BENCHMARK STATES 10-YEAR - Bloomberg.com · BVAL Muni Benchmark 30T 2.55 2.55 0 Source: GBY, ......

Transcript of BENCHMARK STATES 10-YEAR - Bloomberg.com · BVAL Muni Benchmark 30T 2.55 2.55 0 Source: GBY, ......

Tuesday

April 12, 2016

www.bloombergbriefs.com

Bloomberg AAA Benchmark Yields

DESCRIPTION CURRENT PREVIOUS NET CHANGE

BVAL Muni Benchmark 1T 0.55 0.55 -0.01

BVAL Muni Benchmark 2T 0.68 0.68 0

BVAL Muni Benchmark 3T 0.81 0.80 +0.01

BVAL Muni Benchmark 4T 0.94 0.94 0

BVAL Muni Benchmark 5T 1.04 1.03 0

BVAL Muni Benchmark 6T 1.16 1.15 +0.01

BVAL Muni Benchmark 7T 1.28 1.28 0

BVAL Muni Benchmark 8T 1.41 1.41 0

BVAL Muni Benchmark 9T 1.53 1.52 +0.01

BVAL Muni Benchmark 10T 1.64 1.62 +0.01

BVAL Muni Benchmark 20T 2.23 2.22 +0.01

BVAL Muni Benchmark 30T 2.55 2.55 0Source: GBY<GO>, GC I493 <GO>

Puerto Rico Ups Recovery Rates in Revised PlanBY MICHELLE KASKE, BLOOMBERG NEWS

Puerto Rico reduced the amount of potential losses for creditors in a revised debt-restructuring proposal as island officials seek to accelerate negotiations while the commonwealth moves closer to default and Congress considers oversight of its finances.

Puerto Rico and its advisers made public details of the offer first presented in March. General obligation and sales-tax bondholders would recover more of their investments under the latest plan. It would reduce the commonwealth’s $49.3 billion of tax-supported debt to between $32.6 billion and $37.4 billion, a smaller reduction than the cut to $26.5 billion in its earlier plan.

The revised plan increases to $1.85 billion from $1.7 billion the amount Puerto Rico will spend on annual debt-service.

Puerto Rico’s revised proposal offers a 74 percent recovery on general obligations and commonwealth-backed debt, up from 72 percent in its first plan that it unveiled Feb. 1. Sales-tax bonds, called Cofinas by their Spanish acronym, would recover 57 percent, up from 49 percent. It also replaces “growth bonds” included in the commonwealth’s first proposal, with capital-appreciation bonds, which delay interest payments until the debt mature. Growth bonds, by comparison, would only repay if Puerto Rico’s revenue exceeds certain projections.

The commonwealth would allocate $2.4 billion to its pensions in the first five years of the plan. Puerto Rico’s largest pension system’s assets were less than one percent of the $30.2 billion it owes current and future retirees, as of June 2014.

“A sustainable solution cannot place the burden on one stakeholder group alone, and we have the moral and legal obligation to protect the health, safety and well-being of our citizens,” , Puerto Rico’s secretary of state, said in a statement. “These Victor Suarezare the priorities we must balance while working to reach an agreement that will put Puerto Rico back on the path to prosperity.”

Puerto Rico residents who hold commonwealth securities would be repaid last. The revised proposal offers those on-island investors a return of full principal beginning in 2065 and ending 2069. They would receive a reduced 2 percent interest rate starting in 2017.

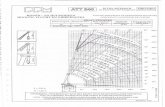

STATE YIELD SPREAD TO AAA CHANGE

CA 1.88 25 +0.03

FL 1.78 15 +0.03

IL 3.47 184 +0.02

NY 1.79 16 +0.11

PA 2.33 70 +0.03

TX 1.90 27 +0.03

MUNICIPALITY AMOUNT

Cornell University NY $132 million Rev

Texas Transportation $615 million GO

Fort Lauderdale FL $165 million Rev

California $1.5 billion GO

Loma Linda Med Ctr CA $883 million RevSource: Bloomberg CDRA <GO>

AMOUNT OUTSTANDING

($MLNS)

MATURING NEXT 30

DAYS ($MLNS)

ANNOUNCED CALLS NEXT 30 DAYS ($MLNS)

