RULE THE MARKET - Karvy Onlinecontent.karvyonline.com/contents/kstreetissue006.pdf · Team: Dr Ravi...

Transcript of RULE THE MARKET - Karvy Onlinecontent.karvyonline.com/contents/kstreetissue006.pdf · Team: Dr Ravi...

ISSUE: 006

13TH OCTOBER, 2018

RULE THE MARKET

From The Desk Of Research HeadCONTENTSEquity 1-6

Derivatives 7-8

Commodity 9-12

Currency 13-14

Mutual Funds 15

Events 16

TeamDr Ravi SinghArun Kumar MantriChirag M SolankiAditya KistampallyNarasinga Rao Nikunj Todi Osho KrishanDeepak SakureVivek K Vivek Ranjan MisraYash BhotikaKonpal PaliMunindra UpadhyayVeeresh HiremathArpit ChandnaAnup B PAmit KumarVinod JRahul ChanderSiddesh GhareDeepak Agarwal

Bharath Sunnam

D Jayant Kumar

Karvy Head Office

Karvy Stock Broking Limited, Plot No.31, 6th Floor, Karvy Millennium Towers, Financial District, Nanakramguda, Hyderabad, 500 032, India.

For More updates & Stock Research

Visit: www.karvyonline.com

Toll free: 1800 419 8283

Email: [email protected]

Analyst CertificationThe following Karvy Research Desk, who is (are) primarily responsible for this report and whose name(s) is/ are mentioned therein, certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: Karvy Stock Broking Limited [KSBL] is registered as a research analyst with SEBI (Registration No INZ000172733). KSBL is also a SEBI registered Stock Broker, Depository Participant, Portfolio Manager and also distributes financial products. The subsidiaries and group companies including associates of KSBL provide services as Registrars and Share Transfer Agents, Commodity Broker, Currency and forex broker, merchant banker and underwriter, Investment Advisory services, insurance repository services, financial consultancy and advisory services, realty services, data management, data analytics, market research, solar power, film distribution and production, profiling and related services. Therefore associates of KSBL are likely to have business relations with most of the companies whose securities are traded on the exchange platform. The information and views presented in this report are prepared by Karvy Stock Broking Limited and are subject to change without any notice. This report is based on information obtained from public sources, the respective corporate under coverage and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of KSBL. While we would endeavor to update the information herein on a reasonable basis, KSBL is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent KSBL from doing so. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. KSBL will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. While acting upon any information or analysis mentioned in this report, investors may please note that neither KSBL nor any associate companies of KSBL accepts any liability arising from the use of information and views mentioned in this report. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Past performance is not necessarily a guide to future performance. Forward-looking statements are not predictions and may be subject to change without notice. Actual results may differ materially from those set forth in projections. Associates of KSBL might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months. Associates of KSBL might have received compensation from the subject company mentioned in the report during the period preceding twelve months from the date of this report for investment banking or merchant banking or brokerage services from the subject company in the past twelve months or for services rendered as Registrar and Share Transfer Agent, Commodity Broker, Currency and forex broker, merchant banker and underwriter, Investment Advisory services, insurance repository services, consultancy and advisory services, realty services, data processing, profiling and related services or in any other capacity.KSBL encourages independence in research report preparation and strives to minimize conflict in preparation of research report. Compensation of KSBL’s Research Analyst(s) is not based on any specific merchant banking, investment banking or brokerage service transactions. KSBL generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.KSBL or its associates collectively or Research Analysts do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. KSBL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report and have no financial interest in the subject company mentioned in this report. Accordingly, neither KSBL nor Research Analysts have any material conflict of interest at the time of publication of this report. It is confirmed that KSBL and Research Analysts, primarily responsible for this report and whose name(s) is/ are mentioned therein of this report have not received any compensation from the subject company mentioned in the report in the preceding twelve months. It is confirmed that Research Analyst did not serve as an officer, director or employee of the companies mentioned in the report. KSBL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither the Research Analysts nor KSBL have been engaged in market making activity for the companies mentioned in the report. We submit that no material disciplinary action has been taken on KSBL by any Regulatory Authority impacting Equity Research Analyst activities.

- DR. RAVI PRAKASH SINGHHead-Technical & Derivatives Research

VOLATILITY – A MAJOR CONTRIBUTOR TO MARKET DYNAMICS

Volatility has always been the flavor of the markets. Along with volatility, market rallies and corrections go hand in hand. But why are we talking about volatility now? Well, the situation across the street is pretty tense and most retail participants are panic stricken at the moment. Panicking and making irrational decisions in horrid times is human nature.

One must understand that without volatility, the markets would always trade in a horizontal manner, thereby leaving no scope for a rally or a correction. Higher volatility has always been associated with market corrections and whenever the India VIX- NSE’s volatility index shoots up by about 3-4% on an intraday basis, it basically indicates that the trend is likely to change, mostly in favor of the bearish market participants.

WHAT IS INDIA VIX AND WHY IS IT IMPORTANT?

India VIX is a volatility index which measures market expectations of near term volatility. It indicates the investor’s perceptions of the market volatility in near term. Higher the India VIX values, higher the expected volatility and vice-versa. The India VIX index is also referred to as the Fear Gauge which is generally used by market participants to make a choice about their trading/investment activities. Basically, India VIX is a measure of the amount by which a primary index is expected to ebb and flow in the near term. The value of this index is derived after a complex set of calculations. Technically, historical data suggests that identifying the potential tops and bottoms on the charts of India VIX have successfully given traders a sense of the probable change in the market direction. Hence, this index which indicates the overall volatility is one of the most important parameters that analysts use to determine broader market trends. Ever since the last market crash, post which the US FED infused liquidity by way of quantitative easing, the India VIX has been trading in a range of 39.02 on the higher side and 8.76 on the downside. In our observation on the monthly charts of the VIX, we sense that market tops are associated with lowest VIX and bear market bottoms with highest VIX. In our opinion, traders may expect such a huge spike with around 35-50 zone, before we stabilize and move in low volatile environment while ideally bear markets bottom out with sharp IVs and volatility is highest during capitulation phase.

WHY IS EVERYONE TALKING ABOUT VOLATILITY AND WHERE ARE THE MARKETS HEADED?

Markets have been cracking from the past 7 weeks or so and there is a big hue and cry that increased volatility is the reason which is absolutely true. Volatility increases as uncertainty swells. Highlighted in bold, below are few reasons responsible for the significant spike in the volatility over the past few trading sessions. We have been reiterating that traders and investors need not panic as we feel that a few of these factors are most likely priced in. While it is difficult to comment on the rising interest rates in the US and the final outcome of the ongoing trade war between US and China, we feel that crude oil prices are likely to cool down and drift lower once other OPEC nations along with Russia will step up the production in the time to come as current prices will entice nations like Libya, Venezuela, etc. to increase their production. This will demonstrate how the law of demand and supply will play its role and thereby once the supply increases, the prices of the commodity will come down. This will have a clear impact on the sliding rupee as well which will eventually stop sliding against the dollar as most of India’s oil imports are settled in dollar terms.

According to us, markets are likely around the near term bottom and 100-150 points here or there on the Nifty’s front will not matter much as far as the Indian markets are concerned. In our observation, mid-caps and small-caps along with large caps have had a sizable valuation based correction and are available at inexpensive prices at the current juncture. Hence, there are good chances of the markets (Nifty) to consolidate around the 10000-10100 mark and possibly move higher from thereon once everything else starts falling in place.

EQUITY

Domestic Economy

• India’s retail inflation rose marginally to 3.77% in September owing to higher fuel and food prices.

• A dedicated liquidity window is among the suggestions Indian non-banking finance companies (NBFC) have made to the Centre which is talking to the industry to ensure uninterrupted fund flow to a sector that has helped expand consumption demand beyond the cities.

• Low demand, little order growth and intensifying price pressure brought down services growth in September to its lowest level in four months according to the widely tracked Nikkei India Services Purchasing Managers Index (PMI). The Services PMI for September fell to 50.9 down from 51.5 in August.

Aviation

• Big relief for the aviation sector as government decided to cut excise duty on jet fuels to 11% from 14%. .

Automobile

• M&M has introduced a personal vehicle leasing option for retail buyers to make the vehicle usage process more affordable and convenient..

IT

• TCS’ Profit rises after margin hits seven-quarter high.

BFSI

• Bandhan bank gets exemption from SEBI w.r.t lock in of 1 yr on promoter shares.

• State Bank of Mauritius loses Rs. 143 crore in cyber fraud.• SBI to purchase loan assets worth up to Rs. 45,000 crore from NBFCs.

Oil & Gas

• IEA lowers it growth forecast in oil demand for 2018 & 2019 due to high prices, trade tension and less favourable economic outlook. The estimated growth in global demand has been reduced by 110000 barrels per day for each of the two years.

