Q3 2016 Market Update · [email protected] Philip J. McMann Partner (301) 231-6202...

Transcript of Q3 2016 Market Update · [email protected] Philip J. McMann Partner (301) 231-6202...

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Larry A. Davis Partner

(301) 231-6225

Philip J. McMann Partner

(301) 231-6202

Tim P. Schmitt Vice President (301) 222-8285

Q3 2016 Market Update Aerospace, Defense Technology &

Government Services

Positive Trends Continue in the Federal Market

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

There continues to be positive momentum across the defense and government services market for publicly

traded (e.g. Tier-1, Mid-Tier, Non-Traditional) and smaller, privately-held government contractors.

Uncertainty around federal spending seems to be in the “rearview mirror” and companies are witnessing

clearer funding visibility on current and future programs. Furthermore, over the past 12 – 18 months public

contractors have repositioned portfolios to focus on core, higher margin business segments that provide

greater returns to shareholders. As a result, Tier-1 and Mid-Tier public companies have surpassed earnings

expectations and continue to deploy cash through dividends and stock repurchase programs. These trends

have translated into strong stock performance, as Tier-1 and Mid-Tier contractors have outpaced the S&P

500 index by 12.6% and 24.8% through Q3 2016 and continue to trade at valuation levels not seen since

2008. In addition, there has been noteworthy M&A as Non-Traditional buyers continue to make headlines

with add-on acquisitions to enhance capabilities, expand market share and add new customers.

Tier-1 Government Contractor Update

Tier-1 contractors reported revenue in-line with expectations during Q3 2016, strong earnings per share

(EPS) growth of 13.0% on a quarterly basis year-over-year (“YoY”), and increased revenue guidance for

Q4 2016. A majority of the Tier-1 companies expect organic growth rates of between 3.0 – 5.0% in 2017.

Lockheed Martin, Raytheon and Boeing reported EPS that significantly beat analyst expectations, driven

primarily by successful M&A efforts (e.g. Lockheed’s IS&GS divestiture, Raytheon’s ForcePoint

acquisition), solid pipeline execution and continued investment in new technologies that align with

customer priorities. In addition, L-3 successfully merged three business units together to better size its

operations and become more responsive to customer demands, and was successful in winning new

contracts and recompetes and expanding scope of work on existing programs. L-3 reiterated its interest in

building upon its resume of recent successful acquisitions (e.g. Harrison, Aerosims, Micreo) and will look

for complementary business that broaden offerings, expands market share and bring in new customers.

We continue to evaluate companies that build upon and leverage L3’s capabilities in high potential areas,

and of course, returning capital to shareholders through dividend and share repurchase programs. – L-3

We continue to use smaller targeted M&A to build technology and market gap to augment both defense

and commercial cyber capabilities. – Raytheon

We have taken significant actions over the past year to reshape our portfolio and strengthen our core

defense business and I am confident this positions us well to grow and deliver long-term value to our stock

holders. – Lockheed Martin

LTM Revenue Quarterly Revenue LTM EPS Quarterly EPS

(Revenue $ in Billions) Consens. Actual Consens. Actual Consens. Actual Consens. Actual

92.80 94.85 Beat 23.60 23.89 Beat 6.09 9.64 Beat 2.62 3.51 Beat

48.33 49.08 Beat 11.45 11.55 Beat 11.35 12.00 Beat 2.87 3.27 Beat

25.49 25.86 Beat 7.91 7.73 Miss 7.35 7.27 Miss 2.38 2.48 Beat

23.78 23.81 Beat 6.00 6.16 Beat 9.81 11.29 Beat 2.81 2.92 Beat

23.63 24.16 Beat 6.04 6.03 Miss 6.61 6.58 Miss 1.64 1.79 Beat

10.21 10.39 Beat 2.54 2.51 Miss 6.94 8.00 Beat 1.82 1.88 Beat

Source: CapIQ

Positive Trends Continue in the Federal Market

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Mid-Tier Government Contractor Update

Mid-Tier contractors were relatively optimistic of their recent quarterly performance. This past quarter

represented YoY organic revenue growth in the low-single digits, despite growth being relatively flat on

an annual basis. EPS growth was in the mid-single digits, justifying senior leaderships’ continued focus

on streamlining operations, improving productivity and optimizing their respective portfolios. CACI,

Engility and Leidos are beginning to reap the benefits of their successful acquisitions of L-3 NSS,

TASC/DRC and Lockheed Martin IS&GS, reporting EPS that exceeded analyst expectations for the

quarter. ManTech and CACI both emphasized their respective capabilities and past performance will

allow them to effectively compete for larger contracts against bigger competitors. Finally, NCI and ICF,

both smaller, more nimble mid-tier contractors, reiterated their desire to acquire companies with

differentiated capabilities that will position them for larger more strategic contracts in the future.

We are bullish on a merger/acquisition market in 2017 and believe that once the election cycle is complete

several strong companies will become actionable – we plan to be active buyers in 2017 – ManTech

We want to buy access to places where we think we could cross-sell or where we think we can expand,

frankly, expand the number of markets that we support by getting into completely new areas of growth,

such as the acquisition of NSS. – CACI

The basic truth is that practically every peer in our space is on the hunt for acqisitions resulting in limited

viable candidates. However, we’ll continue to seek potential targets that provide capabilities, new

customers and additional scale – NCI, Inc.

LTM Revenue Quarterly Revenue LTM EPS Quarterly EPS

(Revenue $ in Billions) Consens. Actual Consens. Actual Consens. Actual Consens. Actual

* 5.72 5.76 Beat 1.90 1.87 Miss 3.06 3.43 Beat 0.96 1.25 Beat

5.12 4.84 Miss 1.24 1.26 Beat 1.82 2.05 Beat 0.46 0.56 Beat

5.47 5.47 Beat 1.39 1.39 Beat 1.68 1.74 Beat 0.43 0.46 Beat

4.49 4.52 Beat 1.11 1.10 Miss 2.79 3.12 Beat 0.78 0.85 Beat

* 3.94 3.99 Beat 1.02 1.07 Beat 5.22 6.38 Beat 1.21 1.47 Beat

* 2.10 2.11 Beat 0.53 0.51 Miss (3.03) (5.43) Miss 0.38 0.52 Beat

1.64 1.61 Miss 0.41 0.42 Beat 1.46 1.45 Miss 0.35 0.38 Beat

1.17 1.17 Beat 0.30 0.31 Beat 3.01 2.83 Miss 0.81 0.81 Beat

1.19 1.23 Beat 0.30 0.31 Beat 2.17 2.36 Beat 0.56 0.55 Miss

0.33 0.33 Miss 0.08 0.08 Beat 0.91 0.98 Beat 0.23 0.24 Beat

*Growth was driven primarily by the acquisitions of National Security Solutions, TASC/DRC and Lockheed Martin IS&GS

Source: CapIQ

Positive Trends Continue in the Federal Market

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Non-Traditional Buyers Remain Hungry in the Federal Market

Acquisitions of government contractors with differentiated capabilities and strong customer relationships

by Non-Traditional buyers continues to be a major 2016 theme in the federal market. As referenced in

ACP’s Q1 2016 Market Update, activity within this group remains robust as companies who have

historically shied away from M&A efforts in the federal market, are now witnessing more favorable

federal budget dynamics and clearer visibility on long-term programs. In November 2016, Huntington

Ingalls Industries, which has been relatively quiet since its spin-off from Northrop Grumman Corporation

in 2011, acquired Camber Corporation to significantly broaden its existing capabilities and customer base.