3,544,841 9,151 8,250Source: MBM<GO>

BENCHMARK STATES 10-YEAR

PRIMARY FIXED RATE

30-Day Supply Fixed: $11.4 Bln (LT)30-Day Supply Fixed: $269 Mln (ST)Sold YTD Fixed: $81 Bln (Neg LT)Sold YTD Fixed: $24.4 Bln (Comp LT)Sold YTD Fixed: $5.5 Bln (ST)

SECONDARY MARKET

MSRB: $11 BlnPICK: $15.1 Bln

VARIABLE RATE

SIFMA Muni Swap Rate: 0.39%Bloomberg Weekly AAA Rate: 0.386% Bloomberg Weekly AA Rate: 0.408% Daily Reset Inventory: $74 Mln Weekly Reset Inventory: $900 Mln

IN THE PIPELINE

SIZE OF MARKET

NUMBERS IN CONTEXT

April 12, 2016 Bloomberg Brief Municipal Market 2

NUMBERS IN CONTEXTMuni Variable-Rate Issuance Poised to Rise, Moody’s Says BY DARRELL PRESTON, BLOOMBERG NEWS

Sales of municipal bonds with variable-rate coupons has stayed at $50 billion or less since the peak in 2008, when auction-rate securities were restructured after the market collapse during the financial crisis. Now sales of debt with coupons that reset is poised to rise, according to Moody’s Investors Service. An expected increase in long-term interest rates will move issuers to borrow more with lower-cost variable-rate debt, Moody's said in a recent report. And new Securities and Exchange Commission rules requiring tax-exempt money market funds to use floating net asset calculations also are encouraging more use of variable-rate debt.

DIARY

Tennessee Bars Memphis Conduit From Selling Housing BondsBY MARTIN Z. BRAUN, BLOOMBERG NEWS

Tennessee has temporarily barred a Memphis agency from issuing municipal bonds for housing, saying it’s suffering from a leadership vacuum while it deals with a high-profile default of debt issued to finance the purchase of two apartment complexes.

The Memphis Health, Educational and Housing Facility Board hasn’t had an executive director since December and is facing scrutiny over a $12 million bond issue by the Global Ministries Foundation to buy the Warren and Tulane apartments in Memphis.

On March 14, Bloomberg reported that the U.S. Department of Housing and and Urban Development cut rent subsidies to more than 1,000 residents because the buildings were infested with roaches and

had numerous health and safety violations. The loss of the federal funds caused the securities to default, pushing the price to as little as 21 cents on the dollar.

“You’ve got an agency that’s going into its fifth month without an executive director and they’re needing to deal with, and some cases respond to, some fairly high profile things,” said Tennessee Housing Development Authority Executive Director in a Ralph Perreytelephone interview. “We think they have their hands full and we want to give them time to work through all of this.”

The Tennessee Housing Development Authority allocates tax-exempt bonds to affordable housing developers. The bonds are then issued through conduits like the Memphis HEHF for a fee.

THDA has referred two developers seeking to issue $22 million of municipal bonds for multi-family apartments through the Memphis HEHF to other area conduits.

, Memphis HEHF Daniel Reidchairman, said in an e-mail that the agency has hired an interim executive director and is working closely with the city of Memphis to address THDA’s concerns.

“The board fully anticipates the prompt resolution of THDA concerns and restoration of full services to pending and new applicants in the very near future,” Reid wrote.

The action by THDA was reported earlier by the Memphis Daily News.

Variable-Rate Comeback for Muni Bonds?

2016 is through the end of February

April 12, 2016 Bloomberg Brief Municipal Market 3

Q&A

April 12, 2016 Bloomberg Brief Municipal Market 4

Q&A

Muni ETFs Are Gaining 'Acceptance' From Investors, VanEck's Colby Says

After the financial crisis and taper tantrum,

investors started to understand the value of muni

ETFs and the liquidity and transparency they

provide, , portfolio manager at VanEck Jim Colby

Global, said. ETF holdings of municipal bonds

have now more than doubled since 2011. Colby

sat down with Bloomberg Radio’s Taylor Riggs.

His comments have been edited and condensed.