• A top US envoy on Iran is headed to India this week for talks ahead of the November 4 deadline set by the Trump administration for countries to bring down their import of Iranian oil to zero.

Metals

• The Aluminium Association of India (AAI) has written to the government asking it to stop prioritizing coal supply to power plants. The exclusion of other industries that required coal was depriving them of the much-needed raw material essential for their functioning according to the association.

Pharma

• Zydus group has aggressively offered Rs. 4500 cr to Kraft Heinz.

• Aurobindo Pharma gets USFDA nod for infection treatment drug.

NEWS

INTERNATIONAL NEWS

• China auto sales sink in September as economy cools.

• Global business leaders suspend ties with Saudi Arabia.

• ‘Path of thorns’: An IMF bailout set to impede Pakistan PM’s populist agenda.

• Donald Trump says Federal Reserve is ‘out of control’, rules out firing Jerome Powell.

• US announces measures to prevent nuclear technology exports to China.

• Virgin’s Branson halts talks on $1 bn Saudi investment in space ventures.

• Walmart to pay $65 mn to settle lawsuit over seating for cashiers.

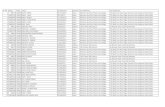

TREND SHEETSymbol CMP S2 S1 R1 R2 TREND

SENSEX 34733.58 33304 34019 35153 35573 Down

NIFTY 10472.5 10014 10243 10597 10722 Down

NIFTYBANK 25395.85 23796 24596 25840 26284 Down

RELIANCE 1,126.55 990 1058 1162 1197 Down

YESBANK 246.45 179 213 274 302 Down

BAJFINANCE 2,287.35 1765 2026 2434 2581 Down

TATAMOTORS 183.75 143 163 211 239 Down

SBIN 263.75 245 255 277 290 Down

TCS 1,918.30 1762 1840 2059 2200 Down

MARUTI 7,287.20 6426 6857 7522 7756 Down

HDFCBANK 1,981.85 1886 1934 2013 2045 Up

ICICIBANK 319.40 288 304 330 340 Up

AXISBANK 584.90 522 553 609 634 Down

FORTHCOMING EVENTSSecurity Name Company name Result Date

AUBANK AU SMALL FINANCE BANK LTD 13-Oct-18

DMART AVENUE SUPERMARTS LTD 13-Oct-18

IBULHSGFIN INDIABULLS HOUSING FINANCE LTD 15-Oct-18

INDUSINDBK INDUSIND BANK LTD 15-Oct-18

MEERA MEERA INDUSTRIES LTD 15-Oct-18

RIIL RELIANCE INDUSTRIAL INFRASTRUCTURE LTD 15-Oct-18

SOUTHBANK SOUTH INDIAN BANK LTD 15-Oct-18

TRIDENT TRIDENT LTD 15-Oct-18

TV18BRDCST TV18 BROADCAST LTD 15-Oct-18

ZEELEARN ZEE LEARN LTD 15-Oct-18

ZEEMEDIA ZEE MEDIA CORPORATION LIMITED 15-Oct-18

CRISIL CRISIL LTD 16-Oct-18

FEDERALBNK FEDERAL BANK LTD 16-Oct-18

HEROMOTOCO HERO MOTOCORP LTD 16-Oct-18

INFY INFOSYS LTD 16-Oct-18

MAHINDCIE MAHINDRA CIE AUTOMOTIVE LIMITED 16-Oct-18

MENNPIS MENON PISTONS LTD 16-Oct-18

SHAKTIPUMP SHAKTI PUMPS (INDIA) LTD 16-Oct-18

ACC ACC LTD 17-Oct-18

BIRLAMONEY ADITYA BIRLA MONEY LTD 17-Oct-18

CYIENT CYIENT LIMITED 17-Oct-18

DCBBANK DCB BANK LIMITED 17-Oct-18

HAVELLS HAVELLS INDIA LTD 17-Oct-18

KSTREET - 13TH OCTOBER 2018 1

INDIAN INDICES (% CHANGE)

GLOBAL INDICES (% CHANGE)

NIFTY MIDCAP100TOP GAINERS & LOSERS (1W)

SECTORAL INDICES (% CHANGE)

FII/FPI & DII TRADING (IN RS. CRORES)

NSE NIFTY TOP GAINERS & LOSERS (1W)

EQUITY

0

0.5

1

1.5

2

2.5

3

NIFTY SENSEX SPBSMIP SPBSSIP NIFTYJR NSEMCAP -8.0

-6.0

-4.0

-2.0

0.0

2.0

4.0

6.0

8.0

NSEA

UTO

NSEBA

NK

NSESRV

NSEPH

RM

NSEIT

NSEM

ET

NSEN

RG

NSEC

ON

NSEREA

L

NSEFM

CG

-8

-7

-6

-5

-4

-3

-2

-1

0

NA

SDA

Q

DO

W JO

NES

S&P50

0

NIK

KEI

HA

NG

SENG

SHA

NG

HA

I CO

MP

FTSE 100

CA

C 40

-20.0

-10.0

0.0

10.0

20.0

30.0

40.0

50.0

AD

AN

I IS

MRPL IS

VK

I IS

RELI IS

ENG

R IS

MPH

L IS

AIA

E IS

RJEX IS

DBL IS

CBO

I IS

-20.0

-10.0

0.0

10.0

20.0

30.0

40.0

HPC

L IS

YES IS

IOC

L IS

BAF IS

EIM IS

INFO

IS

VED

L IS

TCS IS

HC

LT IS

TTMT IS

-4000

-3000

-2000

-1000

0

1000

2000

3000

10/5/20

18

10/6/20

18

10/7/20

18

10/8/20

18

10/9/20

18

10/10

/2018

10/11/20

18

FII/FPI DII

KSTREET - 13TH OCTOBER 2018 2

BEAT THE STREET - FUNDAMENTAL ANALYSIS

Cadila HealthcareCMP Rs.377 Target Price Rs.431Upside 14.3%

Investment Rationale

• Cadila’s revenues increased by 29.5% on a YoY basis to Rs. 28.9 bn during

Q1FY19. Operating margins increased to 22.3% compared to 12.8% in

Q1FY18 due to higher revenues, operating income and lower R & D. Net

Profit grew by 233% YoY to Rs. 4605 mn due to other income of Rs. 1013

mn.

• Key performer was US. US business performed well with 9 new product

launches in the US market in Q1FY19 which includes company’s own

generic version of Asacol HD and Metaprolol.

• Company plans to launch 50 products in the US market in FY19E.

• Exelon (Rivastigime) is an important transdermal product. It is a USD 275-

300 mn product. We have factored the same from FY 2020 onwards.

• Around 2 niche trigger approvals could be: 1) Transdermals 2) Lansaprazole

ODT (USD 225-250 mn).

• The company launched 19 new products on formulation front including few

line extensions for the first time in India. Management expects $200 mn

revenue each from Vaccines and Biosimilars in the next couple of years.

VALUE PARAMETERSFace Value (Rs.) 1.0

52 Week High/Low (Rs.) 515/333

M.Cap (Rs. Bn/US $mn) 386/5.24

EPS (Rs.) 17.9

P/E Ratio (times) (FY20E) 17.2

Dividend Yield (%) 0.93

Stock Exchange BSE

% OF SHARE HOLDING

in Rs.Mn ACTUAL ESTIMATE

YE Mar FY 18 FY 19 FY 20

REVENUE 119364 133620 153962

EBITDA 28,475 28,201 32,792

EBITDA % 23.9 21.1 21.3

PAT 18,292 17,102 21,021

EPS (Rs.) 17.9 16.7 20.5

RoE (%) 21.0 17.2 18.6

PE (x) 19.8 21.2 17.2

P/E CHARTValuation

We recommend BUY rating on the stock with our price target of Rs. 431 based on 21x FY20E.

EQUITY

KSTREET - 13TH OCTOBER 2018 3

BEAT THE STREET - FUNDAMENTAL ANALYSIS

BharatForgeCMP Rs.572Target Price Rs.791Upside 38%

Investment Rationale

• BFL provides forging components to Auto and Industrial sectors. Its growth prospects are primarily linked to the commercial vehicle (CV) industry in India and North America and industrial activities in both the geographies.

• It has taken many strategic initiatives which we believe has strengthened its business model. It has diversified its revenue stream by entering into new segments (non-auto) and thus share of auto business has declined from ~80% in FY07 to ~57% in FY18. BFL has also focused on providing high value added parts (machined components) rather than raw forging components which has increased its overall realizations and margins.

• BFL is preparing itself to enter into new segment such as Aviation, Defence and Railway which is likely to contribute mainly in FY20.

• It is focusing on enhancing its presence in the light material space, for which the company has planned to set up an Aluminum Forging facility in Tennessee, USA at a cost of $55 mn. This facility is likely to address requirement of the North American car market and will commence production in CY20.