In addition, KBR’s previously acquired government services platform Wyle will serve as a beachhead for

its recently closed acquisition of Honeywell Technology Solutions. Accenture has made yet another bet

on the federal cybersecurity market, acquiring Defense Point Security to strengthen its cybersecurity

expertise. DigitalGlobe’s acquisition of The Radiant Group from Aston Capital, LLC, is its first

acquisition since 2014 and will help expand its customer base into the Intelligence and Special Operations

Command markets while broadening its capabilities across the entire geospatial intelligence value chain.

Finally, Cognosante’s acquisition of Business Information Technology Solutions (BITS) in late October,

provides them with a federal platform with access to the T4NG contract and expands the Company’s

capabilities to serve a wider spectrum of public health care.

Through Q3 2016, the federal market has shown positive momentum. The performance of Tier-1 and Mid-

Tier companies has trickled down to the lower and middle-market creating a higher degree of confidence

and certainty in the market. This has fueled renewed M&A interest from Non-Traditional buyers in FY

2016 and is expected to continue through the remainder of the year and into FY 2017.

Recent Non-Traditional Acquirer Transactions Date TEV Acquirer Target Transaction Rationale

Pending $380M

Enhances strategic and operational alignment among

the services businesses and significantly broadens its

customer base

Pending N/A

Further enhances Accenture’s cybersecurity

expertise in incident response, complex security

integration and advanced cyber analytics

11/16/2016 $140M

Broadens DigitalGlobe’s capabilities across the

entire geospatial intelligence value chain and

expands the customer base across the IC and

SOCOM markets

10/27/2016 N/A

Provides Cognosante access to the $22.3 billion

Transformation Twenty-One Total Technology Next

Generation (T4NG) contract and expands the

Company’s capabilities to serve a wider spectrum of

public health care

9/16/2016 $260M

Technology Solutions

KBR’s second acquisition in the gov. space in 2016,

HTSI will be integreated into KBRwyle to create a

total capability government services organization

Sale of PROTEUS Technologies, LLC

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Aronson Capital Partners Advises PROTEUS

Technologies, LLC on its Sale to Polaris Alpha,

a Newly Formed Portfolio Company of

Arlington Capital Partners

Aronson Capital Partners is honored to have served as

the financial advisor to PROTEUS Technologies, LLC

(“PROTEUS”) in its acquisition by Arlington Capital

Partners, as part of a merger of EOIR Technologies and

Intelligent Software Solutions (“ISS”) to create Polaris

Alpha (“Polaris”). ACP served as the exclusive

financial advisor to PROTEUS in this transaction.

Established in 1999, PROTEUS is an innovative,

leading-edge software and systems engineering

solutions firm specializing in the development and

deployment of cutting-edge solutions that support the

Intelligence Community’s cyber security, signals

intelligence, embedded engineering and research

missions.

"Polaris will fill the void between niche players and

prime contractors to deliver agile, sophisticated solutions to a growing number of government customers

disillusioned with the traditional options available to them," said Michael Lustbader, a Managing Partner

at Arlington Capital. "Polaris is a byproduct of the infusion of innovation into the national security sector

and is contractually well-positioned to capitalize on this market opportunity." Polaris has over 1,100

employees and projects over $250 million in 2017 revenue.

ACP believes this transaction follows recent trends and signals future themes in the defense and

government services M&A market:

Growth in cyber security and cyber intelligence spending drives M&A, especially for targets that

have cleared, experienced engineers with footholds at key Intel agencies.

Industry focused private equity firms continue to execute on “buy & build” strategies to form

portfolio companies that can provide a full spectrum of collection, processing and analytics

solutions in response to customer requirements.

Privately held targets with prime contract portfolios in the national security sector command

significant interest from the buyer community.

The undersigned served as the exclusive financial

advisor to PROTEUS Technologies in this transaction.

a portfolio company of

has been acquired by

November 10, 2016

Select M&A Transactions

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Huntington Ingalls Acquires Camber Corporation

On November 2, Huntington Ingalls Industries, Inc. (NYSE: HII) entered into a definitive

agreement to acquire Camber Corp., a portfolio company of New Mountain Capital, LLC for

roughly $380 million, or 8.6x Total Enterprise Value (“TEV”)/Adjusted EBITDA and 1.0x

TEV/Revenue respectively for the Fiscal Year Ended June 30th, 2016. Camber specializes in

aviation sensors and simulations, training and logistical support; information technology

support, agile software engineering and IT, intelligence analysis and operations and

engineering and management to the U.S. Navy, Army, USPTO and the IC.

Post-closing, HII will reorganize its services businesses to establish a new reportable segment

consisting of Camber and the following HII subsidiaries: AMSEC, Continental Maritime of

San Diego, Newport News Industrial, SN3, Undersea Solutions Group and Universal Pegasus

International. Mike Petters, HII's president and CEO, stated: "The acquisition of Camber and

the establishment of our Technical Solutions segment under Andy Green’s leadership builds

upon our strong heritage as a valued and trusted partner to our customers."

DigitalGlobe Acquires Aston Capital’s The Radiant Group

On October 11, DigitalGlobe, Inc. signed a definitive agreement to acquire The Radiant Group,

a portfolio company of Aston Capital, LLC for $140 million in cash and drawings from its

revolving credit line. The Company expects to deliver 2016 revenue of roughly $100 million

(1.4x TEV/Revenue) and industry average EBITDA margins of approximately 10.0%.

The Radiant Group is a provider of geospatial information analysis services to the U.S.

intelligence sector and has contracts with the NRO, NGA, DIA and SOCOM. DigitalGlobe's

acquisition of The Radiant Group will combine two industry leaders in geospatial information

services, and will broaden DigitalGlobe's capabilities across the entire geospatial intelligence

value chain, including smart tasking, collection, processing, big data analytics and delivery of

insights. The acquisition will expand DigitalGlobe's customer base across the U.S. intelligence

and special operations communities through more than 80 additional contract vehicles.

Jeffrey R. Tarr, CEO of DigitalGlobe, Inc., stated: "The acquisition of The Radiant Group

represents an important step in deriving new insights for customers from DigitalGlobe's

imagery and other geospatial information sources.”