Q: I want to start out with the increase in muni holdings for ETFs. According to the Fed Flow of Funds report released last month, ETFs that are invested in munis last quarter rose to $18.5 billion. That’s up from around $8.5 billion in 2011. Why have we seen a big increase in ETFs that are investing in munis?A: The first group of muni ETFs was launched in 2007 and between 2007 and 2011 we had the financial crisis,

, some extreme Meredith Whitneyvolatility in the markets and I think frankly it just took a little while to have the combination of an orderly market and a bit of education dispersed into some of these platforms that are now using the ETFs so they fully understood what this was all about and the advantages to the product. Now clearly there is increased interest and acceptance of the use and utility of the ETF package.

Q: One of the advantages of ETFs is the low-cost access to the market and the tax-advantage structure. I want to focus on the ease of investing. Has that been fueling the increase?A: There is no question about it, and pointedly we’ve been in a low interest-rate environment. And as a consequence the actual yield and return that comes from fixed income is significantly less than what people were used to in prior decades. And as a result a low-cost structure is the right vehicle at the right time to put more income in people’s pockets. So the comparison is fairly simple. If mutual funds and closed end

funds are averaging 70-80 basis points for management fees, the ETF structure, which on average is charging around 29 basis points, that differential between 80 and 29 is significant in terms of the amount of income you retain in a low interest-rate environment.

Q: You’ve mentioned a little bit about volatility. I remember the taper tantrum a few summers ago and some of the arguments for ETFs are liquidity: You can get in and out. The problem is during extreme periods of illiquidity, these ETFs trade at a discount to NAV. Is that improving?A: Number one, market makers who make the market in the stock on the exchange that represents these ETFs, they are far more familiar now with the municipal bond asset class than they were before and these aren’t necessarily the same people who are institutional traders who are on trading desks at the major banks. So I think it took them a little while to get the learning curve and understand how the underlying muni cash bonds traded. And the narrowing of the bid-ask spreads and the narrowing of the volatility between a premium or a discount price of the share to the NAV is something that has occurred because of the time these traders have had trading these

products. And as that relates to liquidity, we have long talked about ETFs offering greater liquidity and greater access in this structure than with individual bonds. The other feature with respect toliquidity is that as a buyer or aninvestor you’re not limited to incrementsof 5,000 denominations, which is thestandard in our industry. You can buy 10shares or 100 shares or 500,000 sharesat a time. That makes it easier for theindividual as well as the institutionalinvestor to be involved.

Q: I know you focus also on high-yield munis. How has performance been? Is the market still able to separate Puerto Rico from other high-yield issuers?A: I know you’ve heard this before but it is true that the municipal market can fairly easily compartmentalize problems. We have done that with Detroit, Jefferson County and now with Puerto Rico, despite the fact that it’s not inconsequential with $70 billion debt outstanding. But the market remains over all very solid and with respect to high-yield I find that at least every week more cash keeps coming in to the high-yield space, and I find that there are plenty of names of bonds that are available in the secondary market that do trade with frequency enough to offer liquidity.

Career history: Several senior municipal fixed income positions including director and senior portfolio manager for High Yield Municipal Fixed Income at Lord Abbett; director and senior portfolio manager for Municipal Fixed Income at John Hancock Funds; director for fixed income management at Old Harbor Capital; and co-manager/senior portfolio manager for municipal funds at Evergreen Asset ManagementEducation: MBA, Finance, Hofstra University; BA, Economics and International Relations, Brown UniversityLast book you read : Lawrence in Arabia, by Scott Anderson

CREDIT CLOSE-UP

April 12, 2016 Bloomberg Brief Municipal Market 5

CREDIT CLOSE-UPAs Muni-Bond Crises Build, Pensioner Wins Show Investors' PerilBY ROMY VARGHESE, BLOOMBERG NEWS

Puerto Rico, Atlantic City and Chicago school district bondholders have reason to fear a fight in court if the ailing governments collapse financially: recent cases show that when municipalities go broke, investors lose when pitted against municipal retirees.

The latest example is San Bernardino, California, which saddled bondholders with a 60 percent loss while keeping retirement benefits intact under a settlement last month aimed at ending its nearly four years in bankruptcy. That’s in line with the outcome of the local-government bankruptcies filed since the onset of the Great Recession, all but one of which sheltered pensioners from the deeper cuts extracted from investors who bought their debt.

“The more cases that come to light like this in favor of pensioners, the odds of breaking those precedents become lower and lower,” said , director Howard Cureof municipal research in New York at Evercore Wealth Management, which oversees $6.2 billion of assets.