• It has invested around Rs. 4 bn in the expansion of its forging and machinery capacity at Baramat.

• BFL has strengthened its balance sheet by reducing debt and lowering capex. Current Debt: Equity (Net) stands at 0.20.

• Secured new orders of INR 1.2 bn across domestic and export markets in S/A business during the quarter. German operations (CDP BF) secured a multi-year EUR 40 mn p.a business win for supply of aluminum forgings.

VALUE PARAMETERSFace Value (Rs.) 2.0

52 Week High/Low (Rs.) 800/551

M.Cap (Rs. Bn/US $mn) 267/3600

EPS (Rs.) 18.0

P/E Ratio (times) (FY20E) 23.0

Dividend Yield (%) 0.4

Stock Exchange BSE

Valuation

At CMP Rs. 572, BFL stock is quoting at PE of 21.6xFY20E earnings. We maintain our BUY rating on the stock with a price target of Rs. 791 (PE of 30xFY20E).

EQUITY

% OF SHARE HOLDING

in Rs.Mn ACTUAL ESTIMATE

YE Mar FY 18 FY 19 FY 20

REVENUE 53160 62602 70746

EBITDA 15368 18160 20593

EBITDA % 28.9 29.0 29.1

PAT 8405 10306 12273

EPS (Rs.) 18.0 22.1 26.4

RoE (%) 19.0 20.3 20.3

PE (x) 31.8 27.7 23.2

P/E CHART

80

96

112

128

Oct

-17

No

v-17

No

v-17

De

c-17

Jan

-18

Jan

-18

Feb

-18

Mar

-18

Mar

-18

Ap

r-18

May

-18

Jun

-18

Jun

-18

Jul-

18

Au

g-1

8

Au

g-1

8

Se

p-1

8

Oct

-18

Oct

-18

Bharat Forge Sensex

KSTREET - 13TH OCTOBER 2018 4

EQUITY

BEAT THE STREET - TECHNICAL ANALYSIS

Aditya Birla Fashion and Retail Ltd

ABFRL sells its apparel under various brand names like Pantaloons, Van Heusen, Allen Solly, Peter England, Ted Baker, Simon Carter, The Collective, American Eagle, Forever 21,

Planet Fashion, Style Up and Louis Philippe. The company in the recent past has seen a lot of demand coming in from smaller towns which makes it the hottest pick from this

space. Technically, the overall chart structure of ABFRL looks good as depicted in the chart above. The stock is forming a Pole and Flag chart pattern on weekly time frame and

looks good to be bought as there has been good accumulation seen in the stock despite weak market conditions. This clearly indicates the firm grip of bulls in the counter.

The stock has immediate support around 160-165 levels and traders may average their long positions thereabout. The second zone of meaningful support is around 150-148

breaking which the stock could negate the above mentioned pattern. On the other hand, the immediate hurdle for the stock is placed around 195-198 zone crossing which the

stock is likely to move towards the mentioned targets.

ITC Limited

ITC is one of India’s foremost multi-business enterprises with a market capitalisation of US $ 50 billion and Gross Sales Value of US $ 10 billion. ITC’s aspiration to create enduring value for the nation and its stakeholders is manifest in its robust portfolio of traditional and Greenfield businesses encompassing FMCG, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business and Information Technology. Technically, the recent chart structure of the FMCG giant indicates that it has witnessed a correction along with the broader markets and is now available for grabs at a relatively inexpensive price after it has taken support around 265 levels. The overall primary trend of the stock is intact and this stock is a must have for longer term portfolios due to its record of good historical performance year after year. Technically, the stock has supports around 260-250 followed by 230-225 levels. While resistances are pegged around 320-330 crossing and sustaining above which a further leg of rally towards 350-375 levels cannot be ruled out. Hence, long positions may be assumed in the counter as per the above prescribed levels.

Stock ABFRL

CMP 185.65

Action BUY

Entry 180-185

Average 160

Stop loss 145

Target 245

Target 2 260

Time Frame 6-9 Months

Stock ITC

CMP 275.20

Action BUY

Entry 270-275

Average 250

Stop loss 225

Target 350

Target 2 375

Time Frame 6-9 Months

KSTREET - 13TH OCTOBER 2018 5

EQUITY

Sentiment

Initiation 325

Stop Loss 350

Target 292

Lot Size 1300

Margin 62500

Open Interest Shares 4377100

Change in OI (Weekly) -67600

Cost of Carry (%) 11.90

SECTORAL SNIPPETS

NIFTY BANK (25395.85) traded highly volatile during the week passed by taking cues from global markets. However, the index ended strong on a positive note outperforming the benchmark index Nifty 50 with a wide margin. Considering the current market volatility and as the indications are in favour of further rebound in the index, the market participants may focus on earnings, global markets and currency movement for further cues. The index ended up with a weekly gain of 4.10%. On the stock front barring one stock, all the stocks ended in green; YESBANK, KOTAKBANK, FEDERALBNK and RBLBANK gained by 19.22% to 7.39% during the week. On the flip side, BANKBARODA has lost 2.72% respectively on the weekly closing basis. Technically, Bank Nifty is testing the resistance at 25470 levels. Above the said levels, the index may face resistance at 25525 and 25630 levels. For the week ahead, supports for the index can be pegged at 24760 levels. On the momentum setup 60-period weekly CCI is plotting below its -100 line indicating underlying bearish trend in the index. However, as most of the momentum indicators are plotting in the oversold zone, a further bounce back cannot be ruled out in the index.

NIFTY PHARMA (9525.60) has underperformed the benchmark index NIFTY and closed the week with a marginal negative return of 0.11% while the benchmark index NIFTY has closed the week with a positive return of nearly 1.5%. The major losers were the index heavy weights like SUNPHARMA along with AUROPHARMA, CIPLA and BIOCON while on the flip side, DRREDDY, GLENMARK, PEL and LUPIN closed with a positive return during the last week. Technically, the index is trading below its 21/50/100 DEMA on daily chart and taking support around its 200 DEMA. On the technical indicator front, the 14-period RSI is trading below its 9-day signal line and poised with weak bias, suggesting weakness in the index in near term. The MACD is also trading below the signal line on daily chart indicating weakness is likely to continue in the index in near term as well. The immediate support for the NIFTY PHARMA is pegged around 9,380-9,350 levels followed by 9,200 levels while on the higher side, the index may face resistance around 9,800-9,820 levels followed by 9,900 levels. Going forward, we expect the index is likely to trade with sideways to negative bias and may underperform Nifty in the coming week. Stock specific action is expected to be seen in the sector during the next week.

NIFTY IT (14,539.20) has ended the week with a negative return of around 6.8% underperforming the benchmark index NIFTY which closed with a positive return of 1.44%. The NIFTY IT index has ended lower for the fifth consecutive week after hitting an all time high near 16229.85 levels. The index breached its short-term moving average during the week which indicates likely selling on any pull back in the near term. The stocks which have outperformed the NIFTY IT index during the week were WIPRO, OFSS, TECHM and INFY while TATAELXSI, INFIBEAM, NIITTECH, HCLTECH, MINDTREE, TCS underperformed the index. All the stocks in the NIFTY IT index ended the week in the negative. On the technical indicator front, the 14-day RSI line is placed below the 9-day signal line and poised with bearish bias on the daily as well as weekly chart, reflecting the index may trade with weakness in the coming trading sessions. Going ahead, the index is expected to trade with sideways to negative bias. The immediate support for the NIFTY IT index is pegged around 14200-14250 levels followed by 14000 levels. While on the higher side, the index may face resistance in the 14700-14800 zone followed by 15000 levels.

NIFTY REALTY (209.55) has ended the week on a flat note underperforming Nifty 50 which ended with a positive note of 1.44%. The breadth of the REALTY index was mixed as 5 out of 10 stocks in the index ended on a negative note. IBREALEST, SOBHA, DLF, HDIL and BRIGADE were the stocks which ended on a positive note of 9.27%,6.11%,5.19%,5.18%, and 0.50% respectively while GODREJPROP, PRESTIGE, UNITECH, OBEROIRLTY, and PHOENIXLTD ended on a negative note with a cut of around -10.18%, -8.23%,-1.96%,-1.87%, and -0.49% respectively. Technically, the said index is trading well below its daily & weekly 21-day exponential moving averages. However, the daily & weekly14-period RSI is oversold and on the daily charts, it is trading above its 9 periods EMA indicating a short-term reversal. On price charts, it has formed a Doji pattern which indicates a short-term pause in the restless selling which was there from past few weeks. Going ahead for the coming week, the index has support at 198 levels and below it at 195 levels while resistance is pegged at 215-218 zone and above it at 223-225 levels. Going ahead, the index is expected to witness some relief rally in the near future as long as recent low of 198.25 holds.