Accenture Acquires Defense Point Security

On October 5th Accenture plc (NYSE: ACN) entered into an agreement to acquire privately

held Defense Point Security, LLC (DPS) and will be a wholly owned subsidiary of Accenture

Federal Services (AFS). DPS is a cybersecurity company supporting the U.S. federal

government with advanced cyber defense and response capabilities, including advanced

Security Operations Center (SOC) expertise, cyber operations, security engineering, and cyber

analytics.

Accenture Federal Services CEO David Moskovitz stated: "With the velocity and ferocity of

cyber threats, DPS' expertise in enhanced operational security and advanced security analytics

will boost AFS' ability to bring cutting-edge cyber solutions that will help federal agencies best

protect their most valuable information. The addition of DPS' specialized cyber defense tools

and methodologies, together with our powerful client insights, will further propel our strategy

to be a leading provider of end-to-end, federal enterprise security services."

Acquirer

Target

Target

Acquirer

Target

Acquirer

Public Company Comparables

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Last 12-Month Returns

Last 12-Month Enterprise Value / EBITDA

Source: CapIQ Mid-Tier Index: BAH, LDOS, CACI, MANT, EGL, ICFI, KEYW, VEC, VSEC, NCIT Tier-1 Index: BA, LMT, GD, RTN, NOC, LLL Defense Index: COL, LLL, HRS, COB, OA, TDY, FLIR, ULE, CUB, KTOS, MRCY, AVAV Aircraft - OEM: UTX, BA, A, GD, SAF, FNC, ERJ, AM, TXT, B, CAE, Aircraft - Suppliers & Aftermarket: PCP, TDG, COL, HO, HXL, TGI, CW, ESL, HEI, MOG.A, ULE

60

80

100

120

140

160

Nov-15 Mar-16 Jul-16 Nov-16

Inde

xed

Perf

orm

ance

LTM 11/10/2016 Returns

Mid-Tier: 30.7%

Defense System/Electronics : 26.8%

Tier-1: 18.4%

S&P: 5.9%

Aircraft - OEM: 6.4%

4.0x

5.0x

6.0x

7.0x

8.0x

9.0x

10.0x

11.0x

12.0x

13.0x

14.0x

Nov-15 Mar-16 Jul-16 Nov-16

Ente

rpri

se V

alue

/LTM

EBI

TDA

11/10/2016 EV/LTM EBITDA

Defense System/Electronics : 12.7x

Tier-1: 11.8x

Mid-Tier: 11.8x

Aircraft - OEM: 11.3x

Aircraft - Suppliers & Aftermarket: 10.9x

Public Company Comparables

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

USD in Mi l l ions , exc luding share prices

As of 11/10/2016 Enterprise LTM LTM

Company Value Rev. EBITDA Rev. EBITDA Rev. EBITDA CY15A CY16P CY15A CY16P

Mid-Tier Federal Service Providers

Leidos Holdings, Inc. 9,934$ 5,803$ 521$ 1.7x 19.1x 1.0x 10.3x 8.4% 8.8% NA 36.6%

CSRA Inc. 7,644 4,839 603 1.6x 12.7x 1.5x 8.7x 15.3% 17.4% NA 27.4%

Booz Allen Hamilton Holding Corporation 6,242 5,550 520 1.1x 12.0x 1.1x 11.2x 9.3% 9.4% (0.1%) 5.4%

Science Applications International Corporation 4,273 4,517 341 0.9x 12.5x 0.9x 12.6x 7.3% 7.5% 11.1% 5.5%

CACI International Inc. 4,244 3,995 343 1.1x 12.4x 1.0x 11.4x 9.2% 8.5% (2.9%) 25.5%

Engility Holdings, Inc. 2,257 2,107 180 1.1x 12.6x 1.1x 12.1x 8.7% 9.0% 52.6% (0.1%)

ManTech International Corporation 1,463 1,610 124 0.9x 11.8x 0.9x 11.7x 7.5% 7.6% (12.6%) 3.7%

ICF International Inc. 1,214 1,176 110 1.0x 11.0x 1.0x 9.6x 9.6% 9.7% 7.8% 5.3%

VSE Corp. 624 622 79 1.0x 7.9x NA NA 14.4% NA 25.9% NA

The KEYW Holding Corporation 563 308 1 1.8x NA 1.8x 14.5x (0.0%) 11.9% 7.3% (6.4%)

Vectrus, Inc. 264 1,214 48 0.2x 5.5x 0.3x 7.2x 3.9% 3.9% (1.9%) 0.8%

NCI, Inc. 164 329 29 0.5x 5.6x 0.5x 5.8x 8.6% 8.7% 5.1% (2.9%)

Mean 1.1x 11.2x 1.0x 10.5x 8.5% 9.3% 9.2% 9.2%

Median 1.0x 12.0x 1.0x 11.2x 8.7% 8.8% 6.2% 5.3%

Tier 1 Prime Contractors

The Boeing Company 92,037$ 94,858$ 7,619$ 1.0x 12.1x 1.0x 8.7x 9.4% 8.1% 5.9% (1.9%)

Lockheed Martin Corporation 86,891 50,612 7,267 1.7x 12.0x 1.8x 12.7x 13.6% 14.6% 1.2% 1.2%

General Dynamics Corporation 52,289 30,929 4,692 1.7x 11.1x 1.7x 11.0x 14.8% 15.3% 2.0% (0.2%)

Northrop Grumman Corporation 48,501 23,805 3,511 2.0x 13.8x 2.0x 13.9x 15.1% 14.8% (1.9%) 2.1%

Raytheon Company 46,271 24,159 3,676 1.9x 12.6x 1.9x 12.7x 14.1% 15.3% 1.8% 5.0%

L-3 Communications Holdings Inc. 14,647 10,393 1,226 1.4x 11.9x 1.4x 12.0x 10.7% 11.7% (4.7%) (1.5%)

Mean 1.6x 12.3x 1.6x 11.8x 12.9% 13.3% 0.7% 0.8%

Median 1.7x 12.0x 1.7x 12.3x 13.9% 14.7% 1.5% 0.5%

Defense System / Electronics F irms

Harris Corporation 16,980$ 7,410$ 1,678$ 2.3x 10.1x 2.3x 10.8x 22.6% 21.3% 28.6% 15.0%

L-3 Communications Holdings Inc. 14,647 10,393 1,226 1.4x 11.9x 1.4x 11.9x 10.7% 11.7% (4.7%) (1.5%)

Rockwell Collins Inc. 12,904 5,259 1,297 2.5x 9.9x 2.4x 9.9x 22.7% 24.9% 0.7% 2.2%

Orbital ATK, Inc. 6,255 4,628 623 1.4x 10.0x 1.4x 9.4x 11.7% 15.1% 105.6% (1.7%)

Teledyne Technologies Inc. 4,610 2,198 355 2.1x 13.0x 2.1x 12.5x 16.2% 16.4% (4.0%) (7.0%)

