o-0 S...o-0 S ... Jefferson

Transcript of o-0 S...o-0 S ... Jefferson

[1}. -sp9er?€'l,ia 4'*aa,?}

jl

[ !'?wart"1k M4

[.,1v'!

71 a?

'd

q -JffiV

?<'1V * ?? ':H

'9'?111

1

Financial Section Lw

(

[I

7/

";?M

l

}I?

fI

!l

1']?l

?'-'-"'!? a - i

l?

r-slj l :%-

ih

l-

1

s

lQ

!W ffi

4x]

?4yytr?N- !r'', %'!

k-q

WXY;T??

ja j

wb.

I

k

'*€ Al

l!LlrpQl

#n

'%ji

Mg

!. jW

.--l

lk

kt il$J!

r

l I-iu

u

t'6A

1r 1 Jl:MnW;d

%i i

1

l

€uuol ftAi

'l

'.,? r

/

Nk

J

l

il-]

j?

P tnNNl

'W-4?

Wa

/i

iT?m.lL

- Jali

11

-i%"!] r,,l

$

&?7W'

rla

l

jl ba

ll

<lksit

lr

Je

Q?t.ml@l

>%?

'?ti

>u'c '??la(:4%m? .6fl':E: S q w.8 Ho E' ?!! F'aa's r,; H' N

effl ,?3 K % k.

; ,,:j :q 4 3 9

O(J+c(0

E!4-l

<)ffi!(/)

%!ll

? a). a) ao (Q ?iC)J:€C:'Cl. -

€:c a?oa5'o' ?o""? :ttit ?j :caa-Toga)S"a):,? .1 1, og. =tt" 2? ? In Ol-

g aa'aa =% .J: a)ffl . aO? ?% J:,'0 ffl '!' 3 . a)jj!" "e j 'u5 !"

=o: -: 9-,L;: ":<-o 6':?a) :>.n=0v :) q'y 'ff a)

%B:Nfoo6:

?w ,'a'a? ;a) Q 'k-*- O Q)(/)(0;ei>B '; -j =oH:?3>eiN-€oa; ?';?EO -B . -5 E(. C: ?C

?'o3EC'Th 'c a= <s Eo a=?a>" Ojo,,oia)9! J)'cl)a)?-na) .0 s Q ()(/)lJ5- -wa) € E 'Tl !'1 rij a, 'Bc, p's a" o0 tn,".c ?2' oo # '>" ri?' affi'C- : o :l >'o E

0 0)E jo C ,;a' ?a=cmCQ,Q.w.U?,,o O) s D = iu g>c C m CQ a> s U).

C-.E?C j)'CL

Xa'?Z'nn€DtnO a)C%?' -5-C)na) (1) 0 ? a) C0 0 a'a'? o ,4? m? C ns -- -:o §c 2 ??-o Bi- ffi g,

'E O a-?'Zm" CL5 3!!r" 5o !!trim.c.?.TT5U) m?cC.:!: rn(b

oFA;a 4? "P '??P' E" a'WaJwc '(Q' W" a: 2" ",a-

C' E '0a as J'mODC'lt)'ffl O Q: E!! ?'u'

'u i € 'o-a: E<cEo:)? ', E .Q § g06

(B l? N @)a-=J:

>H ,o -?Cl"'wC

(;m(<6mB(.U) 0 .C a -a)OCl'me ?'-?- - :> 0(Q ? ?

?C}a)

?.= ci ?s ??u:i9209(/)J:, ,' CE m?'-0?0

I E? a' !:!:go a) 'm C

L2 bo ,? gO i A( 111?mo 7i ?(l) ??(l)?? a) 2 gom s 'W -z-B s !-p =, u,'acD '-'o" !jj' a;e 5=- 'tt: .a?..l,ffi.'9io'a'.i N, (@..) q 9 .c=0 C ?? '-C)')0-

..'h-Qg.a) .C .m -=

"na)m= j ?, j)ll- C (:0 :5 w0:l)

11-,

J-'CD =C(-C)Qa) a= a) aCC: ('C) 'L}(Da (DaC

E ,j ! EE ,i ! -zm - -Bca)0a) ?-l-IEE!' oU)'-!!!l @) ffiu) ? (0 0)

B R 5;,m-

affi.o'aaa ?"; Z ;(4os ,gi,z ,G'C)) ?o':' €e=*','(1) 8'7*!j ?rsL" swmc" > US

!Ie

'F!?c!IQ

(t) n 'h ?a = 0 <DA C O a)

ao 6 ?' "-o EO' C -??o. 0'(0. 2, ' ,:- '?8 '-o".2.m' +;o .,%,o;ziS2,';. (D

n5:-!mi@) rw= z art % rsie z art % gia00J:C2 CO e:- -a5s(5(l)m.-

(. -w C

% M B' 9)= =g?' a'a'-? O m

p?" ?o E E> O @)' 5'() q jm ()o : * 'jm 83 (O iu cri m

,C a) C:,C)

-E!J ?U) ?.mcns !o ?ca)'13,'E)mg)Qa)0 ('-I,N-!;A(QU),!:# :: E qm ? '4'- p'?m ? ? ?o

co !! S 'ai,O B? Cm ?mEo)C:0= E .';2 v{no s-< a"m? )Eo(1) () m y(-- ?? CL ,-iG U) 0)?B(Q

a:?

(7'aa)%-

5a)T'l)8 '?4c

,',, z :o E(f3? .i-iH S 'g y't"aEmart =i (!! sa' a' a' iw J: s,,:a' 4 T)o a'!j', ,C ', ,a''= o E

p A j))a,T K Ec-hJ?

a)

U)9'§,.oo'c fi ?(,l Qm? ?s.. Bc, ae?%J.. C: Cc(tl,.G2 :> ffi N

-'4-a?4

ffl C !':-"- a)

'l--o NS,i,prss O e?a6)@ E(/J)O

a) a) C:: i!:

()ca)

lt- ffi r rn"KEa!a) --?-l m$ Bao =,, ., - (tl?"C? af7 a!' 6'o6CL O) cO B'aU) O a-D C(pOCOB? (f5. 7 ?e%!a)(l)

C , ?t/)@ a) El. ",E @ .E- .m=gip3%m '- a oC(0--.(;5 0 Vl !-5 M € o

E

3iaa

!3Ca)

E=amR

-hl

€Q

(a

QefflaCartJ:

l-

0lh-

2-

€

thC6C!thart

CeU)::Q

Eam('aCm

s

c0?'mO:)nLu

;€

'E} ',(Cu6>OC0Ja)>o

.b-?a) C -E? s f:-l-1, ll}!" '0 a'00"(/)CO)-

n E >ga).!'E, E '5, a) Ci5" 53

!l

Q

Eas*d(tl*.I

€/)

i'aCmc

LL

Co

t:'oaa)a:

t:0We

0!"

E0Q

v:I<4-]

€a)vCartClaV:

>

J:}

mCoClWea:

"WO

Th:$<

?'h-,Om

.,a> ':ffi -C5art A ,E:=' aa?- ?? a) -,'0 "? o() JC: ,. ah' ui

% .= oc?,J)*-aC}

Q)a)J9 B 6C :g -(1)l+-,-co

i..icK,O--:l

e,-,r(? (O >

(1)5p,A E ?;

(DC

.,c ?CL B03.!!!U)?%)(U)c0 4 (35-=a).a-EBCL, "@ a+ff

,oc'-!)g

) N o.Q..a-U)

Qo)(pC.

o

a.E (Clu ,(:w ?. '-r, ,% :}JH.Q A

awl-?C}a)

s(6I" Oj:l u-.

', ,U) 9'C" s A'

5:5,,5.., m- z-;?C)' ffl JQ ffi3accp)aC:Cm0,Q) E

ay

NQCLQ)

r- ?4-I

', c !:'000 0 0

O(/):;(Q ? art >(l) g .- -1-l-&-J2 Q Q

a(% a@ 'mO) ?mf8:a.Eat'a (/) ?'c? ..e? ? ???? ?g)-am.!="o

' rA C as a) CB s ?c ! ?mc K

5==5sioa

B? ; J;l 3" ?zo N ,E 'p"s .C 'a ? 3 a- j)

rs O Q ,0 @ > a(?: ' (0 n "' g) ?

(i o ,Q co > cQ .?a) :":' laTi '32 :) 9i2' oa) eo m' ?a)

€D * -,-ec g. ,3g .j-(:I:(0

rii ) JQ -,-a'g)U)(OC

":o a???'a?'a Eo af?aaa: mo'oo ??""C a: '??:aoU,, = B' N m" "N ,?$),? V ? ,?ca;? s og oD-' o. Q a'Ez? o= a% Wa"

2 c B ?SD %) A 'o o a'aC:' "m L' A?) w c ui a) -+-' m rn

o ?'W E as a) 52 m :soo ;"oo :'o a'i aano :o mcc))a' N'o

Q)%ffC:-kJlllmC- a)

nn."a)>45a'.5CLm.,Oa)wCs 0na+Oo

c

a0

CLC?

C))'o

€,4? 'oOC

0na)sart

'Cl

a),S! §j:lm? -rh. ?CQ:-C))E ;5aa)'@)pn(-)u?-i-O00Cm

a+5"0:czm

B!n(-j,-'0 s

a):5a)(Q

Eo

-gNO

a'???7='Eyeaaq Qj!- Er.nm

C:;iC:- am.2;('m?g n ",0 j5 ?'a

?O @> ()=:i 111 %-Iv E, a)00nO

a M,eL- j:? ,o

-"- sa)?005j:l (/).S (0 m

,;c,, 8c ,N a=thm o! .:m,o <-, o,1" Em BcO oc,' :-c@ .co A -C:lm '?o a?"'a(;), )r-? qo g cmcE; .??cot- :N :: 4"o '=aoL' a:a (n""% Q0

E'?j" 'o V' "7: "o: a'e r';"m B'I ' iS? 2 n.Tp,*C .g<o ?::)n =-;o nEo ,a .2'- m, :.-;=u .?:ffl % z,$mC ';o )o;';o ': a5:Jcza" a';ao j Iom''a':' 7w;=co :?o? f:o.:?? a"C8 =m(- ??:o a)?(1=c)' "-a'o=(3) ,,?':l a";.:aooE.0o.