BRITANNIA INDUSTRIES LIMITED: BUY BRITANNIA (OCT FUTURE) | CMP: 5759.55 SECTOR: FMCG

BRITANNIA is one of our preferred pick in the FMCG space for the week. The stock has outperformed Nifty FMCG and closed the week with a positive return of around 5.73% whereas Nifty FMCG has closed the week in green and generated 0.87% of return. The stock has seen profit taking from the high of around 6934 levels which has dragged the stock to its support of 200 DEMA on daily charts and made the low of 5347.15 levels. Thereafter, the stock has bounced well from the said lower levels with supportive volume formation on daily charts. On technical setup, the 14 period RSI is pointing northward and plotting comfortable above signal line. The price action in the stock in comparison with RSI has seen positive divergence on daily charts indicating stock is well placed to move northwards. Hence, Smart Traders may buy the stock for the target of 5960 with stop loss placed below 5500 levels.

Sentiment

Initiation 5700

Stop Loss 5500

Target 5960

Lot Size 200

Margin 173400

Open Interest Shares 1346200

Change in OI (Weekly) -35200

Cost of Carry (%) 0.99

ICICI PRUDENTIAL LIFE INSURANCE COMP LTD: SELL ICICIPRULI (OCT FUTURE) | CMP: 319.75 SECTOR: FIN SERV

ICICIPRULI has ended the week with a negative bias. The stock has closed the week with a negative return of more than 1% ending at 317.20 levels. Adding to that, the stock is making lower lows from the last couple of weeks and trading below its major moving averages on daily chart exhibiting underlying weakness in the stock. On the technical indicator front, the 14-period RSI is trading below its 9-day signal line and poised with weak bias indicating downtrend in the counter in near term. The MACD is trading below its signal line on daily chart indicating weakness is likely to continue in the stock. The Parabolic SAR (Stop & Reverse) on weekly chart is trading above the price indicating weakness in the stock in the coming trading sessions. From the above observation of price momentum, it seems the stock is likely to trade with negative bias in the coming trading sessions also. Therefore, we recommend Smart Traders to initiate short position in the counter around 325 levels with a stop loss placed above 350 for the downside target of 292 levels.

KSTREET - 13TH OCTOBER 2018 6

WEEKLY VIEW OF THE MARKET

NIFTY (10,472.50): During the last week, markets witnessed dramatic whiplashes and continued to dance to the tunes of the global markets, thereby moving in a wide range of about 3.49%. The index witnessed a highly volatile week even as the Nifty managed to shut shop higher by just more than 1.5%. Market participants have been bearing the brunt of rising interest rates in the US, the ongoing trade war, and the rising crude oil price which is taking a breather around the $80-$82 zone. The rising price of crude oil was a bit of a concern as it was having a cascading effect on the INR. CPI during the month of September marginally moved up to 3.77% in September from 3.69% in August. The inflation shot up due to the higher fuel prices and the decrease in the value of the Indian rupee against the greenback. As far as the IIP data is concerned, the index grew at 4.3 per cent in August, lower than 4.87% recorded in the same period last year. The RBI in the previous week held interest rates unchanged, but shifted the stance from neutral to calibrated tightening, thereby surprising most market participants. During the last week, Nifty made a panic low of 10138.60 and has recovered smartly thereafter. This week we expect Nifty to continue trading on a volatile note in a range of 10200-10600. The index has its weekly supports pegged around 10200-10150 levels whereas resistances are pegged around 10650-10700 levels.

DERIVATIVE STRATEGIES

Type: Short Strangle in NIFTY

First leg Sell one lot of NIFTY OCT 10100 PE @ 39

Second leg Sell one lot of NIFTY OCT 10800 CE @ 28

Max Profit 5,025 (Cumulative premium: 67)

UBEP 10,867

LBEP 10,033

Max Loss Unlimited beyond BEP'S

Stop loss 90 (Cumulative Premium)

Rationale The index is expected to trade in the range of 10100- 11800 levels till the current expiry week.

DERIVATIVES

Type: Call Ratio spread in BANKNIFTY

First leg Buy one lot of BANKNIFTY 17OCT 25500 CE @ 220

Second leg Sell two lots of BANKNIFTY 17OCT 25700 CE @ 145

LBEP & UBEP 25430 & 25970

Max Profit 10,800 (If expires @ 25700) & 2800 below LBEP

Max Loss Unlimited Beyond UBEP

Stop loss 26000 (Spot levels)

Rationale The index is expected to consolidate in the range of 25200-25900 levels with sideways to bullish bias.

Type: Bull Call Spread in HAVELLS

First leg Buy one lot of HAVELLS OCT 610 CE @ 16

Second leg Sell one lot of HAVELLS OCT 620 CE @ 12.50

BEP 613.50

Max Profit 6,500

Max Loss 3,500

Stop loss 570 (Spot Levels)

Rationale The stock is currently trading around its long term moving average of 200-DEMA on the daily charts and is looking strong to test the higher levels of 620-625 levels in the near term.

Type: Bear Put Spread in TATAMOTORS

First leg Buy one lot of TATAMOTORS OCT 180 PE @ 6

Second leg Sell one lot of TATAMOTORS OCT 175 PE @ 4.25

BEP 178.25

Max Profit 4,875

Max Loss 2,625

Stop loss 200 (Spot levels)

Rationale The stock has given a fresh breakdown below the psychological mark of 200 & clocked fresh 52 week lows & is also sustaining well below its all major moving averages.

7KSTREET - 13TH OCTOBER 2018

DERIVATIVES

FII’S ACTIVITY IN INDEX FUTURES FII’S ACTIVITY IN STOCK FUTURES

TOP 6 LONG BUILD UP

Stock Name LTP % Price Change Open Int % OI Change

AMARAJABAT 735.85 2.29 1342600 30.39

BPCL 288.9 8.90 16077600 29.43

OIL 202.6 8.40 3466980 21.28

TVSMOTOR 534.1 5.98 8590000 20.95

KTKBANK 98.3 2.13 19593000 19.45

IOC 133.9 13.43 33612000 17.52

BANKNIFTY OPTION OI CONCENTRATION (WEEKLY) CHANGE IN BANKNIFTY OPTION OI (WEEKLY)

TOP 6 SHORT CLOSURE

Stock Name LTP % Price Change Open Int % OI Change

HINDPETRO 218.4 32.28 22554000 -25.23

MRPL 83 29.69 4644000 -11.95

EQUITAS 128.9 14.73 12224000 -17.32

RELINFRA 329.2 13.67 7764900 -8.36

BAJFINANCE 2287.35 13.05 7314500 -6.62

ENGINERSIN 116.15 12.77 7542500 -26.80

TOP 6 SHORT BUILD UP

Stock Name LTP % Price Change Open Int % OI Change

NIITTECH 1044.95 -10.13 1841250 37.92

RAMCOCEM 585.25 -6.40 1083200 29.82

GRASIM 895.1 -3.00 4580250 21.73

HEXAWARE 388.75 -4.94 5659500 21.51

TCS 1918.3 -8.77 10031500 20.47

HCLTECH 985.15 -9.12 8404200 17.09

TOP 6 LONG CLOSURE

Stock Name LTP % Price Change Open Int % OI Change

TATAMOTORS 183.75 -15.03 70756500 -7.66

TATAMTRDVR 100.9 -14.02 28800800 -5.22

VEDL 214.3 -7.49 43436750 -13.82

HINDALCO 226.7 -5.95 35815500 -6.04

TECHM 693.8 -2.90 14874000 -3.25

OFSS 3930.8 -2.22 301200 -8.81

NIFTY OPTION OI CONCENTRATION CHANGE IN NIFTY OPTION OI

8KSTREET - 13TH OCTOBER 2018

COMMODITIES

BULLIONGold futures were under pressure at the beginning of the week tracking stronger Dollar Index and US 10 Year Treasury Yield. During the week, International Monetary Fund lowered the world growth to 3.7% for 2018-19, 0.2% lower than previously estimated in April. Ongoing trade war between US and China is the major reason for lowering growth forecast. This news sent shock waves to the global market including gold. At the beginning of the week, surge in US 10 Year Treasury Yield to fresh 7 year high led to fall in the gold price. The bullion market took a U turn on Thursday when COMEX gold futures staged the biggest one day rally as the selloff in the global equity market led to safe haven buying in gold. COMEX gold futures for December delivery surged by $28.3 per troy ounce in a single day. Moving in line with international market, Indian market also witnessed a rally during the week. Over and above international market movement, Indian gold market was driven by fall in the USDINR to its historic lows which took MCX gold futures to 2018 highs.