Cobham plc 4,571 2,580 449 1.8x 10.2x 1.8x 10.2x 20.1% 17.3% 5.9% (19.2%)

FLIR Systems, Inc. 4,495 1,625 353 2.8x 12.7x 2.7x 11.3x 22.9% 22.5% 1.7% 5.3%

Ultra Electronics Holdings plc 2,173 1,010 167 2.2x 13.0x 2.1x 11.7x 16.2% 19.1% (3.7%) (6.3%)

Cubic Corporation 1,512 1,481 94 1.0x 16.2x 1.0x 11.1x 7.3% 9.2% 1.2% 2.5%

Mercury Systems, Inc. 1,381 299 52 4.6x 26.8x 3.6x 15.9x 16.7% 21.5% 11.1% 36.7%

Kratos Defense & Security Solutions, Inc. 812 664 10 1.2x NA 1.2x 17.1x 3.1% 6.5% (13.9%) 1.2%

AeroVironment, Inc. 394 253 10 1.6x 38.1x 1.5x 14.7x 6.5% 2.4% 7.9% (6.4%)

Mean 2.1x 15.6x 2.0x 12.2x 14.7% 15.6% 11.4% 1.7%

Median 1.9x 12.7x 2.0x 11.5x 16.2% 16.8% 1.5% (0.2%)

Source: Capital IQ

EV: Enterprise Value

LTM: Trailing Twelve Months

NTM: Next Twelve Months

EV as a Mu lt iple of

LTM NTM EBITDA Margin Revenue Growth

Public Company Comparables

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

USD in Mi l l ions , exc luding share prices

As of 11/10/2016 Enterprise LTM LTM

Company Value Rev. EBITDA Rev. EBITDA Rev. EBITDA CY15A CY16P CY15A CY16P

Aerospace

Aircraft - OEM

United Technologies Corporation 106,715$ 56,885$ 10,362$ 1.9x 10.3x 1.8x 10.0x 18.3% 18.8% (3.1%) 2.2%

The Boeing Company 92,037 94,858 7,619 1.0x 12.1x 1.0x 8.8x 9.4% 8.1% 5.9% (1.9%)

General Dynamics Corporation 52,289 30,929 4,692 1.7x 11.1x 1.7x 10.9x 14.8% 15.3% 2.0% (0.2%)

Airbus Group SE 49,795 72,152 5,272 0.7x 9.4x 0.7x 7.0x 7.8% 9.1% (4.8%) 0.6%

Safran SA 30,977 20,894 4,423 1.5x 7.0x 1.6x 8.5x 20.5% 19.1% 7.9% (5.8%)

Textron Inc. 15,144 13,886 1,600 1.1x 9.5x 1.1x 8.6x 11.7% 11.3% (3.3%) 4.2%

Bombardier Inc. 10,439 16,976 492 0.6x 21.2x N/A 11.8x 3.4% 4.7% (9.6%) (8.6%)

Dassault Aviation SA 9,252 4,631 655 2.0x 14.1x 2.4x 23.2x 10.2% 10.2% 2.0% (12.2%)

CAE Inc. 4,659 2,001 424 2.3x 11.0x N/A N/A 19.4% 22.8% (7.7%) 13.9%

Mean 1.4x 11.8x 1.5x 11.1x 12.8% 13.3% (1.2%) (0.9%)

Median 1.5x 11.0x 1.6x 9.4x 11.7% 11.3% (3.1%) (0.2%)

Aircraft - Suppliers & Aftermarket

TransDigm Group Incorporated 22,983$ 3,106$ 1,398$ 7.4x 16.4x 6.6x 14.0x 44.3% 47.4% 16.1% 16.7%

Thales SA 19,720 16,172 1,770 1.2x 11.1x 1.2x 10.0x 10.3% 11.5% (2.7%) 6.0%

Rockwell Collins Inc. 12,904 5,259 1,297 2.5x 9.9x 2.4x 9.5x 22.7% 24.9% 0.7% 2.2%

HEICO Corporation 5,093 1,342 323 3.8x 15.8x 3.5x 14.6x 23.7% 23.4% 8.2% 15.1%

Hexcel Corp. 4,958 1,986 446 2.5x 11.1x 2.4x 9.9x 22.0% 22.7% 0.3% 8.7%

Curtiss-Wright Corporation 4,735 2,132 407 2.2x 11.6x 2.2x 11.1x 18.7% 19.1% (1.7%) (3.1%)

Moog Inc. 3,022 2,412 323 1.3x N/A 1.2x 9.4x 13.1% 12.7% (6.5%) (1.1%)

Triumph Group, Inc. 2,960 3,740 (170) 0.8x N/A 0.8x 6.8x 13.2% 10.2% 4.4% (5.7%)

Esterline Technologies Corp. 2,933 1,993 276 1.5x 10.6x 1.5x 9.3x 12.7% 13.9% (6.9%) 6.1%

Ultra Electronics Holdings plc 2,173 1,010 167 2.2x 13.0x 2.1x 11.7x 16.2% 19.1% (3.7%) (6.3%)

Mean 2.5x 12.5x 2.4x 10.6x 19.7% 20.5% 0.8% 3.9%

Median 2.2x 11.4x 2.2x 10.0x 17.4% 19.1% (0.7%) 4.1%

Source: Capital IQ

EV: Enterprise Value

LTM: Trailing Twelve Months

NTM: Next Twelve Months

EV as a Mu lt iple of

LTM NTM EBITDA Margin Revenue Growth

Recent M&A Transactions – Government Services & Defense

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

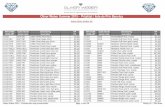

Close Date Name Industry Buyer Buyer Classification $M /LTM Rev

/LTM

EBITDA

Pending Camber Corporation IT Services Huntington Ingalls Industries, Inc. Public Strategic 380.0 1.0 x 8.6 x

Pending Constellis Holdings, LLC Other Apollo Global Management, LLC P/E Sponsor 1,000.0 N/A 5.9 x

Pending Defense Point Security, LLC (DPS) Cyber / Intel Accenture plc Private Strategic N/A N/A N/A

Pending Dell Services (Perot Systems) IT Services NTT DATA, Inc. Public Strategic 3,060.0 N/A N/A

Pending FourWinds Limited Company C4ISR LMI Private Strategic N/A N/A N/A

Pending Honeywell Technology Solutions, Inc. (HTSI) Other KBR, Inc. [KBRwyle] Public Strategic 266.0 0.4 x N/A

Pending Silicon Graphics International Corp. (SGI) Cloud / Data Analytics Hewlett Packard Enterprise Co. Public Strategic 275.0 0.5 x N/A

Pending Spillman Technologies, Inc. IT Services Motorola Solutions, Inc. Public Strategic N/A N/A N/A

11/16/16 The Radiant Group, Inc. C4ISR DigitalGlobe Public Strategic 140.0 1.4 x N/A