"'a?:'i ' ?:?"a a"""'l a??"o?R o:o' ?':?' "?"o"j"" '#oaa??" l--::-." J-"*.:?o':el: '-'io:"

='ti=H== :z=,o=+ 'J.-=: ?'=%[hcE:. ?,:EEa, .:--:=.-. ;#>E l':-'oh""?=m =E"?=(!lm=: =-ti=,m=== .b=lO=,== l=ooi2, :o:coc.??pi. "t i f j:" €1 ?%?""""?H oE j'o" ffioa' ""{i?'.U ; ,= 'm= (),o0t='="r. J'CoO c-oai?'eo (o:'J:l?a'o :=t,?- ?'-a,aG?C=c,ooco'cm'V ao?" =8 cm?o'f5 ,gol?mOOo' ?ao?0"' a:.Co' jomoc' ?ri?'o?"?" oo'a=?J:o" 'o':' ?'aaaQ"o ?':"C?' 3; c:"' ?S2Do'

m?Og2) ?g? .8 ?T.s'?? z;:> s a):? m CL

?--g ,

"'a('O[c'S!! 2f,'oz' 4

nalT; ?7M? ;M" ""W- ..,=?????=,;o?,c,='o"?co?'-' ?'M%lk ':mc,-j-,,o..'oc':?o'?i-%-tu7.O:' ;'?'m' ;cm ??:Eo aM"?aaa "'t'm.o,-,u. %.EL' ?"M,.l?oe'Q :;J ocQi a--,?o'"'i: me"" :'N!s'ao"W.,%?fflm Qm 'M? .fi=a?= N?. ':? jJ,

??Q?.7?i?'?m? " ?"?mo.?.?m?'Nco?.Es?'?'ac,? ' :? a"?'?C??t?. a?":€aa c':'?,nh ' m=: :.c' s co m U) c @ ? 7? cc" m g

)O .m' err, uo;ai i,c,o"o? 'K '@aM W,,'K W, z,a.<O o?a< m o co<C o vi art o.

cOa)

E.r'l:I(;!QwC.a).pa)Ci:lg50s(!)ai(:)a5no--S??1,C50a65i

s

?€6(DE@ .-t'6jC?'?€4

-C:'d(tlff0

0ij::C5

SrD

ff

>

,lHa>

pgD B. !EEa)Nj,;zjm

; 0-a)mc.B e BO,(pC' J' A(O m (Q? -l-J J,(0(l) (Q

5mEa) '0 -CC '- -"-b-i m srsO0'-i-'a:lLL

a)'C)ffll-Om:7n

?'o0C-{Tlri,c- m E)g'oBaP rll E0)-

(;m:QCcC(?:ld.U2 Z ()

mfdH;(Q Q a(/) O 'CL(<[.o

l-

:I0

Iw

Ok

U)

?Uim.0

m

a>'0

ss(1

o!

a)

Na'C:CLo

a0..m

'0

(Offi

Ca)

a8E

U)

U)

nartc

'a360

a)>(Off

a+3ayOC:(Dn

art+J

?C}:)(0

a:if

ffi

mEtn-l-C

(l).05a:a)?-=0.a)OJQ+-

§ ?C))m

a)nC:frCa-:':'u (@ ,U), 35o'i

-a)

V

ma0cffl

ffi(:nCa::)0(Jg

a)(/)<(!)

3

2

?;C0

a'?V

tp

E(!1

W

E

I

&-

a)Em

:E(Oll-5

m

(71m!Q.

ELLI

l

CNI'

S,0

(tl

Elo

S%:

.>(t!

C:QSE;as

CACl

C/)

bg)

:)6(l)

Q:

S,0

m

EsE

I.-a5S

0

U)

Qt:m

sffi

aJ:

6'

U)E0

C

ao

§?i o 3 ffiffjQ

Q=o ma ?Eo ?(3, 3D moi<r> B ,E. g B co .5?.A?o Jo 7=aa 8 V oc)?=.

) 0 ,? E/lt a :?5->E : aci?'o 4co ?c omo :?o2 c m e n .C aQ'v a B m -'W * ffi*E,==B!effim @ as o 2' Em €O E C, j ',:S!i' ?a??o?? "?oc to ?o,)+7 iU B .=a?o

tJ -.- -

?'W'? U 'm'c))Ac' ?ao'ao' mc" oa? €0, C C- (tl-.-aEc(jj-

n--@),(0.a- cQ5- pro "-oa: (6a) ,,oa?a 2..fl : m 15 a)-. 3 EOm-mt=:33'm =c 'ei E.'N ga=a? '% 'F?'e? ":Kj 'a'rs 'amA-":

Jc?.??m'8 'a?-c8 a':, .?ot oo',31 :ffio'': ??ao "@ .'E ;.-"

0 -: o@) a6 l 03 B (/) ?..Cc,0. vv ??"-' C ?>= % j oo E ,: 5a'p IJ N LL B =:!! 4'

,,,m 'm A ow o'ifo o'cji,% ,-r .ai,,?"0' Ao ag;'":.. ."c-a?' !=, ?h.: L-;.7,m?(T =,:}5' U) €0p? ? '?9 .E '5

ir> ? 0) -? -?

..-,,J: O'aa: 5?' W "Oj' f% @o '!" 'o.

C'Q((Q,9 ,(i B ffi 6,-, 0 ,§

,zh=a) :§o. ?t?ff -7ua) g'i=s-E>(3> B?" =(:?c f0? ?w"?aa o?0? B,'

j:C:Mfi

>@ B Q.c 0?0--a)art C m l- O>O' oc =tu :? v? e?, :p @) (6 c 0€'f=""5'z

0 f y TJ ' .C.-D a) m C o CE O s €CI (;@9? C715

@) .C. 3!,)t,'a:

o, o C 'CL E % E. C('i w .(u 'aai ? m e?. .mP o c 4 g .' E- e

omo ')o ;=o? )a'ns ?oo ,;-o c'>ol aaamE'C:c,' E .y E- ,ffl ('o-n Ej? cO oC>'- %?'- =m L?=- (!)" ?oo

mn

muCm

(Zcri€::

v:!<m

:a)

EC

a)>s

C!)

?2va

:)Crart

0?orC

'Eoao

(Xl-

a>

s

l

CQI-

.)<

!O'ea:l

sff

0CN

(0l.-

ia5:n

:§ E.€fl (3))>

%"

Man@gerne4it's Discussionand. g0alysisYear Ended June 30. 2015

= MJefferson CoiPublic Sdh

Shaping the Future

Introduction

Our discussion and analysis of the Board of Education of Jefferson County, Kentucky (the "District") financial performance provides an overview of the District's financialactivities for the fiscal year ended June 30, 2015. The intent of this Management's Discussion and Analysis ("MD&A") is to look at the District's financial performance as awhole. It should be read in conjunction with the District's financial statements.

Financial Highltghts

Serving over 100,000 students, the District is the largest in Kentucky and the 28th largest in the United States. We maintain 156 schools and education centers: 89 elementary,23 middle, 18 igh, 10 special education, and 16 others. The financial position of the District remains strong and stable w'th an operating budget of $1.4 billion.

The District maintains its focus on student achievement. Our students and teachers continue to win awards and reach new goals in numerous academic areas. The student-teacher ratio in elementary schools was 16.2 to 1, middle schools 16.8 to 1, and high schools 16.7 to 1.

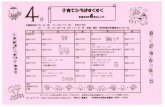

2014-15 2013-14 Change 2014-15 2013-14 Change

Couege scholarships earnedStudents t?g AP testsNumber of tests taken

AP scores eamig college credit

$172 million

6,308

9,77747.O%

$145 million

5,635

8,875

49.O%

18.6%

11.9%

10.2%

-4.1%

Nurnber of teachers

Teachers w'th Master's Degree or higherNational Board Certified Teachers

Student daily attendance rate

6,65382%

380

94.0%

6,63084%

330

94.3%

0.3%

-2.4o/o

15.2%

-0.3%

On the District-wide financial statements, the assets of the District exceeded liabilities by $149. 7 million. The District's total net position increased by $5 .0 million for the fiscalyear ended June 30, 2015. The District's govermnental funds financial statements reported combined ending fund balance of $223.6 million. Of this total, $57.8 million isunassigned in the general fund. However, due to economic uncertainty, along with the needs of specific instmctional priorities, it is necessary to maintain adequate fund balanceto support these initiatives.

Overview of the Financial Statements

The annual report contains:

Management's Discussion and Analysis ("A4D&A")District-wide financial statements and fund financial statements

Notes to Financial Statements

Other required supplementary information, including statements for nonmajor governmental and fiduciary funds

Maiia=ement's DiscussioiiMalqagemell?and AnalysisYear Ended June 30 2015

? MJeffersonPublic Si

Shaping the Future

This amiual report consists of a series of financial statements. The District-wide statements, the Statement of Net Position and the Statement of Activities, provide an overvievvof the District's finances. The fund financial statements and govermnental activities statements tell how these services were financed in the short term, as well as, what remainsfor future spending. The fund financial statements also report the District's operations in more detail than the District-wide financial statements by providing information aboutthe District' s most significant funds. The remaining statements provide financial information about activities for which the District acts solely as a trustee or agent for the benefitof those outside of the District.

Reporting the District as a Whole

The Statement of Net Position and the Statement of Activities

Our analysis of the District as a whole begins with the District-wide financial statements. One of the most imporkant questions raised about the District's finances is whetherthe District as a whole is better off or worse off as a result of the year's activities. The Statement of Net Position and the Statement of Activities repork information about theDistrict as a whole and about its activities in a way that helps answer this question. These statements include all assets and liabilities using the accmal basis of accounting, whichis similar to the accounting used by most private-sector organizations. All of the current year' s revenues and expenses are taken into account regardless of when cash is receivedor paid.

These two statements report the District's net position and changes in them. The District's net position, the difference between assets and liabilities, are one way to measure itsfinancial health. Increases or decreases in the District's net position are one indicator of whether its financial health is improving or deteriorating.

To evaluate the District's overall health, revievv other non-financial factors, such as changes in the District's property tax base and the condition of the District's school buildingsand other physical assets.