SPICESCardamom futures traded in a range during the week due to mixed cues from the rainfall and spot markets. Traders took the cautious approach as heavy rainfall that was forecasted last week may have damaged crop similar to that of the situation in Aug. However, rainfall was normal that may be favorable for the crop leading to hopes of increasing quantity as well as the quality of arrivals in the next round of picking activities. For the week ahead, cardamom futures to trade mixed with biasness towards negative direction with absence of fresh cues in the market. Despite last year’s record exports, exports in the current year are likely to be affected due to strict measures by Saudi Arabia due to pesticide issue. Exporters are actively buying cardamom at the spot markets even though exports to Saudi Arabia are yet to start. On the other hand, there are concerns that traders may opt for more quantity of illegal cheap imports from Guatemala to mix with domestic variety.

Turmeric futures traded mostly down during the week due to limited buying at the spot markets. For the week ahead, turmeric futures to trade higher on expectations of good demand ahead of festival. However, expectations of increased crop production backed by higher area and favorable weather conditions will cap the gains. Sowing activities are complete with an area of 0.66 lakh hec, up by 12% Y/Y from Telangana and Andhra Pradesh states, top growers of turmeric and it is also reported to be higher in Tamil Nadu and Maharashtra. Trading at the futures platform may turn to be dull during the later part of the week due to festival.

Jeera futures traded higher to register gains for the second straight session during the week. Active buying in the spot market ahead of festivals amid supply concerns supported gains in jeera futures prices. Strong export demand is expected for jeera as India is the major supplier to the world market. There is anticipation of higher sowing area during the upcoming sowing season due to higher prices of the commodity; however, there are fears that area may reduce if rainfall remains scanty in the major growing regions of Gujarat.

Dhaniya futures noted sharp gains during the week tracking demand at spot markets ahead of festival. Expectations of lower area under dhaniya during the upcoming sowing season to support prices. Farmers may shift towards other remunerative crops as dhaniya has given poor returns from the past few seasons. Around 5080 MTs of stocks have been allotted for delivery through the exchange delivery process in October expiry; this may increase supplies at the spot market.

BASE METALSAt the opening of LME Week on Monday, base metals segment took a steady position giving the investors a belief that trading in the metal would be risky considering their price volatility. Metals like Copper, Lead and Nickel fell hugely initially and are set to recover slowly by the end of the week on Friday. The reasons for fall in the prices can be attributed largely to the re-opening of Chinese markets after a week long holiday and LME week held at London. Besides, there were many important economic data released which contributed to the volatility in prices. Aluminium which made record high of $2,262 in the previous week slumped by more than 10% to $2023.25 by the end of week. Similarly, Copper slumped by 1.09% after making a high of $6,391.5 in previous week. Metals which were affected by equity markets moved steady but during the mid week as the global economy turned gloomy and raising concerns for demand growth made them lose their supports and heavy fall in the prices were seen. However, approaching the end of week, prices regained their support as dollar index became weak and investors found metals less costly to invest. Also, China trade balance being positive supported price rise for metals. Zinc and Lead took their support of prices from ILZSG report which indicated raised demand for refined metals. Meanwhile, Zinc prices crumbled a little, tracking increased stock piles of steel rebar in Shanghai markets. Annual premium increase in Copper metal is seen with increasing demand for refined metal which will continue in near term.

ENERGY COMPLEXCrude oil rose to $81 a barrel reverting after two days of fall, though prices pared gains after OPEC commented that supply seems to be adequate in 2019 and the outlook for demand is expected to weaken due to slowdown in global growth. OPEC sees the oil market as well supplied and is wary of creating a glut next year, the group’s secretary-general said on Thursday suggesting producers are in no rush to expand a June agreement that raises output. Separately, workers of major oil producers and drillers including Exxon Mobil Corp, Chevron Corp and BP Plc, on Thursday began returning to work and restoring output at U.S. Gulf of Mexico after Hurricane Michael subsided. The U.S. oil drilling rig count fell for a third consecutive week even though crude prices hit four-year highs this week, as rising costs and pipeline bottlenecks in the nation’s largest oil field have hindered new drilling since June. Drillers cut two oil rigs in the week to Oct. 5, bringing the total count down to 861. Meanwhile, Saudi Arabia’s crude exports to the United States fell sharply in September as U.S. oil refiners began seasonal maintenance that has allowed crude inventories to rise, data from Refinitiv Eikon and shipping intelligence firm Kpler showed. A slowdown in Saudi shipments marks a return to lower levels of crude exports into the U.S., where the Kingdom has sent fewer barrels since mid-2017 while focusing on Asian buyers. As per EIA monthly report, U.S. crude oil output in 2018 is expected to grow more quickly than previously forecast to a record high. According to STEO, crude production was expected to rise 1.39 million barrels per day to 10.74 million bpd this year. Addition to it, International Energy Agency said in its monthly report that the world’s spare oil production capacity was down to 2 percent of global demand with further falls likely.

OILS & OILSEEDSSoybean futures are expected to trade sideways to higher in anticipation of rise in demand at physical market. Expected commencement of Bhavantar Bhugtan scheme in Madhya Pradesh could be other factor which may support prices in near term. Bhavantar scheme is formulated by government to protect the interest of farmers if they sell their produce below MSP of Rs. 3399 per quintal. At the same, NAFED could start buying soybean directly from farmers in order to support the prices. Government has released its production forecast for year 2018-19 and pegged total soybean production at 134.59 lakh tonnes against the 109.81 lakh tonnes of prior year, higher by 23% y/y. Soybean Processors Association of India ( SOPA) estimated soybean production for year 2018-19 at 114.8 lakh tonnes against the 83.5 lakh tonnes of prior year. At global front, USDA estimated soybean production in US for year 2018-19 at 127.63 million tonnes and kept its production forecast unchanged for Brazil and Argentina at 120.5 million tonnes and 57 million tonnes respectively. USDA raised its production forecast of world from 369.32 million tonnes to 369.48 million tonnes wherein estimated of ending stocks for year 2018-19 was increased up to 110.04 million tonnes from 108.26 million tonnes. Similarly, RM seed futures are expected to trade sideways due to slack domestic demand. Apart from that, prices may track cues from reports of selling mustard seeds stocks by NAFED in Rajasthan, Haryana and Madhya Pradesh. NAFED has sold about 5240 MT of mustard seed stocks below MSP level wherein 94461 MT were under progressive sale till 5th Oct. NAFED procured about 8.5 lakh tonnes of mustard seed from different states and is now releasing its stocks.

OTHER COMMODITIESDomestic cotton futures are expected to trade mixed to higher and may track supportive cues from USDA monthly supply and demand estimation report which cut its forecast for ending stocks for year 2018-19. USDA revised its projection for global ending stocks downwardly from 77.46 million bales to 74.45 million bales due to fall in inventory levels in India. Cotton inventory in India for year 2018-19 is pegged at 8.98 million bales against the 11.88 million bales of prior month down by 24% m/m. USDA projected global cotton consumption for year 2018-19 at 127.76 million bales. USDA released its monthly supply and demand estimation report on Thursday that trimmed world cotton production for year 2018-19 at 121.66 million bales of 480 lb each against the 121.97 million bales of prior month due to lower production in Australia. USDA cut its cotton production forecast for Australia from 3 million bales to 2.5 million bales. Production forecast for India has remained unchanged at 28.7 million bales (368 lakh bales of 170 kg each) wherein US cotton production raised from 19.68 million bales to 19.76 million bales. Meanwhile, Cotton Corporation of India could commence procurement of cotton in Telangana and other cotton growing states due to surging arrival pressure. Daily arrivals of cotton has improved in line with accelerating harvesting activities in major cotton growing states and ruling in a range of 50000-70000 bales of 170 kg each. Cotton prices are ruling in range of Rs. 5000- 5300 per quintal almost near to the MSP level of Rs. 5150 per quintal for medium staple cotton. Cotton arrivals are expected to improve further due to forecast of favourable weather for harvesting.

9KSTREET - 13TH OCTOBER 2018

GOLD

As on 12th Oct 2018, Gold December contract delivery futures at the COMEX platform are trading around $1223/Ounce. In the mentioned technical chart, it is visible that prices have broken consolidation phase resistance at $1213-1211 levels. At present, prices are trading above the 8,13EMA levels and RSI -14 is treading around 0.65, still it has a potential to move higher. Based on the above technical indications, we are expecting gold futures to move higher up to $1235-1240 levels in the coming week. MCX Gold December futures are expected to move in the range of Rs. 31500 to Rs. 32300 with positive bias

COPPER

As on 12th October 2018, Copper 3M forwards are trading around $6300/Mt. Prices are trading above the 8,13EMA support levels. Copper prices have also broken intermediate falling trend line resistance levels around 6100-6120 and sustaining above the same. The momentum indicator RSI -14 is treading around 0.65 still it has a potential to move higher. Prices are witnessing formation of rising three methods with a bullish continuation pattern in nature. In the bigger scenario, trend is bearish. However, pullback towards the breakout point $6500 is still due. In the coming week commodity is expected to trade in the range of $6100-6500. MCX Nov futures are expected to move within a range of Rs. 445 to 475.