11/15/16 Integrio Technologies, Inc. IT Services Sysorex Global Holdings Corp. Public Strategic 6.0 N/A N/A

11/15/16 Siege Technologies, LLC Cyber / Intel Nehemiah Security, LLP Private Strategic N/A N/A N/A

11/10/16 PROTEUS Technologies, LLC Cyber / Intel Arlington Capital Partners [EOIR Technologies n/k/a Polaris Alpha] P/E Backed Strategic N/A N/A N/A

11/10/16 Intelligent Software Solutions, Inc. (ISS) Cyber / Intel Arlington Capital Partners [EOIR Technologies n/k/a Polaris Alpha] P/E Backed Strategic N/A N/A N/A

10/28/16 Business Information Technology Solutions Inc. (BITS) Healthcare IT Cognosante Holdings, LLC Private Strategic N/A N/A N/A

10/18/16 NEOGOV IT Services Warburg Pincus, LLC P/E Sponsor N/A N/A N/A

10/12/16 Synaptic Solutions IT Services Preferred Systems Solutions (PSS) (CM Equity) P/E Backed Strategic N/A N/A N/A

10/12/16 Software Design Solutions, Inc. IT Services Applied Visions, Inc. Private Strategic N/A N/A N/A

09/16/16 Fusion Technology, LLC Cyber / Intel Calibre Systems, Inc. (CALIBRE) Private Strategic N/A N/A N/A

09/02/16 SilverRhino, LLC IT Services InfoTeK Corp. Private Strategic N/A N/A N/A

08/23/16 Redcore Cyber / Intel Accenture plc Public Strategic N/A N/A N/A

08/17/16 Vistronix Intelligence & Technology Solutions Cyber / Intel ASRC Federal Holding Co. Private Strategic N/A N/A N/A

08/16/16 Lockheed Martin Corp. [Information Systems & Global Solutions (IS&GS)] IT Services Leidos Holdings, Inc. Public Strategic 5,000.0 1.0 x N/A

08/11/16 Aerospace Analytics, LLC Other Richter & Company, LLC Private Strategic N/A N/A N/A

08/05/16 Intelligent Decisions, Inc. [Comms. and Transmission Sysystems business unit] C4ISR Tribalco, LLC Private Strategic N/A N/A N/A

08/09/16 Analytic Strategies, LLC IT Services Frontier Capital [PlanetRisk, Inc.] P/E Backed Strategic N/A N/A N/A

08/04/16 Information Management Technology Corp. (IMT) Cyber / Intel Mission Essential Private Strategic N/A N/A N/A

08/03/16 CASE Forensics Corp. Technical Services Gryphon Investors [JENSEN HUGHES, Inc.] P/E Backed Strategic N/A N/A N/A

08/01/16 MIR3.com, Inc. IT Services Veritas Capital Fund Management, LLC [ENC] P/E Backed Strategic N/A N/A N/A

08/01/16 Symplicity Corp. IT Services H.I.G. Capital, LLC P/E Sponsor N/A N/A N/A

07/27/16 Intercom Consulting & Federal Systems Corp. IT Services AE Industrial Partners, LLC [Belcan, LLC] P/E Backed Strategic N/A N/A N/A

07/27/16 L-com, Inc. Electronics Genstar Capital, LLC [Infinite RF Holdings, Inc.] P/E Backed Strategic N/A N/A N/A

07/14/16 Allied InfoSecurity, Inc. Cyber / Intel Delta Risk, LLC P/E Backed Strategic N/A N/A N/A

07/05/16 Armed Forces Services Corp. (AFSC) Healthcare IT Magellan Health, Inc. Public Strategic 117.5 0.9 x N/A

07/05/16 Wyle Laboratories, Inc. C4ISR KBR, Inc. Public Strategic 570.0 0.7 x 8.5 x

07/01/16 Paragon Communications Solutions, Inc. Cyber / Intel Xator Corp. Private Strategic N/A N/A N/A

07/01/16 Hankins & Anderson, Inc. (H&A) Other The Day & Zimmermann Group [Mason & Hanger] Private Strategic N/A N/A N/A

06/25/16 EOIR Technologies, Inc. Cyber / Intel Arlington Capital Partners P/E Sponsor N/A N/A N/A

06/13/16 Oceans Edge, Inc. [cyber business] Cyber / Intel ManTech International Corp. Public Strategic N/A N/A N/A

05/27/16 Softmart, Inc. IT Services PC Connection, Inc. Public Strategic N/A N/A N/A

05/24/16 Broadspectrum Ltd. Other Ferrovial S.A. Public Strategic 580.0 N/A N/A

05/24/16 Hewlett Packard Enterprise [Enterprise Services] IT Services CSC Public Strategic N/A N/A N/A

05/24/16 Intelligent Decisions, Inc. [counterintelligence and intelligence business units] IT Services Federal Data Systems, Inc. (FedData) Public Strategic N/A N/A N/A

05/23/16 QRC Technologies, Inc. C4ISR DC Capital Partners, LLC P/E Sponsor N/A N/A N/A

05/16/16 Danya International Healthcare IT DLH Holdings Corp. Public Strategic 38.8 N/A 6.0 x

05/06/16 Prime Solutions, LLC Cyber / Intel Altamira Technologies Corp. P/E Backed Strategic N/A N/A N/A

04/22/16 Universal Solutions Initiative, Inc. (USi) IT Services ALATEC, Inc. (Ignite) Private Strategic N/A N/A N/A

04/12/16 Van Dyke Technology Group, Inc., The Cyber / Intel Jacobs Engineering Group, Inc. Public Strategic N/A N/A N/A

03/31/16 Force 3, Inc. Cyber / Intel Sirius Computer Solutions, Inc. P/E Backed Strategic N/A N/A N/A

03/30/16 netAura, LLC Cyber / Intel CenturyLink, Inc. Public Strategic N/A N/A N/A

03/14/16 Advanced Scientific Concepts, Inc. (ASC) [ASCar Division] Electronics Continental AG Public Strategic N/A N/A N/A

03/14/16 INDUS Corp. IT Services Tetra Tech, Inc. Public Strategic N/A N/A N/A

03/04/16 Brimtek, Inc.* C4ISR Digital Barriers plc Public Strategic 45.0 1.1 x 12.9 x

03/04/16 NAL Research Corp. Electronics Jordan Company, L.P., The [Drew Marine] P/E Backed Strategic N/A N/A N/A

03/03/16 Safend Ltd. Cyber / Intel SuperCom Ltd. Public Strategic 1.5 0.3 x N/A

03/01/16 Unmanned Safety Institute (USI) C4ISR ARGUS International, Inc. Private Strategic N/A N/A N/A

02/29/16 Purple Secure Systems Ltd. IT Services CACI International, Inc. [CACI Ltd.] Public Strategic N/A N/A N/A