The District-wide financial statements are divided into two categories:

* Governmental activities: Most of the District's basic services are reported here, including instruction, student support services, instructional staff support services,administrative support services, school administrative support services, business support services, transportation, and plant operations and maintenance. Property taxes,occupational taxes, the Commonwealth's Support Education Excellence in Kentucky ("SEEK"), other Commonwealth support, and state and federal grants finance mostof these activities.

* Business-type activities: School Food SenAces, Adult Education Lifelong Learning Courses, Tuition-based Pre-School, fee-based Day Care, and the Challenger CenterFlight Simulator Enterprise Program are considered as business-type activities of the District. A fee is charged for these activities to assist the District in covering thecost of these services; therefore, they are classified as business-type activities.

s

Mana=ement's DiscussionMaltagiand An.alysisYear Ended June 30 2015

F?a?PiA>lic Si

Shaping the Future

Reporting the District's Most Significant Funds

Fund Financial Statements

Our analysis of the District's major funds provides detailed information about the most significant funds-not the District as a whole. Some funds are required to be establishedby State law and bond covenants. However, other funds are established as needed to help control and manage money for particular purposes or to show that it is meeting legalresponsibilities for using certain taxes, grants, and other money (for example, grants received from the federal and state govermnents). The District's two kinds of funds,governmental and proprietary, use different accounting approaches. The District also uses fiduciary funds, which are separate funds from the governmental and proprietaryfunds described above. These funds :me not included in the District-wide financial statements, but are described below.

Notes to the Financial Statements

The notes provide additional information that is essential to a full understanding of the data provided in the District-wide and fund financial statements.

Governmental funds: Most of the District' s basic activities are reported in governmental funds, which focus on how money flows into and out of those funds and the balancesleft at year-end that are available for spending. These funds are reported using accounting methods called modified accrual accounting, which measiu'es cash and all otherfinancial assets that can readily be converted to cash. The govermnental fund statements provide a detailed short-term view of the District's general government operations andthe services it provides. Governmental fund information helps you determine whether there are more or fewer financial resources that can be spent in the near future to financethe District's programs. We describe the relationship (or differences) between the governmental activities (reported in the District-wide Statement of Net Position and Statementof Activities) and governmental funds in a reconciliation following the fund financial statements.

Proprietary funds: When the District charges students or parents for the services it provides, these services are generally reported in proprietary funds. Proprietary funds arereported in the same way that all activities are reported in the District-wide Statement of Net Position and Statement of Activities. In fact, the District's proprietary funds arethe same as the business-type activities we reported in the District-wide financial statements but provide more detail and additional information, such as cash flows, for proprietaryfunds.

Fiduciary funds: Fiduciary funds are used to account for resources held for the benefit of parties outside the District. These fiinds are not reflected in the District-wide financialstatements because the resources of these funds are not available to support the District's own activities or pro@ams. The basis of accounting for fiduciary funds is similar tothat of proprietmy funds.

6

Maiiasement's Discussioii+viaiiagiand An.alysisYear Ended June 30 2015

?M ,JeffersonPublic Sr:th

Shaping the Future

The District as a Whole

The following is a summary of the District's net position:GovemmentalActffihies

2015 2014

Currentandotherassets $ 328,218,792 $ 354,484869

Capkalasse(s,netofdepreciation,andcons(mctioiiinpiogress 678,901262 663,085.232

TotalAssets 4007,120,054 1017,567,Dl

Deferred Outflows 33,301465 290,707,238

Shoit-term liab+lmies 136,691645 141322,0880(her]iabaies 738,830,321 496,336,134

To ta l Lia bilitie s 875,521966 637,658,222

Deferred Inflows 35,282,059

NetPoskion

kivestedicaptralassets,netofielateddebt

Restricted

Unrestr'c(ed

Total Net Position

255,725,3]9 256,413,828 16,825,680

78,544,164 73,11127

(204,65 1989) (239,942,390) 2,351547

$ 129,617,494 $ 89,642,565 $ 19,177,227

Busiess-tye Activmies2015 2014

$ 10,200,827 $ .11251728

21,!03,761 22,000,938

31404,588 33,252,666

969,364 1028,[4

1300,906 1328,306

11,036,644 4,378y08?

12,337,550 5,706,387

859,175

16,617,456

11,956,937

$ 28,574,393

2015

$ 338,419,6]9

700,105,023

4038,524,642

34,270,829

137,992,551

749,866,965

887,859,516

36,141234

272,550,999

78,544,164

(202,300,442)

$ 148,794,721

Total

2014

$ 365,733,597

685i086170

i,oso,s 19,767

291735,352

142,650,394

500,714,215

643,364,609

273,03 1284

73,?71,127

(227.985,453)

$ 118,216,958

7

Maiia=ement's DiscussioiiMaltagemen{and An?alysisYear Erwjed Jurm 30 2015

?ra? .JeffersmPt?blic Si

Shaping the Future

The following is a surmnary of the District's changes in net position:

Govemmen(alAct#hffis

2015 2014

Busiess-(@e Actffi#ies2015 :iox 2015

Total

21W

Revenues

ProgmmrevenuesCharges forservLe

Opem(% gmn(s &contributions

Generalrevenues

Localtaxes

Sta(e sources

Other

Total Revenues

ExpensesSchoolopemtion &admmistrationSchoolfood sennces

Otherbusiness-type actMl*shiterest on debt service

TotalExpenses

Change in net position

Governmental Activities

$ 586,509

107,749,095

587,030,439

588,622,050

11629,986

1295,618,079

4273,690,610

16,244,178

1289,934,788

$ 5,683,291

$ 902,489

111648,818

567,698,286

466,864,796

14696,048

1158,810,437

1133,89641)4

14,825,786

lJ48,72?890

$ 10,088,547

$ 7,120,266

53,716,102

3,132J42

63,968,510

$ 9,299,977

45,615,744

:iio:is,eiob

57,954,327

$ 7,706,775

161465,197

587,030,439

588,622.050

W,762,128

1359,586,589

62,583,212

1932,405

W0,835

64,656,452

$ (687,9421 $

1273,690,610

57,760,670 62,583,212

2,OK),466 1932,405

180,221 16,385,013

59,951357 1354,594240

(1997,030) $ 4,995,349

$ 10,202,466

157,264,562

567,698,286

466,864,796

14,734,654

12 ?6,764,764

1133,896,D4

57,760,670

2,0?0,466

15,006,007

1208,673;247

$ 8,091517

The revenues in the govermnental funds increased by $136.8 million. Most of this increase was from an accounting change further described in Note M, causing other staterevenues to increase $123 million over the prior year. An increase in real estate property tax rates resulted in an increase in total tax collections for the fiscal year ending June30, 2015 of $9.1 million, while the improving economy resulted in occupational taxes increasing $7.3 million.

Expenses in governmental activities increased by $141.1 million. The maj ority of this increase was due to adding pension expense as required by an accounting change describedin Note M. Additionally, instmction expenses increased as a result of salary increases and increased cost of fringe benefits, most notably pensions.

8

Maiiaeement's Discussioiilvlanagtand AllYeat Ended June 30 2015

alysis ?M .?Public S(

Shaping the Future

The following schedule provides a comparison of the District-wide revenues for governmental activities for the current and previous years:Rewnues 2015 2014 Ch an ge

Local Sources :

PropertyTaxes $ 397,722,644

OccupationalTaxes 139,825,242

OtherTaxes . 49,482,553State Sources:

SEEKProgram 277,043,057

Other State Revenues and Grants 311,578,993

KSFCCauocation 8,171,637

Grants(federalandlocal) 99,577,458

Interest 1,389,755

OtherSources 10,826,740

TotalRewnues $ 1,295,618,079

$ 388,628,855

132,569,312

46,500,119

270,658,773

196,206,023

7,638,789

104,010,029

1,663,952

10,934,585

$ 1,158,810,437

$ 9,093,789

7,255,9302,982,434

6,384,284

115,372,970

532,848

(4,432,571)

(274,197)

(107,845)

$ 136,807,642

% (Ihange

2.3%

5.5%

6.4%

2.4%

58.8%

7.O%

-4.3%

-16.5%

-l.0%

1 1.8%

Revenue Sources

[:l Grants - Federal and Local -7.7%7.7oA

N SEEK Program - 21 .4%

30.7o/.':>q qnril.Q-lo [] Other State Revenues and Grants -

24. 7%

[J Occupational Taxes - 1 0.8%

W Other Lool Taxes - 4.8%

lO.El%24.7%

[:l Property Taxes - 30.7%

9

Mana:ement's Discussioiiivtanagiarid An.,alysisYeat Ended June 30 2015

>un KFkU t? .Jefferson Cmi

Public Sdh

Shaping the Future

The following summary is a comparison of total District-wide expenses for governmental activities:

2015 2014 Chanp ChanpExpenses

Instmction

Student support services

Instmctional staff support services

Distrid administrative support services

School administrative support services

Business support services

Plant operations and maintenance

Transportation

Coimnunity services

Other instrudional support servicesMiscellaneous

Interest

$ 729,319,975

60,064,328

133,254,466

7,711,286

94,277,648

33,236,652

108,222,195

87,973,527

16,012,870

34,945

466,078

16,244,178

$ 633,177,394

50,729,048

118,955,171

6,972,822

84,150,967

38,844,491

103,975,188

84,374,237

9,134,416

10,000

553,066

14,825,786

$ 96,142,581

9,335,280

14,299,295

738,464

10,126,681

(5,607,839)

4,247,007

3,599,290

6,878,454

24,945

(86,988)

1,418,392

15.2%

18.4%

12.O%

10.6%

12.0%

A4.4%

4.l%

4.3oA

75.3%

249.4%

-15.7%

9.6%

Total Expenditures $1,286,818,148 $1,145,702,586 $ 141,115,562 12.3%

2.5%

/?0.0/O

Expense Categories

2.6%

0.6%.