CRUDE OIL

As on 12th October 2018, Crude oil November contract delivery futures at the NYMEX platform are trading around $71.50/barrel. In the mentioned price chart, it is visible that prices are witnessing formation of Shooting star and the, engulfing pattern. At present prices are trading far higher from the 8DMA, it had deviated more than 3%. The momentum indicator RSI-14 is witnessing formation of negative divergence. While combining above technical clues, we are expecting commodity to breach consolidation phase breakout point of 70.70 in the coming week. Overall, commodity is expected trade within a range of $70-75/ barrel on negative bias. MCX October futures are expected to trade within a range of Rs. 5100-5550 on negative bias.

COMMODITIES

TREND SHEET

Commodities 5-Oct 12-Oct % Change 52 Week High% Change from 52

Week High52 Week Low

% Change from 52 Week Low

MCX Gold (Rs/10 gms) 31154 31868 2.3% 32014 -0.5% 28055 13.6%

MCX Silver (Rs/Kg) 39274 39015 -0.7% 41698 -6.4% 36000 8.4%

MCX Crude Oil (Rs/bbl) 5546 5262 -5.1% 5669 -7.2% 3264 61.2%

MCX Natural Gas (Rs/mmBtu) 232.7 232.9 0.1% 250.8 -7.1% 162.5 43.3%

MCX Copper (Rs/kg) 456.55 461.85 1.2% 493.25 -6.4% 402.55 14.7%

MCX Lead (Rs/kg) 147.9 152.4 3.0% 172.5 -11.7% 137.25 11.0%

MCX Zinc (Rs/kg) 197.95 198.65 0.4% 232.7 -14.6% 163.8 21.3%

MCX Nickel (Rs/kg) 940.2 939.2 -0.1% 1095.2 -14.2% 692.8 35.6%

MCX Aluminium (Rs/kg) 157.7 151.45 -4.0% 178.85 -15.3% 128.3 18.0%

NCDEX Soybean (Rs/Quintal) 3240 3233 -0.2% 3895 -17.0% 2754 17.4%

NCDEX Refined Soy Oil (Rs/10 kg) 752.85 750 -0.4% 796.35 -5.8% 655.05 14.5%

NCDEX RM Seed (Rs/Quintal) 4117 4060 -1.4% 4262 -4.7% 3675 10.5%

MCX CPO (Rs/10 kg) 594.9 587.2 -1.3% 673 -12.7% 533.5 10.1%

NCDEX Castor Seed (Rs/Quintal) 4654 4862 4.5% 4890 -0.6% 3831 26.9%

NCDEX Turmeric (Rs/Quintal) 6946 6912 -0.5% 8066 -14.3% 6316 9.4%

NCDEX Jeera (Rs/Quintal) 19195 20135 4.9% 22360 -10.0% 14010 43.7%

NCDEX Dhaniya (Rs/Quintal) 4839 5065 4.7% 6021 -15.9% 4186 21.0%

MCX Cardamom (Rs/kg) 1387.4 1380 -0.5% 1458.3 -5.4% 818.5 68.6%

NCDEX Wheat (Rs/Quintal) 2046 2025 -1.0% 2074 -2.4% 1575 28.6%

NCDEX Guar Seed (Rs/Quintal) 4227.5 4145 -2.0% 4737 -12.5% 3465 19.6%

NCDEX Guar Gum (Rs/Quintal) 9112 9080 -0.4% 10468 -13.3% 7200 26.1%

MCX Cotton (Rs/Bale) 22180 22690 2.3% 24280 -6.5% 18180 24.8%

NCDEX Cocud (Rs/Quintal) 1706 1775 4.0% 1878.5 -5.5% 1166 52.2%

NCDEX Kapas (Rs/20 kg) 868 868 0.0% 1010 -14.1% 854 1.6%

MCX Mentha Oil (Rs/kg) 1716.5 1682.7 -2.0% 1991.9 -15.5% 1106 52.1%

TECHNICAL RECOMMENDATIONS

10KSTREET - 13TH OCTOBER 2018

COMMODITIES

MCX CRUDE MCX NATURAL GAS

CALENDER SPREAD NYMEX - CRUDE OIL CALENDER SPREAD NYMEX - NATURAL GAS

NEWS DIGEST

• According to estimates of ICSG, Copper should see a deficit of 92,000 tonnes for the current year and 65,000 tonnes deficit in 2019.

• China, top consumer of metals is expected to increase its demand for Copper by 1.6 million tonnes in 2019 which gives a strong support to the rise in prices.

• As per ILZSG reports, Global demand for refined Zinc metal is exceeding supply by 322KT in 2018 and the market is forecasted to remain in deficit of the metal by 72 KT in 2019.

• The Buenos Aires Grains Exchange of Argentina said that farmers are still in the stage of sowing the 2018-19 corn crop and have so far planted 26.9 percent of the 5.8 million hectares dedicated to the harvest which could grow to a record 43 million tonnes. Argentina is a key global exporter of wheat and the world’s third largest supplier of corn.

• India’s oil imports from Iran edged up in September from the previous month as refiners pushed back loading of some August cargoes due to a delay in obtaining government approval to use Iranian ships and insurance.

• Last month, India shipped about 528,000 barrels per day (bpd) oil from Iran, about 1 percent more than the 523,000 bpd of August and about 27 percent more than a year earlier.

WEEKLY COMMENTARY

• The dollar crept up reflecting investors’ confidence in the U.S. economy despite criticism by President Donald Trump of the Federal Reserve and a sell-off in U.S. equities.

• Gold prices fell on Friday as Asian shares firmed, but the metal held near a more than 10-week high hit in the previous session when it breached a key resistance level, stoking optimism about a potential uptick in prices.

• Also, worries about the economic impact of the Sino-U.S. trade war, a spike in U.S. bond yields this week and caution ahead of earnings seasons have all been cited as potential reasons behind the selloff, the biggest market rout since February.

• Base metals segment steadied on Friday morning after witnessing volatility during the previous session weighed by the forecasted gloomy economy and falling dollar index. Unlike, previous session ended on Thursday, international markets are trading positively on Friday’s session thus directing to end the week on a positive note.

• Also, metals are taking support from the positive trade balance data of China released previous week. Varying dollar index slightly driven by fundamental factors will have an impact on the coming week.

-0.2

-0.18

-0.16

-0.14

-0.12

-0.1

-0.08

-0.06

-0.04

-0.02

0

28-Sep 30-Sep 2-Oct 4-Oct 6-Oct 8-Oct 10-Oct 12-Oct

$/B

BL

0

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

0.09

28-Sep 30-Sep 2-Oct 4-Oct 6-Oct 8-Oct 10-Oct 12-Oct

$/M

MB

tu

205

210

215

220

225

230

235

240

245

0

10000

20000

30000

40000

50000

60000

70000

24-Sep 26-Sep 28-Sep 3-Oct 5-Oct 9-Oct 11-Oct

Open Interest Volume Price (INR/MMBTU)

4700

4800

4900

5000

5100

5200

5300

5400

5500

5600

5700

0

20000

40000

60000

80000

100000

120000

140000

160000

180000

200000

20-Sep

21-Sep

24-Sep

25-Sep

26-Sep

27-Sep

28-Sep

1-Oct

3-Oct

4-O

ct

5-Oct

8-Oct

9-Oct

10-O

ct

11-Oct

Volume Open Interest Price (INR/Bbl)

11KSTREET - 13TH OCTOBER 2018

COMMODITIES

PRICES OF METALS IN LME/ COMEX/ NYMEX (IN US $)

Commodity Exchange Contract 5-Oct 12-Oct % change

Aluminium LME 3M 2105.5 2025 -3.8%

Copper LME 3M 6186.5 6273.5 1.4%

Lead LME 3M 1985.5 1997.5 0.6%

Nickel LME 3M 12655 12705 0.4%

Zinc LME 3M 2621 2619.5 -0.1%

Gold CME DEC 1206.7 1227.7 1.7%

Silver CME DEC 14.68 14.61 -0.5%

WTI Crude oil CME OCT 74.29 70.99 -4.4%

Natural Gas CME OCT 3.155 3.235 2.5%

INTERNATIONAL COMMODITY PRICES

Commodity Exchange Contract 5-Oct 12-Oct % change

Soybean CBOT NOV 895 885.75 -1.0%

Soy oil CBOT DEC 29.46 29.02 -1%

CPO BMD DEC 2223 2194 -1%

Cotton ICE DEC 76.06 76.75 0.9%

SPOT PRICES (% CHANGE)

LME WAREHOUSE STOCKS (IN TONNES)

