowing

newandamendedStandardsandInterpretationseffec-

tiveasat1January2010.Thefollowingsectionpro-

videsasummaryofStandardsthatareofrelevanceto

SIMONAAG,aswellasdetailingthepossibleimplica-

tionsfortheconsolidatedfinancialstatements:

� IAS39“FinancialInstruments:Recognitionand

Measurement”(EligibleHedgedItems)

� IFRS2“Share-basedPayment”(GroupCash-settled

Share-basedPaymentTransactions)

� IFRS3“BusinessCombinations”/IAS27“Consoli-

datedandSeparateFinancialStatements”(PhaseII:

generalrevisionaspartoftheconvergenceproject

oftheIASBandFASB

� IFRIC17DistributionsofNon-cashAssetstoOwners

(newinterpretation)

� ImprovementstoIFRS2008

� ImprovementstoIFRS2009

Thefollowingsectionprovidesasummaryoftherelev-

antStandards,aswellasdetailingthepossibleimpli-

cationsfortheconsolidatedfinancialstatements:

� IAS39“FinancialInstruments:Recognitionand

Measurement”(EligibleHedgedItems)clarifiesthat

anentityisentitledtodesignatejustsomeofthe

changesinthecashflowsorfairvaluesofafinan-

cialinstrumentasahedgeditem.Thisalsoencom-

passesthedesignationofinflationasahedgedrisk

orportioninparticularsituations.TheSIMONA

Grouphasascertainedthatthisamendmentwillnot

affecttheGroup’sfinancialposition,financialper-

formanceandcashflows,astheGrouphasnot

enteredintoanysuchtransactions.

� IFRS2“Share-basedPayment”(GroupCash-settled

Share-basedPaymentTransactions)containsamend-

mentstothescopeandaccountingofGroupcash-

settledshare-basedpaymenttransactions).The

amendmenttoIFRS2hasnoeffectonthefinancial

position,financialperformanceandcashflowsof

theSIMONAGroup,asnoshare-basedpaymentis

offered.

� IFRS3“BusinessCombinations”/IAS27“Consoli-

datedandSeparateFinancialStatements”were

amendedextensivelyaspartoftheconvergence

GrOup FINANCIAl StAteMeNtS

28

-

projectimplementedbytheIASBandFASB.Thekey

amendmentsarecentredaroundtheintroductionof

anoptionrelatingtothemeasurementofnon-con-

trollinginterests,withachoicebetweenrecognition

onthebasisoftheproportionateidentifiablenet

assets (purchased Goodwill Method)andtheso-

calledFull Goodwill Method,wherebytheentirepor-

tionofgoodwillapplicabletotheminorityshare-

holdershallberecognised.Otherpointsincludethe

revaluation,withrecognitioninprofitorloss,ofany

existingownershipinterestsatthedateofinitially

obtainingcontrol(businesscombinationachievedin

stages),therecognitionattheacquisitiondateof

anyconsiderationcontingentonfutureeventsas

wellastherecognitionoftransactioncostsinprofit

orloss.Thetransitionalprovisionsstipulateapro-

spectiveapplicationoftheamendments.Thereare

nochangesinrespectofassetsandliabilitiesthat

arisefrombusinesscombinationspriortotheinitial

applicationofthenewstandards.Theamendments

mayhaveaneffectonthecarryingamountofgood-

will,ontheresultsofthereportingperiodinwhicha

businesscombinationhasoccurredandonfuture

results.Inparticular,applicationofthefull-goodwill

methodmayresultinhighergoodwillbeingrecog-

nised.Theseamendmentshadnoeffectonthe

2010financialyear,asnotransactionsrelatingto

businesscombinationsoccurredintheperiodunder

review.

� IFRIC17includesdetailsonhowtoaccountfordis-

tributionsofnon-cashassetstoownerseitherfrom

reservesorintheformofdividends.ThisInterpreta-

tiondoesnoteffectthepresentationoffinancial

position,financialperformanceandcashflowsof

theSIMONAGroup,asnosuchdistributionswere

made.

3.2 Issued standards and interpretations which have

not yet been applied (eu endorsement completed)

TheInternationalAccountingStandardsBoard(IASB)and

theInternationalFinancialReportingInterpretations

Committee(IFRIC)issuedthefollowingStandardsand

Interpretationswhichhavealreadybeenadoptedbythe

EuropeanUnionaspartofthecomitologyprocedurebut

whoseapplicationwasnotyetmandatoryinthe2010

financialyear.TheGroupwillnotapplytheseStandards

andInterpretationsforanearlierperiod.

� IFRS1“First-timeAdoptionofInternationalFinancial

ReportingStandards”(LimitedExemptionfromCom-

parativeIFRS7DisclosuresforFirst-timeAdopters)

� IAS24“RelatedPartyDisclosures”

� IAS32“FinancialInstruments:Presentation”(Classi-

ficationofRightsIssues)

� IFRIC14“PrepaymentsofaMinimumFunding

Requirement”

� IFRIC19“ExtinguishingFinancialLiabilities

withEquityInstruments”

� VariousimprovementstoIFRS(omnibusstandardfor

thepurposeofamendingvariousIFRSs).