56.7%

22.4%

10

W Instmction - 56.7%

N School-based support - 22.4%

[] District administration - 0.6%

[:l Business services - 2.6%

N Plant operations and maintenance -8.4%

0 Transportation - 6.8%

N Miscellaneous - 2.5%

Maiiaxement's DiscussioiiMalqagiand An.alysisYear Ended June 30 2015 Shaping the Future

Business-type Activities

Operating revenue of the District's business-type activities decreased $2 .2 million. School Food Service revenue decreased $2.1 million, as the District implemented communityeligibility, a program where entire schools in areas over a certain percent of impoverished students may receive free meals. This reduction in operating revenues was offset byadditional federal grants funding the program. Adult Education, Tuition Preschool, and Daycare Operations revenues remained stable. Enterprise Programs revenues increased$.1 million as additional programs were added to this fund.

General Fund Budgetary HigMghts and Future Budgetary Impucations

The District's Draff Budget is presented to the members of the Board of Education by January 31 each year, followed by a Tentative (Original) Budget by May 30, and, oncethe members of the Board of Education approve tax rates in September, the Working (Final) Budget is submitted to the Kentucky Department of Education by September 30.

General Fund revenues were $8.3 million over budget, while expenditures vvere $110.4 million under budget. Revenues exceeded budget due to a significant increase in on-behalf payments related to the Kentucky Teachers Retirement System in excess of funds budgeted for this purpose. Instruction expenses and plant operations and maintenanceexpenses fell short of budget as a result of budgeted positions that became vacant for part of the year, school funds that are permitted to carry forward to the subsequent schoolyear, and some operational expenses where the District over-budgeted due to refunds or lower-than-expected cost of operations. As a whole, our General Fund decreased fundbalance by $.7 million. As discussed further in the T .ocal Fconomic Outlook section on page 14, the local economy is in a period of slow growth.

Our Constmction Fund experienced a $14.9 million decrease during the year. Tbis was due to prior year bond proceeds being spent on 2014-2015 constmction projects. BuildingFund decreased $6 million during the year as funds were used for planned constmction projects. On whole, our Construction Fund and Building Fund are well stmctured forfuture capital needs. We anticipate our revenue stream remaining stable for routine activities into the future.

In accordance with the requirements of Govermnental Accounting Standards Board Statement number 68, Accounting and Reportingfor Pensions, the District has recorded itsproportionate share of certain financial factors of the pensions in which its employees participate. These factors include certain inflows and outflows of funds wich 'w'll beamortized over future years and net pension liability. The very nature of the net pension liability indicates that these pensions have not been fully funded, whether by employeecontributions, employer contributions, or investment earnings. Although the District has always paid its entire contribution based on rates determined by each pension and muchof the responsibility falls on the state, the need to shore up these pensions may become a factor in future employer match rates or state funding.

11

Maiiaeement's DiscussioiiManagtand An.Year Ended Jura 30 2015

,alysisJefferson (,ounty

Public Sdxx*/?

Shaping the Future

Capital Assets and Debt Adniinistration

Capital Assets

At the end of June 30, 2015, the District's investment in capital assets for its governmental and business-type activities was $700.1 million, representing an increase of $15million (net of depreciation), as shown in the following tables:

Gowrnrnental activities :

Lind

Land improvemen?sBuildings and impmvernentsTechnologyBuses and vehicles

Fumiture, fixtures and other

Constmction in progress

Total

Less : accumulated depreciation

Govemrnental assets net of depreciation

June 30, 2015

$ 29,266,802

38,805,380

1,137,212,567

90,054,340

97,075,127

53,998,827

23,255,056

1,469,668,099

790,766,837

$ 678,901,262

June 30, 2014

$ 29,023,021

36,998,200

1,105,393,391

87,507,927

94,766,249

50,013,957

8,871,511

1,412,574,256

749,489,024

$ 663,085,232

Percent Change

0.8%

4.9%

2.9%

2.9%

2.4%

8.O%

162.1%

4.O%

5.5%

2.4%

Constmction in progress increased significantly as we continued major HVAC renovations including Southern High School, Fern Creek High School, Liberty High School,Dunn Elementary, Field Elementary, and Lowe Elementary.

12

Maiia=ement's Discussioii+viaiiagiand An,alysisveat Ended Jun0 30 2015

?rM ,JeffersmPublic Sd

Shaping the Ftgture

June 30, 2015 June 30, 2014 Percent Change

Business-type actiwties:Lind

Land improvementsBuildings and improvementsTechnologyBuses and vehicles

Fumiture, fixtures and other

$ 1,000,000

4,745

17,085,604

798,691

1,990,747

27,291,595

$ 1,000,000

4,745

17,067,854

830,439

1,891,985

26,656,997

0.l%

-3.8%

5.2%

2.4%

Total

Less : accumulated depreciation

48,171,38226,967,621

47,452,02025,451,082

1.5%

6.O%

Business-type assets net of depreciation $ 21,203,761 $ 22,000,938 -3.6%

Total Capital Assets Govemmentaland Business-type activities $ 700,105,023 $ 685,086,170 2.2%

Business-type activities Technology equipment had increased during the year ended June 30, 2013 as School Food Services had completed a major upgrade of its technologyequipment due to a new point of sale system. These newer technology assets reduced our need for additions in the current year and are being depreciated in excess of assetreplacement. Additionally, School Food Services purchased new refrigerated delivery trucks.

District facility persomiel develop a long-range facility plan through evaluation of every building, identification of appropriate renovations, and analysis of demographic censusto determine future growth needs. All findings are shared with each school for review by staff, SBDM councils and PTA. Adjustments are made to the plan after the reviews.The long-range facili ty plan details the unmet needs for the District for the next four years. The plan is submitted to the Kentucky Department of Education for approval. AtJune 30, 2015, the iu'imet needs for the District totaled an estimated cost of $826.9 million.

Funding for these needs is typically provided from the General Fund, Constmction Fund or through Bond issues. Bond issues are paid with Building Funds (local s-cent propertytax), State Capital Outlay funds at $100 per student or the Kentucky State Facility Constmction Commission ("KSFCC") funds. To ensure continued academic success for ourstudents, we must provide a learning environment that is safe, functional, inviting and well-maintained.

Additional information on the District's capital assets can be foiu'id in Note D of this report. Information concerning bonds and long-term liabilities is in Note F of this report.

Debt Service Fund

At year-end, the District had approximately !5447.7 million in outstanding debt, compared to $463 .2 million last year. The District continues to maintain favorable debt ratingsfrom Moody's and Standard & Poor's.

13

Maiia:ement's DiscussionlVlaliagemen{and? An?alysisYear Endsxj June 30. 2015

?r MJeffersonPublic S(

Shaping the Future

Local Economic Outlook

The District is enj oying a period of gyowth in our economy-driven revenues, such as a 5.5% increase in occupational license taxes which are based on net profits and salariespaid witbin our jurisdiction, and a 4.9% increase in property valuations. Louisville maintains some resiliency by being a regional hub of many companies or industries. hiherentstrength can be found in the balance among the educational, health and social services, manufachu'ing, professional services, retail trade, tourism, insurance, and transportationsectors. Recently, Ford has completed a $600 million investment at one of their Louisville plants adding 1,800 jobs svhere they build the Escape. Additionally, Arnazon.comis opening a distribution center, an extensive theme park has opened, and two additional Ohio River bridges are being constructed, which will bring investment and additionaljobs to the area. This future growth is critical as Jefferson County's unemployment rate remains high at 6.8% as of June 2015, slightly below the state rate of 7.4% and abovethe national unemployment rate of 6.1% as of June 2015 according to the Labor Market Statistics provided by the Local Area Unemployment Statistics Program. JeffersonCounty property valuation assessments have shown 1 .3% growth for the 2014-2015 school year, continuing to grow for the third consecutive year since the downtum.

Jefferson County's central location, extensive transportation network and quality of life are factors in attracting and maintaining a healthy business community. Recently,Louisville was named one of the top ten New Brainpower Cities in Arnerica by Newgeography.com, a top-twenty market with economic momentum by Forbes.com, ranked inthe top Best Bank for Buck Cities by Forbes, named one of the ten "best large meh:o areas for homeownership" by NerdWallet, and named a "City to Watch" in the SmarterCities environmental survey. Additionally, our quality of life is demonstrated by being named among one of "America's safest cities for families with small children" byUnderwriters Laboratories Inc., "Best Foodie Getaways around the World" by Zagat, the fourth most "Photo-Friendly" city in America by Popular Photography Magazine, theUnited States' 40' most literate city by Central Connecticut State University, one of the top 25 "Bicycle-Friendly Cities" by Bicycling Magazine, and one of the "Most LivableU.S. Cities for Workers" by WomenCo.com.

Metro Louisville has many initiatives designed to increase the quality of life and stimulate the business environment. Having declared Louisville 'the City of Parks," MeboLouisville has embarked on an initiative to encircle the city with a continuous loop of hiking trails, and maintain its three Olmstead parks, 85-acre Waterfront Park and JeffersonMemorial Forest, the largest urban forest in the United States. Metro Louisville is also working to hire more police officers, and increase communication systems for its police,fire and emergency medical systems. Metro Louisville is assisting its fastest growing companies through Pro3ect High Impact, which assists these companies with various needssuch as hiring, real estate, and incentives, and is working on numerous economic development, housing, library expansion, and drainage and maintenance projects.

Overall, with many local and national businesses expanding their footprint in Jefferson County and excellent quality of life, Jefferson County's economy has the stabilitynecessary to minimize the impact of economic downtums.

Contacting the Jefferson County Board of Education Management

This financial report is designed to provide a general overview of the finances of the Jefferson County Board of Education and to show management's accountability for thesefunds. If you have questions about tis report or need additional information, contact the Chief Financial Officerffreasurer of the Jefferson County Board of Education, P. 0.Box 34020, Louisville, Kentucky 40232-4020.

14

?(l!d

C)F

-zO>mw wihOlhuOr y'D€50f-iVl W-m

WThOOl' NWl>OtNcN-w l/'11/'I6 ffl {N 4 '6N 10 ('IN

NVi

S' Th'l/l

$

(X5'

OsNc)l)

I>NW

4'('l

-tw)I-0('l

01%tN0 '.DCls000CThml'0 m*CD00't0€0 0a-mTh00SC6-tcS tF;CS{N4C;O<sxmlz >l>t'-z-w0% -41/i ('4 l'; t'l4 q 'J g

Os'N

gg§gW€

CN'UTh01)

S'

llall'-

l/'r(CrI'E

9?ll"l

11) 50 N';5 :!; $

m

Nl'

(Xi'

M v>i

a

'e

'5:'C

?'