The $3.7 trillion municipal market is contending with an new bout of unprecedented, if circumscribed, round of financial distress by governments struggling to cover their debts to bondholders and retirees.

As Puerto Rico veers toward record-setting defaults, bondholders have lobbied Congress to block giving the island power to file for bankruptcy, though House Republicans have proposed allowing a court-supervised restructuring. In Illinois, Republican Governor has pushed for Bruce Raunerletting Chicago’s school system file for Chapter 9 as it reels from ballooning pension obligations that officials shortchanged for years, while in New Jersey lawmakers are fighting over how to rescue Atlantic City that may involve bondholder losses.

The outcome in San Bernardino shows why bondholders should be wary of

distressed local governments that can petition to have debts reduced in court, according to BlackRock Inc., the world’s largest money manager.

“Pensions are faring far better than other creditors under Chapter 9,” analysts led by , Peter HayesBlackRock's head of municipal bonds, wrote in an note yesterday. “This reinforces the view that bondholders need to be extremely cautious dealing with distressed municipalities.”

“The more cases that come to light like this in favor of pensioners, the odds of breaking

those precedents become lower and

lower.”— HOWARD CURE, EVERCORE WEALTH

MANAGEMENT

San Bernardino, a city of 215,000 residents about 60 miles (96 kilometers) east of Los Angeles, was among the municipal bankruptcies that followed the onset of the 18-month recession at the end of 2007, which caused tax collections to tumble. Contending with costly fire and police contracts, the community filed in August 2012.

Last month, it announced a deal with Commerzbank Finance & Covered Bond SA and bond insurer Ambac Assurance Corp., the holder and guarantor of about $96 million in pension-obligation bonds, that wrote down the debt by 60 percent. City officials argued they had little recourse: If forced to cover the full amount

to bondholders, they wouldn’t be able to fully fund promised pension benefits, they said in a court filing last month. A judge must approve the city’s exit from court protection.

Another California city, Stockton, also continued full pension payments at the expense of bondholders, even though a judge ruled that it could have tried to reduce that obligation, too. The city argued that fight would take too long and could jeopardize the welfare of retirees.

“Pensions enjoy a pretty strong level of political support,’’ said , Thomas Aaronsenior analyst at Moody’s Investors Service in Chicago.

San Bernardino’s workforce didn’t emerge unscathed, with the city eliminating retiree health-care subsidies and requiring employees to put more of their pay into the pension system. But it didn’t cut pension benefits. It’s also coping with a decision in 2012 to cease payments into the California Public Employees’ Retirement System that proved costly by triggering a $2 million penalty and an interest rate of 7.5 percent on the skipped obligations.

With benefits intact, the community’s pension contributions are set to grow from $19 million in the next fiscal year to as much as $44 million by 2030. That compares with a general-fund budget of $128 million this year.

In every recent bankruptcy nationwide except for Central Falls, Rhode Island, pensioners have fared better than bondholders, according to Moody’s. In Detroit’s, the biggest, pensioners recovered about 82 percent of what they were owed, compared with 25 percent for bondholders, according to the rating company.

Given the discretion given to cities to draft their plans out of bankruptcy, “this trend should not reverse itself,’’ said Bill

, director of municipal research Bonawitzin Philadelphia at PNC Capital Advisors, which oversees $6.5 billion in municipal bonds.