Commodity 5-Oct 12-Oct Change % Change

Copper 181975 166600 -15375 -8.45%

Zinc 200350 190775 -9575 -4.78%

Aluminium 963350 933500 -29850 -3.10%

Lead 114150 116400 2250 1.97%

Nickel 226476 224226 -2250 -0.99%

SHANGHAI WAREHOUSE STOCKS (IN TONNES)*

Commodity 5-Oct 12-Oct Change % Change

Copper 111995 125700 13705 12.24%

Zinc 29204 43373 14169 48.52%

Aluminium 832256 842676 10420 1.25%

*Until Wednesday

COMEX WAREHOUSE STOCKS (IN TONNES)

Commodity 5-Oct 12-Oct Change % Change

Copper 170155 166923 -3232 -1.90%

WEEKLY STOCK POSITION IN LME (IN TONNES)

CHINESE TRADE BALANCE

Sep Aug Change Year ago Change Year to

date Change

Crude Oil & Refined Imports mln T mln T Pct mln T Pct mln T Pct

Imports

Crude oil 37.21 38.38 -3 37.01 0.5 336.41 5.9

Refined products 2.92 2.7 8 2.3 26.8 24.59 9.8

Fuel Oil No. 05-07 1.73 1.36 27.3 1.13 53.2 12.19 18.5

Natural gas 7.62 7.76 -1.8 5.94 28.3 64.78 34

Exports

Crude oil 0.29 0.18 58.3 0.45 -36.7 2.2 -38.7

Refined products 4.07 5.32 -23.5 3.82 6.5 44.1 20.5

Net Imports:

Crude oil 36.93 38.2 -3.3 36.56 1 334.21 6.4

Refined products -1.15 -2.62 56.1 -1.52 24.3 -19.51 -37.4

Note: Natural gas and fuel oil no. 5-7 exports will appear in final trade data.

Base Metals mln T mln T Pct mln T Pct mln T Pct

Imports

Unwrought Copper 5,21,000 4,20,000 24 4,30,000 21.2 39,90,000 16.1

Copper ores & concentrates 19,30,000 16,60,000 16.3 14,70,000 31.3 1,49,91,000 19.5

Exports

Unwrought aluminium & products

5,07,000 5,10,000 -0.6 3,70,000 37 42,54,000 17.5

Note: Unwrought copper imports includes anode, refined, alloy and semi-finished products. Unwrought aluminium exports include primary metal and alloy and semi-finished products

Coal, Iron & Steel mln T mln T Pct mln T Pct mln T Pct

Imports

Coal (incl lignite) 25.14 28.67 -12.3 27.08 -7.2 228.96 11.8

Iron ore 93.47 89.35 4.6 102.83 -9.1 803.34 -1.6

Steel products 1.2 1.06 13.6 1.24 -2.9 9.97 -0.4

Exports

Coal (incl lignite) 0.18 0.48 -63.1 0.69 -74.3 3.45 -47

Coke & semi-coke 0.53 0.78 -31.9 0.47 13 6.93 20.6

Steel products 5.95 5.87 1.4 5.14 15.8 53.08 -10.7

Rare Earths 4,951 4,314 14.8 3,715 33.3 39,980 3.9

Net Exports

Steel products 4.75 4.81 -1.3 3.9 21.7 43.12 -12.8

Note: Rare earth export figures are in tonnes

12KSTREET - 13TH OCTOBER 2018

USD/INR

This is the daily chart of USDINR FUT pair and the pair has been trading in a broader range of 74.68 on the higher side and 73.65 on the lower side for the week.

The pair saw strong profit booking from higher levels for the week with Divergence with Relative Strength index and prices violated the supports of 74 levels with MACD about to give crossover, likely supply to continue. SELL USDINR FUT 73.90-74.05 TGT 73.30 SL 74.25.

EUR/INR

This is the daily chart of EURINR and the pair traded in a broader range of 86.50 on the higher side and 85.25 on the lower side.

The pair saw some candlestick reversal from higher levels with Divergence between Price and indicator while MACD having a negative crossover but above zero line and pair trades above the 20DMA and 50DMA expects some supply at higher levels. SELL EURIRN FUT 85.65-85.90 TGT 84.95 SL 86.25.

GBP/INR

This is the daily chart of GBPINR and it traded in a range of 98.80 on the higher side and 96.80 on the lower side.

The pair continues to trade higher, but last two days saw some profit booking, still pair trades above the 20DMA and 50DMA while MACD remains above the zero line while RSI remains at 68.70 expects demand from lower levels. BUY GBPIRN FUT 97.00-96.75 TGT 97.75 SL 96.55.

JPY/INR

This is the daily chart of JPYINR FUT and it traded in a broader range of 66.66 on the higher side and 65.05 on the lower side.

The pair trades above the 20DMA &50DMA while Relative Strength index (RSI) placed at 61 divergence while MACD indicators placed above the zero line. SELL JPYINR FUT 65.90-66.10 TGT 65.35 SL 66.40.

TECHNICAL RECOMMENDATIONMARKET STANCE

The Indian Rupee moved all over the places with an opening at 73.94 a dollar and printing an all-time low at 74.47 and comfortably closed higher at 73.6. Government officials are considering multiple steps to curtail the widening current account deficit and oil prices. Crude Oil price slipping by around 4% during the week helped the Rupee in recovery. Global equities and commodities moved lower during the week after IMF downgraded the global growth projections. US benchmark 10 year yield also reversed after touching 11 year high largely impacted by the IMF report. President Trump openly accusing FED is hampering the US economy by raising the rates combined with lower than expected US CPI numbers for the month of September dented the probability of Fed to raise rates in December pushed the Yields lower. US core CPI remained softer at 0.1% as against expectations at 0.2% (MoM). Indian Rupee is expected to move marginally higher tracking lower crude prices and pending technical correction. Sterling Pound and European single currency moved higher during the week.EU Chief Brexit Negotiator Barnier said Wednesday that a deal next week is within reach, it still hinges on Prime Minister May’s acceptance of a customs union, with above news and dollar weakness brought cheers to the investors in Pound. Barnier also claimed that 85% of the Brexit deal has been agreed, although adding that they still need to agree on the Irish border issue.

NEWS FLOWS OF LAST WEEK

• The IMF said, sustained trade tensions could slash Asia’s economic growth by up to 0.9 percentage point in coming years and urged policymakers in the region to liberalize markets to offset the fall in export sales.

• Wall Street indices continued their southward move and witnessed high volatility as investors worried about rising interest rates. This dampened the sentiment even in Asia.

• Oil prices steadied late during the week after a market rout driven by sharp falls in equity markets and indications that supply concerns have been overblown, but were still on track for a weekly fall of more than 4 percent.

• Japanese 30-year bonds posted a yield of 0.90%, its highest since February 2017.