J 't:=sE

8('i'0(N

M

l'l

W

S'

z

o's S Q -iOs % (,) IC)W -! Q l'-)

%; > QN 4 -w

fi -'r 0T) (% C)'e7 q Q

'.6

S(C}

Vl4l'n

mM0

€l'flI'-{:N'('IPdQffl' S'

171h

Thl/I50

l/II'

(Thl/IC)l)

0W€

UaVNIX)!

h 0 'el' l"i 0) 0% ot) fTh h In 0 ) Cj) V'i 0('l o; Q -4 Q -4 oq '(

-:' CN'Rt>* CIO-to 0 (%

l/l O l' (N l' >

C; 5% S 4 A 4IA 51' (N l' > H tnC; co S 4 A 4 ('J' (D?0 € (fi Vl (NN (D

g

l/IE

0

S('I

Vl(C)

Sl'l

lfi50-sl'-

l/Igl/IN60';?lf-QOQS.;0z

8 #gQ

INI/lt?-yEIO

-ei-:ml"llfi(N

S' m' #' ;'0 N lfl l'l'te :lfi ('l

06'(N

€ > O f (Nl-n f W € 0)W -: (Th N R; 0 i ;0) h l'- '10h (fl00 0

c; 'A q UaV5'Uaiq-zj

'e

z

UaiSCX)

OC?'sglJ]wO'6'6-s€l/}('Th' Vi'IN S

Os

m

4V'rISN

€lX-s-fOQ4 6 -'r(N N lfiPEE

S 6 -i7' g' g'

f(Th%N'

O;'N

LOff

E6

0z

;2

'a

Umm

(/)

JIJ

a

3tEE

QE

b

"ltm

E

!:l

!m

g

l/'l

0(N

6'l'fl

Es

(A

d

!!i 'ao a"g !WB o."< 111?Cl>a> 5r?-; -5 g 05..OCj(atii112,>aiJff'!Fj; ...i.i, 03 x o, 'aa"

'= U) a'H "aa> oasa ea' ="a''fflu w"'= :a" "g, ,, ?m,oa ao-o r-

-g ?>j3 Qu'o ???3. B> ?G aB 'R?

!lm111

?1p

e

nbQO' Ek';"..0e ?5n:a.lgaAo%o @ Er Q "oETh

i%g%%-5 ,?$ (11U!:

(im

2>

!

!iE

E

ffi

lim

g

% 9a(I)., o .P

31 !J

9E

..0O

,E EE s

el a44g>Om@,,>l?? IA 11) .- rh D

aiu ? B > E>om@,>p U) (/l O) 11>g+ E C- > ' >

!o Na l' o o j'ao 7'a i' o No j' 7.' =:4 0 § V j ; ; f ob g ; ; 'H %A;<<a 3 '1:€

'lo 'i ,'o F; U) 50

N ?N!s mX=3L? n 3

s "B e a'!@ a g Es- a,5 a2 a§ s 'Fa'!'Es'Cvi ' a .Ei% .C) 0 >

iEiga

ffi

Q(i-i

g:l?

d

..0

s

j" g 'eo g

Y. so .!e <, 4OC)

'-y

B ' a'Cl6 ; 3g,B 'a a'Cl ?= U)6 Tj j,?, ,2 w B

Is

E' Eo ,"aO ?aCt. =-m U) O ITI (Yv (1) w r> M!. > W@ > lj)', )El2Q

2

vsi

E

61110

Aii

2

3oS

u

U

:'jua

.affi

Q

U)

lk)d

C)2

C/l

? 19ie),o(;

e!ilX >?(g,,?*- djE

m'm'o'o'oa'm oo ty O Vl ; oo'oni6oowirivinS+r*hQ (l! W- t%l E- 19 Vl Vl 5Q @! Q o.Q (j * N 'O 'O vi v'i lx) Th 0 a.

ioa ;k, ; :' ;, M6 oaM fi ffl ;ea y6, '::"%, 0 na ?' < l'l O I' S ? $',? q ;' 4 3 E) 0 :

lli

(N

56

f

l)6

..J

'o : U'l S flo E U'l EIN > vs -(xi , , Yffia'-fflll'i

21Si

W

(N10

(N()l"l

INeem

!

flNln# m lfiE IN Vl

N llat INM tN mI'; ; gj% Th IJs

>64

Thfla'l

IIXThTh

--i

lNisrfla%lNas

2i

W M vii

unail:ii(}l11)l>lail*l€l

81a.i

iiilE (alE()i" 'wju.g' 4i% ort..[)l?'Olart l

uaO?() #i

ol(11 un

alll)iJE(/)lo

W

Vl

t-

V'i

tA

lt?

EW

Vi

lfi

..!

56

V?

S

O

@s0U'i

10(15

Vl

m g2 2 ta vs0. ," ffil, ffiM" . 'A (al '#

> -i 'D?

lh

tri c< o oo "la'o ? ? a- *'

+l>l'- .?! * 6 = Ql; ThaIN '@sa B '9 INIR ;' - '.oIn

N0

ID'

emlir?l

6lt?EYl!iEl

v*i

viiSil?-? iuior;isr

!:,l:'

;l.g 'qiv-d:?j,

a)

c-i

;,51S:":iE, ,Alti -()i> Ji:> <,

O

l)a

0

m(j5

l'l

W

ffV'?

NW

W

!

f N l'i* <r Vs

EINVIIN'/'IINMN(6; Q gS(Th'(ho : #tj

IN0Uai

!?

=wi-riiqi

'!lnl

CTh

Sa0le)

Th

ql'l(@

VX

E

!:J

IM =.==i IA 141(0ff

>

<r

E

e

m

(/)

>Jta:N*-l

E

2!9aEo

Qao

laJ

%%mo

g@

*??eau

Au(:i1

!mmo

E

!)

('1

0l'?

eE

)?'i

ThE

W

s

.?41'al T 'ji-l- E,03j

? S E.!!lo

Uai (e E E 01) IN ll'l 1% O lri tt) ol)

%S IN 4 m 7 i6 g) : .l's f. h.oo f v'l6 N 1% f I'- g,Th tll *

""m' :' 4n' :"?' 3' mTh' fi, =? ,g1 yM U'.o('l o -' t - . .

a% S ,,a '- ,,,aa W. ,a J'?> ?'? aj:?' I??a at?' 9 @'5a'

&"}

0)0)

!! ': 'H"t(: art O)"'11)DO .!)

? ffff g? z.

'E "l os av. ay 't 'a os

i E ,a. b-a .p. 7ga ll== Haa . ..an. 76 aa=iE-ov,,otg.!s Q () 11) .Q el m ? 4 0 E 6

a,a '0 ffia j ! E .Ho 'H j' art ! ; 7 5aHOe

ffi

l)a

f

W

IX)

'.0l)a

s

:Q

:

€8

>

H

h h > > nl-t vs z tq >iQ q q (; "J'et' 01)' k' V'l' O'!%l '.b o oo (l)jvi->yi

1!)

o

o

:5 ":ai. tt?= .au nam...=aaa'ap S T :'a" ffi e ?ffl a" offiC)t ",

'P}'#

'. M 'j 41 el O'ie' ?8 '?a..3 '! ',,'ao,a" E' .=9 EE3.E>

X)0@o B ? ,9 oJ- " E' ?H >O ! E # !l

410Qja'a O ':l E ?3 "l'"v<WSOE

ca

jQ>

01

A

.;6

€

o?

>

<

S

e

o

QMffia

.ffl,x

ZW

IU ','aalllB.Z

u

m

maD

@11 .B-Z etEEtdal

ul-iti ,gl

;a' o ea'

: giBffN?'j!

O

Ba

>

(:

i

o?

l::

'y

a

?

e

o

E

.ti

a0E'

o

111

>r

o

g

s

J5

i

Z

>l*a

e

a

Z

m

a

e

m

(/)

a

)j

Z

Balance Sheet - Governmental Funds

Board of Education of Jeffers on County, Kenhicky

June 30, 2015

General

Fund

Grants &

Awards

Fund

Construction

Fund

Total NomnajorGovernmental

Funds

Total

Governmental

Funds

Assets

Cash and cash equivalentsInvestments

Accounts and grmits receivable

Prep aid exp endituresInventories

Due from othcr funds

$ 174,018,131 $ 35,527,166

68,082,870

20,003,614 $ 17,634,842 73,198

4,203,103

3,704,679

36,713,088 22,661,025 68,990,115 $

TotalAssets $ 306,725,485 $ 40,295,867 $ 104,590,479 $

$ 209,545,297

68,082,870

37,711,654

4,203,1033,704,679

874,130 129,238,358

874,130 $ 452,485,961

Ijabilities

Accrued liabilities

Due to other funds

Total Ijabilities

$ 94,525,213 $ 969,996 $

92,992,391 28,705,723

187,517,604 29,675,719

9,066,826 $

2,569,055

11,635,881

18,677 $ 104,580,712

124,267,169

228,847,88118,677

Continued

17

Balance Sheet - Govermnental Funds-Continued

Board of Education of Jefferson County, Kenhicky

June 30, 2015

General

Fund

Grants & Awards

Fund

Constmction

Fund

Total NonmajorGovemmental

Funds

Total

Governmental

Funds

Fund Balances

NonspendableRestricted

Committed

AssignedUnassigned

7,907,782

36,000,000

17,456,000

57,844,099

10,620,148 92,954,598 855,453

7,907,782

104,430,199

36,000,000

17,456,000

57,844,099

Total Fund Balances 119,207,881 10,620,148 92,954,598 855,453 223,638,080

Total Ijabilities and

FundBalances $ 306,725,485 $ 40,295,867 $ 104,590,479 $ 874,130 $ 452,485,961

Reconciliation of Total Governmental Fund Balance to Net Position of Governmental Activities

Total Govemmental Fund Balances

Amoums reported for governmental activities in the statemmt of net assets are different because:Capital assets are not financial rcsourccs and are not reported in the fund financial statements.Bonds are noncurrent liabilities and are excluded from the fund financial statements.