RESULTS OF SALES

April 12, 2016 Bloomberg Brief Municipal Market 6

Long-Term Bond Sales Results

SELLING DATE

ISSUE STATE RATING TAXAMT

($Mlns)1 YEAR 5 YEAR 10 YEAR 20 YEAR STATUS TYPE

SENIOR MANAGER

ENHANCEMENT

04/11Floyd Co Hosp Auth -Ref-A

GA Aa2e// N 84.224.000/0.860

5.000/1.390

5.000/2.080

3.125/3.260

Repriced NegtBank Of America Merrill Lynch

04/11N W Dallas Co Flood Cntrl

TX // N 15.842.000/1.000

2.000/1.700

4.000/2.420

3.125/3.240

Final NegtRaymond James & Assocs

04/11Clear Brook City Mud -Ref

TX /BBB+/ N 12.582.000/0.950

2.500/1.750

2.375/2.600

3.125/3.350

Final NegtCoastal Securities Inc

BAM

04/11Western Reserve Lsd -Ref

OH Aa2 // Q 8.863.000/0.720

3.000/1.140

4.000/1.700

4.000/2.410

Final NegtFifth Third Securities

SD CRED PROG

04/1111:30

N Central Tech Clg Dt - A

WI Aa1// N 10.002.000/0.650

2.000/1.180

2.000/1.880

Awarded CompHutchinson Shockey Erley

04/1112:00

Wyandotte Co Usd #203 -A

KS /AA-/ N 17.072.000/0.700

2.000/1.200

2.000/1.850

Awarded CompRobert W. Baird & Co Inc

04/1112:00

Des Moines Cmnty Clg 46-A

IA Aa1// T 8.052.000/0.700

2.000/1.550

2.350/2.350

Awarded CompRobert W. Baird & Co Inc

04/1112:15

Whitehall Coplay Sd-Ref-A

PA /A+/ Q 10.002.000/2.000

Awarded CompJanney Montgomery Scott

AGM ST AID WITHHLDG

04/1113:00

Prior Lake Isd #719 -Ref

MN Aa2 // N 21.405.000/0.590

5.000/1.100

5.000/1.740

Awarded Comp Piper Jaffray & CoSD CRED

PROG

04/1114:00

S Hamilton Cmnty Sd IA /A-/ Q 9.692.000/0.750

2.000/1.200

2.250/1.650

3.000/2.650

Awarded Comp DA Davidson & Co MAC

*Moody's/S&P/Fitch

Most Active Bonds

DESCRIPTION STATE DATED COUPON MATURITY VOLUME PRICED AVERAGE YIELD AVERAGE NO. OF TRADES

Los Angeles Dept Of W CA 04/21/16 5.000 07/01/46 128,400,000 120.366 2.609 65

Univ Of Ca Regents CA 04/20/16 5.000 05/15/46 126,050,000 120.766 2.633 94

Univ Of Ca Regents-At CA 04/20/16 N.A. 05/15/46 70,100,000 100.000 1.400 37

Lwr Neches Vy Dev-Var TX 11/09/10 N.A. 11/01/38 70,000,000 100.000 0.000 14

Puerto Rico-A PR 03/17/14 8.000 07/01/35 57,870,000 66.579 12.338 38

Los Angeles Dept Of W CA 04/21/16 5.000 07/01/41 56,690,000 120.918 2.550 30

Univ Of Ca Regents CA 04/20/16 5.000 05/15/41 54,220,000 121.212 2.589 26

Tx Trans Comm Babs TX 08/26/09 5.517 04/01/39 48,000,000 134.933 3.329 10

Univ Of Ca-Au-Txbl CA 04/20/16 1.910 05/15/21 47,400,000 100.000 1.909 17

New York St Dorm Auth NY 04/27/16 5.000 10/01/46 46,350,000 142.514 2.890 20

Fl St Brd Of Admin FL 03/08/16 2.163 07/01/19 41,230,000 100.937 1.861 12

New York St Dorm Auth NY 04/27/16 5.000 10/01/26 40,580,000 131.722 1.672 34

Ny Dasny-Ref-A NY 05/05/16 N.A. 07/01/38 40,300,000 99.993 2.261 414

Univ Of Ca-As-Txbl CA 04/20/16 3.552 05/15/39 40,100,000 99.988 3.552 21

Riverside Asset-Ref-A CA 12/10/08 N.A. 11/01/32 40,000,000 100.000 0.000 8

New York St Dorm Auth NY 04/27/16 5.000 10/01/46 38,205,000 121.236 2.563 42

Ny Dasny-Ref-A NY 05/05/16 5.000 07/01/41 35,975,000 119.326 2.800 35

Ct Hlth & Edu-A CT 04/21/16 5.000 09/01/53 29,275,000 102.680 4.670 19

Fl Hurricane-Ser A FL 04/23/13 2.995 07/01/20 28,285,000 103.439 2.138 18

RESULTS OF SALES

TRADING

ACCORDING TO

April 12, 2016 Bloomberg Brief Municipal Market 7

ACCORDING TO

Puerto Ricans who plowed their savings into the island’s bonds may eventually get paid in full. They probably just won’t be alive to see it. Puerto Rico residents would be the last in line under a revised debt-restructuring proposal released yesterday, which would give them the option to recoup their full original investment in return for putting off repayment until 2065 and accepting just 2 percent annual interest for nearly half a century. The option reflects a goal of paying Puerto Ricans who depend on the income, though they’d still feel an immediate impact: Almost all of the island's pension bonds, which attracted its citizens because interest was tax exempt only in the commonwealth, offer coupons greater than 6 percent. There’s also another risk to consider: With other debt maturing first — including new zero-coupon bonds given to creditors that