02/29/16 Resilient Systems, Inc. Cyber / Intel IBM Corp. Public Strategic N/A N/A N/A

02/25/16 Miltec Corp. Other General Atomics Corp. Private Strategic 14.6 0.5 x N/A

02/24/16 KEYW Corp. [SETA Business] Technical Services Quantech Services, Inc. Private Strategic 12.0 N/A N/A

02/05/16 Space/Ground System Solutions Inc. (SGSS) Other O'Neil Group Company, LLC [Braxton Science & Technology Group, LLC] P/E Backed Strategic N/A N/A N/A

02/04/16 Obsidian Analysis, Inc. Technical Services Cadmus Group, Inc., The Private Strategic N/A N/A N/A

02/02/16 Invotas International Corp. Cyber / Intel FireEye, Inc. Public Strategic N/A N/A N/A

02/01/16 L-3 Communications (NSS) IT Services CACI International Inc. Public Strategic 550.0 0.5 x N/A

Target Information Buyer Information EV Information

*Brimtek EV includes $20 million earnout based on 2017 performance

Recent M&A Transactions – Government Services & Defense

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Close Date Name Industry Buyer Buyer Classification $M /LTM Rev

/LTM

EBITDA

01/29/16 New World Solutions, Inc. Technical Services SOS International, LLC (SOSi) Private Strategic N/A N/A N/A

01/29/16 Wavefront Technologies, Inc. Cyber / Intel Ball Corp. Public Strategic N/A N/A N/A

01/19/16 PAE Other Platinum Equity Holdings (PEH) P/E Sponsor N/A N/A N/A

01/15/16 Clearsoft, Inc. IT Services Battle Resource Management, Inc. (BRMi) Private Strategic N/A N/A N/A

01/15/16 Cobham plc [Surveillance Business] C4ISR Marlin Equity Partners P/E Sponsor 10.0 N/A N/A

01/14/16 iSIGHT Partners, Inc. Cyber / Intel FireEye, Inc. Public Strategic 200.0 N/A N/A

01/14/16 Ness Technologies, Inc. [Ness TSG IT Advanced Systems Ltd.] IT Services Israel Aerospace Industries (IAI), Formula Systems (1985) Ltd. Public Strategic 50.0 N/A N/A

01/13/16 Social Intelligence Corp. [government solutions business] Cloud / Data Analytics Altamont Capital Partners [OMNIPLEX World Services Corp.] P/E Backed Strategic N/A N/A N/A

01/13/16 Tandel Systems, Inc. Technical Services AE Industrial Partners, LLC [Belcan, LLC] P/E Backed Strategic N/A N/A N/A

01/12/16 Marshall Communications Corp. Other Mission Solutions Group (MSG), Inc. Private Strategic N/A N/A N/A

01/12/16 Tetra Concepts, LLC Cloud / Data Analytics CM Equity Partners, L.P. (CMEP) [Preferred Systems Solutions, Inc. P/E Backed Strategic N/A N/A N/A

01/06/16 Talentscale, LLC Other SCST, Inc. Private Strategic N/A N/A N/A

12/31/15 Applied Measurement Professionals, Inc. (AMP) Technical Services PSI Services, LLC Private Strategic N/A N/A N/A

12/23/15 Ability Computers & Software Industries Ltd. Other Cambridge Capital Acquisition Corporation Public Strategic 192.0 3.9 x 9.6 x

12/21/15 Airbus Group SE [commercial satellite business] Other Apax Partners S.A. P/E Sponsor N/A N/A N/A

12/21/15 GATR Technologies, Inc. C4ISR Cubic Corp. Public Strategic 232.5 N/A N/A

12/21/15 TeraLogics, LLC IT Services Cubic Corp. Public Strategic 39.0 N/A N/A

12/18/15 Alta IT Services LLC IT Services System One Holdings, LLC Private Strategic N/A N/A N/A

12/16/15 Lewis Innovative Technologies, Inc. Cyber / Intel Mercury Systems, Inc. Public Strategic N/A N/A N/A

12/11/15 Cyveillance, Inc. Cyber / Intel LookingGlass Cyber Solutions, Inc. P/E Backed Strategic N/A N/A N/A

11/30/15 SRA International IT Services Computer Sciences Government Services Inc. Public Strategic N/A N/A N/A

11/23/15 STG. Inc Cyber / Intel Global Defense & National Security Systems, Inc. Public Strategic 165.0 0.8 x 9.0 x

11/19/15 ATC Associates, Inc. Other Bernhard Capital Partners P/E Sponsor 64.0 N/A N/A

11/16/15 Data Networks Corp. IT Services ASRC Federal Holding Co. Private Strategic N/A N/A N/A

11/03/15 GSM Consulting, Inc. IT Services Preferred Systems Solutions (PSS) (CM Equity) P/E Backed Strategic N/A N/A N/A

11/03/15 MAR, Inc. Cyber / Intel Oasis Systems LLC P/E Backed Strategic N/A N/A N/A

11/02/15 SPARC, LLC IT Services Booz Allen Hamilton Public Strategic 50.0 N/A N/A

11/02/15 The Protective Group, Inc. Other Point Blank Enterprises, Inc. (Sun Capital Partners) P/E Backed Strategic N/A N/A N/A

10/31/15 Novetta Solutions, LLC Cyber / Intel The Carlyle Group LP P/E Sponsor N/A N/A N/A

Target Information Buyer Information EV Information

Cloud / Data

Analytics

25%

Cyber / Intel

18%

Other

27%

IT Services

12%

C4ISR

7%

Healthcare IT

9%

Technical

Services

2%

Target Industry

Public Strategic

41%

Private Strategic

29%

P/E Backed

Strategic

20%

P/E Sponsor

10%

Buyer Classification

Recent M&A Transactions – Aerospace

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

Close Date Name Industry Buyer Buyer Classification $M /LTM Rev

/LTM

EBITDA

Pending Arcam AB; SLM Solutions Group AG Structures & Components General Electric Co. [GE Aviation] Public Strategic 1,400.0 9.9 x N/A

10/04/16 Triumph Group, Inc. Structures & Components Calspan Corp. Private Strategic N/A N/A N/A

10/03/16 Star Aviation, Inc. Structures & Components Carlisle Companies, Inc. P/E Sponsor N/A 0.0 x N/A

10/03/16 Tekna Seal, LLC Electronics Snow Phipps Group [Winchester Electronics Corp.] P/E Sponsor 10.5 N/A N/A

09/26/16 Raisbeck Engineering, Inc. Other Acorn Growth Companies P/E Sponsor N/A N/A N/A

09/12/16 Motion Dynamics Corp. Structures & Components Vance Street Capital, LLC P/E Sponsor N/A N/A N/A

09/07/16 Texas Pneumatics Systems (TPS) Inc. MRO Aviation Technical Services, Inc. (ATS) Private Strategic N/A N/A N/A