Savingp from refunding bonds are not current and are not rep orted in the fund financial statements.Long-term workers compensation liability is noncurrent and is excluded from the fund financial statements.Long-term vacation pay liability is noncurrent and is excluded from the fund financial statements.Long-temi sick leave liability is noncurrent and is excluded from the fund financial statements.Bond Merest payable is a noncurrent liability and is excluded from the fund financial statements.Net p ension liability is noncurrent and is excluded from the fund financial statements.Deferred outflows from p ension contributions after measurement date are excluded from the fund financial statements.Deferred inflows from dMerences between projected mid actual p ension earnings are excluded trom the tund statements.

$ 223,638,080

678,901,262

(443,295,919)

(5,766,059)

(19,793,836)

(6,370,149)

(40,879,980)

(3,879,278)

(256,722,092)

33,301,465

(29,516,000)

Net Position of Governmental Activities $ 129,617,494

See Notes to Financial Statements

18

S tatement ofReve nue s , Expendhure s a nd Cha nges ;rn Fund Balanc es- Govemmen(alFunds

Board of Education of Jefferson County, Kentucky

YearEndedJune 30,2015

Geneml

Fund

Gmnts&

Awa rd s

Fund

Cons(mction

Fund

TotalNonmajorGovemmental

Funds

Total

Govemmental

Funds

Revenues

Localsoui?es

Propeny(axesOccupaiional(axes0 th e r ta xe s

Grants from localagencies and donors

$ 365,574,681139,825,24249,482,553

$ 8,435,955

$ 32,147,963 $ 397,722,644139,825,24249,482,553

8,435,955

S(a(e sources

SEEKpmgmmOtherstate revenues

KSFCC allocation

267,901,401

187,441,090 34,228,8089,141,656

8,171,637

277,043,057

221,669,898

8,171,637

Gmnts fromthe Unijed S(ates government 91,141,503 91,141,503

iteies}

Othersources

1,151,761

7,634,870

3,252

2,950

$ 234,742

489,649 3,527,4621,389,755

11,654,931

TotalRevenues 1,019,011,598 133,812,468 724,391 52,988,718 1,206,537,175

Expe nditure skistmction

Studentsuppoitservices ,kistmc(ionalstaffsupponservicesDistrictadmiishat#e supponservicesSchooladministiative suppoffservicesBusiness suppoitservicesPlant opemtions and mai(enanceTm n s p o rta tio nCommunityservicesOtherinstnictionalsuppoitservicesBuflding renova(ionsO(her

Debtserice

P*c:alkiteres(

553,492,618

50,170,141

93,493,757

3,987,782

86,582,157

38,77?,374

107,531,470

76,919,959

2,540,172

27,404

886,842

18,892

72,605,803

3,728,451

43,102,030

86,339

124,654

1,353,317

299,232

3,895,603

7,245,627

96,499

3,009,041

46,146,672

447,?86

104,204

3,737

29,914,485

16,034,197

626,202,625

53,898,592

136,595,787

4,074,12?

86,706,811

40,124,691

10 7 ,8 3 4 ,4 3 9

80,815,562

9,785,799

27,404

47,130,013

3,475,119

29,914,485

16,034,197

TotalExpenditures 1,014,422,568 135,546,596 46,593,858 46,056,623 1,242,619,645

19Continued

Statemem ofFlevenues, Expendkures and Changes in Fund Bahnces

- GovemmentalFunds--Contiued

Board of Education of Jefferson County, Kenhicky

YearHndedJune 30,2015

Geneml

Fund

Gmnts&

Awards

Fund

Cons(mc(in

Fund

TotalNonmajorGovemmental

Funds

Total

Govemmental

Funds

Revenues in F.xcess of

(Less Than) F.xpenditures 4,589,030 (1,734,128) (45,869,467) 6,932,095 (36,082,470)

OtherFinancing Sources (Uses)Proceeds ofrevenue refiindmg bondsRe fund% schoolbuildjng revenue bondsPmceeds ofschoolbui!jig revenue bondsPremtums on bonds sokl

Discoun(s on bonds sokl

TransferstoPioprie(aryFundsTmnsfeisi

Tmnsfem ou(

(3,118,393)

(2,343,316)

1,753

2,343,316

57,915,000

(57,915,000)16,465,000

6,797,556

(4,6 16,706)

15,964,380

(3,603,567)

35,173,067

(47,533,880)

57,9 15,000

(57,915,000)16,465,0006,797,556

(4,6 16,706)(3,116,640)

53,480,763

(53,480,763)

Total0therFinancingSources (Uses) (5,461,709) 2i345i069 3 1,006,663 (12,360,8 13i 15,529,210

Net Change in Fund Balances (872,679) 610,941 (14,862,804) (5,428,718) (20,553,260)

Fund Balances, Beginning of Year 120,080,560 10.009,207 107,817,402 6,284,171 244191,340

FundBalances,F.ndofYear $ 119,207,881 $ 10,620,148 $ 92,954,598 $ 855,453 $ 223,638,080

Reconciliation of the Stateme nt of Revenues, F.xpenditures and Changes in Fund Balancesof Gove rnmental Funds to the S tatement of Ac tivities

Net Change m Fund Ba Ia nce s - Tota lGove rome nta lFundsA mounts reporte d forgove mmentalac ttvirts : rh e sta Iemenr of acttvities are cHffere nt be cause

Addhions to c apka la ssets c apha lize d on distnc (- wMe s(a(eme nt ofnet posnion.Disposkins ofcapkkalassets are reflec(ed on (he skakement ofachvkis.Cap'nalassei use is expensed as depreciaiin on the statement ofactffihies.Bond pric ialpayme nts a re rec orde d a s a reduc (ion ofa ha bay on the state me nt ofnet posffion.Bonds issued are capkalmed on the s(atemen( ofnetposkmn.Cap#a Uze d savjngs from bond re fundigs must be amonme d ove rihe re ma mig Me ofthe bonds.hisumnce expenses to be paM i fumie years are reflected on the siatemem ofneipostjon.Bond interest payabb is reflec(ed on (he fiuuaccmalbasis on the s(atemen( ofnetpos#jon.Long-termworkers c ompensatin &bMy mcreased on the district-wide financmlstatemen(s.Long- te rm va c anon paya ble de ci? a se d on the dist* t-wMe fina nc ialstate ments.Long-term sick )eave payab)e decreased on the dffit*(-wide financialstatements.Pension expense rep+sents the cos( ofprovMtng hng-(erm beneis on the s(aiemem ofactmkffi s.The pension e xpe nse forKTRS is e nti b) the re sponsfltfliky ofthe Commonwe a kh ofKenmc kyP roraefe rre d outfkiws from c omributions afte rme a suremen( da{e a re on the dis(ri (-wide s!ate me nt ofne( pos#jon.

$ (20,553,260)

75,148,659

(9,140,023)(50,192,606)29,9 {4,485

(15,378,885)

(5,986,521)297,662

(209,981)853,216

191,466

(2,5 19,432)(119,952,049)89,909,09533,301,465

Change in Net Positio n of Gove rnme ntalAc tivities 20 $ 5,683,291

See No(es to the FiancialStatemen(s

oldOF

O

g4ql qOPh€l M(%lq'g*l 'D-z' --o (%l- - I "-- l-m

:i :l i'/}t'

Th'llalOa

>J

P5a'OQflp

C),EO@5' @)Zl.Ql,,iQ

,ds :,p,/0o

W Eo

ZEtH d l/'l'?ms ? -d

'0" (NC%-m'jj@6E3 "H("lU Q yH d. ,?"a € A

,(/l()a'CjaA C!:j€CE fll62-

zl-ma't=llEil 3 -j;=il(.. ot,,i ?

,g

:la'Cl&I8

ffi

o6

.J:Q

c/l

M

%

lnln'xt?-Qfi

(NCThV'l0

-'rV'; 6l>-: (D-mf <D

e?}

P O 0%llal (N 0)-z 0 00

fK {XS fiFk-t-t-:('J

0

00

O

l/i'(0P

f

lm")

Wm

t?0

yC) chI Ch;S oorl A100% (ftl P(Neft Ol Q

(,; :1 10

a

h

l/il/i

8

8

ffi

S

VlmmVi(NQNCJ'sF<OsCJs-i

Vi' -Q'

'.0(0(N6N

N'

-i l/'i D f eN F '<-z (N In 010 In -i ttiQ (N Q oq ('4 0 ;

(N N

ci' (? 5' S' vi' CN' o6"j f E ,-l E Oi (Nt4'sffCsl>-* -z

00€NE

Vi'Vi

$

REIn

l/'iS%'N'l/ig

B?E. r:, ,=:. "?ah, y==g W :,('6 'f M 16S fsf

0CDSci'lan(OS'Vi

hM'('l!/10)('-%?%i?

?

l'n

O

m

m

('l

R

S'00'%0g

01U?

ViD

Th'm

S'h?

Os'?

M (lri

()a'ci

:"-Bl-jel';'s5i(4is (f3

?

'/iO

Ch'?

'?

Mr

m

l/10ffl

Osm

?

E f > (Th (N N 01) 1%m m-i-i c%l (N (N cslH f-10 tn Th E ('0?) 6 '6 4 & C5 -: tK;09't E'f -(0?) 6 '6 41% % fq'im ?

9l/')('6?

-tl'-(j

'?

0

e'lh

l'-ffif

C)0101l/11

Sl(?-il'l

/?M' (Nl/ImS-:S'O

N

Q

'/10(N

("lm

h

'.Cr('lN

O'Vi0

("lEE

'?

64)i

:la'd&l3

gffi

ooJC/)

Vim

(N

(>'eNQ

Vi

Vi?€N

0';'NOi

l/i

-m 01-i E 't' N f 0) 'fh 0 0) 0(fi E N 00 ('l')O <:Jz Q €N Q 0%4 Q Q (:

(" D Os 'e Cfl ('- D 00> OQ N Y m p -z06CA'-fi S

Mm

(fi'€NE

F

hOC}

8r'6's6Vig

'j)j ":3 o'M aaaa9. o"% 'a";= oo9S 'f (O l?A (fr€'f

Nlhl(Nlo61ViI.?

m

OC)0

m

m

?