Staying Alive to 2065 delay all interest and principal until balloon payments come due — they could be asked to take another round of haircuts if the ailing economy doesn’t turn around, said of Matt FabianMunicipal Market Analytics. “Local

holders should do whatever they can not to be stuck with the local option,” said

Fabian, a partner at Concord, Massachusetts-based MMA. “With

Puerto Rico’s population and economy collapsing, and likely continuing to

contract for the foreseeable future, it’s hard to assume the commonwealth will

ever have the money to fully repay those“Local bondholders zeros.” He continued:

would be far better off taking their losses upfront or, better, fighting in court for whatever recovery they can win.”

— Brian Chappatta, Bloomberg News

San Francisco will borrow $260 million in

San Fran's Transit Hub

short-term financing to complete a transit hub that’s over budget, city officials said. The short-term variable-rate certificates will be purchased by the Metropolitan Transit Commission and Wells Fargo & Co. to complete the first, $2.3 billion phase of the Transbay Transit Center, Mayor Edward Lee’s office said in a statement. Rising construction costs have added $700 million to the project, which is designed to link 11 transit systems in eight Bay Area counties.The loan will be repaid by special taxes and increased tax revenue generated in the district where the transit hub is located. The city and transit commission have proposed measures to improve oversight and management of the project, including the public works department assuming construction management. The Cesar Pelli-designed hub is intended to evoke the grandeur of New York’s Grand Central Terminal.

— Darrell Preston, Bloomberg New

TWEET OF THE DAY BY JOE MYSAK, BLOOMBERG BRIEF

April 12, 2016 Bloomberg Brief Municipal Market 8

Find Muni Data on the Bloomberg Terminal

DATA FREQUENCY ON THE TERMINAL

AAA Benchmark Valuation Daily GC I493 <GO>

Benchmark State Yields Daily MBM <GO>

VRDO Rates, Inventory Daily MBIX <GO>, ALLX BVRD <GO>

Upcoming Sales Daily CDRA <GO>

Volume, MSRB, PICK Daily SPLY <GO>, YTDM <GO>, MSRB <GO>, MBIX <GO>

Results of Sales Daily CDRA <GO>

Most Active Daily MSRB <GO>

Most Searched DES Every Wednesday SECF <GO>

Variable-Rate Calendar Every Thursday CDRV <GO>

Most Traded Borrowers Every Friday MFLO <GO>

Week-Ahead Calendar Every Monday CDRA <GO>

Supply and Demand Every Friday SPLY <GO>, BVMB <GO>

Muni Credit Risk Every Monday MRSK <GO>

TWEET OF THE DAY BY JOE MYSAK, BLOOMBERG BRIEF

There's a Teacher Shortage in Hawaii

Erika Christakis@ErikaChristakis

Why doesn't Hawaii (and other districts) solve the teacher shortage problem the American way: by paying more? twitter.com/crampell/statu…Details

The Yale lecturer and "The Importance of Being Little'' author replies to a tweet of an Associated Press story, "Hawaii Looks to Mainland to Deal With Big Teacher Shortage.''

Bloomberg Brief:Municipal Market

Newsletter Managing Editor

Jennifer Rossa

Municipal Market Editor

Joe Mysak

Brief Editor

Siobhan Wagner

Contributing Analyst

Sowjana Sivaloganathan

Municipal Data Team

Marketing & Partnership Director

Johnna Ayres

+1-212-617-1833

Advertising

Christopher Konowitz

+1-212-617-4694

Reprints & Permissions

Lori Husted

+1-717-505-9701 x2204

Interested in learning more about the Bloomberg

terminal? Request a free demo .here

This newsletter and its contents may not be

forwarded or redistributed without the prior

consent of Bloomberg. Please contact our

reprints and permissions group listed above for

more information. Bloomberg believes the

information herein came from reliable sources,

but does not guarantee its accuracy.

© 2016 Bloomberg LP. All rights reserved.