09/06/16 Young & Franklin, Inc. Structures & Components TransDigm Group, Inc. Public Strategic 260.0 3.5 x N/A

09/01/16 Filtra-Systems Co. Structures & Components Chickasaw Nation Industries, Inc. (CNI) Private Strategic N/A N/A N/A

08/12/16 Axiom Materials, Inc. Other Sorenson Capital P/E Sponsor N/A N/A N/A

08/02/16 ZTM, Inc. Structures & Components Liberty Hall Capital Partners, L.P. [Accurus Aerospace Corp.] P/E Backed Strategic N/A N/A N/A

07/26/16 CTS Engines, LLC Structures & Components Platte River Equity P/E Sponsor N/A N/A N/A

07/18/16 Greenwich AeroGroup, Inc. [Aero Precision Industries, LLC; DAC International, Inc.; Structures & Components Odyssey Investment Partners, LLC P/E Sponsor N/A N/A N/A

07/18/16 Kansas Plastics Co. Other Tramec, LLC Private Strategic N/A N/A N/A

07/12/16 Moeller Mfg. Company, LLC (Moeller Aerospace) Structures & Components AE Industrial Partners, LLC P/E Backed Strategic N/A N/A N/A

07/12/16 North Coast Composites, Inc., North Coast Tool and Mold Corp. Other Acorn Growth Companies [AGC Aerospace & Defense] P/E Backed Strategic N/A N/A N/A

07/06/16 PCB Group, Inc. Electronics MTS Systems Corp. Public Strategic 580.0 N/A N/A

06/30/16 Fly By Wire Systems France S.A.S. Electronics LORD Corp. Private Strategic N/A N/A N/A

06/21/16 J&M Machine, LLC Structures & Components Liberty Hall Capital Partners [Accurus Aerospace Corp.] P/E Backed Strategic N/A N/A N/A

06/20/16 Bombardier, Inc. [Amphibious Aircraft business] Structures & Components Viking Air Ltd Public Strategic N/A N/A N/A

06/17/16 Adetel Group [51%] Electronics Centum Electronics Ltd Public Strategic N/A N/A N/A

06/16/16 Precision Made Products, LLC Structures & Components O2 Investment Partners [Alpha Sintered Metals] P/E Sponsor N/A N/A N/A

06/10/16 Micro-Coax, Inc. Electronics Carlisle Companies, Inc. Public Strategic N/A N/A N/A

06/01/16 Mipnet Industries / JTT Composites Structures & Components Compagnie de Saint-Gobain Public Strategic N/A N/A N/A

06/01/16 Warmelin Precision Products Structures & Components Nautic Partners [Aerostar Aerospace Manufacturing, LLC] P/E Backed Strategic N/A N/A N/A

05/31/16 Kreisler Manufacturing Corp. Structures & Components Arlington Capital Partners [United Flexible] P/E Backed Strategic 33.7 N/A N/A

05/31/16 Oxford Performance Materials, Inc. (OPM) Structures & Components Hexcel Corp. Public Strategic N/A N/A N/A

05/24/16 ILC Holdings, Inc. [Data Device Corp.] Electronics TransDigm Group, Inc. Public Strategic 1,000.0 5.0 x N/A

05/19/16 AC&A, LLC Structures & Components AE Industrial Partners, LLC P/E Sponsor N/A N/A N/A

05/04/16 Sigma Precision Components UK Ltd Structures & Components Silverfleet Capital Partners LLP P/E Sponsor 94.0 N/A N/A

05/02/16 IMSAR, LLC [radar product line] Other Fortem Technologies Private Strategic N/A N/A N/A

04/20/16 Innovative Control Systems (ICS) Electronics Reiser Simulation and Training GmbH (RST) Private Strategic N/A N/A N/A

04/05/16 ESNA, Elastic Stop Nut Corporation of America Structures & Components Rosewood Private Investment [Novaria Group} P/E Backed Strategic N/A N/A N/A

04/05/16 Sky-Tec Partners, Ltd. [product line] Other Tailwind Technologies, Inc. [Hartzell Engine Technologies, LLC] P/E Backed Strategic N/A N/A N/A

04/04/16 Centrax Turbine Components Other Blackstone Group, L.P., The [MB Aerospace Holdings Ltd] P/E Sponsor N/A N/A N/A

04/04/16 Prime Aviation Services S.p.A. [60%] MRO BBA Aviation plc Public Strategic N/A N/A N/A

03/30/16 Landmark Aviation [six FBOs] MRO KSL Capital Partners, LLC P/E Sponsor 190.0 N/A 11.8 x

03/23/16 Ferco Aerospace Structures & Components Rosewood Private Investments / Tailwind Advisors [Novaria Group] P/E Backed Strategic N/A N/A N/A

03/23/16 Forming Technology, Inc. (FTI) Structures & Components Hexagon AB Public Strategic N/A N/A N/A

03/21/16 Jackson Flexible Products, Inc. Structures & Components Tillerman & Co. P/E Sponsor N/A N/A N/A

03/18/16 Airbus Group SE [Defense Electronics] Other KKR & Co. P/E Sponsor 1,200.0 1.1 x N/A

03/15/16 Aurora Flight Sciences Corp. [equity stake] Manufacturer Enlightenment Capital P/E Sponsor N/A N/A N/A

03/08/16 Airbus DS SatCom Other Satcom Direct Communications, Inc. Private Strategic N/A N/A N/A

03/01/16 Unmanned Safety Institute (USI) Other ARGUS International, Inc. Private Strategic N/A N/A N/A

02/26/16 Harris Corp. [Aerostructures] Structures & Components Albany International Corp. Public Strategic 210.0 2.7 x 15.0 x

02/23/16 Mettis Aerospace Ltd Structures & Components Stirling Square Capital Partners P/E Sponsor N/A N/A N/A

02/23/16 TeleCommunication Systems, Inc. Other Comtech Telecommunications Corp. Public Strategic 430.8 1.2 x 10.7 x

02/22/16 New England Airfoil Products, Inc. Other Pietro Rosa TBM S.R.L. Private Strategic N/A N/A N/A

02/03/16 AIM Aerospace, Inc. Structures & Components Liberty Hall Capital Partners P/E Sponsor 220.0 N/A N/A

01/29/16 Precision Castparts Corp. Structures & Components Berkshire Hathaway, Inc. P/E Sponsor 37,200.0 3.7 x 13.1 x

01/27/16 General Ecology, Inc. Other JLL Partners [Loar Group, Inc.] P/E Backed Strategic N/A N/A N/A

01/07/16 Silverado Cable Co. Structures & Components Phoenix Logistics, Inc. Private Strategic N/A N/A N/A

01/06/16 Able Aerospace, Inc., Able Engineering and Component Services, Inc. MRO Textron, Inc. Public Strategic N/A N/A N/A