000

a-l

(:hle;l

?ViE

(NCTh

Chm

m

>'m

$l/11',61('11sOs'm

M 'EA

;)%

.Ej !

(/) 3

E 2

?'C}

g a':n g ?% 1 EW(4@n-'a ?E(4@HS'bwa.i '? '7."' s 'E lfi? 11) (l) -z,;'b r '6oR ,,.% [email protected]&gOQ . 6 ('l11)','5

v,>' a2 !%Ej

Ba>RdIJ ,:j

'3N j ;j- o:s %- a'a11) @mE3E ae DB? 2 ?> ?7!' oa'C/)E>

U)(/l(l) (p U)

a? ?7 Bol'ai (/) e

a' 5a!j! o, g<i,i o; =gy +-i @m -a @H- Q .,mO =t

-IE!H

Ea

zabEEelW

oijgS

'E

E

,=s 4o lBjg

}aoEEm

o

4

E86R

oSo

k

3g

W

(l)

E

#IQ --Ipj?5?d

BE

Ui..fNaWp

Q5';y:ib{iu(fc& 2E U?": Ae3')'; Co?E- 5"': G"': ;:oIL(7Eo2

EE

25J)BEm

i:Lz4Q

Y (6.Y= iiiE.%g,i8

aCl(il)g

?g ,2,g(qB :Q,e,Q:J:5!dE S-C)Bb

DUyI Cim lwlz(71(G4)EEr B @

%m

ER

S

i-gS

EoE?m

oEQm

7E

aDEmgQ

"E

m

B

m

m

lmo

'€

'fl

E

ffo6

Am

2

',C%J>N(mo

JEo

!El?ffi

eLm

2

E

WQ(ljd

C/)

-0am

.EELoQ

!

O2

C/)

'l ol i =l fll-j0 I'- h N lfilfiTh l'l'i tll @15I'-z f 0

-l -lml/l'l/j

lftIn

'P@z

Vl50 Cl's

@s Cfs N

(Th (%l mOs j? * N N

171 'D 0; i0l qv-ziri>l osoomThM1 Iq> ol!) Y q.l q- -' -- ?I -a

El-CTh l 0

??'? l ?H.H. l v'i.

l?

l'Oelifl0irimhool -z6' S' l/i' Ch' NW N Q Q. hm W t' ()

(A

('I 0 0 t'l h

(; 0 -m ;O'tfi€-h.-

lfi

p * os qsO r (NCl's-h-f .

l/j W I'

r (N F'-1%('l

('-WC)0

Ch

Qti #

S'N

&I')

WfS

l'("i-ffi(%l

N (N0 0In Vl

ffilllal l/jB?

R

ES

54' ?< B?5(s,Egi.0 .gagi011)

:Z 'EI-f::

41 s ,(1)!1.0 WB?g

eflh 0('l

(Nlfl g4' l 4'r l r

ii?l

01) W N Os

l' l' 6 (0 l/'?

Th '.0 l/'i E-l -l '-l

h 1%W 00

'!I 'Al

NNCts

INel'l

;l Qi0 0 (%lIA l/1 z

WfS

('-(q#

N

In Vl01) W0 0

I/i lfi

v>i

Q u Q u Q

@')CN

J

j

2b€ EEou

0E

?eiz oa-?: 111Iml,C!(1)E'bg5(lil

. ' i lfi!jo O

3EQ -@

('l

OB5OJ(i-i :e r-sO IJ;1 -l:l0 )j -6i-a r IDd0aaQ,E!J'a

B. E (grZa€:;

s

.E1360

IA

tm

2'

!IN Nj. 1.0 tuB!IH

IU 1-1js, oE1o

0

J

-;

.B

N€(-d

lfj(q4hl/1

&t')

Vll'l

('

(f}

0000

@sE

Ellaj

m ; S ? ly F;' ; lfi Sf l"l ml'fi lfi Wr M oo M * -z S 5C) S S z(% tt'? o O 'D -z r> O l'l m m

orS" 6' .-s' > '-o' -z v (- 0 0rs ?N = .z ta. 0% p. = y p. Vl .w

In ? Ol:)% q (? M 3."(N N N

CTh' in' m lfi? ? I' C>-w 0 w 6

Vi Os l/r Vi?? ? Vi 'D

(Th' 1% m' 6' f moo r- 3(N 6 -ioo cl's > S R4' 4' -w m *(O l/I (D Q. 0

'f;(D y 6 4y ? Th Cl%

< m m Nl'fi l'fi oa Ch

('- l'l'l O -:Ct5 E -l MIN In .m Q-w y 0% 'a

IN N N

V'? 0 l"i('Ifl'-IX) Th I'-

f€

M E In-zOs'('l

S'

In

('-01)01)

Th#

tts -i nlfi W t'0(110 l'-

Th' -Q' m'V{ -m (Nl/I (Th -Q

N (N (N

M M &l)

M &I')

:j

.i'EO

-0g

CL6'

(li

j0

C

O'y0

E

Ei

-5(Z

>J

EE

26gsEB

s

%tmo

Es!imeJ

jli-mo

1

eaoE

l/'i

0(%l

0('l

A

EQ

ffl

>

J11)

um

J

41

E ao " M ! J e € r: 1 'W 2 '= Q,: :.-- ;o-':a=a ?';o :lf o: :o ?ao" 'j o:lo '::a J'o' ?'y' aa ','@Gell

nk

g €, :3 :G Ei 8 ! E"o 'ffi]= '&. l(i k t t t t G t %!!

o- a a ; 6 6 6 6 6 a t' 6z.W

51 §(,l Q '-sr

ouQ. ago, 3u@d>

-m

a!;!*mmIJ

<

E

mml.;

e!i

o4

R

E

Z

s

A'

1

aEa9

@

&

u

Q

Z

a9

a-Ei<

E

-;E

E

EJ

E

Z11-a

@

>

ssE

<U)lim '-I

lt

o

?;

fJ ,%gm

Xdug%6(pE

E 'Th'- ffiag?lm

l-l(l)EJ4)ulm

O?&a5ro"u 4?

%I"OY

PdE

SQm

C7)

!i.Ei

..E

o

Q62

8

+N

? 0 (/l:55'!, s s@ a> C-S 'E" l<Q

r> oo y <r? (% -i C)

.Q' N' 16' m'm -z * 'eChOF'tti('fj(h'6 m

El?W

(fi

0

Th

(n('fl5i/il/l (fiioSO*0#(lTih

-l56'

EVl00)

+i("l

o'-l

(Th

M M M rhl

mi

??R(gP

E*??:!

:!?Rm

@F LO

N

>m'*6

E

.=26

a, §25-E53

22E6

?C}11);a?I !Q:rE§mwg

%mno

.4g

.;,;jZ a,2 a',Q E l/lO 'fi -

r<O? la? ?1

Y

aO)

.> 41:I!(j(':l(j

ga u'ch O<nD

Jao(a *.l @ -im=

?iti a'avm >-ff oo>-os!i q > o >B' U !l < !l<'

a:jo

U)I.i

,(L) bJ)j?4?y::a

'7 0 :J<Om

:J

u

EajE€u

Co

?'a

{Em

.E;?

O

(4

0

2a*

C/l

Notes to FinaiicialStatementsYeat Ended June 30 2015 Shaping the Future

Note A- Summary of Significant Accounting Poucies

Reporting Entity-The Board of Education of Jefferson County, Kentucky (the "District") is established under and governed by the Kentucky School Laws and maintairisa system of schools primarily for kindergarken through twelfth gyade, but also including pre-school, vocational and adult education. The District is a school district of theCommonwealth of Kentucky having boundaries coterminous with the boundaries of Jefferson County, excluding the City of Anchorage.

The accompanying financial statements include all funds and activities of the District, including the Jefferson County School Board Finance Corporation (the "Corporation"),a non-stock, not-for-profit Corporation. The Corporation was created to act as an agency in the acquisition and financing of any capital project which may be undertakenby the District. Accounts of the Corporation are included in the financial statements as a capital projects fund.

The District is not includable as a component unit within another reporting entity. Board members are elected by the public and have decision-making authority, the powerto designate management, the responsibility to develop policies which may influence operations and primary accountability for fiscal matters.

Accounting Standards-The financial statements of the District have been prepared in conformity with generally accepted accounting principles ("GAAP") as applied togovernment units. The Govermnental Accounting Standards Board ("GASB") is the accepted standard-setting body for establishing governmental accounting and financialreporting principles.

District-wide and Fund Financial Statements-The District-wide financial statements (the Statement of Net Position and the Statement of Activities) displayinformation about the reporting government as a whole. These statements report information on all the activities of the District, except for the fiduciary funds. Thedoubling-up effect of interfund activity has been removed from these statements. Govermnental activities, which normally are supported by tax revenues, are reportedseparately from business-type activities, which rely significantly on fees and charges for support.

The Statement of Activities demonstrates the deyee to which the direct expenses of a given function or segment are offset by program revenues. Direct expenses are thosethat are clearly identifiable with a specific function or segment. Program revenues include: 1 ) charges to students or parents who purchase, use, or directly benefit fromgoods, services, or privileges provided by a given function or program; and 2) grants and contributions that are restricted to meeting the operational or capital requirementsof a particular function or program. Taxes and other items not properly included among program revenues are reported instead as general revenues. The Districtallocates certain indirect costs to be included in the program expense reported for individual functions and activities in the District-wide Statement of Activities.

Separate financial statements are provided for governmental funds, proprietary funds and fiduciary funds, even though fiduciary funds are excluded from the District-wide financial statements. Major individual governmental funds are reported as separate columns in the fund financial statements.

Continued

26

Notes to FinaiicialStatementsYear Ended Jur+e 30 2015

=rM' .Jefferson OoiPublic Sd?i

Shaping the Future

Note A-Summary of Significant Accounting Policies-Continued

Measurement Focus and Basis of Accounting-The District-wide financial statements are reported using the economic resources measurement focus and the accrual basisof accounting, as are the proprietary fund financial statements. The fiduciary fund financial statements are reported using the accmal basis of accounting. Revenues arerecorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of related cash flows. Property taxes are recognized as revenues inthe year for which they are levied. Grants and similar items are recognized as revenue as soon as all eligibility requirements imposed by the provider have been met.