Basedonsoundjudgement,theSIMONAGroupmay

potentiallybeaffectedbythefollowingamendments:

� IAS1“PresentationofFinancialStatements”

� IAS27“ConsolidatedandSeparateFinancial

Statements”

� IFRS3“BusinessCombinations”

� IFRS7“FinancialInstruments:Disclosures”

WiththeexceptionofIAS24,applicationoftheafore-

mentionedstandardsandinterpretationsisunlikelyto

havesignificantimplicationsforthefuturefinancial

statementsissuedbytheSIMONAGroup:

IAS24(amended)wasissuedinNovember2009and

mustbeappliedbyentitiesforannualperiodsbeginning

onorafter1January2011.Itrevisesthedefinitionof

relatedpartiesinordertosimplifytheprocessofidenti-

fyingrelationshipswithrelatedparties,aswellas

01GROUPMANAGEMENTREPORT 02 GrOup FINANCIAl StAteMeNtS

GroupIncomeStatement

GroupStatementofComprehensiveIncome

GroupStatementofFinancialPosition

NotestoConsolidatedFinancialStatements

GroupStatementofCashFlows

GroupStatementofChangesinEquity

DetailsofShareholdings

Auditor’sReport

OtherInformation

04FINANCIALSTATEMENTSOF

SIMONAAG(EXCERPT)

01COMPANY

29

-

itemsaredisclosedanddiscussedseparatelyinthe

notestotheconsolidatedfinancialstatements.

principles of consolidation

Theconsolidatedfinancialstatementscomprisethe

accountsofSIMONAAGanditssubsidiariesforeach

financialyearended31December.Thefinancialstate-

mentsofSIMONAAGandthesubsidiariesareprepared

usinguniformaccountingpoliciesforthesamereporting

period.

Allintragroupbalances(receivables,liabilities,provi-

sions),transactions,incomeandexpensesaswellas

profitsandlossesfromtransactionsbetweenconsoli-

datedentities(“intercompanyprofits”)areeliminatedas

partofconsolidation.

Subsidiariesarefullyconsolidatedeffectivefromthe

acquisitiondate,whichisthedateonwhichtheGroup

effectivelyobtainscontrol.Inclusionintheconsolidated

financialstatementsendsassoonastheparentceases

tocontrolthesubsidiary.Changesinaparent’sowner-

shipinterestinasubsidiarythatdonotresultinaloss

ofcontrolareaccountedforasequitytransactions.

Non-controllinginterestsaredisclosedseparatelyinthe

GroupincomestatementandwithinequityoftheGroup

statementoffinancialposition.

[3] NeW FINANCIAl repOrtING StANdArdS

3.1 Accounting standards applicable for the first time

in the financial year

Theaccountingmethodsappliedtotheseconsolidated

financialstatementsareconsistentwiththoseapplied

inthepreviousyear,withtheexceptionofthefollowing

newandamendedStandardsandInterpretationseffec-

tiveasat1January2010.Thefollowingsectionpro-

videsasummaryofStandardsthatareofrelevanceto

SIMONAAG,aswellasdetailingthepossibleimplica-

tionsfortheconsolidatedfinancialstatements:

� IAS39“FinancialInstruments:Recognitionand

Measurement”(EligibleHedgedItems)

� IFRS2“Share-basedPayment”(GroupCash-settled

Share-basedPaymentTransactions)

� IFRS3“BusinessCombinations”/IAS27“Consoli-

datedandSeparateFinancialStatements”(PhaseII:

generalrevisionaspartoftheconvergenceproject

oftheIASBandFASB

� IFRIC17DistributionsofNon-cashAssetstoOwners

(newinterpretation)

� ImprovementstoIFRS2008

� ImprovementstoIFRS2009

Thefollowingsectionprovidesasummaryoftherelev-

antStandards,aswellasdetailingthepossibleimpli-

cationsfortheconsolidatedfinancialstatements:

� IAS39“FinancialInstruments:Recognitionand

Measurement”(EligibleHedgedItems)clarifiesthat

anentityisentitledtodesignatejustsomeofthe

changesinthecashflowsorfairvaluesofafinan-

cialinstrumentasahedgeditem.Thisalsoencom-

passesthedesignationofinflationasahedgedrisk

orportioninparticularsituations.TheSIMONA

Grouphasascertainedthatthisamendmentwillnot

affecttheGroup’sfinancialposition,financialper-

formanceandcashflows,astheGrouphasnot

enteredintoanysuchtransactions.

� IFRS2“Share-basedPayment”(GroupCash-settled

Share-basedPaymentTransactions)containsamend-

mentstothescopeandaccountingofGroupcash-

settledshare-basedpaymenttransactions).The

amendmenttoIFRS2hasnoeffectonthefinancial

position,financialperformanceandcashflowsof

theSIMONAGroup,asnoshare-basedpaymentis

offered.

� IFRS3“BusinessCombinations”/IAS27“Consoli-

datedandSeparateFinancialStatements”were

amendedextensivelyaspartoftheconvergence

GrOup FINANCIAl StAteMeNtS

30

-

projectimplementedbytheIASBandFASB.Thekey

amendmentsarecentredaroundtheintroductionof

anoptionrelatingtothemeasurementofnon-con-

trollinginterests,withachoicebetweenrecognition

onthebasisoftheproportionateidentifiablenet

assets (purchased Goodwill Method)andtheso-

calledFull Goodwill Method,wherebytheentirepor-