CURRENCY

CURRENCY TABLE

Currency Pair Open High Low Close

USD/INR 73.94 74.47 73.52 73.6

EUR/INR 85.12 86.16 84.86 85.17

GBP/INR 96.96 98.51 96.44 97.15

JPY/INR 64.94 66.41 64.78 65.51

13KSTREET - 13TH OCTOBER 2018

ECONOMIC GAUGE FOR THE NEXT WEEK

GMT Date Local Time Country Indicator Name Period Poll Prior Unit

10 Oct 2018 China (Mainland) M2 Money Supply YY Sep 8.3% 8.2% Percent

10 Oct 2018 China (Mainland) New Yuan Loans Sep 1,347.0B 1,280.0B CNY

10 Oct 2018 China (Mainland) Outstanding Loan Growth Sep 13.2% 13.2% Percent

15 Oct 2018 12:00 India WPI Inflation YY Sep 4.90% 4.53% Percent

15 Oct 2018 18:00 United States NY Fed Manufacturing Oct 20.00 19.00 Index

15 Oct 2018 18:00 United States Retail Sales Ex-Autos MM Sep 0.4% 0.3% Percent

15 Oct 2018 18:00 United States Retail Sales MM Sep 0.6% 0.1% Percent

15 Oct 2018 18:00 United States Retail Control Sep 0.3% 0.1% Percent

15 Oct 2018 19:30 United States Business Inventories MM Aug 0.5% 0.6% Percent

16 Oct 2018 07:00 China (Mainland) PPI YY Sep 3.5% 4.1% Percent

16 Oct 2018 07:00 China (Mainland) CPI YY Sep 2.5% 2.3% Percent

16 Oct 2018 07:00 China (Mainland) CPI MM Sep 0.7% 0.7% Percent

16 Oct 2018 18:45 United States Industrial Production MM Sep 0.2% 0.4% Percent

16 Oct 2018 18:45 United States Capacity Utilization SA Sep 78.2% 78.1% Percent

16 Oct 2018 19:30 United States JOLTS Job Openings Aug 6.939M Person

16 Oct 2018 19:30 United States NAHB Housing Market Indx Oct 67 67 Index

17 Oct 2018 14:30 Euro Zone HICP Final MM Sep 0.5% 0.2% Percent

17 Oct 2018 14:30 Euro Zone HICP Final YY Sep 2.1% 2.1% Percent

17 Oct 2018 14:30 Euro Zone HICP-X F, E, A, T Final MM Sep 0.4% 0.4% Percent

17 Oct 2018 14:30 Euro Zone HICP-X F,E,A&T Final YY Sep 0.9% 0.9% Percent

17 Oct 2018 18:00 United States Building Permits: Number Sep 1.278M 1.249M Number of

17 Oct 2018 18:00 United States Housing Starts Number Sep 1.221M 1.282M Number of

18 Oct 2018 18:00 United States Initial Jobless Claims 13 Oct, w/e 215k 214k Person

18 Oct 2018 18:00 United States Continued Jobless Claims 6 Oct, w/e 1.660M Person

18 Oct 2018 18:00 United States Philly Fed Business Indx Oct 21.0 22.9 Index

19 Oct 2018 07:30 China (Mainland) Urban investment (ytd)yy Sep 5.3% 5.3% Percent

19 Oct 2018 07:30 China (Mainland) Industrial Output YY Sep 6.0% 6.1% Percent

19 Oct 2018 07:30 China (Mainland) Retail Sales YY Sep 9.0% 9.0% Percent

19 Oct 2018 07:30 China (Mainland) GDP YY Q3 6.6% 6.7% Percent

19 Oct 2018 07:30 China (Mainland) GDP QQ SA Q3 1.6% 1.8% Percent

19 Oct 2018 19:30 United States Existing Home Sales Sep 5.30M 5.34M Number of

19 Oct 2018 19:30 United States Exist. Home Sales % Chg Sep -0.7% 0.0% Percent

CURRENCY

14KSTREET - 13TH OCTOBER 2018

MUTUAL FUNDS

(Formerly, Reliance Top 200 Fund)(An open ended equity scheme predominantly investing in large cap stocks)

RELIANCE LARGE CAP FUND

The current market scenario seems most favourable for the large companies that lead with established business models & competitive advantage.

CURRENT INVESTMENT PHILOSOPHY• Reliance Large Cap Fund invests predominantly in stocks of top 100

companies by full market capitalization.

• Large cap stocks endeavor to provide stability & liquidity to the portfolio.

• It endeavors to generate alpha while owning best of the index companies.

• It endeavors to invest in leaders or potential leaders with established business models & sustainable free cash flows.

• It endeavors to invest in growth companies at a reasonable valuation & relatively better return on equity.

• It invests in emerging large cap companies which have an established business model with a proven management track record and a potential to generate high cash flows.

WHY INVEST• Investments in established businesses – market leaders with tactical

exposure to sustainable alpha creators

• Portfolio well positioned to benefit from domestic revival through allocations in themes like:

• Urban Discretionary – Auto, Hotels, Resorts, Recreational Activities

• Short Cycle Capex – Industrial Capital Goods, Industrial Products, Consumer Non Durables

• Key overweights – Consumer Discretionary, Industrial Capital Goods

This product is suitable for investors who are seeking*:

• Capital appreciation over long term

• Investing predominantly in equities and equity related instruments of both large cap and mid cap companies

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The stocks mentioned above are not a recommendation to buy/sell.The scheme currently holds investments in the said stocks & forms a part of the portfolio of the scheme as on August 31, 2018 which may or may not form a part of the portfolio in future. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

SCHEME DETAILSInception Date 08th August 2007

Fund Size Month end AUM (Aug 2018) ₹ 11601.13 Crores

Scheme Type An open ended equity scheme predominantly investing in large cap stocks

Benchmark S&P BSE 100

Fund Manager Sailesh Raj Bhan

Entry Load Nil

Exit Load 10% of the units allotted shall be redeemed without any exit load, on or before completion of 12 months from the date of allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load.

Redemption of units would be done on First in First out Basis (FIFO):

• 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units

• Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units

SCHEME PERFORMANCE SUMMARY

Particulars CAGR%

1 Year 3 Years 5 Years Since Inception

Reliance Large Cap Fund 16.55 14.16 22.85 12.04

B: S&P BSE 100 (TRI) 18.02 15.51 18.75 10.62

AB: S&P BSE Sensex (TRI) 23.20 15.22 17.32 10.27

Value of Rs.10,000 Invested

Reliance Large Cap Fund 11,655 14,883 28,012 35,202

B: S&P BSE 100 (TRI) 11,802 15,417 23,640 30,555

AB: S&P BSE Sensex (TRI) 12,320 15,300 22,243 29,510

Inception Date: Aug 8, 2007

Fund Manager: Sailesh Raj Bhan (Since Aug 2007)

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

15KSTREET - 13TH OCTOBER 2018

Training Session from HDFC Life(NPS) for Bangalore employees inBasavangudi Branch

IAP Activity in Shriram Transport, Thrissur, Kerala

IAP Activity in Karvy Jabalpur Branch

DEMATERIALISATIONIS MANDATORY

As per the notification issued by Ministry of Corporate Affairs, unlisted companies cannot issue physical shares from 2nd October, 2018. They have to issue shares in demat form only.

• Buyback, bonus issue and rights issue cannot be issued by these companies unless securities of company’s promoters, directors, etc. are in dematerialised form.

• Any investor who holds shares in unlisted companies has to get it dematerialised if he wants to transfer shares

• Any investor who wants to buy shares through private placement or avail bonus shares and rights issue has to hold shares in dematerialised form.

All unlisted companies are required to secure ISIN from CDSL or NSDL for each type of security.

Karvy being a pioneer in the financial realm since 3 decades and providing depository and RTA services as well can facilitate the process of dematerialisation of existing shares and also offer demat account opening facility.

Q. What is the main objective of a Demat account?

The main objective of a demat account is to facilitate easy trade and transfer of the shares and also enable an investor to get the benefits of corporate actions like bonus shares, dividend, rights issue, etc.

Q. How many accounts can I have?

• You can open more than one Demat Account.

• You can hold shares, debentures, bonds, NSC, KVP in a single Demat Account.

• You can save charges on multiple accounts by consolidating your holdings into one account, if there are no other compelling reasons to keep separate accounts.

Q. Can I take a loan on my demat holding?

1. Yes, you can pledge the securities in your account in favor of a lender to avail a loan.

Q. Is there nomination facility in Demat Account?

• Nomination can be made only by individuals holding beneficiary accounts either singly or jointly.

• The Nominee needs to complete a few formalities with DP and get the securities transferred into his/her account.

STEPS TO TRANSFER SHARESFROM ONE DEMAT ACCOUNT TO ANOTHER

Fill the DIS form & submit to your current broker

Your broker will send request to

depository (NSDL/CDSL)

Depository shall transfer the shares to your new Demat

Account

Shares shall reflect in your new Demat

Account

Investor surrenders the physical certificates to the DP

DP informs the

Depository about the request

DP submits the certificates to the Registrar of the issuer company

Registrar communicates

with the depository to confirm the

request

Dematerialization of the certificates

is done by the Registrar

Registrar informs the

depository about completion of

dematerialization

1 2 3 654

STEPS TO CONVERT PHYSICAL SHARES TO DEMAT

Q. Do I have to contact all companies for any updation in my personal details?

For your demat shares, your one point contact for all the changes/updation is DP.

Q. What precautions should I take to prevent misuse of securities lying in my account?

• Keep DIS book in safe custody.

• When writing an instruction on the DI Slip, strike-out the empty spaces.

• Change your password frequently if you are using internet facility for your Demat Account.

• Before giving Power of Attorney (POA) to any person operating your Demat Account, understand the contents and implication of such POA.

Q. How much do I pay for my Demat Account?

1. You can pay Rs. 650 as an account opening fee and enjoy many exclusive offers*.

Q. Whom should I contact in case of any queries?

1. You can call on our toll free no 18004198283 or write a mail at [email protected].

Q. What all documents are required to Open Demat Account?

1. To open a demat account, you need a mobile number linked to Aadhaar, active mobile number, PAN card, digital signature, cancelled personalized cheque.

Q. What if I already have a Demat account with another Depository Participant?

You can open a trading account with us and link it to your existing demat account. Alternately, you can open a new trading and demat account with us, transfer your securities and funds to the new account and close the older account.

Q. Things to check before Opening Demat Account

Before opening a demat account, one should always check the brokerage charges, annual maintenance charges, any other charges if applicable, technology and trading platforms and other supporting value-added features and customer services.

Q. Various Types of Demat Account

At Karvy, we offer customized solutions to meet every investor’s unique requirements. You can opt for only demat or only trading account, demat and trading account with access to trading equity, commodity, currencies, mutual funds and other exchange-traded securities.