Governmental fund financial statements are reported using the current financial resources measurement focus and the modified accmal basis of accounting. Each fund is aseparate accounting entity with a self-balancing set of accounts. Revenues are recognized as soon as they are both measurable and available. Revenues are considered tobe available when they are collectible during the current period or soon enough thereaffer to pay liabilities of the current period. For this purpose, the District considersrevenues to be available if they are collected w'thin 60 days of the end of the ciu'rent fiscal year. Expenditures generally are recorded when a liability is incurred, as underaccmal accounting. Hovvever, debt service expenditures, as well as expenditures related to compensated absences and workers' compensation claims, are recorded onlywhen payment is due.

Revenues susceptible to accrual are property taxes, interest revenue and charges for services. Occupational tax revenues are not susceptible to accrual because generallythey are not measurable until received in cash.

Funds are classified into tmee categories: governmental, proprietary and fiduciary. The District reports the following major governmental funds:

The General Fund is the District's primary operating fund, which accounts for all of the activities of the general government not required to be accounted for in anotherfund. Local taxes account for of the General Fund revenues, while the Support Education Excellence in Kentucky ("SEEK") program accounts for of General Fundrevenues. SEEK is a program that began in 1990 as the result of the Kentucky Education Reform Act ("KERA"), and is basically the method by which state funding isobtained.

The Grants and Awards Fund is a special revenue fund which accounts for the activities of specific education related programs in accordance with restrictionsestablished by the various grantors (primarily the United States Govermnent and state and local governments). This includes certain KERA grants which carry grantorrestrictions related to expenditures.

The Construcaon Fund accounts for funds from three sources. First, funds generated by sales of bond issues are used for various constmction projects at educationalfacilities. Second, proceeds from the sale of properties and equipment owned by the District are to be used at the discretion of the District for future construction projects.Last, any funds remaining in the Capital Outlay and Building Funds at the end of the year are escrowed to pay for categorical priorities listed in the Long-Range FacilityPlan, discussed on page 13 of the MD&A.

Continued

27

Notes to Fi?naiicialStatementsYeat Ended June 30. 2015

ad'7F*Jeffierson CorPublic Sdh

Shaping the Futurae

Note A-Summary of Significant Accounting Policies-Continued

Proprietary Funds distinguish operating revenues and expenses from non-operating items. Operating revenues and expenses generally result from providingservices or producing and delivering goods in connection with a proprietary fund's principal ongoing operations. Operating expenses include the cost of sales andservices, administrative expenses, and depreciation of capital assets. All revenues and expenses not meeting this definition are reported as non-operating revenuesand expenses. The District reports as a major proprietary fund the School and Community Nutrition Services ("Food Service") Program which provides certainfood preparation at the Nutrition Center and serves breakfast and lunch at schools throughout }efferson County.

Fiduciary Funds are used to account for assets held on behalf of outside parties or on behalf of other funds within the District. This fund consists of agency fundsfor various scholarship programs administered by the District on behalf of the third-party donors, and agency funds held on behalf of student organizations andsegregated among elementary schools, middle schools and high schools. Since fiduciary funds are held on behalf of others, these funds are excluded from theDistrict-wide financial statements on pages 15-16.

Cash and Cash Equivalents-The District considers demand deposits, money market funds, and other investments with an original maturity of 90 days or less, to be cashequivalents.

Inventories-Inventories are valued at the lower of cost, using the first in, first out method, or market. Generally, the only inventory items marked to market are diesel,gasoline, and items determined to be obsolete with no current market value. The Food Service Fund's inventories consist of food and supplies valued at cost and U. S.Govemment commodities whose value is determined by the U. S. Department of Agriculture.

In the govermnental funds balance sheet, reported inventories in the general fund are equally offset by a fund balance reserve which indicates that they do not constitute"available spendable resources" even though they are a component of total assets.

Continued

28

Notes to FinaiicialStatementsYear Ended June 30 2015

:M .Jefferson CouiPublic Sdx>

Shaping the Future

Note A-Sununary of Significant Accounting Policies-Continued

Capital Assets-Capital assets include land, buildings, vehicles, office equipment, school equipment, and food service equipment, and are reported in the applicablegovernmental or business-type activities column in the District-wide Statement of Net Position. The District maintains a record of its capital assets, and those with a costof $1,000 or more are capitalized. All computers, regardless of cost, are capitalized. Additions to capital assets are recorded at cost and depreciated using the straight-linemethod. The District has elected not to capitalize interest on debt used to finance buildings. Capital assets are depreciated over estimated useful lives as determined by theKentucky Department of Education, as follows:

Land improvements

Buildings

Building improvements

Carpet/tileTechnology equipmentSchool buses

Other vehicles

Rolling stockFood service equipmentFurniture and fixtures

Audio-visual equipment

Other general equipmentMusical Instmment

Estimated life (years)20

50

25

7

s

10

s

15

12

20

15

10

10

Estimates-The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptionsthat affect reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts ofrevenues and expenses during the reporting period. Actual results could differ from those estimates.

Continued

29

Notes to Fi?naiicialStatementsYear Ended June 30. 20t5

Note A-Summary of Significant Accounting Poucies-Continued

Fund Balance--Under GASB statement 54, fund balance is separated into five categories, as follows:

Category Defu'iition

Nonspendable Permanentlynonspendablebydecreeofthedonor,suchasanendowrnent,oritemswhichmaynotbeusedforanotherpurpose,such as amounts used to prepay future expenses or already-purchased jnventory on hand

Legauy restricted under federal or state law, bond authority, or grantor contmct

Comtnitments passed by the Board

Funds assigned to management priority including issued encumbrances

Funds available for future operations

=s€*Jefferson CoiPublic Sdh

Shaping the Ftdure

Re5tricted

Comtnitted

Assigned

Unassigned

Cate6ory District PurposeNonspendable Prepaid expenses

Inventory on hand

Grant or donor-directed funds

Bond proceedsFunds governed by specific state laws

Cash flows protection

Encumbered purchase orders

Funds available for future operations

Committed

Assigned

Unassigned

Restricted

General Grants &

Fund Awards Fund

4,203,103

3,704,679

10,620,148

36,000,000

17,456,000

57,844,099

Constmction

Fund

92,954,598

NonmajorFunds

611,741

243,712

PurposeTotal

4,203,103

3,704,679

11,231,889

92,954,598

243,712

36,000,000

17,456,000

57,844,099

Continued

30

Notes to Fi?nancialStatementsYear Ended June 30 2015

Je? CoixrtyPublic SdxxJs

{fE3!h.Shaping the Future

Note A-Summary of Significant Accounting Poucies-Continued

It is the District's practice to liquidate funds when conditions have been met releasing these funds from legal, contractual, District, or managerial obligations, usingrestricted funds first, followed by cormnitted fiinds, assigned funds, then unassigned funds.

Encumbrances are not liabilities and, therefore, are not recorded as expenditures until receipt of material or service. Encumbrances remaining open at the end of the fiscalyear are automatically re-budgeted in the follow'ng fiscal yeax. Encumbrarices are considered a managerial assigmnent of fund balance in the governmental funds balancesheet. Board policy 04.31 grants this authority to the Superintendent or the Superintendent's designee. The Superintendent has granted fund balance assignment authorityto the Director of Purchasing.

Statutorily, the Kentucky Department of Education may assiune financial control over any school district whose fund balance drops below 2% of the total expenditures ofcertain funds. To maintain balances above this level, they recommend reserving at least 5%. The elected Jefferson County Board of Education committed funds to ensurefund balance remains above these levels. While these funds have been properly committed and not budgeted for future years' expenditures, there is no mandate on how thecommitted funds would be used if the District fell below the 2oA floor.

Property Tax Revenues-Property taxes are levied each November on the assessed value listed as of the prior January 1 for all real and personal property in JeffersonCounty. The billings are considered due upon receipt by the taxpayer; however, the actual due date is based on a period ending 30 days affer the tax bill mailing.

On-Behalf Payments-The Commonwealth of Kenhicky pays certain expenses on behalf of the District. In the financial statements, these payments are recorded as anexpense and other state revenue. These expenses include the following:

Health insurance

KTRS employer matchHRA, dental, vision, and life insuranceState administration fee

Re?urs ement from federal programsState facility constmction supportTechnology systems

2014-15

$ 104,727,393

86,611,458

5,014,443

1,279,639

(8,864,359)8,171,637

508,579

2013-14

$ 99,685,357

69,421,126

5,124,366

1,098,119

(10,283,450)7,638,789

489,487

$ 197,448,790 $ 173,173,794

Budgetary Principles-The Superintendent must submit the proposed budget for all funds other than school-based activity funds (agency funds) to members of the Boardeach year. The Board Members will then discuss and, where so desired, amend the proposed budget and w'll adopt a final budget by September 30 of each fiscal year. Anyadjustments to the adopted budget must be approved by the Board.

Continued

31

Notes to FinaiicialStatementsYear Ended June 30 2015

2 MJe? CoiPublic Sd>

Shaping the Future

Note A-Summary of Signtficant Accounting Policies-Continued

Budget information is presented for the General Fund and other funds with a legally-adopted budget. This budgetary data is prepared on the modified accmal basis ofaccounting, in accordance 'w'th generally accepted accounting principles. Budgetary revenues represent original estimates modified for any adjustments authorized by theBoard during the fiscal year. Budgetary expenditures represent orig'nal appropriations adjusted for budget transfers and additional appropriations approved during the fiscalyear. Although budgets are prepared on a line-item basis by cost center for each department, expenditures may legally exceed budget in these areas but may not exceed thebudget in total.

Interfund Receivables and Payables-Each fund is a separate fiscal and accounting entity, and thus interfund transactions are recorded in each fund affected by atransaction. Interfund receivables and payables for the District arise generally from two types of transactions: 1 ) all funds are initially received into the General Fund, thusa payable and receivable are established in the appropriate funds; and 2) payments are from the General Fund checking account, which may not have the legal liability forthe expenditure, thus a payable from the fund having the legal liability is established at such time. Typically, interfund receivables and liabilities are reso}ved monthly, andall of these balances should be resolved within a year. All interfund receivables and payables have been eliminated on the District-wide Statement of Net Position.

Due from otherFunds Reportedin General Fund

Due to other