01/05/16 All Metals Processing of Orange County, Inc. Structures & Components Watson Family Investments, LLC P/E Sponsor N/A N/A N/A

01/05/16 Gemcor II, LLC Structures & Components American Industrial Partners [AIP Aerospace] P/E Backed Strategic 14.0 N/A N/A

01/04/16 Ascending Technologies GmbH Other Intel Corp. P/E Sponsor N/A N/A N/A

12/31/15 Pipavav Defence and Offshore Engineering Ltd MRO Reliance Defence Systems Private Limited Public Strategic N/A N/A N/A

12/21/15 Robertson Fuel Systems, LLC Other HEICO Corp. Public Strategic 255.0 N/A N/A

12/16/15 MB Aerospace Holdings Ltd. Structures & Components Blackstone Group, L.P. P/E Sponsor N/A N/A N/A

12/07/15 Abaco Systems, Inc [GE Intelligent Platforms Embedded Systems, Inc.] Electronics Veritas Capital Fund L.P. P/E Sponsor N/A N/A N/A

12/02/15 N2 Imaging Systems, LLC Other UTC Aerospace Systems Public Strategic N/A N/A N/A

11/30/15 GRW Bearing GmbH Structures & Components Kaman Corp. Public Strategic 142.8 2.8 x N/A

Target Information Buyer Information EV Information

Recent M&A Transactions – Aerospace

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

12

Close Date Name Industry Buyer Buyer Classification $M /LTM Rev

/LTM

EBITDA

11/25/15 Cobham plc [Advanced Composites Business] Structures & Components Meggitt plc Public Strategic 200.0 2.5 x 10.0 x

11/19/15 Breeze-Eastern Corp. Structures & Components TransDigm Group, Inc. Public Strategic 206.0 2.3 x N/A

11/18/15 Fairchild Semiconductor International, Inc. Electronics ON Semiconductor Corp. Public Strategic 2,400.0 7.1 x N/A

11/13/15 Secure Communication Systems, Inc. Electronics Benchmark Electronics, Inc. Public Strategic 230.0 N/A N/A

11/05/15 Tri-State Care Flight, LLC Other Air Methods Corp. Public Strategic 222.5 2.7 x N/A

10/28/15 OM Group, Inc. [businesses] Structures & Components Apollo Global Management, LLC P/E Sponsor N/A N/A N/A

10/06/15 The Byran Company, Inc. Structures & Components M Line Holdings, Inc. Public Strategic 5.1 N/A N/A

10/01/15 Bombardier, Inc. [Military Aviation Training Unit] Other CAE, Inc. Public Strategic 15.9 N/A N/A

09/28/15 Corvid Technologies Other Chickasaw Nation Industries, Inc. (CNI) Private Strategic N/A N/A N/A

09/23/15 Landmark Aviation MRO BBA Aviation plc Public Strategic 2,065.0 N/A 12.8 x

09/17/15 Aviaso Other Honeywell, Inc. Public Strategic N/A N/A N/A

09/08/15 Compac Development Corporation Electronics Air Industries Group, Inc. Public Strategic 1.2 N/A N/A

08/28/15 Electroservices Enterprises Ltd. Electronics Keysight Technologies, Inc. Public Strategic N/A N/A N/A

08/24/15 Astroseal Products Manufacturing Corp. Structures & Components HEICO Corp. Public Strategic N/A N/A N/A

08/19/15 Aerospace & Commercial Technologies, Inc. (ACT) Structures & Components HEICO Corp. Public Strategic N/A N/A N/A

08/19/15 Baines Simmons Americas, LLC Other Air Partner, Inc. Public Strategic 9.4 N/A N/A

08/19/15 PneuDraulics, Inc. Structures & Components TransDigm Group, Inc. Public Strategic 325.0 N/A N/A

08/14/15 Tempus Applied Solutions, LLC Other Chart Acquisition Corp. Public Strategic 100.0 N/A N/A

07/23/15 RTI International Metals, Inc. Other Alcoa, Inc. Public Strategic 1,500.0 1.9 x 13.0 x

07/20/15 HITCO Carbon Composites, Inc. [Aerostructures division] Structures & Components Avcorp Industries, Inc. Public Strategic N/A N/A N/A

07/08/15 StandardAero MRO Veritas Capital Fund L.P. P/E Sponsor N/A N/A N/A

07/02/15 Educational Services, Inc. Other IMPAQ International, LLC Private Strategic N/A N/A N/A

07/01/15 Cuming Microwave Corp. Structures & Components PPG Industries, Inc. Public Strategic N/A N/A N/A

07/01/15 Safe Air Limited MRO Airbus Group Australia Pacific Limited Public Strategic N/A N/A N/A

Target Information Buyer Information EV Information

Structures & Components

52%

MRO8%

Electronics15%

Other25%

Target Industry

Public Strategic33%

Private Strategic17%

P/E Backed Strategic

17%

P/E Sponsor33%

Buyer Classification

Representative ACP Transactions

805 King Farm Boulevard, Suite 300 | Rockville, Maryland 20850 | P 301.231.6200 | F 301.231.7630 | aronsoncapitalpartners.com

WHO IS ARONSON CAPITAL PARTNERS?

Aronson Capital Partners is a leading financial advisor to government services and technology firms. We exercise our special

domain expertise in the Defense, Intelligence, and Federal Civilian markets to achieve exceptional results for our clients. In

addition to completing more than 100 transactions in the federal sector, our principals have decades of executive level, hands-on

experience in the industry – a key differentiator that leads to success.

on its sale to on its sale to

on its sale toon its acquisition

ofon its sale to

on its sale to

portfolio company of

on its sale to

on its sale to

portfolio company of

on its acquisition of

on its divestiture of IC

SETA assets to

portfolio company of

on their sale to

on its sale toon its sale to

on its acquisition of

the Preclinical

Services Business of

on its sale to

AdvisedAdvised

on the sales of its Alliant Business Unit to

on its sale to

Advised

on its sale to

AdvisedAdvised

on its sale to

portfolio company of

on its sale to

portfolio company of

on its sale to

portfolio company of

AdvisedAdvisedAdvisedAdvisedAdvised

AdvisedAdvisedAdvisedAdvisedAdvised

AdvisedAdvisedAdvisedAdvisedAdvised

AdvisedAdvisedAdvisedAdvisedAdvised

on its sale to

portfolio company of

on its sale to

portfolio company of

on its sale to

portfolio company of

on its sale to

portfolio company of

Mergers & Acquisitions

• Sell & Buy-Side M&A

• Private Equity Investments

• Management Buyouts

• Divestitures

• Asset Sales

Corporate Finance

• Recapitalizations & Restructurings

• Common & Preferred Equity

• Debt Capital Raises

• Minority Equity Investments

Financial Advisory

• Internal Capital Transaction Advisory

• Independent Corporate Valuations

• Fairness Opinions

• Strategic Alternatives Assessments